vernonwiley

Introduction

I first covered shale drilling company EOG Resources, Inc. (NYSE:EOG) in late 2021, praising the company for its disciplined growth approach, shareholder-focused management and strong balance sheet. The stock has performed extremely well and returned 61.1% in capital appreciation compared to a 22% decline in the S&P 500 (SPY), and that does not even take into account the generous dividends.

Of course, this is in no way an allusion to my supposed ability to time the market – I consider this impossible and measure returns over the long term, i.e., years or decades. Moreover, EOG’s impeccable return is mainly attributable to the energy crisis that emerged largely as a consequence of Russia’s invasion of Ukraine and the resulting sanctions, but, of course, also the years of underinvestment and resulting capacity constraints.

EOG Resources released its third quarter 2022 results yesterday (November 03). In this article, I share my impressions of the company’s performance so far in 2022, take a quick look at the balance sheet, briefly discuss risks, and present my expectations for the future.

EOG Resources Continues To Execute At A High Level

During the quarter, EOG added the Utica resource in Ohio to its portfolio, which until recently consisted of Bakken, Powder River, Wyoming DJ, Delaware, Eagle Ford and Dorado deposits. The company is a de facto U.S.-only driller, as its Trinidad and other assets account for only about 0.1% of quarterly crude oil and condensate volumes and 11% of natural gas volumes. The Utica resource further improves the diversity of the portfolio, and by developing this resource, EOG continues to deliver on its promise to direct funds only to so-called “premium drilling projects,” thereby further lowering cost of supply. The company accumulated 395k net acres and 135k mineral acres at a total cost of less than $500 million (p. 5, third quarter 2022 press release) and expects to complete 20 proprietary wells by 2023, in addition to the 18 legacy wells already in operation.

The company exceeded its already strong second quarter volume of 83.8 MMBoe by an additional 0.8 MMBoe, well above the expected 82.6 MMBoe. Total crude oil and condensate production of 464.6 MBod was about 1% above midpoint guidance and in line with second quarter production. Actual natural gas liquids volumes (209.3 MBbld) were 7.3% above the midpoint guidance as well, nearly 4% higher than in the second quarter, and nearly 33% higher than in the third quarter of 2021. Natural gas volumes were down from the second quarter (-3.9%), but still above the third quarter of 2021 (+3.3%) and roughly in line with the expected 1,469 MMcfd. The volume decline was largely due to maintenance activity at the Trinidad facility. Similar volumes are expected for the fourth quarter: 464.4 MBod of crude oil and condensate, 195 MBbld of natural gas liquids, and 1,400 MMcfd of natural gas.

Based on these production numbers, EOG reported quarterly revenue of $7.59 billion, which exceeded estimates by $610 million and was up 59% from a year ago. Non-GAAP earnings per share were $3.71, slightly below expectations but still up significantly from $2.16 a year ago. Cash operating costs increased slightly by 6% from the previous quarter, primarily due to higher transportation, lease and well costs, but also production and processing costs. EOG recorded a nice $1.69 billion profit from hedge settlements, which more than offset the negative impact of lower oil prices (-$650 million). Free cash flow was again extremely strong at $2.26 before working capital adjustments, dwarfing the company’s third-quarter dividend payout of $1.31 billion (with special dividends accounting for two-thirds).

Hardly surprisingly, and underscoring management’s confidence in the business, the regular dividend was increased by 10% to $0.825 per quarter. Investors who bought EOG just a year ago, when the stock had already gained significantly since the 2020 stock market crash, are benefiting from a solid yield on cost of over 3.8%. It is also worth noting that EOG has never cut its regular dividend.

But it gets better – the days of thoughtlessly investing excess cash flow (or borrowed money) in drilling projects with unprofitable all-in costs – which the industry was notorious – are long gone, and management is distributing much of its excess free cash flow to shareholders. For the third quarter, management declared a special dividend of $1.50 per share, bringing the total declared payout for 2022 to date to $8.875, representing a yield on cost of 10.3%. In addition to promising sustainable dividend growth, management intends to continue returning excess cash to shareholders through special dividends, as well as opportunistic buybacks.

The fact that only a negligibly small number of shares have been repurchased so far in 2022 (worth $95 million), while the company has about $5 billion in outstanding repurchase authorization (p. 43, third quarter 2022 10-Q), suggests that the shares are currently overvalued, as management is known to act prudently in its role as capital allocator.

Risks

Of course, EOG’s generous returns of cash to shareholders are largely dependent on the company’s drilling and development activities and, of course, the price of oil. Since it is generally assumed that the world is heading for a recession, lower oil prices can be expected. However, as the availability of (fossil) energy continues to be a problem for the reasons mentioned above, I believe that lower oil prices are only temporary and that the price of a barrel will probably remain at a high level for a longer period of time (some even talk about a new super cycle). Understandably, however, a fluctuating oil price would affect EOG’s share price.

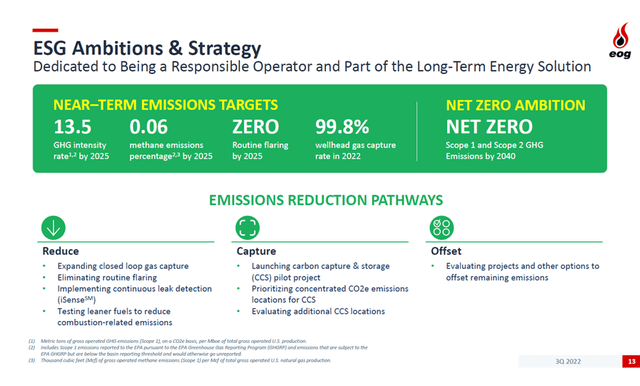

Taxes on what is referred to as “windfall” profits could, of course, hurt the positive outlook. Other risks include potential liabilities due to oil spills or excessive emissions, but it seems worth noting that EOG is on a solid path to become more environmentally friendly (Figure 1). The intensity of its Scope 1 greenhouse gas emissions has decreased from 17.1 in 2017 to 14.0 in 2021, and the percentage of Scope 1 methane emissions has decreased from 0.40% in 2017 to 0.06% in 2021. The company expects to roughly maintain these levels until at least 2025. Of course, as a shale driller, EOG is subject to significant ESG-related risks, even if the company makes its operations more environmentally friendly. However, given its solid balance sheet (see below), I would not overstate the risk of potential ESG-related credit constraints. Future growth could be limited by reduced or outright suspension of permitting activity, but given that EOG already has multiple permits, this regulatory change would likely have only a delayed impact.

Figure 1: Slide 13 of EOG’s third quarter 2022 earnings presentation

A Brief Update On EOG’s Balance Sheet

For most of the last decade, shale drillers have had a reputation for “drilling at all costs” and relying heavily on external funding sources. Back in my original article, I highlighted how well EOG has weathered the trough years and repeatedly demonstrated its disciplined approach towards capital allocation. Morningstar rated EOG’s capital allocation quality as “exemplary” and recognized that the company avoided mergers and acquisitions and instead focused on its scale and technical capabilities.

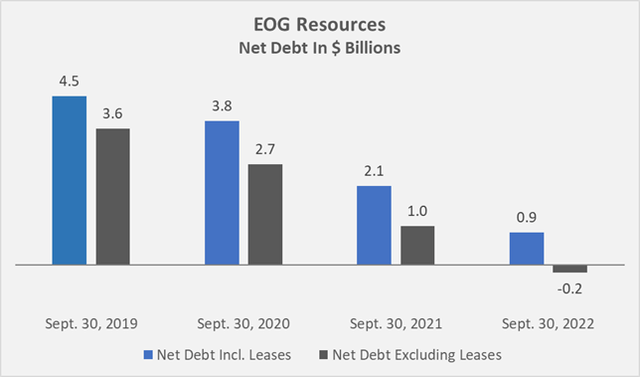

Properly focused, EOG entered 2022 in excellent shape, and although much of its free cash flow is returned to shareholders via dividends, the company was able to further improve its already solid balance sheet. Figure 2 gives a good sense of the company’s discipline and the importance management places on operating on the back of a solid balance sheet. Since 2019, EOG’s net debt has gradually declined, and along with Q3 2022 results, management reported a net cash position. And even when including lease obligations, the company’s leverage is still extremely conservative. On a net basis, EOG spent $41 million on interest payments in the quarter – hardly noteworthy compared to the pre-interest free cash flow of $2.3 billion before working capital adjustments and stock-based compensations (typically around $40 million per quarter).

