alfexe

It is certainly no surprise that the stock market has delivered a very disappointing performance over the past several months, which is mostly due to the actions of the Federal Reserve and the disappointing performance of the economy. It seems highly unlikely that things will change anytime soon, especially given that today’s CPI print showed no signs of the end of the inflation that has been plaguing the United States. This will likely have many investors trying to find options to help them protect their wealth and still provide them with a steady source of income to pay their bills.

In this article, we will discuss one possible solution, the Eaton Vance Risk-Managed Diversified Equity Income Fund (NYSE:ETJ). As I pointed out in a past article on this fund, the fund’s management uses a fairly unusual options strategy to protect its assets against a market downturn, which has generally been effective as the fund is the only closed-end fund (“CEF”) that managed to deliver a positive total return in 2008’s market crash. It has not been performing quite as well so far this year, but there may still be some reasons to revisit it. As I have discussed this fund before, this article will focus mostly on the developments that have occurred over the past year since my article and provide an updated analysis of the fund’s finances.

About The Fund

According to the fund’s webpage, the Eaton Vance Risk-Managed Diversified Equity Income Fund has the stated objective of providing its investors with current income and gains, with a secondary objective of capital appreciation. This is certainly nothing that is unusual for a closed-end equity fund as many of them have a similar objective.

The unusual thing here is the strategy that this fund uses to achieve its objective. In short, the fund uses its assets to invest in a diverse portfolio of common equities and then hedges its exposure by buying puts against the S&P 500 index. In addition to buying the puts, the fund sells call options against the index with the same maturity date. This is a classic collar strategy that is generally used as a way to obtain downside protection should the market fall. The goal is for the fund to avoid losing much money if the index declines, as it has generally been doing this year. Indeed, as we can see here, the S&P 500 index is down 15.80% over the past twelve months:

Seeking Alpha

Curiously, though, the Eaton Vance fund has been down 24.27% over the same time period:

Seeking Alpha

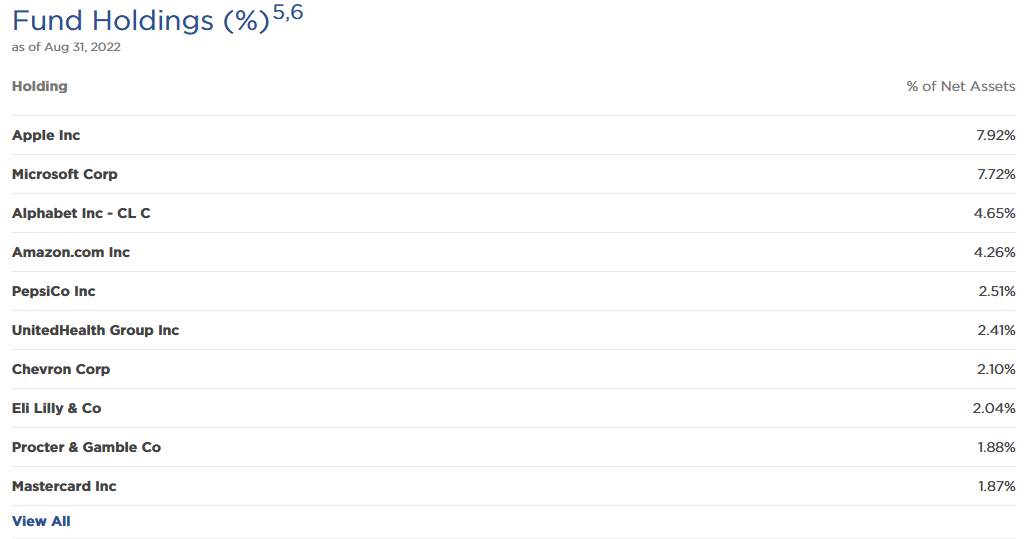

This is in spite of the collars that the fund is using to protect itself against such an event. At first glance, this certainly appears confusing, but it may be possible to find a cause of this situation by looking at the fund’s largest positions. Here they are:

Eaton Vance Funds

This is a bit different from the last time that we looked at the fund, although we still see the large allocation to four of the five technology giants. In fact, the fund’s allocation to Apple Inc. (AAPL) has actually increased over the past year, although the weightings for both Alphabet (GOOG)(GOOGL) and Amazon (AMZN) have gone down. The reason why this could be important in explaining the decline is that the technology stocks were dramatically overvalued heading into this year and have in aggregate been poor performers.

Unfortunately for many of these companies, their products are generally considered to be discretionary as opposed to necessary. As the prices of things such as food and energy have been rising and straining the budgets of many households, there are far fewer people willing to spend money on Apple’s newest gadget. Admittedly, the stock prices of pretty much everything except for energy companies are down this year but technology has been an especially hard-hit sector. This almost certainly dragged down the fund as its put options are on the S&P 500 index, not on any individual stock.

Interestingly, these four technology companies and UnitedHealth Group (UNH) are the only positions that made the top ten holdings list both last year and today. This would appear to indicate that the Eaton Vance Risk-Managed Diversified Equity Income Fund does a significant amount of trading. However, this is not the case. The fund only has an annual turnover of 41.00%, which is quite low for an equity fund. This could be a good thing for investors though because trading activity creates a drag on returns. The reason for this is that it costs money to buy and sell stocks or other assets, which are taken directly out of the fund’s returns. This is one reason why index funds have become so popular since they do almost no trading and therefore usually have very low costs. This does not necessarily mean that a fund with high expenses will underperform the market, but it is much harder for management to deliver outperformance due to the drag on returns.

As I have noted in past articles on closed-end funds, I do not like to see any position in a fund account for more than 5% of the fund’s assets. This is because this is approximately the level at which an asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for more than 5% of the fund’s total portfolio then this risk will not be diversified away. Thus, any event that causes an asset’s price to decline when the market itself does not could result in that asset dragging the whole fund down with it. We certainly see that reflected here as the heavy weighting to just a few of the major technology companies has been causing the fund to underperform the market so far this year.

The Impact Of Inflation On Forward Returns

Earlier today, the Bureau of Labor Statistics released the latest inflation report, which showed that core inflation came in at an incredibly high 6.6%, about 2.9-sigma above consensus. This comes as the Federal Reserve stated that it would consider slowing down further rate hikes. This report makes that rather unlikely, and many analysts are now stating that the Federal Reserve will likely do another 75-basis point hike later in the year, with one analyst even predicting a 100-basis point increase.

If the Federal Reserve actually does this, it seems almost certain to cause the broader market to decline as it has been doing this year. This is because the bull market that we have been seeing over the past decade was not driven by economic fundamentals but by the Federal Reserve’s “easy money” policy. Now that this policy appears to be ending, market participants are selling off and keeping more of their assets on hand, which is pressuring the market downward. This increases the need for investors to have a way to protect their own assets against further market declines, which is what the Eaton Vance Risk-Managed Diversified Equity Income Fund purports to offer (although it has been failing miserably due to the consumer discretionary and technology-heavy portfolio).

Revisiting Market Valuation

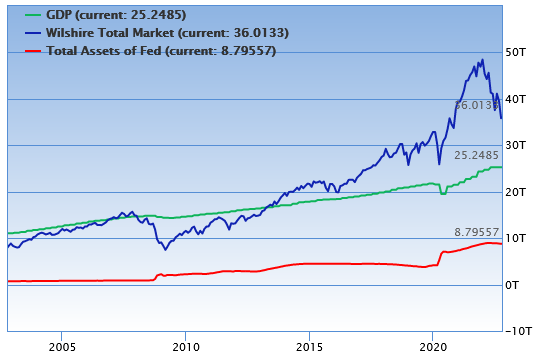

Despite the fairly steep decline that we have seen in the market so far, the overall market appears to still be overvalued. We can see this by looking at the total market capitalization-to-GDP ratio, which is not exactly a ratio that many investors are familiar with. Although this ratio is not often discussed, Warren Buffett once called it, “the best single measure of where valuations stand at any given moment.”

As of October 12, 2022, the total market capitalization of all American companies is $36.6192 trillion, which is 145% of the last reported gross domestic product of the United States. As we can see here, this ratio is considerably above average:

GuruFocus

Historically, this ratio always reverts to the mean so that could be a very real sign that stocks have room to decline further. This will likely happen should the Federal Reserve continue to raise interest rates. Thus, investors appear to continue to need downside protection.

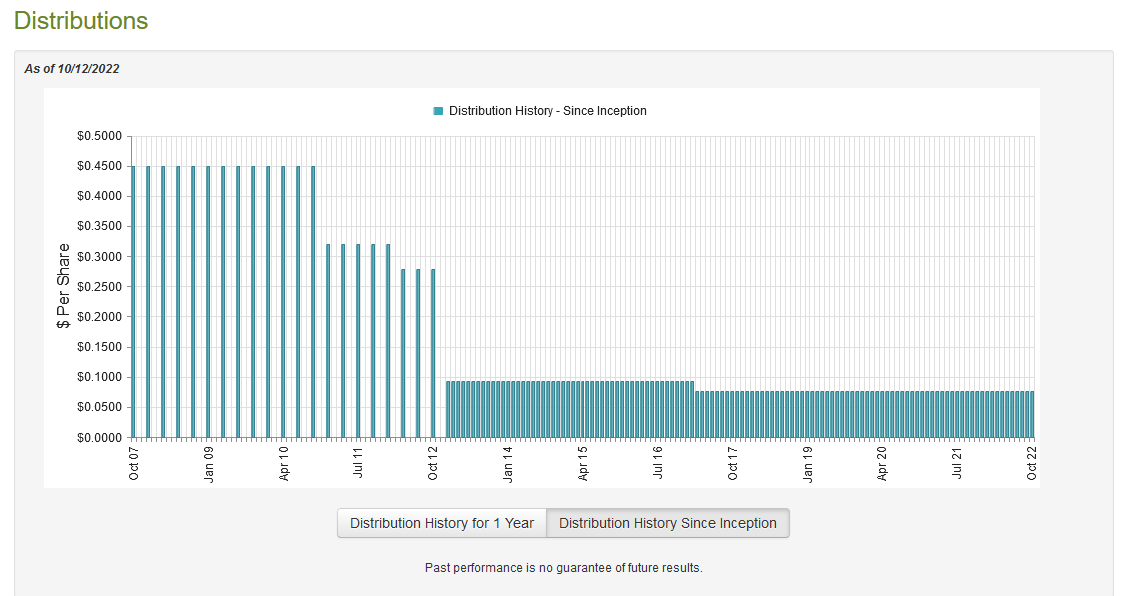

Distribution Analysis

One reason why many investors purchase shares of the Eaton Vance Risk-Managed Diversified Equity Income Fund is because of the historically high yield that the fund possessed. Indeed, as stated earlier, the fund has the generation of current income and gains as one of its major objectives. The fund currently pays a distribution of $0.076 per share monthly ($0.9120 per share annually), which gives it an 11.18% yield at the current price. The fund has been remarkably consistent about this yield over time as well, having maintained it since 2017:

CEF Connect

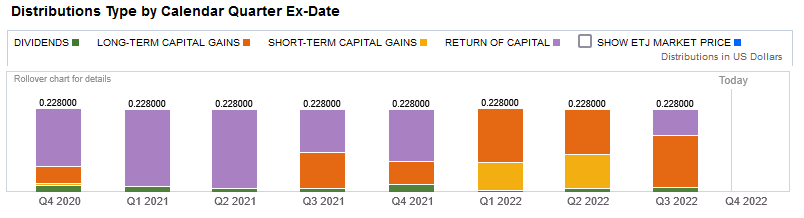

This makes the fund fairly likely to appeal to those investors that are looking for a steady source of income to pay their bills, something which is increasingly important in today’s inflationary environment. The fact that in recent quarters most of this distribution was classified as capital gains as opposed to a return of capital may also provide some comfort:

Fidelity Investments

We do still see that, in the past, the fund had a significant amount of return of capital distributions. This is something that may concern a few people, even though recent distributions have not had this problem. The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a fund’s distributions to be considered a return of capital. The two most common scenarios are when the fund distributes unrealized capital gains and returns from certain options strategies. As these are both things that this fund could do, we should investigate to see exactly how it is financing these distributions as part of our analysis of the fund’s ability to sustain its distribution.

Fortunately, we do have a relatively recent report to consult for that purpose. The most recent financial report for the Eaton Vance Risk-Managed Diversified Equity Income Fund corresponds to the six-month period ending June 30, 2022. As such, it should be able to give us a good idea of how well the fund performed during the choppy market in the first half of this year as well as verify that the distributions that have been paid out so far this year are indeed mostly capital gains. During this six-month period, the fund received a total of $4,489,452 in dividends and $17,726 in interest from the assets in its portfolio. This gives the fund a total income of $$4,507,178 during the period. It paid its expenses out of this amount, leaving it with $1,099,243 available for investors. This was nowhere close to enough to cover the $30,290,114 that it actually paid out in distributions though.

With that said, the fund does have other methods to obtain the money that it needs to pay its distributions. One of the most important ones is capital gains. The fund generally failed at this, however. During the six-month period, it had $40,984,794 in realized capital gains but this was offset by $153,151,621 in unrealized losses. Overall, the fund saw its total assets decline by $111,067,584 before it even paid out the distribution. This is certainly not encouraging as it clearly indicates that the fund could not afford the distribution that it paid out. With that said though, it did realize enough in capital gains to pay the distribution, thus it does certainly appear that the distribution for the first half of the year was indeed completely financed by capital gains per the above chart.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund, the usual way to value it is by looking at the net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were completely shut down and liquidated.

Ideally, we want to acquire shares of a fund when we can acquire them at a price that is less than net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. Unfortunately, the Eaton Vance Risk-Managed Diversified Equity Income Fund has traded for considerably above its net asset value for quite some time now and this continues to be the case today. As of October 12, 2022 (the most recent date for which data is currently available), the fund had a net asset value of $7.87 per share but traded for $8.34 per share. This represents a 5.97% premium to the net asset value. This is well above the 4.95% premium that the fund has had over the past month so it seems rather expensive right now. It would be a good idea to wait until the price comes down a bit before buying in.

Conclusion

In conclusion, I want to recommend the Eaton Vance Risk-Managed Diversified Equity Income Fund, as it seems likely that the market will continue to decline over the next several months as the Federal Reserve continues to try and combat inflation. This fund’s strategy is perhaps the best of any closed-end fund to provide protection for investors.

Unfortunately, I cannot do that because the underlying portfolio does not appear to be particularly good in an environment in which rising fuel and food prices are stretching the finances of an average household. In addition, the fund is incredibly expensive right now, which is yet another strike against it. Overall, it may be a good idea to look elsewhere for protection and income.

Be the first to comment