spooh

Introduction

Whilst the continued setbacks faced by the Mountain Valley Pipeline project earlier in 2022, hereon referred to as the MVP project, were far from over for Equitrans Midstream (NYSE:ETRN), the first quarter nevertheless saw me doubling down as their dividends get safer, as my previous article discussed. To the initial delight of their shareholders, there was hope for a quick fix as a bill was slated to move through the United States Senate but alas, it ultimately failed. Thankfully shareholders can seemingly count on the dividends, if not the government, which currently provides a high yield of 7.59%, as discussed within this follow-up analysis.

Executive Summary & Ratings

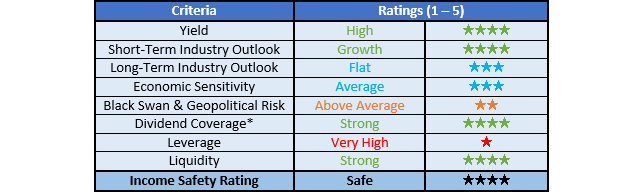

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

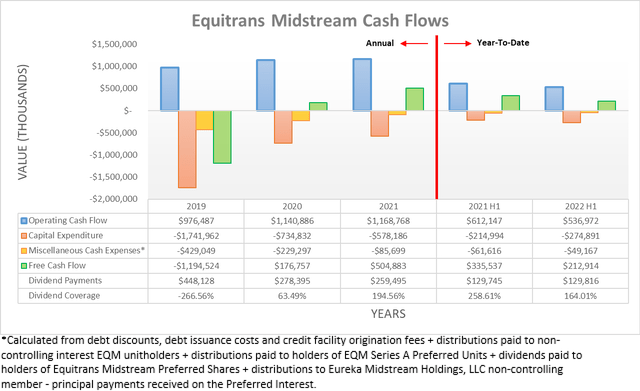

Even though they enjoyed solid cash flow performance during 2021, disappointingly, the first quarter of 2022 saw a weak start to the year with their operating cash flow down materially year-on-year against 2021, regardless of whether including or excluding their temporary working capital movements. Thankfully the second quarter saw their cash generation picking up with their operating cash flow for the first half of 2022 now at $537m and thus far more than double its result of $185.9m during the first quarter.

Despite their cash generation picking up, their operating cash flow during the first half of 2022 is still down 12.28% year-on-year versus their previous result of $612.1m during the first half of 2021 or 9.36% year-on-year if excluding their working capital movements. When reviewing their financial statements, this was primarily driven by their revenue sliding 7.90% year-on-year to $670.8m versus $729.3m for these same two periods of time, which was driven by the same forces during both quarters, as per the commentary from management included below.

E-Train operating revenue for the first quarter 2022 was lower compared to the same quarter last year by $38 million. This is primarily from the impact of deferred revenue. lower gathered volumes and lower water services revenue.”

– Equitrans Midstream Q1 2022 Conference Call.

ETRN train operating revenue for the second quarter of 2022 was lower compared to the same quarter of last year by $20 million. This is primarily from the impact of deferred revenue, lower gathered volumes and lower water services revenue.”

– Equitrans Midstream Q2 2022 Conference Call.

If zooming down into their results for the second quarter of 2022 in isolation, it sees their operating cash flow of $174.8m excluding working capital movements only down a relatively tiny 3.75% year-on-year versus their previous equivalent result of $181.6m during the second quarter of 2021. This marks a sizeable improvement sequentially versus the first quarter of 2022 that saw its result down 14.00% year-on-year and thus as a bottom line takeaway, the second quarter saw their financial performance stabilize. Interestingly, these green shoots appear likely to continue growing larger as the year progresses given management lifted their guidance, as the tables included below display.

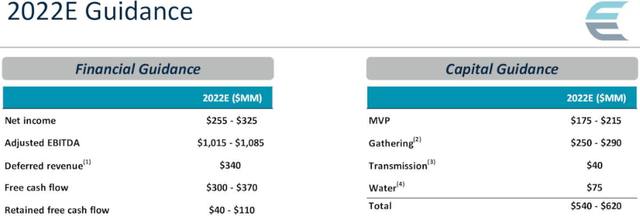

Equitrans Midstream Second Quarter Of 2022 Results Presentation

Whilst not a big change relatively speaking, they have now lifted their 2022 guidance for adjusted EBITDA to $1.05b at the midpoint versus $1.01b when conducting the previous analysis following the first quarter. In theory, their cash flow performance should continue improving during the second half of the year given its positive correlation, as their new guidance is now above their previous result of $1.012b during 2021, as per their fourth quarter of 2021 results announcement. Meanwhile, their accompanying capital expenditure guidance is now slightly lower with its midpoint of $580m, which is $20m below when conducting the previous analysis following the first quarter. These two variables work together to lift their free cash flow and thus support their already strong dividend coverage of 164.01% during the first half, thereby increasing their safety.

The bigger issue right now is not necessarily their weak start to 2022 but rather the continuing setbacks regarding their MVP project. A few months ago, it was hoped that a bill proposed by United States Senator Joe Manchin would see the federal government step in and effectively rush through permits to finally get this problematic project completed but alas, it did not pass the Senate. If nothing else, this is once again a cautionary tale for investors about counting on the government to smooth over their investments, especially those in the controversial midstream industry.

Following this disappointment and continued setback, some analysts now see their MVP project not coming online until as late as mid-2025. It will be quite interesting to see if management updates their guidance on this matter when they release their upcoming results for the third quarter of 2022 because as of the second quarter, they were still aiming for late 2023, seemingly regardless of the now-dead senate bill, as per the commentary from management included below.

