AlexanderFord

Erie Indemnity Company (NASDAQ:ERIE) remains robust with solid fundamentals. It is well-positioned, given its highly strategic pricing and strong customer base. Its stellar Balance Sheet proves its adequate capacity to sustain its size and cover its borrowings and dividends. Now that P&C insurance is at the forefront of climate change, growth prospects are more attractive. Even better, the stock price does not appear divorced from its fundamentals anymore.

Company Performance

With almost a century of existence in Erie, Pennsylvania, Erie Indemnity Company acts as the attorney-in-fact for the Erie Insurance Exchange, owned by the policyholders and subscribers. It engages in P&C insurance, providing underwriting, renewal services, and policy issuance for the policyholders. So, its primary revenue stream is the management fee from policy issuance and renewal, and reimbursements.

ERIE and the Erie Insurance Exchange maintain a mutual dependency. They ensure the fundamental soundness of one another. Their strong bond lies with the policyholders or subscribers. As such, ERIE imposes a management fee from a portion of written premiums. The management fee rate varies with the current and projected financials of the Exchange. As per the subscriber’s agreement, the maximum management fee of the written premiums is 25%. Put it simply, the success of its insurance companies at the Exchange is also the success of ERIE. The increase in written and retained policies leads to more returns for ERIE.

To understand it better, the primary function of ERIE is to run and manage the business operations. Erie Indemnity Co. operates a very unique business model. It is because the exchange does not have employees or agents. So, it provides other services, including customer and administrative support, IT, sales and advertising, and agent compensation. It is classified as an insurance company, but it acts more like an insurance service provider. It may be pretty unconventional, but this model drives a more stable level of viability.

Today, insurance data are geared towards the continued flourishing of insurance businesses at the exchange. In fact, there is an increased policyholder and subscriber retention. It is most evident in the health insurance exchange with a booming CAGR. It is primarily driven by pandemic fears. I believe the P&C insurance is going in the same trend since it is also at the forefront of climate change resilience. The same uptrend is visible in Erie Indemnity Company.

In ERIE, the policies in force are 3.1% higher than in 1Q 2021. It is a combination of increased new premiums and policy retention. The policy retention rate increased by 0.9%. It is way better than in 1Q 2021 with an 8% decrease from 1Q 2020. Likewise, new premiums are 4% higher than in 1Q 2021 and 20% higher than in 1Q 2020. Both its commercial and personal lines are showing upward momentum. It is a pleasant trend since policy issuance and renewals are its primary revenue growth drivers.

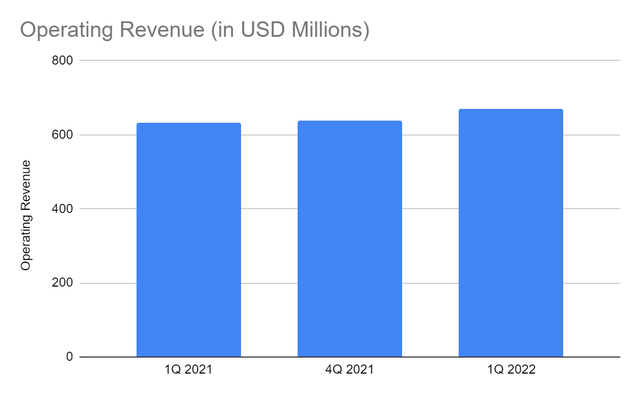

The operating revenue of ERIE, including investment income, amounts to $669 million. It is a 6% year-over-year growth from the comparative quarter. Again, it is driven by its primary revenue stream, the management fee from policy issuance and renewals. Its administrative services reimbursement revenue is also higher than in the previous year. Indeed, its popularity in Pennsylvania and the boom in the underlying insurance businesses are driving its success.

Operating Revenue (MarketWatch)

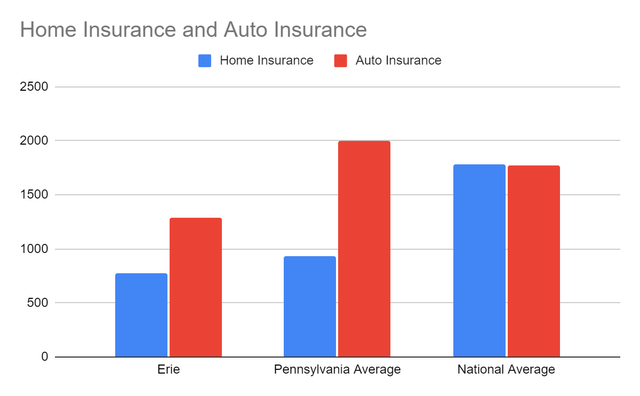

But, ERIE does not depend on external factors alone. It has a large operating capacity and capital, allowing it to sustain its operations and innovation. Note that even the insurance industry is also geared to technology amidst the digital transformation. Also, its insurance business has strategic pricing, which is lower than many of its peers in Pennsylvania. The average annual premium for its homeowners insurance is only $774. NerdWallet rates it with 4.5 stars, making it one of the top five insurance service providers in the state. The premium is also lower than the state and national average of $930 and $1,784, respectively. Likewise, its auto insurance of $1,288 is way lower than the state and national average of $2,002 and $1,771. As such, it is more flexible, which is more vital amidst inflationary pressures and increased demand for P&C insurance. There is still more room to adjust the prices to generate more premiums and offset the rising expenses. With more premiums, more services are needed from ERIE, and in turn, more management and administrative fees.

Home Insurance and Auto Insurance Price (NerdWallet and Bankrate)

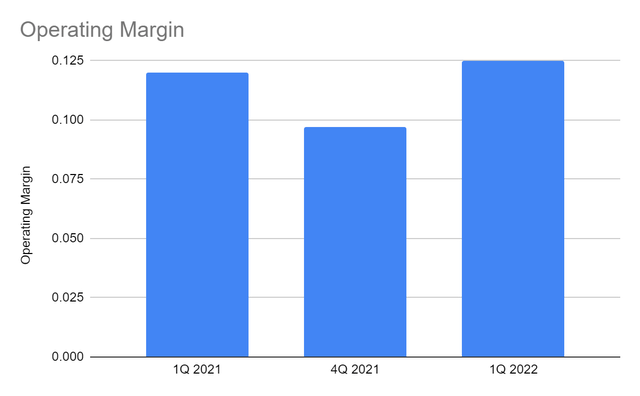

Even better, ERIE maintains its efficient management. There are no economies of scale since the increase in revenues is also the same as the increase in expenses. Yet, the fact that it keeps its costs and expenses manageable means a lot for the company. The operations are more stable compared to 3Q and 4Q 2021. Note that the impact of Hurricane Ida led to an upsurge in insurance claims and demand. It adheres to the industry trend wherein underlying insurance businesses in an exchange are realizing more stable income. The operating margin is 0.125 vs 0.12 in the comparative quarter.

Operating Margin (MarketWatch)

Why Erie Indemnity Company May Stay Afloat Amidst Economic Uncertainties

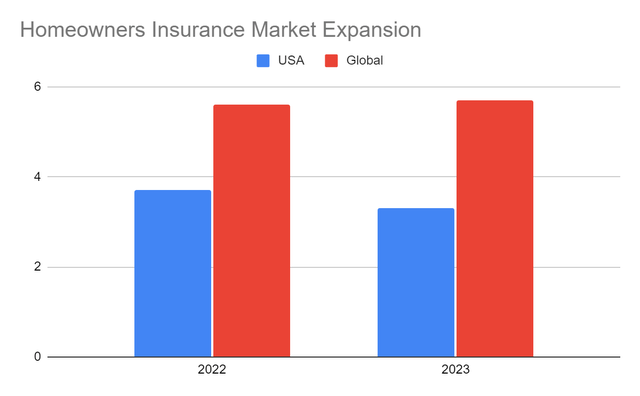

The recovery of the US economy does not appear to be as simple as initially expected. The increased production and spending are causing a surge in prices. So, the recent inflation rate set another all-time high at 9.1%. It is most evident in the real estate market, given the skyrocketing demand and shortage. Now, average home prices are over $400,000. It is no wonder that the housing market has appeared to cool down with a 3% decrease in revenues. In contrast, inflation makes the value of the house, house parts, and belongings higher. So, the demand for P&C insurance may be sustained. We must also consider the increased frequency and intensity of natural disasters in recent years. Hurricane Ida is a perfect example, leading to $2.5-3.5 billion in damages in Pennsylvania. Also, the demand for houses is still above pre-pandemic levels with the Millennials comprising the majority. That is why P&C insurance is at the forefront of climate resilience and may expand by 3.3-3.7% from 2022 to 2024.

Homeowners Insurance Market Expansion (Insurance Journal)

Likewise, the auto insurance industry observes a shortage of new and old cars. But, its value is still high as more people still prefer to drive private cars. Earlier this year, 80% of Americans expressed their preference for private cars when going to work and other establishments. It also adheres to the 7% upsurge in car sales in 1Q 2022. Auto insurance may benefit from its spillovers. RVs are still in an uptrend despite the increased price of fuels. The pent-up demand for leisure travel is the primary growth driver.

Given this, the industry performance may stay robust in the following years. These may lead to a sustained increase in its personal and commercial lines. Also, it may improve its auto insurance segment, which is a substantial factor that affects its profitability. It is still possible, given its impressive policy retention and renewal. It may expand to take advantage of the potential boom. It is on the right track as it continues to capitalize on innovation and technology.

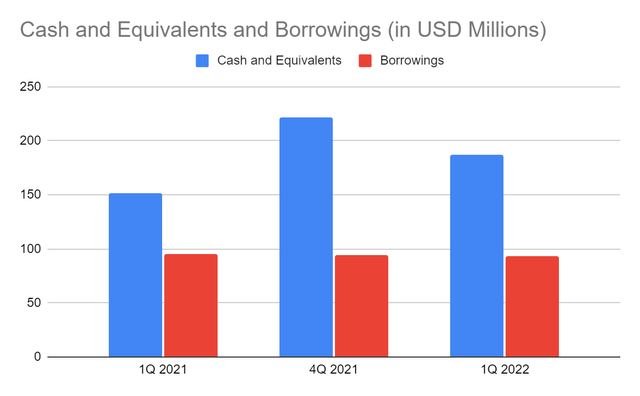

Erie has more attractive growth prospects, given the potential increase in the industry. Also, it has a strong market positioning with its strategic pricing and customer base. Yet, its strong financial position is what makes it solid and sustainable. Its cash and cash equivalents alone are enough to cover its borrowings. If we add all its investment securities, they will comprise about 50% of the total assets. Its investment securities are also prudent, which may produce more yields in the long run. It may be a challenge now, given the increased interest rates. But their appeal appears to rebound as recession fears return. Overall, its Balance Sheet is stellar.

Cash and Cash Equivalents and Borrowings (MarketWatch)

Stock Price Assessment

The stock price is in a sharp uptrend in the last two months. After its dip from 4Q 2021 to April 2022, it rebounded to its range in December. At $191.38, the stock price is only 1% higher than the starting price. The PE Ratio of 34.24 is way higher than the ideal and historical earnings multiple. Other valuation ratios like EV/EBITDA of 23.84 also show that the price is high.

Meanwhile, dividend payments are high and uninterrupted. With a dividend yield of 2.33%, it is way higher than the S&P 500 and NASDAQ components with 1.69% and 1.51%, respectively. For its consistent dividend payments in over thirty years, it is part of the Dividend Champions. This year, quarterly payments are $1.11 per share, which is 7% higher than in the previous year. They are still well-covered with a Dividend Payout Ratio of 85%. We can assess the price better using the DCF Model and Dividend Payout Ratio

DCF Model

FCFF $244,000,000

Cash $141,000

Outstanding Borrowings $900,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 52,290,000

Stock Price $191.38

Derived Value $172.24

Dividend Discount Model

Stock Price $191.38

Average Dividend Growth 0.1077366104

Estimated Dividends Per Share $4.44

Cost of Capital Equity 0.1339365268

Derived Value $169.7239025 or $169.72

Both models adhere to the potential overvaluation of the company. There may be an 11-15% downside. So, it does not convey an ideal buying opportunity for now.

Bottom Line

Erie Indemnity Company is already a sound and well-positioned company. Its fundamentals are a good fit in a challenging market and also show attractive growth prospects. Dividends are also enticing and sustainable. But, the stock price is not at an ideal level of $168-172. The valuations show it is not a good time to buy stocks now. Even so, I am confident about its performance. So, investors must still wait for a better entry point. The recommendation is that Erie Indemnity Company is a hold.

Be the first to comment