Sergey Dolgikh

A Quick Take On Euronet Worldwide

Euronet Worldwide (NASDAQ:EEFT) reported its Q3 2022 financial results on October 21, 2022, beating expected revenue and EPS estimates.

The company provides a wide range of payment related technologies and services worldwide.

My outlook for EEFT is a Buy at around $91.50 on the basis of good execution and a generally improving environment for financial services as the pandemic continues to wane and lockdowns ease.

Euronet Overview

Leawood, Kansas-based Euronet Worldwide is a payment and transaction processing and distribution solutions provider, specializing in the provision of automated teller machine cash withdrawal and deposit services, outsourced ATM and POS management solutions, credit and debit card outsourcing, card issuance, and merchant acquiring services.

The company also provides currency conversion, customer relationship management, mobile top-up, bill payment, fraud management, foreign remittance, cardless payout, banknote recycling, tax-refund services and integrated electronic financial transaction software, among other offerings.

EEFT is headed by Chairman and CEO, Michael J. Brown, who has 30 years of experience in the financial services industry and has held a number of senior executive roles at global financial services companies. His experience includes leadership roles at Mastercard, Credit Suisse and JPMorgan.

The firm acquires new customers through methods including marketing campaigns, targeted advertising, strategic partnerships, and referrals from existing customers.

Euronet also leverages its extensive network of financial institutions, agents, retailers, merchants, and content providers to reach potential customers.

Euronet’s Market & Competition

According to a 2019 market research report, the market for payment processing services is expected to reach $62.3 billion by 2024.

This represents a forecast CAGR of 9.9% from 2019 to 2024.

The main drivers for this expected growth are a continued growth in the number of merchants seeking integrated payment processing solutions and the entrance of new market participants with new technology offerings.

Major competitive or other industry participants include:

-

PayPal (PYPL)

-

Global Payments (GPN)

-

Block (SQ)

-

Wirecard (OTC:WRCDF)

-

Visa (V)

-

Jack Henry & Associates (JKHY)

-

Paysafe Group (PSFE)

-

Fiserv (FISV)

-

Others

The firm operates in a number of other markets in addition to payment processing.

Euronet’s Recent Financial Performance

-

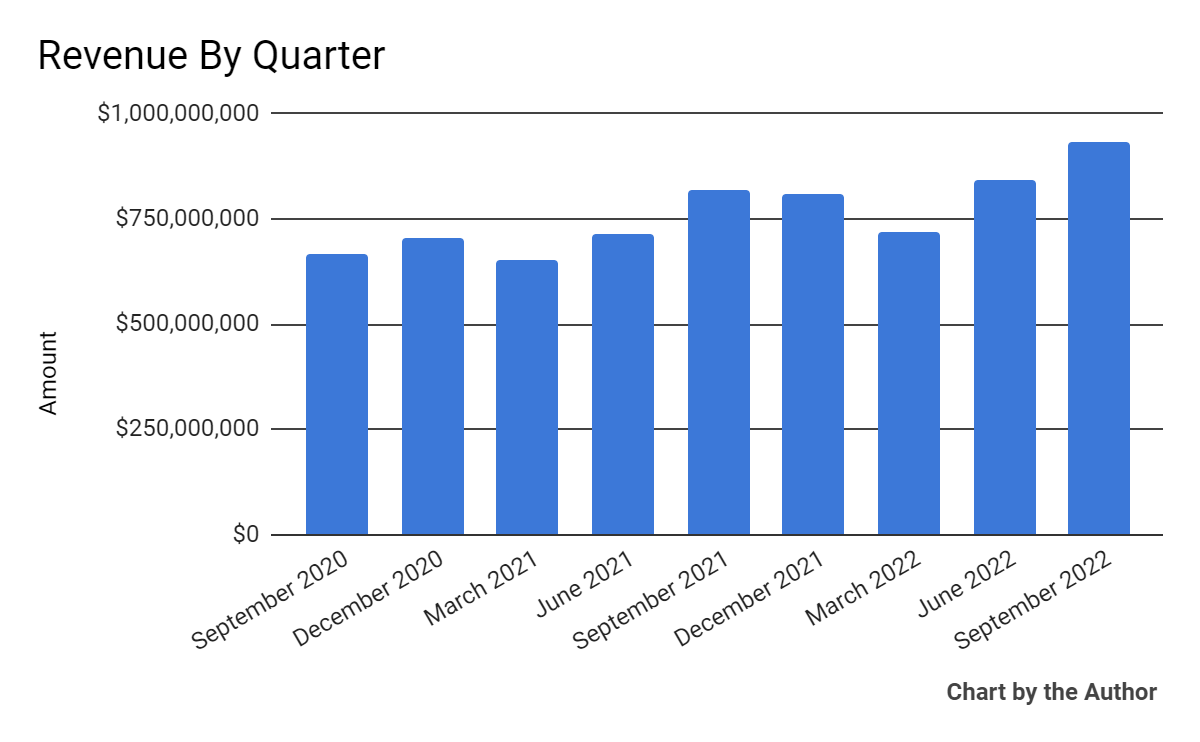

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

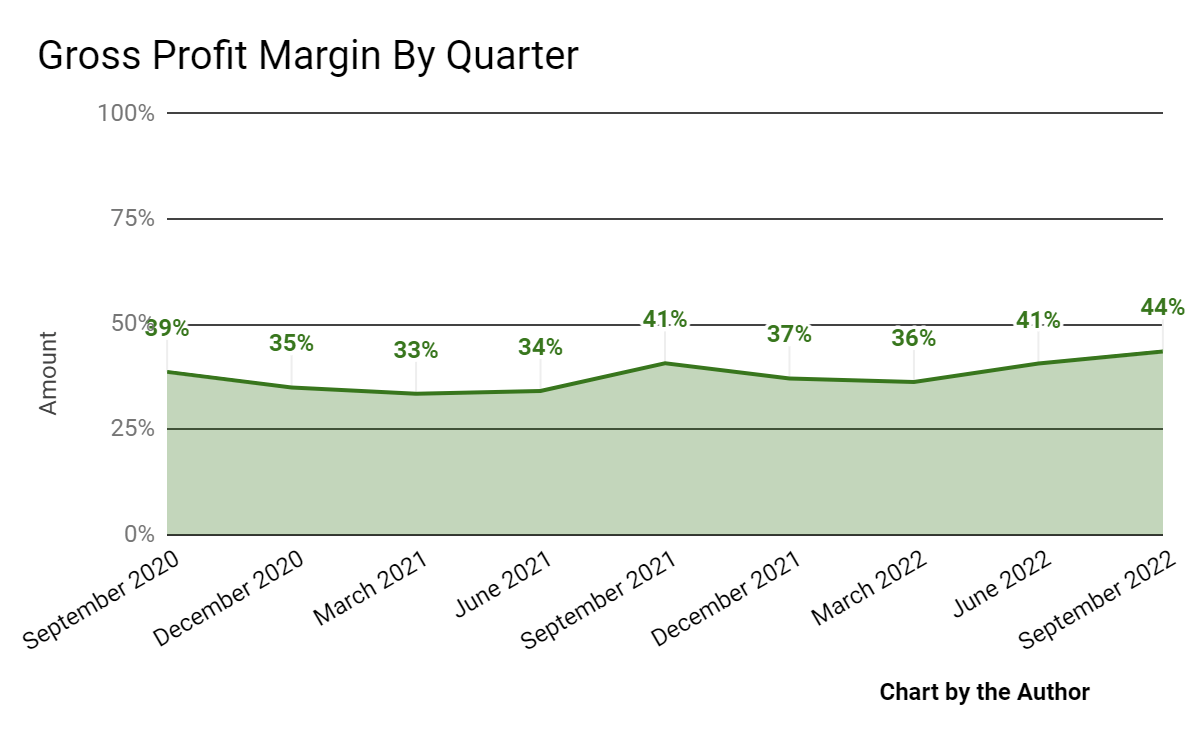

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

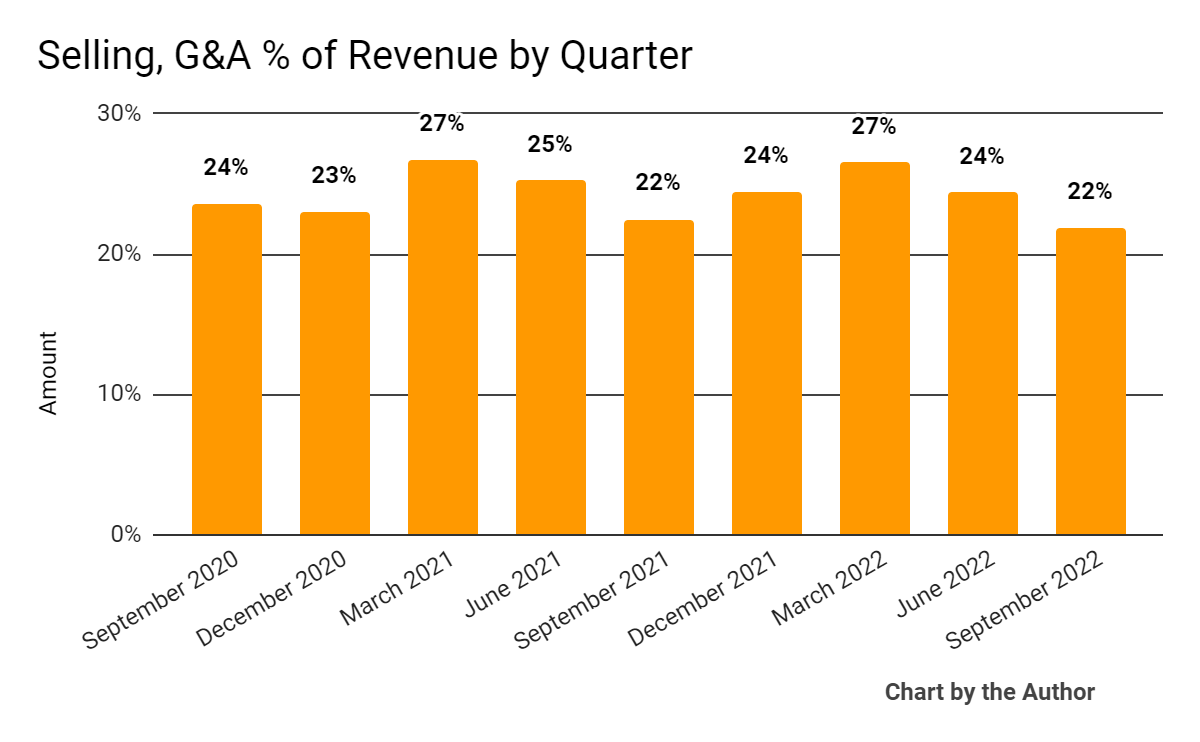

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated within a range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

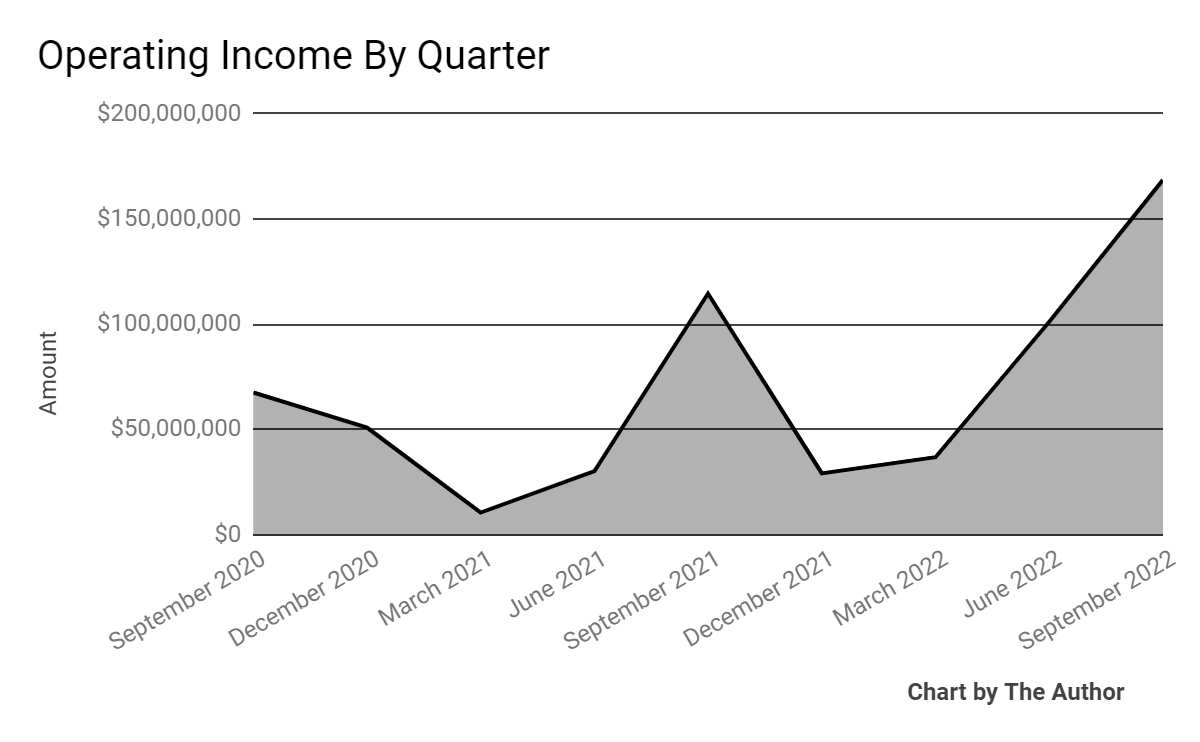

Operating income by quarter has risen markedly in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

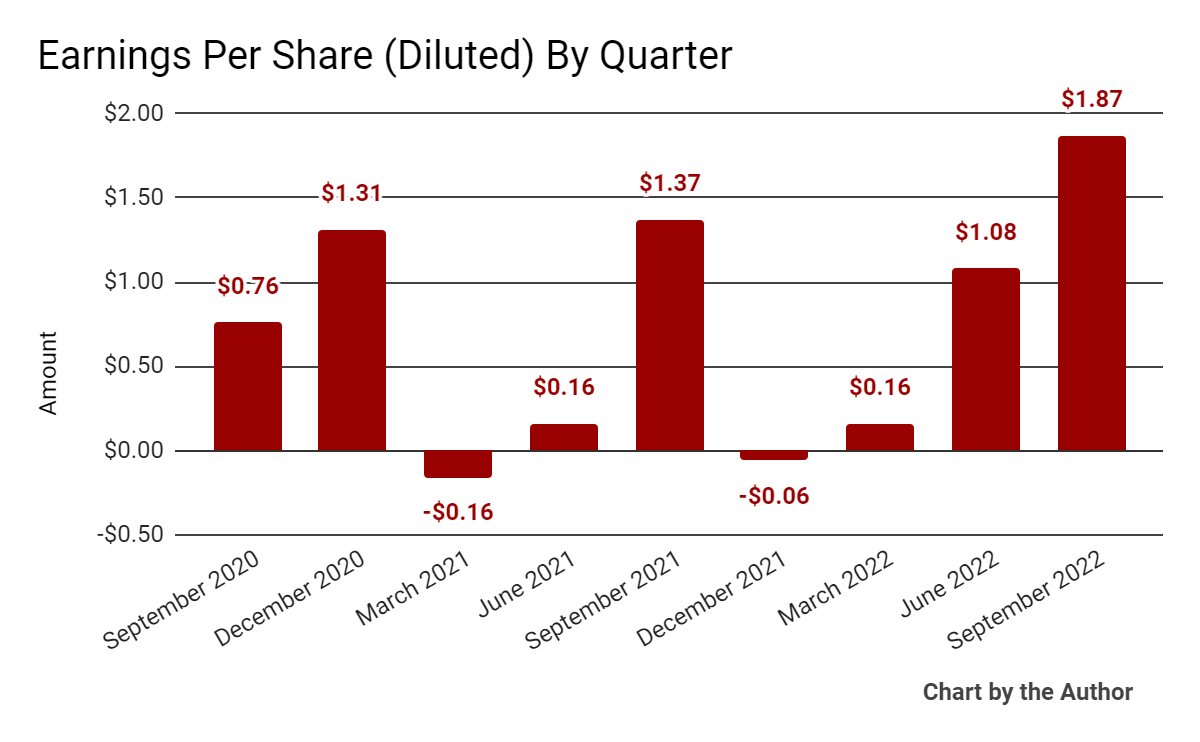

Earnings per share (Diluted) have also grown in recent reporting periods:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

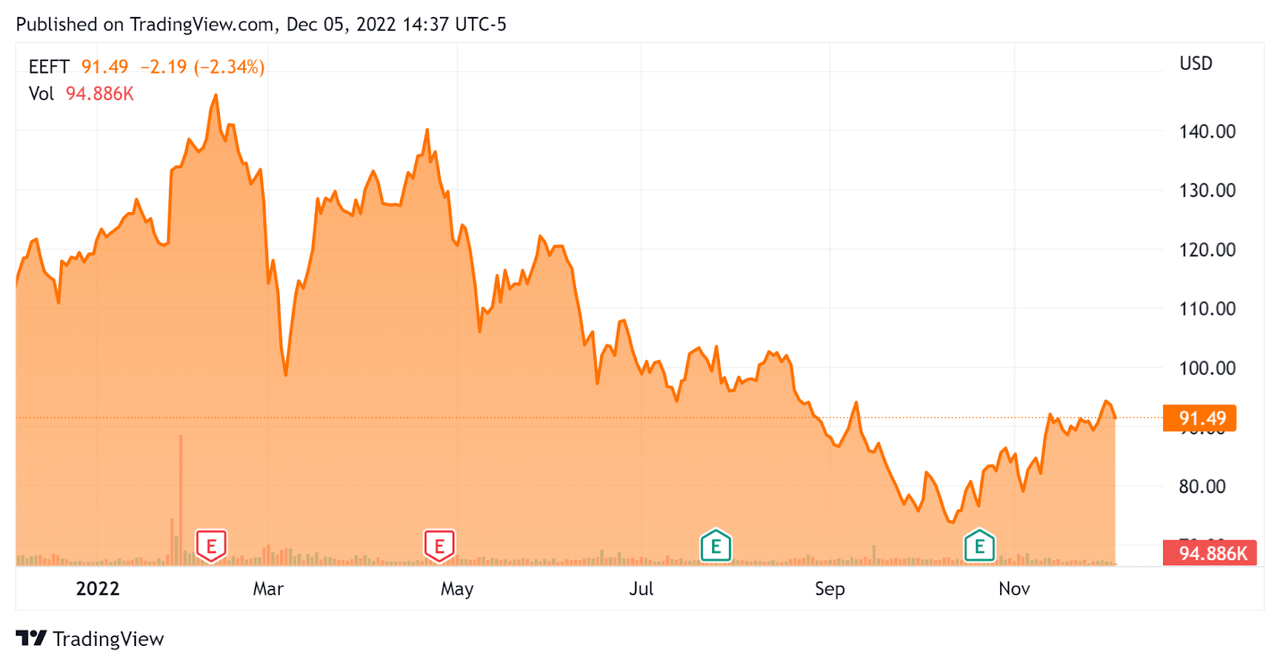

In the past 12 months, EEFT’s stock price has dropped 19.3% vs. the U.S. S&P 500 index’s drop of around 13.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Euronet

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.5 |

|

Enterprise Value / EBITDA |

10.4 |

|

Revenue Growth Rate |

14.3% |

|

Net Income Margin |

4.9% |

|

GAAP EBITDA % |

14.3% |

|

Market Capitalization |

$4,650,000,000 |

|

Enterprise Value |

$4,910,000,000 |

|

Operating Cash Flow |

$550,870,000 |

|

Earnings Per Share (Fully Diluted) |

$3.05 |

(Source – Seeking Alpha)

