(This article was co-produced with Hoya Capital Real Estate.)

matejmo

On November 12, 2021, in conjunction with the Hoya Capital Income Builder (hereafter HCIB) marketplace service, I introduced the ETF Reliable Retirement Portfolio (hereafter ETFRRP).

For tracking purposes, the official inception date of the portfolio was November 9, 2021. The purchase prices used were the closing prices from the previous day, November 8, 2021. We decided on $500,000 as the opening value of the hypothetical portfolio, as we felt this amount perhaps struck a nice median as being representative of an investor who subscribed to a service such as HCIB.

On October 4, 2022, I offered the 2022 Q3 update on the portfolio. I referred to this update as “the quarter everything collapsed.” I led off with a tweet from Charlie Bilello featuring the fact that the classic 60/40 portfolio of U.S. stocks/bonds was down 21% YTD through Q3 2022, the second worst year in history (after 1931). Sadly, the Q3 performance of the ETFRRP was slightly worse than even this benchmark. Here is how I explained that result.

However, the simple fact remains that the ETFRRP underperformed this very relevant index. In short, the reason is that what I might refer to as the alternate asset classes I included in the portfolio—international stocks, real estate, and gold—all had a very difficult quarter.

For a complete discussion of the theory behind the initial portfolio construction, as well as the starting balance and positions, please feel free to reference the articles referenced above. In the next section, however, I will offer an abbreviated overview of key data points and concepts to lay a groundwork for the performance update that is ultimately the subject of this article.

Portfolio Structure And Themes

Based on 2022 investment outlooks from several reputable sources, here are the key themes that drove portfolio construction.

- A bias toward value stocks in the U.S. – Of late, a relatively small subset of U.S. growth stocks has significantly outperformed virtually every other asset class. Various analyses suggest that value stocks may offer a better risk/reward profile moving forward.

- The return from U.S. equities may be only marginally higher than bonds – Particularly for retirees, finding a solid balance of risk/reward is worthy of consideration. I attempt to find this balance in my portfolio.

- Superior growth opportunities may come from outside the U.S. – A mid-year 2021 update from Vanguard forecast Euro-area stocks as potentially outperforming their U.S. cousins by roughly one-half percent; a range of 2.9% – 4.9% as opposed to 2.4% – 4.4%. And emerging markets offered even higher potential, albeit with more volatility and risk.

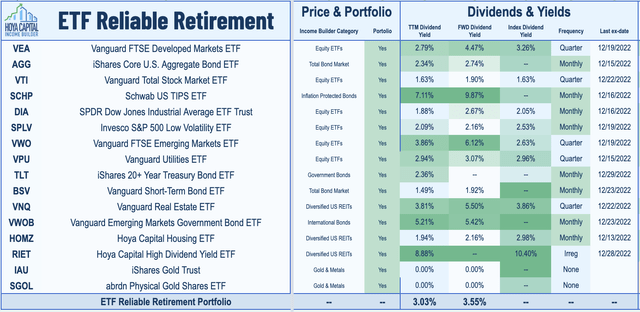

Below, I have reproduced the table of exchange-traded funds (“ETFs”) included in the portfolio. However, the weightings are proprietary to subscribers of Hoya Capital Income Builder.

ETFRRP by ETF Monkey (Hoya Capital Income Builder)

At a high level, the portfolio is comprised of five asset classes:

- U.S. Stocks

- Foreign Stocks

- Bonds/TIPS

- Real Estate

- Gold.

As a conclusion to this section, I might note that, while a high dividend level was not the primary focus of this portfolio, nine of the 14 dividend-producing ETFs pay dividends monthly, with the remaining five paying quarterly. The two gold-backed ETFs, of course, pay no dividends.

2022 Q4 & Full-Year Update: Where The Rubber Meets The Road

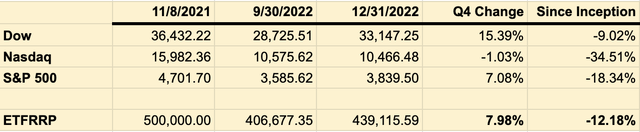

In the graphic below, I offer a comprehensive overview of how the ETFRRP has performed, compared with major U.S. market averages.

In terms of the full-year update, I will use the inception date of the portfolio, 11/18/2021. Due to the brief interval between this date and December 31, I did not put out a 12/31/21 report and so don’t have precise 2022 starting numbers. Ironically, the market was almost flat between those two points in time so the numbers I am reporting here are likely very close to a true full-2022 report.

ETFRRP by ETF Monkey vs. Market Averages (Author-Generated Spreadsheet)

Briefly, as can be seen, Q4 was solid for this fairly conservative portfolio, with a gain of 7.98%. This cut the overall loss for the year to 12.18%, as opposed to the 18.66% YTD loss I reported in Q3. I can accurately report that dividends on the portfolio were $13,006 for calendar-year 2022, or an overall dividend return of 2.60%.

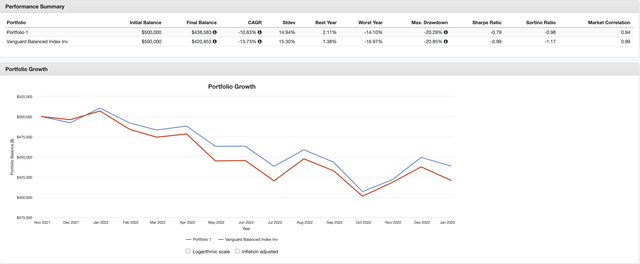

Since this aspires to be a balanced portfolio, as a benchmark for evaluation I ran a comparison in Portfolio Visualizer against the Vanguard Balanced Index, as represented by a mutual fund such as Vanguard Balanced Index Fund Admiral Shares (VBIAX). In the analysis, I set the flag to include, and reinvest, all dividends. Here are the results, focusing first on Q4.

2022 Q4 Returns – ETFRRP vs. Vanguard Balanced Index (PortfolioVisualizer.com)

If you look carefully at the above, based on my Q3 starting point of $406,677, the ending value calculated by Portfolio Visualizer is roughly $400 lower than my actual. During the quarter, I executed a couple of minor rebalancing transactions, as well as a couple of small profitable trading hunches. This accounts for the actual results being slightly better than what is shown here.

Bottom line? The outperformance of the ETFRRP in Q4 more than made up for the Q3 underperformance when measured against the same index, leaving me very happy indeed.

Next, the same exercise for the period since inception.

Returns Since Inception – ETFRRP vs. Vanguard Balanced Index (PortfolioVisualizer.com)

First of all, I might note that the ending balance of $438,583 calculated for the ETFRRP in this exercise reflects a mere $180 variance from the Q4 exercise. In both cases, then, the results proposed by Portfolio Visualizer line up very well with the actual results, despite my modest trading and rebalancing decisions along the way.

Secondly, I find myself extremely happy with the overall results. Between the additional asset classes I included, and what I would describe as a very modest amount of “active management” in terms of playing small trading hunches, the ETFRRP beat the Vanguard Balanced Index not only in total return, but in the risk-adjusted metrics as well.

Rather than offering a lengthy written breakdown of each ETF, with the help of GOOGLEFINANCE functions, I put together a comprehensive spreadsheet, with the results by ETF, for both Q4 as well as the entire year. Have a look, and then I will offer just a few brief comments.

ETFRRP – Performance By ETF (Author-Generated Spreadsheet)

With the exception of cash, basically every asset class experienced sharp declines during 2022. As featured earlier, I referred to my Q3 update as “the quarter everything collapsed.” Even gold was sharply down at that point, before mounting a nice rally in Q4 to end the year almost even.

Particularly did interest rate-sensitive asset classes get destroyed. The 4 ETFs that were by far my worst performers for 2022, all with declines of roughly 30%, were long-term treasuries and real estate.

However, the message I constantly preach, that of staying diversified, paid off handsomely in Q4. As just one example, both in June and again in December, I wrote articles reminding readers not to ignore potential in foreign equities. With that in mind, I can’t help but note that this was my best-performing sector in Q4, ahead of even U.S. stocks on an overall basis.

One last comment before I wrap up this section. In mid-November, I raised the cash level of the portfolio to approximately 10%. Prior to this time, I was almost fully invested across the asset classes I had chosen, typically with only 1-2% of the portfolio in cash. However, based on the 2023 investment outlook I will present next, I decided to give myself a little cushion to play with.

2023 Investment Outlook

Before I go any further, I would like to feature two of my past articles that I still believe are very relevant today.

The first, On Deliberate Asset Deflation And The Fed, was written all the way back in May, 2022. I summarized work by Credit Suisse Investment Strategist Zoltan Pozsar. In brief, Pozsar featured that, to an even greater extent than stocks, U.S. household balance sheets had been swelled by the then-recent breathtaking increases in housing prices. With that in mind, consider this brief excerpt from the investment note I summarized:

Consider the possibility that the Fed, on a singular mission to slay inflation, won’t rest in its pursuit of tighter financial conditions until yields shift higher, stocks fall more, and housing turns as well. (Italics mine)

The second article, The World Of 4,818 Faces An Uncertain Future, was written in August. In that article, I posited that continuing inflation as well as geopolitical shocks were going to combine to make it challenging for the S&P 500 to regain that all-time high of 4,818, achieved on January 14, 2022.

In brief, my view for 2023 is that investors—and in particular conservative investors—would do well to stay conservatively positioned and well-diversified.

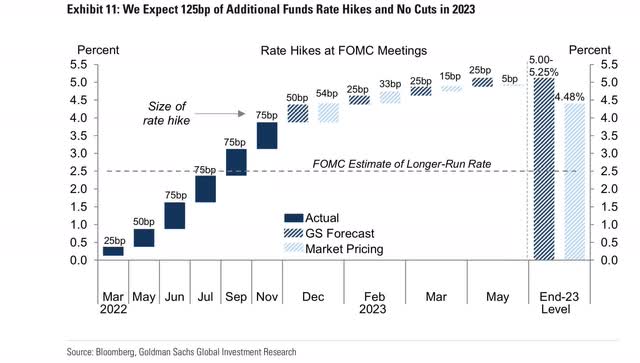

I’m not going to bombard you with a ton of graphics, just a couple along with a little bit of very “big picture” commentary.

First, this one from Goldman Sachs (GS). In this graphic, GS offers its view of expected Fed funds rate increases compared to what is currently priced in by the market. As can be seen, the market appears to be pricing in roughly .75% less than GS. In other words, GS appears to be taking Jerome Powell’s “higher rates for longer” mantra very seriously.

Fed Interest Rate Projections – 2023 (Goldman Sachs Investment Research)

Next, a very nice graphic I found from Vanguard.

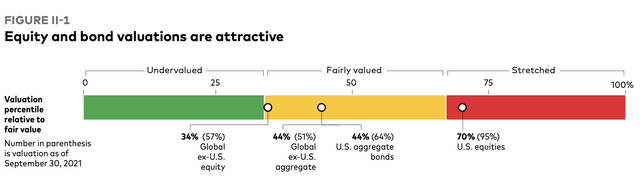

Equity & Bond Valuations Relative to Fair Value (Vanguard)

Along the scale of undervalued to overvalued, Vanguard lists several broad asset groups, and where they consider them to be at this point in time. It can quickly be seen that several other asset groups appear to be “cheaper” at this point than U.S. equities.

In a recent note to investors, OakTree’s Howard Marks used the phrase “sea change.” I thought that well captured the point in time at which I believe we are now. For the last several years, low interest rates and massive economic stimulus have led to overpricing of assets, with FOMO (fear of missing out) being the dominant driving force. But now, a sea change has occurred. Decent rates of return can be achieved from cash and short-term assets. In turn, this drives up the return investors should demand from equities to compensate them adequately for the additional risk they assume. In turn, that would tend to drive, or at least hold, down the prices of such equities.

What are some takeaways?

- Keep a reasonable portion of your portfolio in cash, in order to take advantage of opportunities which may present themselves.

- Decent returns are very likely to be had from bonds, with the best risk/reward profile coming at the short end of the duration spectrum.

- Per the above graphic from Vanguard, balance your equity investments between global and U.S.

In other words, as I said above, conservatively positioned and well-diversified.

I’ll stop there for now. I hope this piece has proved to be of some use, offering a perspective to consider. I’d love to hear from you in the comments below!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment