EUR/USD Rate Talking Points

EUR/USD continues to carve a series of lower highs and lows as the Federal Reserve delivers another 75bp rate hike, and the exchange rate may struggle to retain the rebound from the yearly low (0.9952) as fresh data prints coming out of the US are likely to keep the central bank on track to implement higher interest rates throughout the remainder of 2022.

EUR/USD Post-Fed Rebound Susceptible to US GDP, PCE Report

EUR/USD trades within last week’s range as the Federal Open Market Committee (FOMC) retains its current approach in combating inflation, and it seems as though the central bank will adjust the forward guidance over the coming months as Chairman Jerome Powell acknowledges that “it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

Nevertheless, fresh data prints coming out the US economy may keep the FOMC on track to implement higher interest rates as the Gross Domestic Product (GDP) report is anticipated to show a rebound in the growth rate, while the core Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, is expected to hold steady at 4.7% per annum for the second month.

Signs of a resilient economy along with evidence of sticky inflation may force the FOMC to deliver another 75bp rate at its next interest rate decision on September 21 as the committee remains “determined to take the measures necessary to return inflation to our 2 percent longer-run goal,” and it remains to be seen if the fresh projections from Chairman Powell and Co. will highlight a steeper path for the Fed Funds rate as the central bank is slated to release the updated Summary of Economic Projections (SEP).

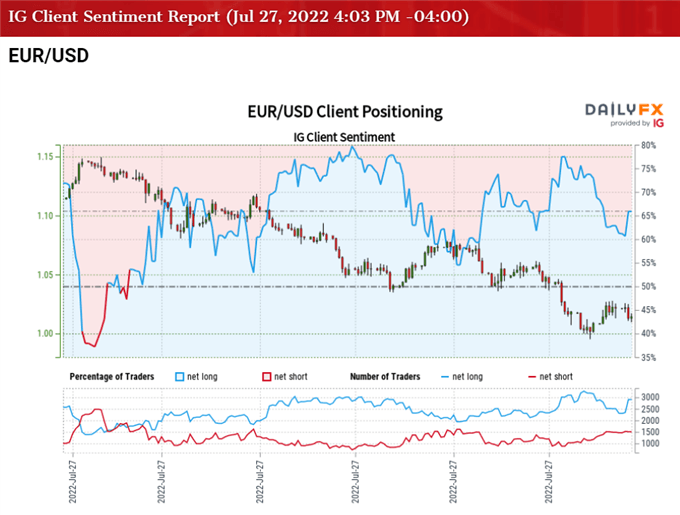

Until then, developments coming out of the US may sway EUR/USD as the Fed struggles to bring down inflation, while the tilt in retail sentiment looks poised to persist as traders have been net-long the pair for most of the year.

The IG Client Sentiment report shows 63.17% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.71 to 1.

The number of traders net-long is 2.67% lower than yesterday and 8.21% higher from last week, while the number of traders net-short is 8.83% higher than yesterday and 12.16% higher from last week. The rise in net-long interest has fueled the crowding behavior as 61.83% of traders were net-long EUR/USD last week, while the increase in net-short position comes as the exchange rate continues to carve a series of lower highs and lows.

With that said, developments coming out of the US may drag on EUR/USD if the data prints fuel speculation for another 75bp rate hike in September, and the exchange rate may struggle to retain the rebound from the yearly low (0.9952) if it fails to hold within last week’s range.

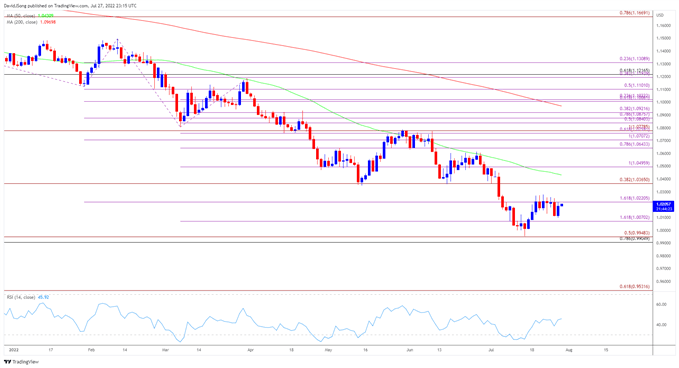

EUR/USD Rate Daily Chart

Source: Trading View

- The recent rebound in EUR/USD appears to have stalled ahead of the former support zone around the May low (1.0349) as it struggles to hold above 1.0220 (161.8% expansion), with the series of lower highs and lows in the exchange rate raising the scope for a move towards 1.0070 (161.8% expansion).

- Failure to hold above parity may push EUR/USD back towards the yearly low (0.9952), with a break/close below the Fibonacci overlap around 0.9910 (78.6% retracement) to 0.9950 (50% expansion) bringing the December 2002 low (0.9859) on the radar.

- However, EUR/USD may face range bound conditions it if snaps the bearish price series, with a move above 1.0220 (161.8% expansion) opening up the 1.0370 (38.2% expansion) region.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment