Michael Ciaglo/Getty Images News

In December I wrote an article titled: Those Aren’t Really Hawks: Ascendant Bitcoin Under Historic Fed Stimulus. The article made three points. First, though there had been a severe shift in Fed members’ targets for year-end 2022, the federal funds rate would remain historically low despite the coming hikes. Second, the simple lesson from the FOMC’s quantitative easing history is that generally their balance sheet increases and each new phase is more substantial than in prior expansions. Last, that these tendencies over time should be supportive of harder assets in the crypto space with strong tokenomics, especially Bitcoin (BTC-USD) and Ethereum (ETH-USD).

In December, the average target of FOMC members for year-end 2022 federal funds rate was between .75% and 1% and purchases of Treasury securities and agency mortgage-backed securities continued, though at a quickly reducing amount. Now, just six months later, the current rate has already surpassed the prior .75%-1% target and sits between 1.5%-1.75%. And the Fed has surprisingly already begun ramping the runoff of the balance sheet by reducing the amount of principle payments reinvested.

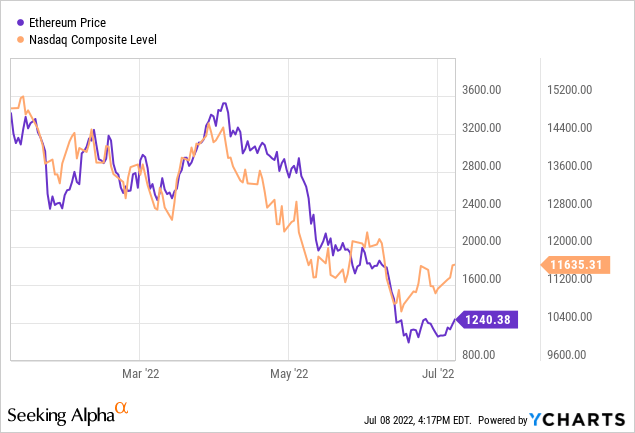

So the whole thesis, that fear and uncertainty surrounding rate hikes and a QE reversal were overblown, has proved substantially wrong. And of course this surprising hawkishness, a reaction to the entrenched and spilling inflation in the energy sector, has meaningfully dragged down risk-on and rate sensitive assets. Further, in the chart above note the close correlation between the Ethereum price decline and the fall in the Nasdaq Composite level during this period of rapidly adjusting outlook in the credit markets.

So interest rate policy and the macro environment are driving action in the digital asset space. For Ethereum in particular, the Fed factor has proven more important than news on The Merge, regulation rumblings out of Washington, or issues lower down the altcoin ladder, such as with Terra (LUNA-USD). However before considering the all-important Fed policy outlook, the article below briefly reviews The Merge with a focus on how it will undergird Ethereum in the coming year of rate policy adjustment.

2023 Foundations Still Strong: Importance of The Merge

Working though changes in plans and delays, The Merge of Ethereum’s Mainnet execution layer with its Beacon Chain proof-of-stake consensus mechanism appears imminent. Final practice runs and a litany of fixes on the public testnets are occurring. June’s Grey Glacier update pushed back and set the mining difficulty bomb for September. So all signs still point to a third quarter implementation. In the coming weeks this timeline could be confirmed following The Merge on the important Goerli testnet and its aftermath. The Merge is key to price action in the quarters that follow as it increases Ethereum’s regulatory moat, could precursor a staking revolution, and meaningfully improves the coin’s tokenomics.

Even before The Merge, Ethereum has a larger than average moat against direct regulatory action as there is a growing consensus that the coin is a commodity rather a security. Though the recently proposed Responsible Financial Innovation Act is unlikely to pass quicky and in its current form, the bipartisan bill affirms that Ethereum’s regulatory authority will fall to the CFTC rather than the SEC.

Digital assets that meet the definition of a commodity, such as bitcoin and ether, which comprise more than half of digital asset market capitalization, will be regulated by the CFTC.

Source: LUMMIS, GILLIBRAND INTRODUCE LANDMARK LEGISLATION, lummis.senate.gov, 6/7/22

And after The Merge, Ethereum will benefit from having the preferred consensus mechanism from an ESG perspective and therefore also a regulatory perspective. Estimates from the Beacon Chain point to proof-of-stake being ~2000x more energy-efficient than proof-of-work.

The Merge may also tend to tighten the supply of Ethereum in two ways. There are currently about 13 million of the total 120 million ETH staking on the Beacon Chain. These ETH are locked and cannot be withdrawn until a cleanup upgrade is instituted following The Merge.

Once the cleanup upgrade goes live there will technically be additional tradable supply as the 13 million ETH is unlocked. However, as the staking returns should to be in the high single digits, longer-term institutional investors may look to stake ETH once the uncertainty surrounding the lock up period is removed. This would increase demand and de facto tie up supply.

One countervailing consideration… there are questions about what the miners will do with the significant percentage of ETH they are holding. Miner stock prices have fallen, discouraging share sales, and bond financing is now prohibitively expensive. So it is likely a portion of the held supply will come to market to fund mining operations for other coins or tokens.

Last, the rate of increase in the supply of Ethereum following The Merge will also drastically fall, and possibly reverse. There will no longer be a two ETH issuance per block to the winning miner in the proof-of-work consensus. Rather, those choosing to stake their coins will be rewarded for securing the platform. The new rewards to those staking will be a fraction of the prior proof-of-work issuance. And note that base fees are now burned. So depending on the gas prices, the fee burns could be larger than the staking rewards, making the system slightly deflationary.

So where from here?

The Fed and market participants may now be estimating more rate hikes and tightening than will actually be realized in the remainder of 2022. And if the full complement of currently anticipated hikes do not materialize, one could expect this to be generally supportive of tech equities and risk on assets, including crypto.

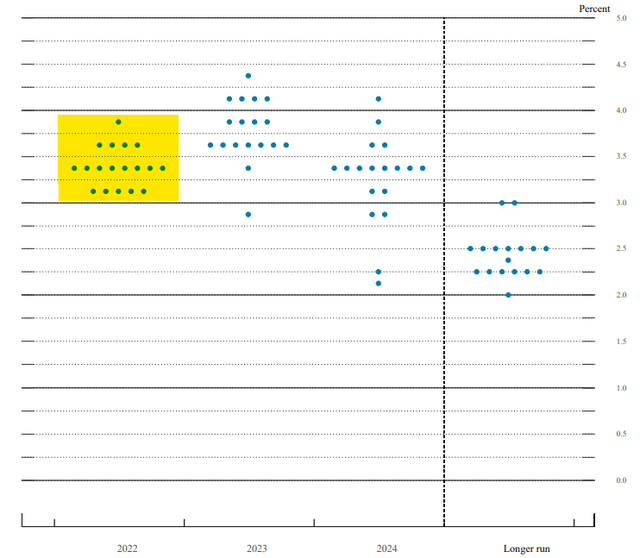

June SEP, Dot Plot (federalreserve.gov)

The median FOMC participant has the yearend 2022 federal funds rate between 3.25% and 3.5%. This implies total increases of 1.75% during the next four meetings. Going back to 2000, the largest increase over a similar period totaled 1% and was equally distributed in .25% increments. And for clarity, this will be on top of the 1.5% increase over the prior three meetings.

With a tight labor market and sustained core inflation above even the new symmetrical target range, the current situation is substantially different than seen over the past two decades. But still, the size and speed of the current trajectory is extraordinary. Also FOMC participants in the past have expressed concerns about large, swift changes to the rate. And notably one of the more hawkish members, Esther George, surprisingly voted against the .75% increase in June.

President George dissented because she judged that a large increase in the target range for the federal funds rate would add to uncertainty about policy concurrent with the beginning of balance sheet runoff in ways that could unsettle households and businesses and could also adversely affect the ability of small banks to meet the credit needs of their communities.

Source: Minutes of the FMOC June 14–15, 2022, federalreserve.gov, 7/6/22

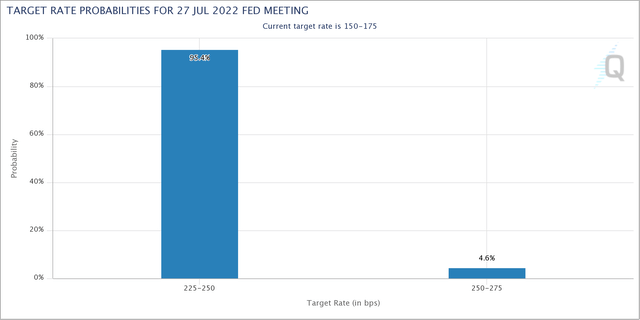

As seen in the graphic below, following the strong June jobs report last Friday, market expectations based on futures prices point to a 95% chance of a .75% increase at this month’s meeting, with a small 5% chance of a 1% rise. From my perspective this outlook is an example of how expectations are overweighted to the hawkish side. And there remains a solid, though minority, possibility the Fed only moves .5% and basically zero chance of a 1% raise. The smaller probability .5% increase would only require the coming CPI and retail sales numbers to both deviate from expectations on the low side.

Rate Probabilities Post July Meeting (cmegroup.com)

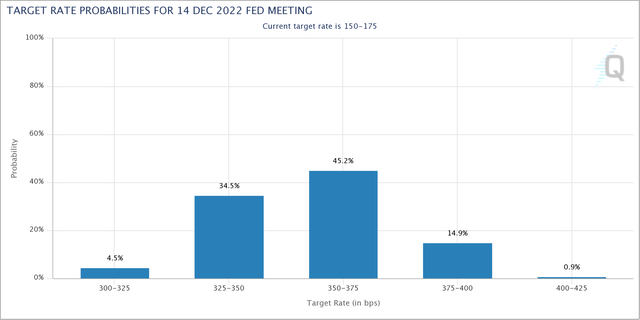

For reference the chart below shows market expectations for the federal funds rate at yearend, as a probability, based on futures prices. It can be directly compared to the yellow highlighted Fed SEP dot plot above; it has a highly similar though marginally more hawkish distribution.

Target Rate Probabilities Yearend (federalreserve.gov)

In the June minutes there is a focus by the Fed on communications and they even directly mention their own credibility. They now appear sensitive to not repeat prior statements about the transitory nature of the inflation or to ever stress the idea that their tools are not well suited for tackling inflation caused supply constraints.

Powell has also recently emphasized that controlling high inflation is necessary for sustained max employment; high inflation has been linked to low investment and slower growth. Put differently, the Fed is further bolstering its anti-inflation rhetoric by showing there is not a direct tradeoff in their dual mandate.

My highlighting the Fed’s focus on communications concerning inflation does not imply they are unserious about using direct policy tools to reduce inflation. But rather that they believe strong talk is a tool in their arsenal as well.

Many participants noted that the Committee’s credibility with regard to bringing inflation back to the 2 percent objective, together with previous communications, had been helpful in shifting market expectations of future policy and had already contributed to a notable tightening of financial conditions that would likely help reduce inflation pressures by restraining aggregate demand.

Source: Minutes of the FMOC June 14–15, 2022, federalreserve.gov, 7/6/22

As a bookend to this section, consider the following from Chair Powell. Despite his purposefully hawkish stance, he emphasized:

Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common.

Takeaway

Tightened and tightening financial conditions could reduce inflation rates and inflation measures prior to the September Fed meeting. Should this occur, direct policy firming at the final three meetings of the year may not be as robust as current Fed communications or market expectations now indicate. There could even be a pause in hikes prior to reaching the 3.25%-3.5% median yearend target.

Further, beyond outlier inflation developments, the max foreseeable policy tightening of another 2.0% in raises is already priced into market expectations. So the opportunity for a shift is to the dovish side. This is generally constructive for expected value calculations in the tech sector and for risk on assets, including Ethereum.

In the quarters that follow The Merge, Ethereum will benefit from its new proof-of stake consensus mechanism. Proof-of-stake is ESG and regulator friendly. Because of the relatively high yields, an Ethereum staking revolution is possible once the off-putting lockup requirement is removed in the period following The Merge. And because proof-of-stake does not require the substantial issuance to miners for securing the platform, growth in total supply will drastically flatten following The Merge.

I expect positive sentiment in the months leading up to The Merge and that this period neatly coincides with a more favorable macro environment. Assuming Ethereum maintains above $950 and the Nasdaq Composite above 10,800, my target is between $1,400 and $1,480 near the date of The Merge.

Be the first to comment