sefa ozel

Esperion Therapeutics (NASDAQ:ESPR) recently reported its Q2 earnings that produced a beat on revenue, but a miss on EPS. Although the company’s earnings were mixed, I am happy to see that Esperion continues to drive consistent growth in sales of NEXLETOL and NEXLIZET, as well as growing revenue from its partners. In addition, the company publicized that it has 100% MACE-4 accumulation in the company’s CLEAR Outcomes trial, which means we should have the top-line data ready in early Q1 of next year. Now, Esperion is heading towards a major inflection point that could redefine Esperion and its fundamental outlook. I believe this pending catalyst helped fend off the sellers and could bolster the share price as we wait for the data. As a result, I am adjusting my position management strategy to focus on the CLEAR Outcomes top-line data expected in Q1 of 2022.

I intend to review the company’s Q2 earnings and commercial progress. Furthermore, I provide my opinion on the importance of the company achieving 100% MACE-4 accumulation in the company’s CLEAR Outcomes trial. Finally, I discuss how I plan on managing my ESPR position for the rest of 2022.

Q2 Earnings Report and Partnership Updates

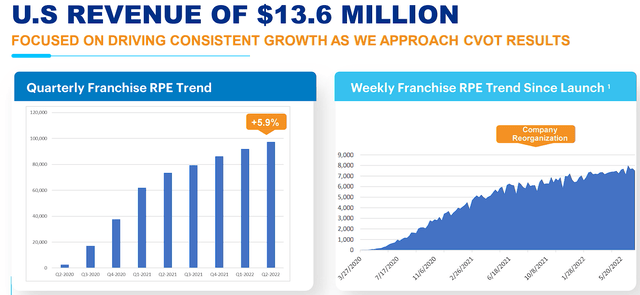

Esperion recently reported its Q2 earnings that showed it pulled in $13.6M in U.S. product revenue for Q2, which was up around 28% year-over-year. Its combined royalty and partner revenue for Q2 came in at 5.3M, thus, bringing Esperion’s total revenue to $18.8M. If you adjust for the upfront payment in Q2 of 2021, the company saw an increase of approximately 50% year-over-year.

Esperion Q2 Revenue and Commercial Trends (Esperion Therapeutics)

I have been directing most of my attention to U.S. sales, however, I shouldn’t be overlooking the company’s European partner, Daiichi Sankyo (OTCPK:DSKYF), which reported strong NILEMDO and NUSTENDI growth and has cumulatively treated at least 70,900 patients.

Additionally, the company’s partner in Japan, Otsuka Pharmaceuticals, is now planning to advance its NEXLETOL and NEXLIZET program into Phase III. Keep in mind that Otsuka’s partnership deal includes $450M in total development and sales milestones to Esperion. Furthermore, Esperion will also receive tiered royalties from 15-30% on net sales of NEXLETOL and NEXLIZET in Japan.

In terms of expenses, the company’s R&D expenses came in at $32.4M, which is a 29% increase year-over-year. The company explained that the R&D expense increases were primarily due to the rapid closeout of the CLEAR Outcomes, so we should see these numbers subside in the coming quarters. For SG&A, Q2 expenses were $29.6M, which was a 36% cut year-over-year thanks to the company’s cost-cutting initiative Esperion implemented in Q4 of 2021.

Esperion’s cash position appears to be holding up well. At the end of the first half of 2022, Esperion had $235.8M cash, cash equivalents, restricted cash, and investment securities available for sale. The company expects this cash runway to extend “through the anticipated completion and readout of the CLEAR Outcomes trial and continues to fund continuing operations for the foreseeable future following those results.”

My Thoughts On The Earnings

I feel like I have some cognitive dissonance about the company’s Q2 earnings. On one hand, I am happy to see some growth from the company’s partners and a fairly healthy cash position due to a reduction in expenses. On the other hand, the company’s U.S. sales growth is a bit concerning considering we are only a couple of years into a commercial launch. The company is reporting that it is still seeing some issues with prior authorizations for the scripts, so perhaps that is stunting the growth rate.

So, we are seeing progress in some areas… but not enough in others. It is like being pleasantly surprised, yet, still kind of disappointed.

Importance of 100% Mace Accumulation

Certainly, investors should be encouraged to see growth from NEXLETOL and NEXLIZET in the U.S. and Europe, but, the major potential growth driver is still on the horizon. Now, the company has hit 100% MACE accumulation CLEAR Outcomes trial, which is on course to report top-line results for CLEAR Outcomes in early Q1 of 2023 with “a brief top line statement of primary endpoint results.” The company is also planning on presenting “comprehensive study results” at a medical conference later on in the quarter. This data readout and subsequent presentations of the CLEAR Outcomes study will be incredibly potent catalysts for the company and shareholders. The CLEAR Outcomes study could reveal that NEXLETOL has the potential to be the first “oral LDL lowering therapy since statins to be indicated for CV risk reduction.” Indeed, NEXLETOL is projected to be a “new class of medicine for CVD in patients who have a statin intolerance.”

Moreover, we could see how NEXLETOL can have an impact on anti-inflammatory markers as well as their glucose-lowering effects. Obviously, having the data and the label could make NEXLETOL one of the most important cardiovascular and lipid products on the market.

