EUR/USD Price, News and Analysis:

- ECB policy meeting, ZEW and Markit PMIs all on the docket this week.

- US dollar nudges higher ahead of US Presidential inauguration.

Recommended by Nick Cawley

Download our Fresh Q1 Euro Forecast

EUR/USD traders are in for a busy week with a raft of important economic releases, the latest ECB policy meeting and President-elect Joe Biden’s inauguration all hitting the market in a matter of a few days. Included in this data outturn are the latest ZEW and Markit PMI readings for Germany and the Euro Area (EA), inflation data for the EA, the latest ECB policy decision and German Ifo readings at the end of the week. The Martin Luther King holiday in the US today is keeping a lid on price action so far, but volatility is expected to increase from tomorrow onwards. For all market-moving economic data and events, see the DailyFX Calendar.

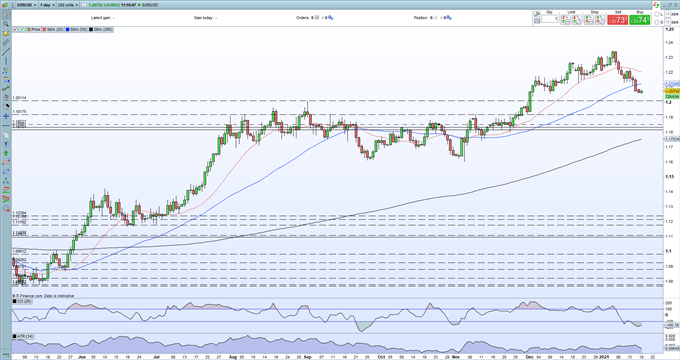

The daily EUR/USD chart suggests that the pair may struggle to move in the short-term and that the path of least resistance is for lower prices. Today’s range is tight due to the US holiday and the pair sit just above the multi-week support around 1.2055. The pair have a small boost today, provided by a marginally weaker US dollar, but the recent downtrend remains in place. The pair have also opened below the 50-day simple moving average after breaking below the 20-day sma just over a week ago. The CCI shows EUR/USD as being heavily oversold. A break lower should see 1.2011 and 1.2000 tested in short-order before 1.1900 to 1.1920 comes into play. The short- and medium-dated moving averages at 1.2122 and 1.2204 provide initial levels of resistance.

EUR/USD Daily Price Chart (June 2020 – January 18, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 11% | 19% | 15% |

| Weekly | 16% | -4% | 4% |

IG Retail trader data show 48.26% of traders are net-long with the ratio of traders short to long at 1.07 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment