MF3d/E+ via Getty Images

Thesis Summary

Ethereum (ETH-USD) is close to undergoing a historic change in its protocol. The much-awaited “merge” will switch Ethereum’s consensus mechanism to Proof-of-Stake, which should help make the network more efficient.

The ETH merge won’t fix all of the network’s problems and comes with its own new issues.

However, I believe the merge will ultimately be successful and bullish for ETH, so I am recommending you buy the dip.

The Merge: What, When and Why

The much-anticipated Merge will make the Ethereum blockchain a PoS consensus. This means that instead of having miners, you have stakers. Instead of solving complex equations to mine new blocks, rewards are given to stakers, anyone who has committed/locked up a minimum amount of Ethereum for this purpose. Of course, the more you have staked, the higher the odds are that you will receive a reward.

The move towards PoS has been labelled the merge because it involves merging the current Ethereum blockchain with the Beacon chain. The Beacon chain already exists as a separate blockchain which operates on PoS but does not have smart contract capabilities. Once the merge is complete, ETH will be made up of the current “execution layer” and the Beacon chain, which will act as the “consensus layer”.

The merge is scheduled to happen sometime around August this year. Ethereum has already completed a merge with the Ropsten testnet last month and is now about to carry out a second test merge with the Sepolia testnet. However, experts are sceptical about the official launch date. Ethereum has a long history of not meeting deadlines, and the “difficulty bomb”, which will render mining unprofitable and incentivize staking, has recently been delayed a further two months. This implies the merge will also be postponed.

But why is the merge so anticipated? Because the move to PoS will make Ethereum faster and cheaper to use. For starters, PoS will do away with mining, which can be considered environmentally unfriendly. But, most importantly, with this upgrade, ETH will be able to process transactions faster, primarily as future upgrades like sharding are implemented.

In conclusion, the merge will be a historic moment in crypto and will change ETH forever. For the most part, this will be an improvement, but we mustn’t fall into the trap of thinking this upgrade will solve all of Ethereum’s issues.

Not So Fast

While ETH will be more efficient after the merge, in terms of speed and cost, it won’t be the fastest blockchain.

Once sharding is implemented, Ethereum should be able to process up to 3,000 transactions per second, which is considerably more than the current figure of 30. However, this is still much slower than chains like Solana (SOL-USD) which claims to carry out 50,000 tps or Cardano, (ADA-USD), which plans to reach 2 million tps.

Ethereum will still need to rely on layer two solutions to stay relevant such as Polygon (MATIC-USD) or Fantom (FTM-USD). This is why I am also bullish on many of these altcoins.

The other problem with the merge is that it could make ETH more centralized, and this is something that ETH founder Vitalik Buterin recently talked about. And this is something I also covered in a recent Ethereum article. As it stands now, Lido Finance, which is a staking pool, could end up controlling over a third of the ETH network. Ultimately though, I believe this problem can be addressed with DAOs. Centralization can work as long as it is democratic.

Ethereum Chart

Now is the time to buy ETH. It has incredible long-term potential, and we are also seeing possible signs of a bottom forming.

ETH Long-term chart (Author’s work)

Using Elliott Wave Theory, we can predict that the next move up in Ethereum could take us towards the $8,000-$10,000, which would be a very juicy return if you buy at today’s price.

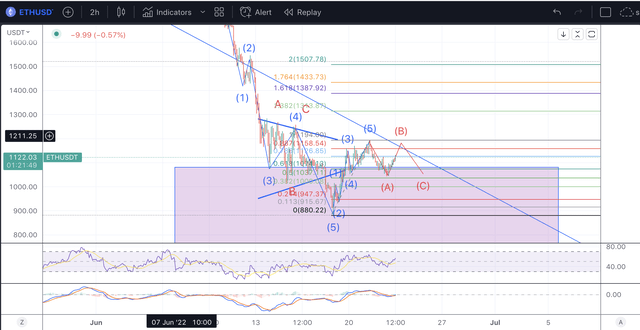

ETH short-term chart (Author’s work)

Now, if we zoom into the action of the last few days, we can see that ETH completed a five-wave move down, which was part of a larger five-wave move down in the wave C shown in the first chart. Since then, we have completed an impulsive five-wave rally, and we are now coming down in what looks like a corrective ABC. If we can hold the $900 and rally above the recent local high, then odds are the bottom is in.

Final Thoughts

The Ethereum network could become the most valuable blockchain shortly, and the merge is a significant step in the right direction. There’s a lot to like about Ethereum, both fundamentally and from a charting perspective, and I believe now is the time to be aggressive.

Be the first to comment