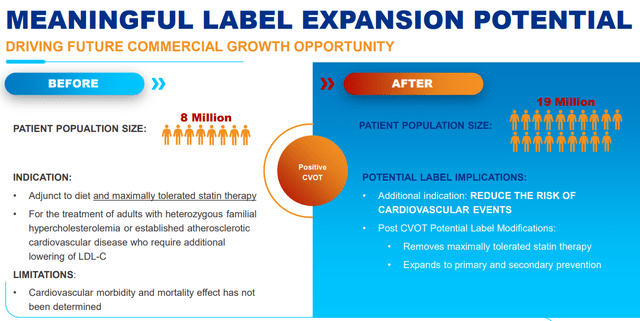

In fact, the company reported that a payer market research project directed in Q2 confirmed that positive data from CLEAR Outcomes would “unlock exponential growth through improved market access and expanded market share” and enlarge its target population size from roughly 8M to 19M people in a global lipid market that is projected to surpass $11B by 2026.

NEXLETOL and NEXLIZET Label Expansion Prospects (Esperion Therapeutics)

So, the company hitting 100% MACE accumulation has allowed the company to set an estimated readout timeline for the top-line… which could then give us an estimate for an sNDA for cardiovascular risk reduction.

Will The Data Support Approval?

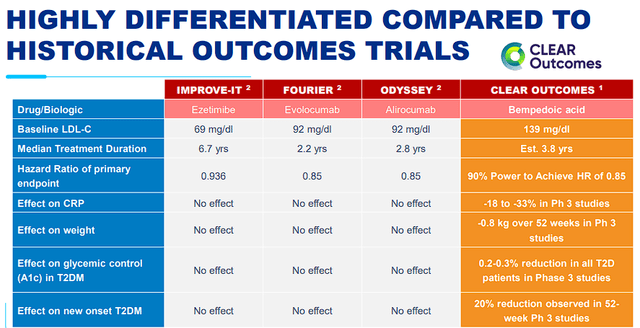

CLEAR Outcomes is powered for a 15% reduction in cardiovascular events with the highest LDL cholesterol of any recent non-statin trial (139 mg/dl) in a population with 80% of patients who cannot take a statin. What is more, CV patients are likely to be diabetic or obese, which the company believes are often “hyper responders” to its drugs based on Phase III studies.

CLEAR Outcomes vs. Historical Trials (Esperion Therapeutics)

Obviously, a drug that can reduce: LDL-C, C-reactive proteins, bodyweight, and hallmarks of diabetes should have some positive impact on cardiovascular outcomes. As a result, I am optimistic the data will reveal NEXLETOL has a place in improving cardiovascular outcomes.

The Plan

Indeed, I am going to discount the company’s earnings reports and commercial numbers between now and Q2 of next year. Obviously, we would like to see the company continue to report growth to help preserve its cash position as long as possible. However, I believe the company’s battle with prior authorizations is going to keep a lid on growth until we get the CLEAR Outcomes data. Therefore, I am going to commit to centering my position management around the anticipated catalyst in Q1.

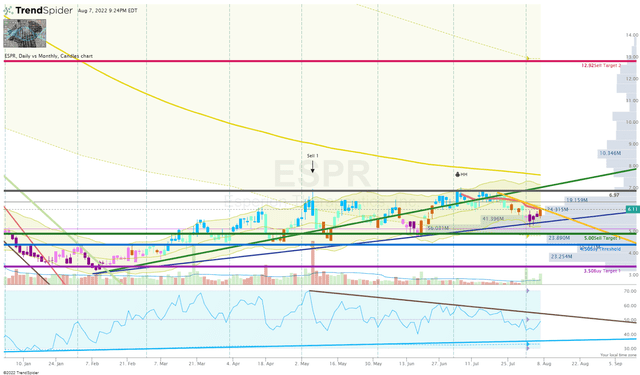

Admittedly, I haven’t touched my ESPR position after booking some profits on ESPR after it moved over my “Sell Target 1.”

ESPR Daily Chart (TrendSpider)

I have been waiting for the stock to make its next move either in the direction of my Sell 2 Target where we can book additional profits or to my original Buy Threshold of $4.50 to reapply profits. But, the stock appears to be trading sideways. At this point, we are closer to the Buy Threshold, so I will set an alert in that area and will monitor the ticker for an opportunity to place a buy order. Obviously, we are rooting for a move towards Sell Target 2, however, I am not anticipating any major catalysts until the CLEAR Outcomes data in the first quarter of next year. Nevertheless, we should expect to see a “run-up” in the share price ahead of the CLEAR Outcomes data. Therefore, I am willing to make upsized additions if the market wants to take ESPR below the Buy Threshold and towards my Buy Targets.

If all goes well, we could see a nice run-up in the share price ahead of the CLEAR Outcomes top-line data readout and subsequent pop in the share price that might allow us to book substantial profits and convert my ESPR position into a “house money” state. By going to “house money”, I would essentially de-risk the position and allow ESPR to potentially develop into a great speculative investment and remain a “Top Idea” in my Seeking Alpha Marketplace Service, Compounding Healthcare.

Be the first to comment