Spencer Platt/Getty Images News

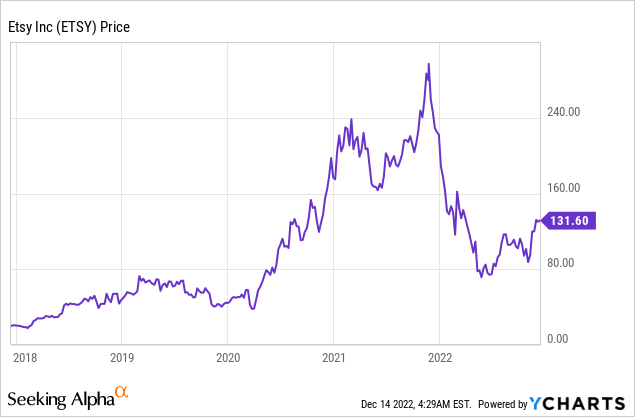

Etsy (NASDAQ:ETSY) runs an e-commerce marketplace that specializes in handmade and unique products. The company benefited massively from the lockdown of 2020, as customers had time on their hands and stimulus cash to spend. Homemade facemasks were a key product winner on Etsy in 2020. This was driven by an international shortage and platforms such as eBay took a hard stance, banning the sale of these items. Etsy’s number of active buyers is still double over its pre-pandemic level, despite the “reopening” of traditional retail and a tough economic environment. In this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Business Model

Etsy operates an e-commerce marketplace that connects independent sellers with buyers. However, this service is different from Amazon (AMZN) in that it doesn’t offer generic goods but specializes in unique items. I like to think of Amazon as being the online mall, while Etsy is the small shop in a hipster neighborhood. I am a firm believer in “cycles”, with regard to trends and consumer habits. Consumers tend to flock to a preference of mass-produced cheap goods, before returning to the “good ol days” of handcrafted, premium items. Etsy covers the niche market for the latter.

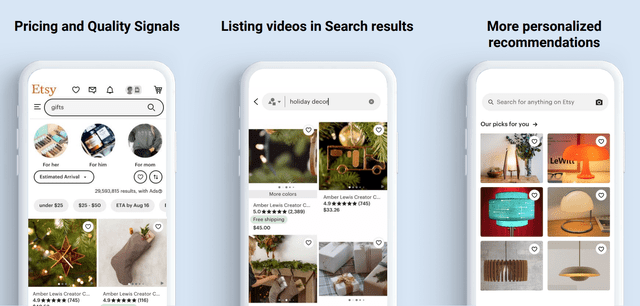

Etsy is continually innovating its product and has developed features such as pricing and quality signals, video-based listings, and personalized recommendations.

Etsy product innovation (Q3,22 report)

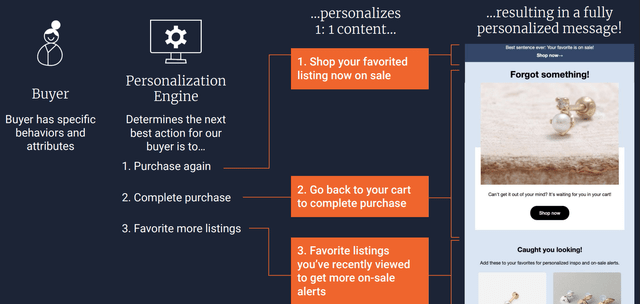

The company’s “Personalization Engine” tailors products, one to one, to a specific buyer. In the world of sales “if you are marketing to everybody, you are marketing to nobody”, therefore personalization generally increases both repeat purchases and average order value [AOV].

Etsy Personalization Engine (Q3,22 report)

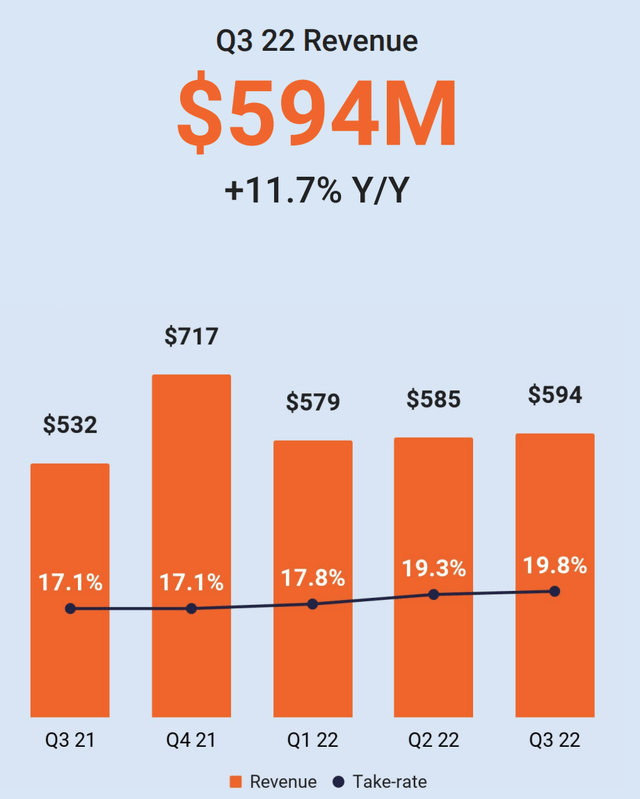

Third Quarter Financials

Etsy reported solid financial results for the third quarter of 2022, revenue was $594.47 million, which increased by 11.7% year over year and beat analyst estimates by $30.47 million. The take rate also improved from 17.1% to 19.8%. This was driven by the aforementioned investments in product innovation and personalization. This has helped to improve metrics across retention, reactivation, and repeat purchases.

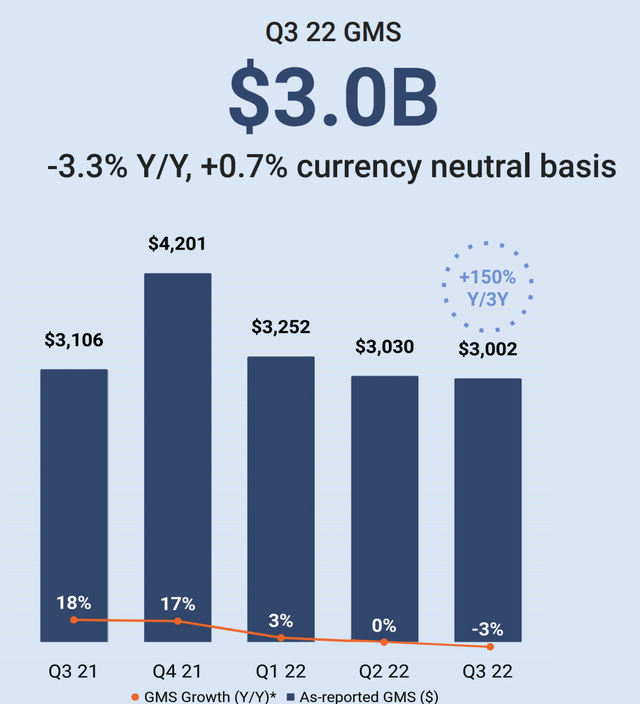

The company reported Consolidated Gross Merchandise Sales [GMS] of $3 billion, which declined by 3.3% year over year. The annual decline was a result of lower consumer demand driven by the macroeconomic environment and FX headwinds. A positive is on an FX neutral basis GMS, increased by 0.7% year over year and is still up 150% over three years ago. This is fantastic news as it means a vast number of customers Etsy acquired during the 2020 lockdown have stuck with the platform.

Gross Merchandise Sales (Q3,22 report)

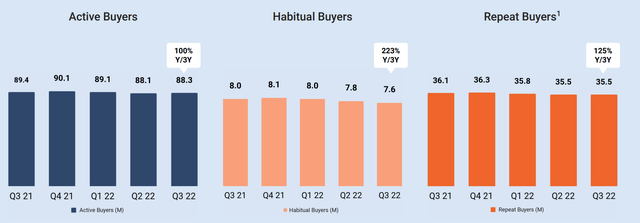

Etsy reported “stabilization” in its active buyers, which have declined by just 1.2% year over year to 88.3 million. However, as mentioned prior, over the past three years, active buyers are up by 100%, which is positive regarding the retention of those who joined during the pandemic. Etsy has also increased its number of “Habitual Buyers” by 223% to 7.6 million over 3 years. In addition, it has a strong “Repeat Buyers” of 35.5 million, which was aligned with the last quarter and up 125% over 3 years.

Etsy has also invested in building up its number of sellers on the platform and improving their experience. The company recently rolled out its “Star Seller” program, which provides sellers with a dashboard with metrics they should care about like response times, shipping times, and review scores. Etsy has then gamified the system through the offering of badges to the best sellers. According to the company’s data, those “star sellers” who win a badge earn ~18% more GMS. Etsy reported 7.396 million active sellers on the platform, which was down 0.9% year over year.

The company also rolled out its “Purchase Protection Program” to improve trust in the platform and the experience for both buyers and sellers. This resulted in positive improvements in conversion rates at both the listing page and cart. This is a positive strategy and something Airbnb (ABNB) has also done for their accommodation marketplace.

On the support side, Etsy has slashed its average resolution times in half while improving customer satisfaction scores. The company has also rolled out the ability for sellers to granularly control the return policy for each item. This is vital on a platform such as Etsy as many products are customized and unique.

Acquired Brands

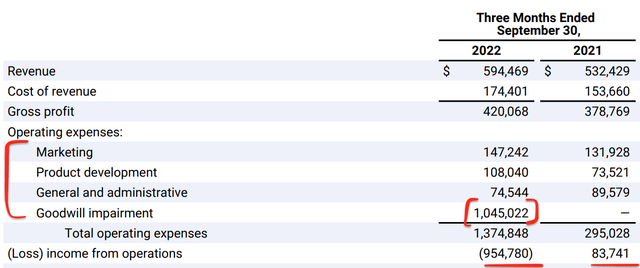

Etsy has expanded its platform through a series of acquisitions. This includes the 2021 acquisitions of fashion resale marketplace Depop and Brazil’s “Etsy style” marketplace Elo7. The company made these acquisitions during the “good times” when the economic situation was strong and many industry leaders through the 2020 e-commerce boom would continue. However, now the macroeconomic situation has changed, management admitted that the timing “could have been better”. Therefore, the company has had to write off a huge $1 billion goodwill impairment on these acquisitions as valuations have fallen. A positive is this is a “noncash” impairment and thus the company hasn’t actually had to pay out $1 billion.

It is also still early days for these acquisitions, and Etsy has elected a new CEO for Depop to accelerate growth. In addition, Elo7 in Brazil is working directly with the in-house Etsy team to optimize its marketing and improve search on the platform. “Reverb” the musical instrument marketplace acquired in 2019 is also investing in improving its search and product.

Profitability and Expenses

Etsy is operating at a heavy loss and reported negative $955 million in the third quarter of 2022, which was substantially worse than the $83.7 million reported in the prior year. A positive is this was driven by the aforementioned goodwill impairment charge of $1 billion, which was a non-cash expense. Therefore, if we adjust for this, the company reported Non-GAAP Earnings Per Share of $1.07, which actually beat analyst expectations by $0.30. Another positive is General and Administrative expenses declined from $89.58 million in Q3,21 to $74.5 million in Q3,22. This means the business is demonstrating some operating leverage as it scales.

Etsy has a solid balance sheet with ~$1 billion in cash, cash equivalents, and short-term investments. However, the company does have a fairly high long-term debt of $2.3 billion.

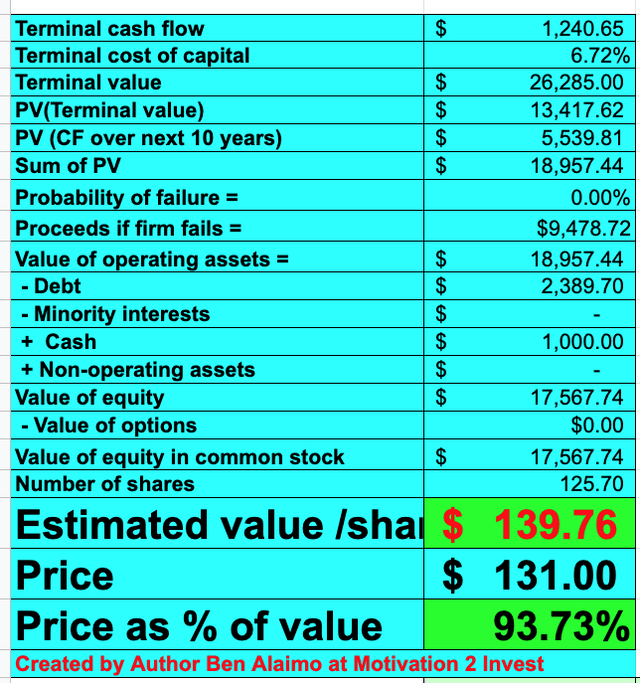

Advanced Valuation

To value Etsy, I have plugged its latest financials into my discounted cash flow model. I have forecasted a 12% revenue growth for next year, which is at a similar growth rate to this year, given the macroeconomic environment. However, in years 2 to 5, I have forecasted consumer demand to improve and the company to grow at a 20% rate.

Etsy stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted net income. I have also forecasted the company to continue to increase its number of repeat buyers and order value, increasing its operating margin to 26% in 8 years.

Etsy stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $139 per share, the stock is trading at $131 per share and thus is ~7% undervalued.

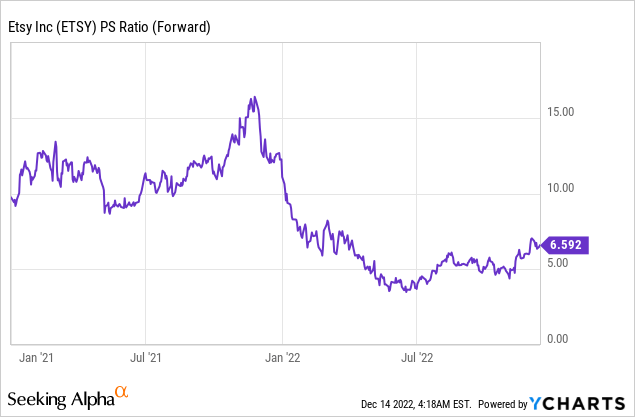

As an extra data point, Etsy trades at a Price to Sales ratio = 6.59, which is cheaper than historic levels.

Risks

Recession/Lower Consumer Demand

The high inflation environment is squeezing both consumers and businesses. This has resulted in tepid consumer demand, especially in e-commerce. Many analysts are forecasting a recession in 2023, thus, Etsy stock may remain suppressed for at least the next 6 to 12 months.

Final Thoughts

Etsy is a great company and I believe it has a unique place in the e-commerce market. Most buyers will visit Amazon for quick, cheap, and utility-based products. However, when they want to be inspired and shop for something more unique, Etsy makes sense. Its management is doing all the right things, by investing in product improvements, etc. However, so far, we are not seeing the results show up in the numbers, which could be due to the recessionary environment. Etsy stock is undervalued intrinsically and relative to historic multiples. In addition, as economic conditions improve, I expect consumer demand to increase and Etsy to perform well long term.

Be the first to comment