EUR/USD Analysis

- Eurozone PMI relief despite the disappointing numbers

- Wednesday full of ECB member speeches/appearances ahead of FOMC minutes

- EUR/USD key technical levels updated

Euro PMI Relief and a Whole Host of ECB Speakers Later

Yesterday’s eurozone PMI data presented a potential stumbling block for the euro after the currency put in a decent run of strength against the dollar. Both the manufacturing and services PMI were expected to print lower than the April figure and surprised to the downside, which was not unexpected. In contrast, the UK Composite PMI data dropped by the 4th largest increment (6.4 points) since the index began; with services contributing the most to the decline in the economic outlook. Staying with the UK, Flash data for May has witnessed the fastest rise in operating expenses since this index began, leading to the slowest rise in business activity since the global recovery from the pandemic.

This morning we’ve already seen the ECB’s Panetta and ECB President Christine Lagarde as she and Klaas Knot engage in various sessions during the World Economic Forums in Davos. Elsewhere, we will hear from staunch hawk Robert Holtzmann, the dovish Pablo Hernandez de Cos and finally ECB Chief Economist Philip Lane.

Main Risk Events Ahead: FOMC Minutes

Looking ahead, we have US durable goods orders before the Fed’s Brainard speaks. The main, high impact data however, points to the FOMC minutes that will be released this evening. Markets will be keen to gauge how seriously a 75 basis point hike was considered and the general sentiment towards future tightening measures alongside the quantitative tightening discussion.

EUR/USD Key Technical Levels

The euro has risen cautiously since the May 12th bottom, mainly due to a softer US dollar as US companies undershoot earnings targets while issuing warnings about the deteriorating consumer trends that have been witnessed. Walmart and Target saw their share prices tank after disappointing results and communicated a shift in consumer trends towards cheaper alternatives. The theme of lower future earnings reflects some of the challenges US firms are experiencing as the Fed remains on track to hike rates aggressively into year end.

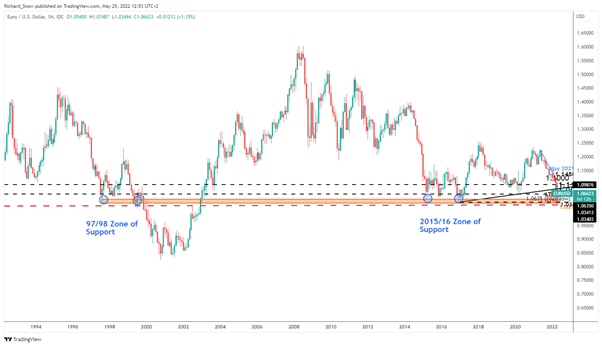

Today, however, EUR/USD has pulled back towards the 2020 low of 1.0635. the 1.0635 level represents the first challenge to the longer-term bearish trend which will rely heavily on future dollar price action. A break below 1.0635 highlights the upper side of the large 1.0310 – 1.0450 zone (see monthly chart for significance).

Resistance appears at 1.07575 and 1.0805 which are a long way off for now. EUR/USD bulls will be on the lookout for a possible bounce off 1.0635 if a longer-term bullish reversal is to remain constructive.

Rates markets have built up an expectation for the ECB to hike a total of 100 basis points in 2022 with lift-off often suggested to take place in July after asset purchases end. In my view, much of the EUR/USD reprieve has coincided with the general relief rally we have seen across global markets as the dollar showed signs of fatigue at elevated levels. In the absence of a long term trend reversal, EUR/USD appears vulnerable to a continued bearish move.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

The monthly chart highlights the zone of support that halted previous declines in EUR/USD and therefore, remains a crucial zone of consideration when analyzing potential bearish continuation below 1.0300.

EUR/USD Monthly Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment