jiefeng jiang

** As I’ve done since February, I’m making a subscriber only article available to the general Seeking Alpha audience which highlights my outlook for the markets, CEF/ETF recommendations and most importantly, my end-of-month Equity CEF Performance spreadsheet. I encourage you to review the article and see if this might fit into your own strategy **

Below is your YTD Equity CEF Performance spreadsheet link updated through July 1st, 2022:

Note: You will need Microsoft Office or Excel to open the spreadsheet

Market Update Through July 1st, 2022

Can the markets build on Friday’s rally ahead of the long 4th of July weekend?

Though it really only appeared in the last 90 minutes of trading Friday, after another tumultuous week for the equity markets, it was a welcome relief to see the S&P 500 (SPY) close at $381.24, up 1.06% on the day.

You can probably thank the bond markets for a break in the pessimism as yields came down and short-term rates broke well below 3%. That gave the markets a sense that despite a slowing economy, the Federal Reserve may not need to be as aggressive as they have implied by talking up the number and size of interest rate hikes this year.

Of course, that all depends on inflation and we’ll need to see evidence, like in the coming CPI and PPI when released on July 13th and 14th, that inflation is coming down. Until then, we may actually get a bit of a rally in the equity markets if we start seeing stocks of companies coming out with earnings performing better or at least, not collapsing on poor earnings or guidance.

One sector that has really gotten taken to the cleaners this year has been the semiconductors, and it didn’t help when Micron (MU), $53.65 market price, said they expected their current quarter to come in at $1.63/share on sales of $7.2 billion when expectations were for $2.60/share on sales of $9.15 billion.

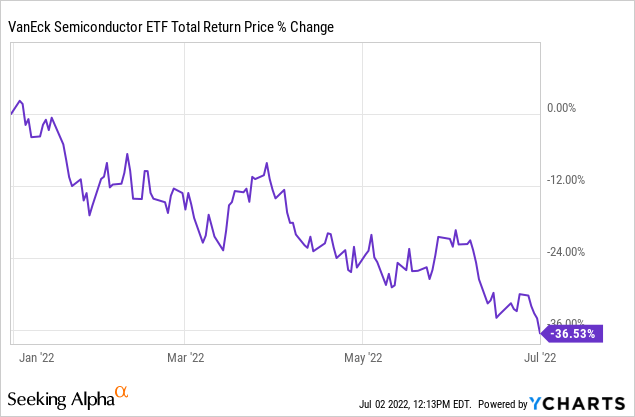

That sent the whole sector down and the popular VanEck Semiconductor Index ETF (SMH), $195.99 closing market price, -3.8%, is now down -36.5% YTD.

Y-Charts

Clearly, this is a broken sector but there’s also little doubt that the semiconductor industry will recover at some point. It’s just a matter of when and timing your investments. Though I don’t own SMH, if you believe the sector may be close to a bottom, there are a couple strategies, such as selling put options below the current price or buying the fund itself and selling call options against your position over the current price, that could work.

I can’t say for sure where the markets go from here and you almost have to look at very short time frames of a week or two in making investment decisions. This is NOT an invest and forget market and I’ve said over and over again that you can expect that the lows are not in yet because I’m still expecting some version of a black swan event to occur though I can’t say what that will be.

It could be a sudden development, like in the Russia/Ukraine war, or it could be over a certain period of time, like inflation not peaking yet, but either way, it could have black swan ramifications not unlike what happened in 2008 when financial firms like Lehman Brothers and Bear Stearns went kaput.

I wrote about this yesterday but more importantly there are some ways you can minimize the downside risk of your portfolios even if that occurs. The first is by maintaining hedges and adding to hedges during strong up market moves over a couple days to a week. The second is having a diversified portfolio that now includes fixed-income funds. Though bonds and equities have both been decimated this year, one could argue that the bond markets at least have priced in what could be considered a worst-case scenario already, and thus they should not have as much downside from here.

You can choose whatever fixed-income sector suits your needs and I have chosen to achieve that diversification primarily through municipal bond CEFs. And like virtually all bond sectors last week, municipal bonds had a very good week and were a big reason why my taxable accounts had a very good week last week despite the fall in the equity markets.

One muni bond fund that I continue to recommend is the Nuveen Municipal Credit Income fund (NZF), $12.66 market price, which was actually highlighted in Barron’s this weekend (subscription required). As one of the best performing funds historically, NZF has fallen to a comparatively wide -7.9% discount primarily because another Nuveen muni CEF recently merged into it and that usually means a number of shareholders from the old fund will be sellers in the new fund for a period of time after the merger.

NZF should really be trading near the same valuation as its sister fund, the Nuveen AMT-Free Muni Credit Income fund (NVG), $13.35 market price, which trades at only a -3.9% discount but does offer a slightly higher 5.7% current yield vs. 5.6% for NZF. Neither fund saw a change in distribution when Nuveen declared July distributions yesterday so that should also be another net positive for both NZF and NVG.

Equity CEFs

I’ll have more to say on equity CEFs on Monday when the updated Equity CEF/ETF Portfolio comes out but I did want to highlight a couple of recent recommendations.

Despite the difficulties in the equity markets this year, continuing to add to CEFs when discounts widen and to average down your basis during a bear market will prove to be beneficial when the market environment improves. That improvement may be over the second half of the year or it could be as short as the next couple weeks in this market, but I would continue to act on my suggestions to add to positions, particularly if you have a high level of cash, say 15% or so, a diversified portfolio with bond exposure and some hedges, as I’ve suggested.

That should give you significant downside protection just in case we have another leg down in the markets while at the same time, capturing more upside during the inevitable rebounds both in the markets and in my recommended funds.

We’re already seeing this in the Cornerstone funds (CLM), $8.75 market price, and (CRF), $8.45 market price, and last week we saw this in the Eaton Vance Tax-Managed Buy/Write Strategy fund (EXD), $10.29 market price, a fund I recommended on Monday at $9.63.

EXD has actually risen more than I expected and if you go to Sheet3 of the Equity CEF Performance link above, you’ll see the Eaton Vance Tax-Managed Buy/Write Income fund (ETB), $15.67 market price and EXD near the top, which simply shows how much better their market prices have been performing compared to their NAVs this year.

On the other hand, if you go back to Sheet3, you’ll see the Cornerstone funds are at the bottom of the sheet, i.e. their market prices are dramatically underperforming their NAVs, which is not necessarily where you want to be but should bode well for the funds going forward.

This is sort of the game you play with CEFs. Find funds, equity or fixed-income, that have seen anomalies in their valuations despite having outperforming NAVs, and keep adding to them on legs down.

Though this doesn’t always work and some of the BlackRock funds like the BlackRock Capital Allocation fund (BCAT), $14.72 market price, and the BlackRock Science & Technology II fund (BSTZ), $19.90 market price, come to mind this year, I would note that even in the case of BSTZ, which has seen its market price drop -45.9% YTD (see bottom of Sheet2), there will come a time when it recovers.

Though I made several recommendations on BSTZ last year, with the last on Dec. 15 when the fund was at $35.28, I knew enough that technology stocks were not going to have a good year in 2022 and that I should limit any recommendations of technology focused CEFs going forward.

In fact, I removed BSTZ from an Actionable Buy to just a Buy earlier this year when it was clear that technology and growth sectors were going to underperform compared to value sectors. Which is why the vast majority of Actionable Buys now are value focused. More on that Monday.

This doesn’t mean I don’t like BSTZ and I still maintain a position in it. It’s just that I don’t know when technology will start to recover. Though I know when it does, BSTZ will start to recover too.

But more importantly, funds like BSTZ aren’t really hurting me that badly and the move to overweighting energy, utilities and value funds this year just means that diversifying to what’s working, along with the hedges, bond funds and averaging down in certain funds, has allowed me to significantly outperform the major market indices YTD.

That was never more evident than last week when the NASDAQ-100 (QQQ), $282.13 market price, was down -4.2% and my managed accounts were up.

Be the first to comment