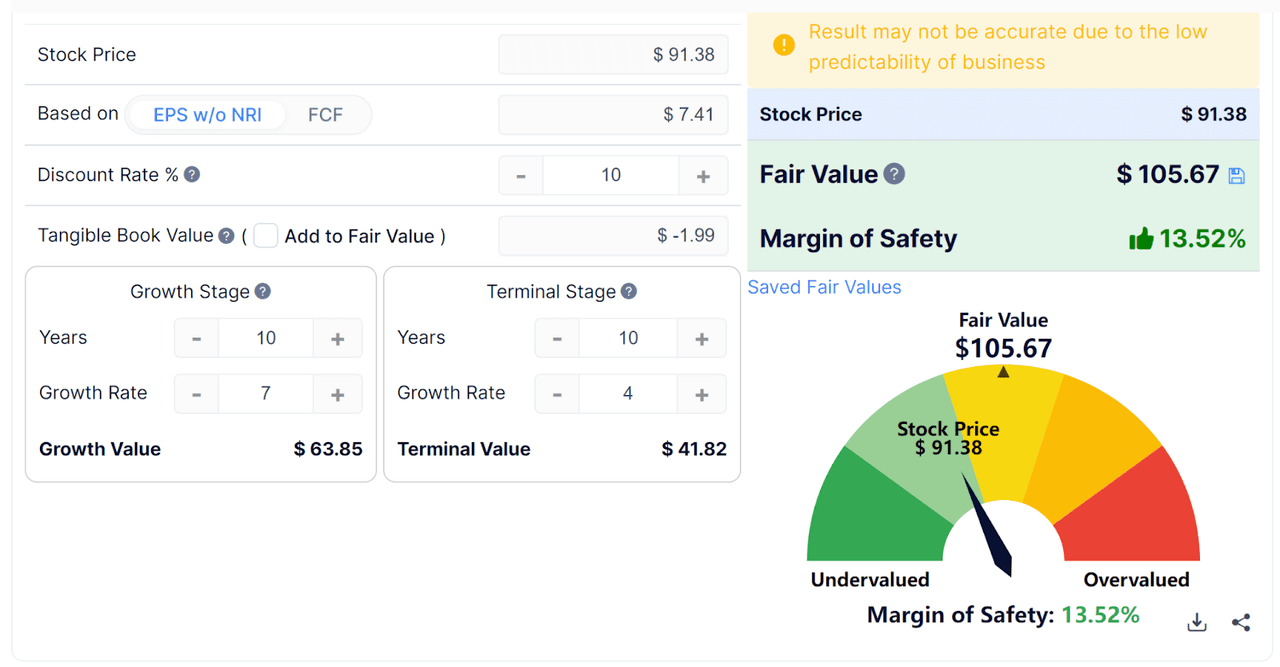

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Analysis (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $105.67 versus the current price of $91.38, indicating they are potentially currently undervalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On Euronet

In its last earnings call covering Q3 2022’s results, management noted that the European Tourism Association found that international arrivals in Europe were 26% lower than pre-pandemic levels, while arrivals in Asia-Pacific were 72% lower than 2019.

But the company’s epay segment is experiencing growing demand for mobile and digital payments content and consumers and businesses are increasingly looking to make cross-border payments. During COVID, epay and money transfer businesses still grew at a double-digit rate, despite the difficult conditions.

The firm’s EFT business has continued to expand in Europe with a new independent ATM network being launched in Estonia and a network participation agreement being signed in Spain.

Additionally, 500 non-branch ATMs were acquired from the Bank of Philippine Islands, 15 credit unions in the US and US military bases in Germany have been signed up for outsourcing agreements, 3,000 new merchants have been added to the portfolio, and 1,800 ATMs have been installed in the current year.

Challenges in the ATM supply-chain have slowed down expansion efforts but new manufacturers are being worked with in order to add more ATMs.

As to its financial results, total revenue rose 14% year-over-year, while gross profit margin increased to 44%, the highest in the last nine quarters.

SGA costs as a percentage of revenue dropped to a nine-quarter low, while operating income rose to a nine-quarter high.

For the balance sheet, the firm ended the quarter with unrestricted cash and equivalents of $967 million and $1.7 billion in total debt.

Over the trailing twelve months, free cash flow was $445.4 million, of which capital expenditures accounted for $105.5 million.

Looking ahead, management was cautious about 2023 in terms of macroeconomic influences as well as COVID restrictions on the travel and hospitality industries and the knock-on effects to its various business segments.

However, the firm is continuing to see a return path to normalcy in many of its segments as the pandemic wanes.

My discounted cash flow analysis suggests that the stock may be undervalued at its current level and projected forward earnings and growth trajectory.

The primary risk to the company’s outlook would be a stronger-than-expected global slowdown after a series of sharp interest rate hikes to quell inflation.

But, Euronet appears well positioned for further growth and the stock may be a bargain where it is.

So, my outlook for EEFT is a Buy at around $91.50 on the basis of good execution and a generally improving environment for financial services as the pandemic continues to wane and lockdowns ease.

Be the first to comment