Vertigo3d

Essent (NYSE:ESNT) is one of the middle-of-the pack US private mortgage insurers (PMIs). Their business is to insure bank mortgages so that once they’ve been originated, they meet the requirements for banks to sell them from their balance sheets to government sponsored enterprises (GSEs) that promote national objectives like home ownership. After the financial crisis the PMIs have been regulated, and their portfolio of risks are definitely much safer than they once were. FICOs are high, loan to values (LTVs) are high, although falling as the value of properties fall. The issue is that underwriting growth is slowing down as housing affordability is affected by rate hikes. That’s not such a problem. The issue is latent forces for unemployment that would cause reserves to rise again, and be a cause for elevated claims. The stock is cheap, but mainly because of COVID-19 reversed reserves. With the market also being extremely competitive, we’re worried they’ve been in a race to the bottom with their current risk portfolio. Overall, the environment is choppy and with other options on the market we pass.

Q2 Results

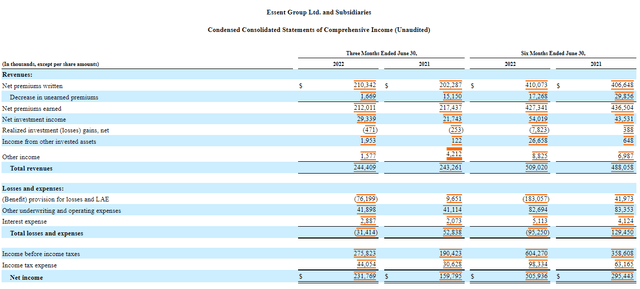

The net income figures saw very substantial increases to $232 million from $160 million YoY. This is almost entirely due to a release of reserves related to COVID-19. When the initial unemployment hit markets from COVID-19, defaults did start to rise a bit. Unemployment is the thing that ESNT is most levered to. These reserves could reverse back to what they were before.

IS (sec.gov)

YoY there hasn’t been much revenue growth; it’s been basically flat and volumes have not been driving any income growth really. This reflects a less alarming but still important factor affecting ESNT’s results. There has been a slowdown across the industry in mortgage underwritings as the housing market slows. Higher rates mean doubled mortgage rates and the affordability of buying houses has definitely declined. Moreover, buyers probably are scared off by falling prices. We’re almost back to early 2020 levels in housing prices. The reversal has been quite severe, and therefore LTVs are also falling on the pretty large vintage of risks underwritten in the year of very high housing prices. The US market has been rather hot even relative to other property markets. Prices could have a long way to fall, especially if we have latent unemployment risks.

Conclusions

Ultimately, the unemployment risks are more of a concern in relation to reserves rather than volumes. The low multiple for ESNT, around 8x on normalised earnings based on reserve levels during COVID-19, accounts for some decline in volumes. The problem is default risks on the portfolio. The market for insurance and banking stocks reacts quite closely to announcements around reserves. With ESNT’s price going flat after the initial 2020 rebound, markets aren’t necessarily ready for unemployment related reserves to kick in.

Why are we so worried about unemployment? It comes down to the fact that consumer facing businesses, due to a meaningful decline in consumer confidence (an entirely justified one), are having slowdowns. Meanwhile, corporates are spending more than ever and hiring. There will be a reckoning for those bloating headcounts, and with rates likely encouraged higher by this phenomenon which kept employment high, there are latent forces for unemployment rises on top of direct hits expected from further rate increases, not just from the ones that already occurred.

Another thing we don’t love is how competitive PMI is. With a bulge in vintages around years when rates would have been the most competitive, there has been a bit of a race to the bottom. Markets like this that struggle a bit to stay rational are not those we like. When there are volume concerns as well, but also higher risk of impairment to current in force policies, a compressed multiple makes sense. Honestly, 8x on a more normalised figure seems a little high still. This should be trading at very late cycle multiples. Around normalised 4x wouldn’t have been a surprise. While we can’t tell the future, and aren’t sure exactly what markets have priced in, we don’t see the need for hazarding cash in what could be a bit of a troubled market.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment