Scott Olson/Getty Images News

Thesis

The Enhanced Equity Income Fund (NYSE:EOI) is a closed end fund from the “buy-write” Eaton Vance family. The vehicle has current income as its primary objective. As per the fund literature:

The Fund invests in a portfolio of primarily large- and midcap securities that the investment adviser believes have above-average growth and financial strength and writes call options on individual securities to generate current earnings from the option premium.

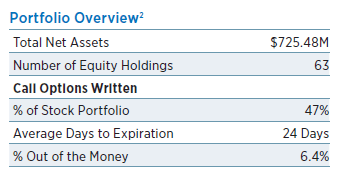

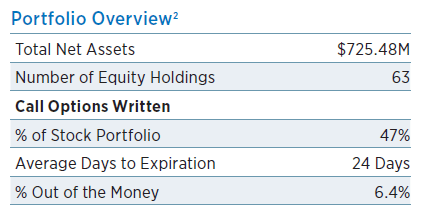

The CEF currently has covered calls on 47% of the portfolio (as of the last fund fact sheet):

Portfolio Overview (Fund Fact Sheet)

Versus other buy-write funds from Eaton Vance EOI has a longer duration for the written calls, namely 24 days versus roughly 14 for ETV and ETB, while the options are also more out of the money at 6.4%. An option which is more out of the money has a lower delta, which means less premium and coverage in a market sell-off.

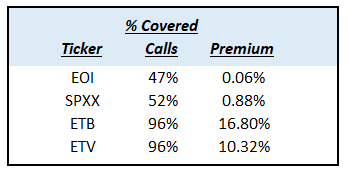

It is interesting to note how the market is currently pricing the percent of the portfolio covered by options and the moneyness of the options:

Buy-Write Funds (Author)

We can see a massive divergence between funds like EOI and SPXX which only have call options written against roughly 50% of their portfolios versus ETB and ETV which have 96% of the portfolios with options against them. We do not think the pricing is correct here and we have already highlighted here and here why we think the premiums for ETB and ETV are currently too high and our expectations for a mean reversion.

EOI has a total return profile that is very much in-synch with the S&P 500 as per the below “Performance” section. Basically EOI is a vehicle which transforms the S&P 500 capital gains into monthly dividends (Seeking Alpha erroneously has this fund as a quarterly pay on the summary page). For a retired retail investor who wishes to get income from the equity market this vehicle checks all the right boxes. Management has done a tremendous job here in generating a robust historic performance for the fund that closely tracks the index. The fund takes positions which are not always in line with the index (Chevron (CVX) is a top holding right now, for example) but from a sectoral stand-point EOI closely follows the S&P 500.

We like EOI and its risk/reward metrics and its historic robust performance in tracking the index. We like the options overlay structure which allows the fund to generate income and buffer down market moves and feel EOI is an ideal vehicle for a retail investor looking for monthly income from the equity market. We feel we are currently in a bear market and there is another down leg to come, but given the flat premium to NAV for the fund an investor can start thinking about buying small chunks weekly to start a position here. A more conservative investor can wait for a market capitulation to go long the fund.

Holdings

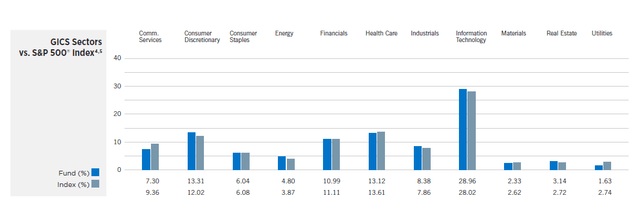

From a sectoral standpoint EOI closely matches the S&P 500 index:

Sectoral Breakdown (Fund Fact Sheet)

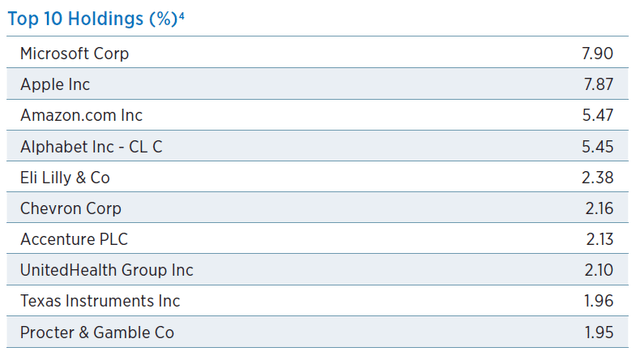

From an individual name perspective however, the fund exposes a basis to the index:

