Leestat

EQT: NYMEX Futures Moving Down Toward October Lows

EQT Corporation (NYSE:EQT) enjoyed a remarkable Q3 earnings release by the company in late October, as natural gas futures (NG1:COM) surged to their previous highs. Its results were also predicated on an NYMEX benchmark price of $8.18.

However, the energy crisis in Europe has de-escalated, as Europe also agreed on its gas price caps to deal with the volatile swings seen in August/September. Bloomberg highlighted that the cap “could have been used on roughly 40 days in August and September – when prices neared records.”

Therefore, we assessed that investors should not expect NG1 to reach such levels in the near term, even though the pricing mechanism is slated to take effect in February. Moreover, demand destruction has worried the market, as Bloomberg Intelligence articulated:

Gas consumption in Europe is set to shrink by more than 50 billion cubic meters in 2022, ‘the sharpest decline in history,’ led by price-driven demand destruction and mild weather. – Bloomberg

Europe’s Gas Price Caps Likely Worsened Sentiments

Notwithstanding, energy strategists have not concurred over the likely impact of the price caps. Goldman Sachs highlighted that it could worsen the supply crisis without a demand floor by “encouraging demand.” However, we think the market has continued to reflect worsening global macroeconomic headwinds, with Europe likely already in a recession.

Hence, the headwinds over EQT’s operating performance through 2023 could worsen further, even as it lifts its production next year.

There’s little doubt that EQT, as one of the leading integrated natural gas producers, could continue to benefit from Europe’s energy crisis. Bloomberg also reminded the market that the supply/demand dynamics could continue to favor leading companies like EQT as Europe deals with a structural challenge through 2026. It added:

After this winter, the region will have to refill gas reserves with little to no deliveries from Russia, intensifying competition for tankers of the fuel. Even with more facilities to import liquefied natural gas coming online, the market is expected to remain tight until 2026, when additional production capacity from the US to Qatar becomes available. That means no respite from high prices. – Bloomberg

Even Bullish Analysts Project A Slowdown

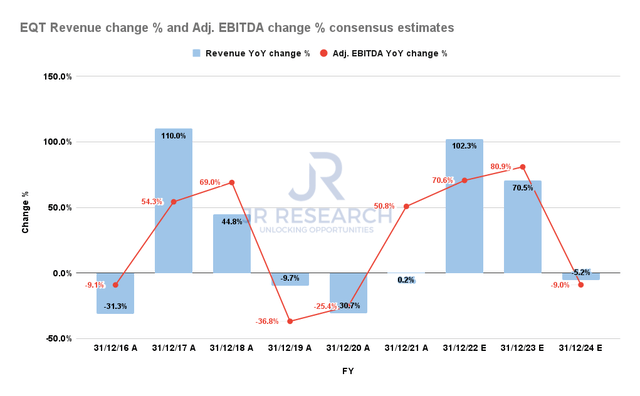

EQT Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Despite that, even the bullish Street analysts found it challenging for EQT to continue its remarkable performance through FY24.

As seen above, EQT’s revenue and adjusted EBTIDA growth is projected to fall markedly through 2024. However, investors should note that the Street significantly upgraded EQT’s 2023 projections after its Q3 release.

However, with current natural gas prices markedly lower, we believe there are downside risks to those estimates. Accordingly, it could suggest why the market has been reluctant to re-rate EQT’s valuation higher, despite its robust operating performances.

The Market Has Not Re-Rated EQT

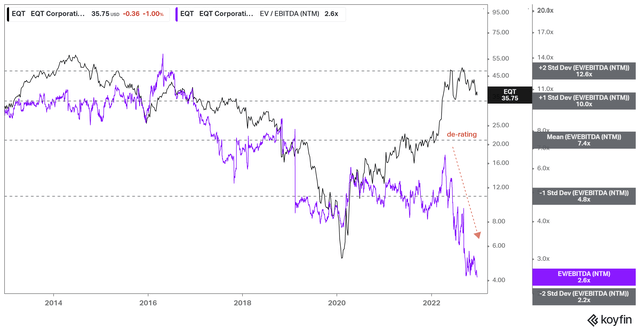

EQT NTM EBITDA multiples valuation trend (koyfin)

EQT last traded at an NTM EBITDA of 2.6x, well below its 10Y average of 7.4x. It’s also well below its peers’ median of 3.7x (according to S&P Cap IQ data). Therefore, EQT bulls could argue that its valuation is not aggressively configured.

Despite that, the market de-rated it, even as its stock price surged in 2022, posting a YTD total return of 68%. So is the market missing something?

We believe the market’s message is clear: investors should expect further earnings compression, suggesting potential downside risks to the upgraded Street estimates.

Though far from over, Europe’s energy crisis has likely subsided from the heights seen in August/September and is unlikely to revisit those highs.

Hence, the need for further de-rating is necessary to account for the uncertainty emanating from a potential global recession.

Takeaway

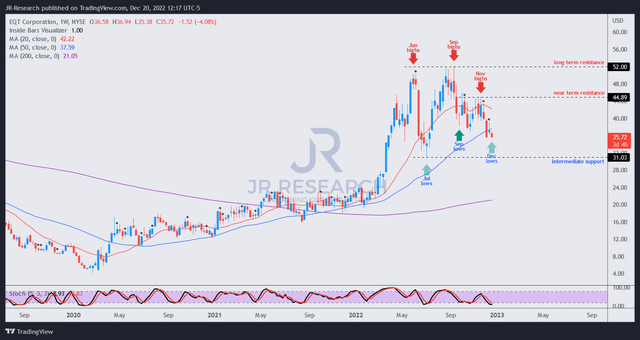

EQT price chart (weekly) (TradingView)

In our previous articles, we cautioned investors to be wary of the bull traps apparent in EQT’s price structure.

For now, EQT appears to be consolidating, as its momentum has also reached oversold zones. However, we assessed that EQT’s pullback had not reflected the weakness in NG1 and the Dutch TTF futures.

Therefore, a further pullback to re-test its July lows cannot be ruled out.

Maintain Hold for now.

Be the first to comment