So we have outstanding guidance that says second half of 2023 is when we expect to put MVP in service that incorporates the ordinary course, if you will process to complete with the permitting and get through the Fourth Circuit. So that’s already within our guidance.”

– Equitrans Midstream Q2 2022 Conference Call (previously linked).

Whether the wait for their MVP project to come online is another year or many more, at least in the interim shareholders can still sit back and collect their high dividend yield, which helps ease the disappointment of these continued setbacks. Very importantly, there was seemingly no indication of their earlier commitment to sustain their dividends wavering during their second quarter of 2022 results conference call.

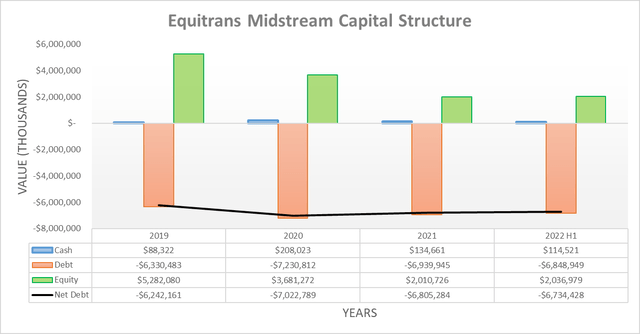

Thanks to their cash generation picking up during the second quarter of 2022, their net debt edged lower after having increased slightly during the first quarter, thereby now landing at $6.734b. Not only is this down versus its level of $6.844b when conducting the previous analysis following the first quarter, it is also down slightly versus its level of $6.805b at the end of 2021. Whilst certainly not a sizeable improvement, the direction is nevertheless positive for income investments and given their strong dividend coverage, this should continue into the future.

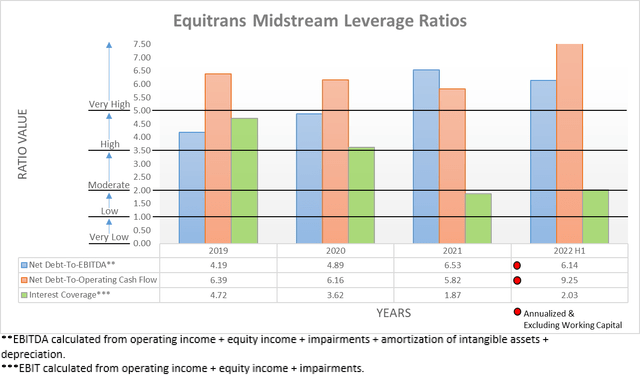

Following their stabilized underlying financial performance during the second quarter of 2022, it was not surprising to see their net debt-to-EBITDA of 6.14 and net debt-to-operating cash flow of 9.25 remaining broadly unchanged versus their respective results of 6.08 and 9.04 when conducting the previous analysis following the first quarter. Whilst these are nevertheless once again well above the threshold of 5.01 for the very high territory, it is not overly concerning as the future earnings of their MVP project should see these plunge once coming online, plus in the meantime, their liquidity offers sufficient breathing room.

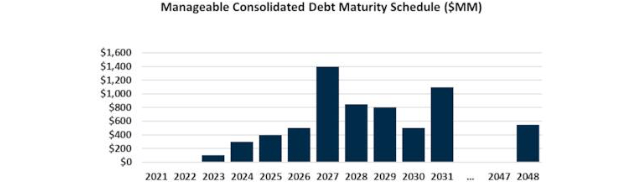

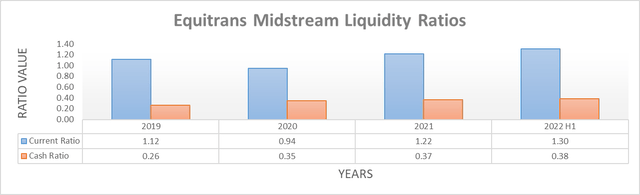

Apart from suppressing their net debt, the other benefit of their cash generation picking up during the second quarter of 2022 was boosting their liquidity, which helped swell their cash balance to $114.5m from its level of $41.6m when conducting the previous analysis following the first quarter. This resulted in their cash ratio increasing to 0.38 versus 0.20 across these same two points in time, thereby more than offsetting their current ratio decreasing to 1.30 versus 1.57 respectively, which only arose from various immaterial current asset and liability movements. Even more importantly, they have now completed their debt refinancing that was mentioned within my previous analysis and thus now see far lower maturities during 2023 and 2024 at only circa $100m and $300m respectively, as the graph included below displays. This compares favorably to their previous debt maturity profile following the first quarter that saw $600m and $500m during 2023 and 2024 respectively, thereby buying them more breathing room.

Equitrans Midstream Second Quarter Of 2022 Results Presentation

Conclusion

Despite their weak start to 2022 and continued setbacks to their MVP project, it appears that everything else is moving favorably for their dividends. Not only has their earnings guidance for 2022 been lifted, their accompanying capital expenditure guidance is also slightly lower, which supports their strong dividend coverage. Elsewhere, their net debt is trending downwards, albeit slowly but this is not necessarily a problem as they have now refinanced most of their upcoming debt maturities for 2023 and 2024. It would have been nice to see the government simply fix their MVP setback but alas, this now appears off the table. Although disappointing, thankfully it appears shareholders can still count on their dividends and thus I nevertheless still believe that a strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Equitrans Midstream’s SEC filings, all calculated figures were performed by the author.

Be the first to comment