Top 10 Holdings (Fund Fact Sheet)

We can see from the above table how Chevron, Accenture and Eli Lilly are in the fund’s top holdings, but not in the index. The manager has the ability to change its top holdings as it sees fit to generate alpha. However we have seen the sectoral balance to closely match the index throughout time. We are thinking about this fund as an S&P 500 fund with an active manager that tries to generate alpha.

The fund has only 63 holdings vs. the index which has 500:

Portfolio Overview (Fund Fact Sheet)

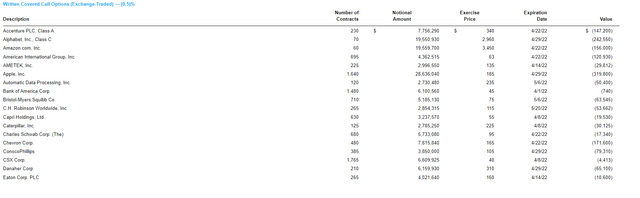

To note that the fund writes options against individual holdings rather than the index:

Single Name Options (Semi-Annual Report)

This is a bit different than other funds which hold more equities and write the options against the index itself. Right now the fund is taking advantage of the VIX levels exposed by each security (i.e. individual name implied vol) rather than the index vol.

Performance

The fund is down roughly -18% year to date, largely in line with the S&P 500:

YTD Total Return (Seeking Alpha)

We can see from the above total return graph that the two vehicles have largely moved in-sync this year with a very slight underperformance for EOI.

On a 5-year time-frame the performance exhibited by the two vehicles is similar:

5-Year Total Return (Seeking Alpha)

We can see that EOI is up 61% while the S&P 500 is up 74.8%.

A 10-year chart paints a similar picture:

10-Year Total Return (Seeking Alpha)

Please note that these are total return charts, meaning that dividends are factored in.

Premium / Discount to NAV

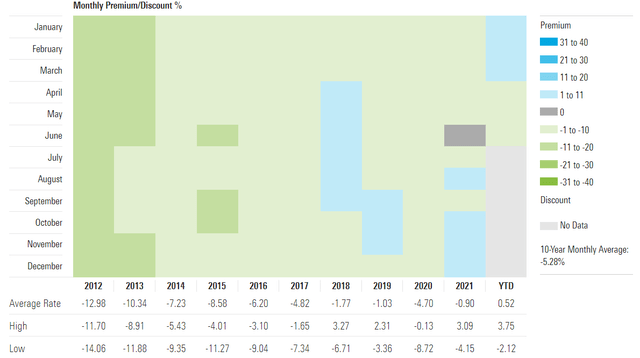

The fund has historically traded at discounts to net asset value:

Premium / Discount to NAV (Morningstar)

Currently the fund is fairly flat versus NAV. We find this interesting since the other Eaton Vance funds which are categorized in the “buy-write” section are currently trading at exorbitant premiums to NAV. We feel this is the case due to the investors’ desire to monetize a high level of VIX, but we are puzzled as to why 50% hedged funds would not command any premium. Basic math would argue for a premium between 0% and 50% of what is exhibited by the other funds.

Conclusion

EOI is a “buy-write” fund from the Eaton Vance family. The vehicle has only 63 holdings but a sectoral breakdown which matches the S&P 500. The fund has 47% of its portfolio covered by single name call options and has generated historic total returns very much in line with the index. We view this CEF as a great way to transform equity returns into monthly dividends, and a retired retail investor looking for income from equity markets exposure should find this fund as an ideal choice. The CEF currently has a flat premium to NAV, unlike other buy-write funds which are trading at substantial premiums to net asset values. We like this fund and its analytics but feel there is another down leg in this bear market. An ideal entry point would be after a general equity market capitulation.

Be the first to comment