imaginima

(Note: This article was in the newsletter on September 7, 2022 and has been updated as needed.)

There has been a lot of speculation about how natural gas producers like EQT (NYSE:EQT) could benefit from the natural gas situation. But many producers of commodities often lock in long-term relationships through transportation agreements within the basin they produce. Very few managements actually look at pricing enough to actually allow their commodity products to travel to places that would produce more income than the actual transportation costs incurred.

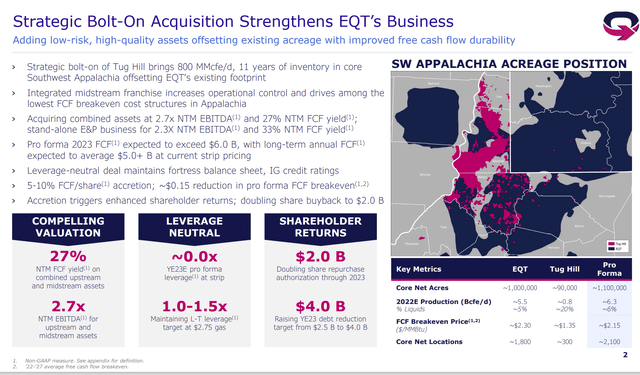

When the Rice Brothers took over the management of EQT Corporation, they inherited a real mess. One of the faster ways out of that mess is the acquisition of Tug Hill and the accompanying XcL Midstream. This accelerates the company’s objective of better prices while waiting for committed transportation to expire, so the company can transport more natural gas out of the basin. Right now, sales are pretty much only in-basin to an oversupplied area. A lot of operators I follow are “in the same boat.”

That means that exporting natural gas for many is not an option as exporting only recently became an option for this management. Long-term transportation agreements would have to expire to allow the redirection of product, or the company would have to acquire transportation on another midstream for this to be an option. Many times, purchasing transportation on another midstream line takes time due to the long-term nature of existing contracts (as well as the fact that many pipelines have pre-existing capacity commitments).

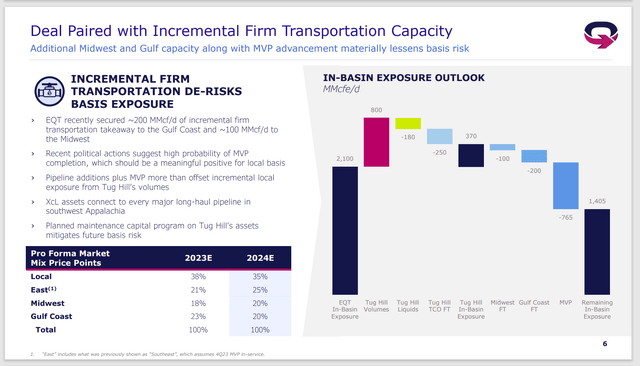

EQT Product Exposure To Higher Priced Markets Challenges (EQT Bolt-On Acquisition Announcement)

One of the things made painfully clear by the above slide is that the company was largely restricted to the Appalachian basin and its subpar pricing due to long-term transportation agreements. Management recently got a little bit of transportation to the lucrative export market. But there is a long way to go to get better pricing for the natural gas. As shown above, Tug Hill arrangements materially help the pricing situation.

This basin pricing strategy most likely happened during the time period of the management that was replaced by the current management. But it also takes a long time to undo such arrangements. This is a very costly strategic decision that many managements make (and they also hope that shareholders will not notice).

Management also reported a hedging loss with a recent filing of $1.6 billion. Actual cash settlements have materially lowered the realized price for some time. The hedging situation will likely be resolved in the next fiscal year. But the transportation to stronger pricing markets is a longer-term project.

Notice also that management is hoping the Mountain Valley pipeline completes to jump-start the process of getting natural gas production to a less-saturated market.

In the meantime, the latest proposed acquisition may eventually offer a way to get at least some production to more lucratively priced markets. Management noted the pricing issue several times in the past after they took over management. Now there is a slide that really documents the challenges. This may make the acquisition extremely valuable because of the various midstream hookups that were not available to the company as it is currently constituted.

Out Of Basin Possibilities

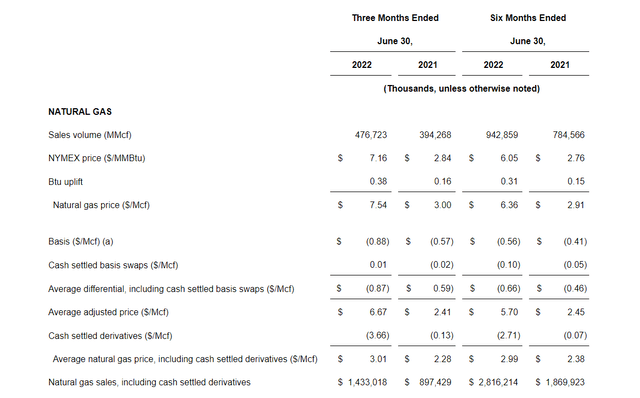

Antero Resources (AR) is one company that was concerned about sales prices long before now. Management often talked about more midstream capacity than needed, and I remember comments about a waste of money. Then again, let us look at the difference in selling prices in the latest quarter.

Antero Resources Average Sales Prices For The Second Quarter 2022. (Antero Resources Second Quarter 2022, Earnings Press Release)

Antero Resources often posts some of the best-selling prices in the basin when compared to other Appalachian producers.

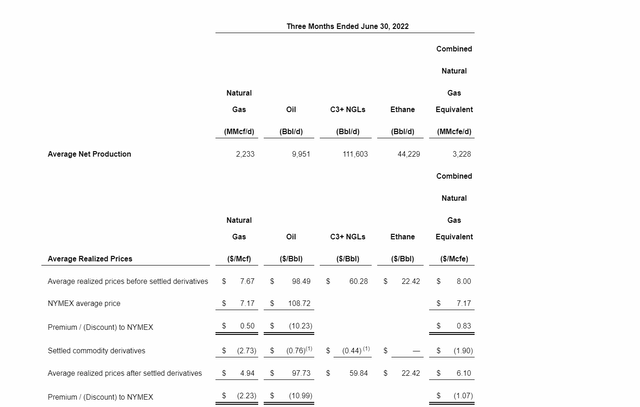

Now, here are the EQT sales prices.

EQT Natural Gas Sales Prices And Hedging Second Quarter 2022. (EQT Second Quarter 2022, Earnings Press Release)

EQT is primarily a dry gas producer. So generally, the natural gas price predominates to the point where liquids make an immaterial (or barely material) difference.

If you compare the natural gas realized price that Antero received with the EQT price, there are significant differences that demonstrate a huge profit improvement potential.

Antero Resources management can often claim to beat the prices in the basin by sending the natural gas out of the basin to sell to the extent that is both possible and reasonable. EQT, on the other hand, is dependent upon the basin pricing because management never made transportation arrangements to get the natural gas out of the basin.

Acquisition Advantages

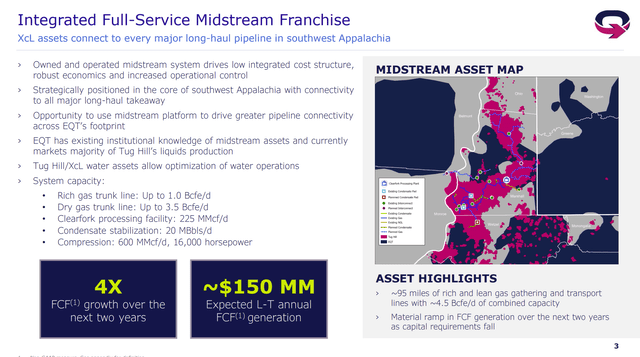

That makes the midstream operations of the acquisition a very important area of examination.

EQT Acquisition Proposal Midstream Advantages (EQT Acquisition Proposal September 2022)

Before anyone can contract with long-haul pipelines to get products to another market, the midstream operation has to first be able to connect to those pipelines. Clearly, that is the case for the proposed acquisition. It also makes the acquisition fairly valuable to a company whose production is likely locked into a basin that oversupplies the local market.

Many times, midstream capacity can be increased with add-on, highly profitable projects that do not take a lot of capital. In this case, even an outright expansion of running a parallel line may at some point be justified. Nothing motivates management like a better sales strategy because every additional sales dollar heads “straight to the bottom line” with few deductions.

EQT Acquisition Proposal Advantages (EQT Proposed Acquisition September 2022)

Of course, it never hurts to see all of the reasons for the acquisition. It actually looks darn conservative. Management is using stock to keep the financial leverage low. So, management is depending upon the deal being good enough to be accretive to shareholders.

One of the things about this is the second move by management away from dry gas towards more liquids production. Liquids prices are so strong currently that natural gas breakeven prices on these properties are very low. Long-term followers of these companies will remember at least one time when that was not the case. The point is that different strategies win over time. The key to growing large is to have the flexibility to change the production mix to ensure above-average profitability under a wide variety of scenarios. The move into the production of more liquids is therefore a move in the right direction.

What To Note

Previous EQT management did a lot of things to hurt company profitability. Some of those things like pricing strategy are now becoming apparent to the average shareholder. This points to the importance of always trying to get above-average management whenever one considers an investment.

Management is often the largest asset or liability for investors to consider. But management is not on the balance sheet. In the case of EQT, the relatively new management has spent years improving the situation, and yet, there is still more work to do. Sometimes, investors will never find out everything that management does. But oftentimes, it is the unknown things that can make a long-term difference. That was the case here with the marketing strategy that resulted in lower-than-possible product prices.

The new acquisition not only has conservative assumptions and low ratios, but it also has the promise of more connections to better-priced markets in the future. One of the things that is absolutely necessary is the ability to redirect production to markets with superior commodity prices. That will result in extra midstream costs for the flexibility. But midstream costs are often a small price to pay when compared to the extra profits that result.

This management is worth the consideration of investors over a wide price range. They have treated investors well in the past. That is likely to continue for a long time into the future.

Be the first to comment