Figure 2: EOG’s net debt including and excluding lease obligations (own work, based on the company’s 2019 to 2022 10-Q3 statements; discounted lease obligations were taken from the corresponding 10-K, for 2022, the data from the 2021 10-K was used).

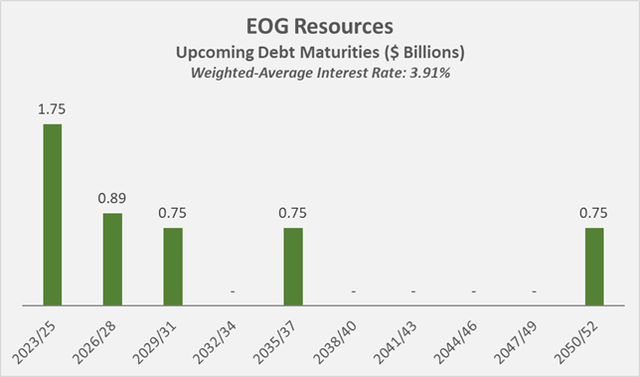

Figure 3 shows an updated maturity profile, from which it is easy to see that EOG is in an extremely comfortable position. At a time when other companies are scrambling to refinance their debt at somewhat reasonable rates due to lackluster free cash flow and rising interest rates, EOG will be able to repay the $1.75 billion maturing over the next three years from its petty cash. And even if the company decides to channel the cash into higher dividends, buybacks and growth opportunities (which management is approaching extremely carefully), refinancing the bonds would not hurt the company’s pre-interest free cash flow either, as the current weighted average interest rate is a comfortable 3.91% (theoretical interest expense of $191 million per year), suggesting plenty of headroom. EOG’s strong balance sheet also gives a sigh of relief to investors who (probably rightly) fear impending ESG-related lending constraints.

Figure 3: Maturity profile of EOG’s debt (own work, based on the company’s 2021 10-K)

Conclusion – Dependability Has Its Price

Third quarter results confirmed that EOG continues to fire on all cylinders, literally printing cash that it generously returns to shareholders. While a recession is likely around the corner and oil prices may temporarily decline as a result, I still believe that we are in a period of sustained higher oil prices, from which EOG will benefit significantly due to its low-cost production portfolio.

The balance sheet is extremely strong, providing insulation against potential ESG-related lending constraints, and the significant cash position acts as a buffer in what is likely to be a volatile environment. I generally see EOG’s future as very bright and believe that the elephant – ESG risks that could translate into permit suspensions or an outright ban on fracking – has temporarily left the room for good. The world is simply not capable of making a rapid transition to renewable energy sources. The tricky situation into which the European Union in general and Germany in particular have maneuvered themselves makes this clear.

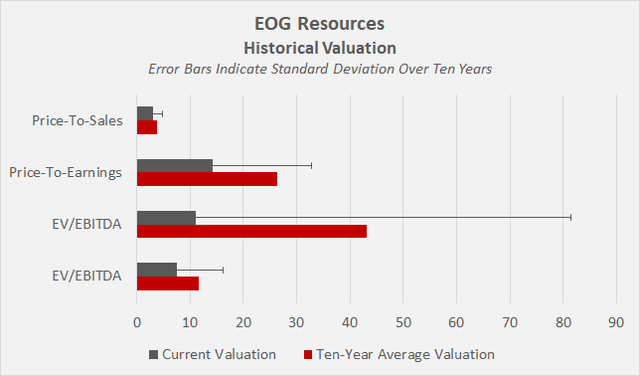

However, at a share price of $146, it is difficult to conclude that the shares are still worth owning. Cyclical companies are difficult to value, and while it may be true that we are approaching a new supercycle, as some have suggested, I think it is prudent not to buy shares of a cyclical company when expectations are high. Morningstar has determined a fair value of $98 for EOG Resources based on a net asset value forecast. This did not take into account the new Utica resource, so the updated fair value could be slightly higher, but the current price tag definitely seems inflated. The stock’s overvaluation is also underlined by the historical valuation in Figure 4. Seeking Alpha’s quant rating system has currently assigned a D rating to the stock, which also signals overvaluation. To be fair, it is worth mentioning that the valuations are the result of a decade of lackluster share price performance and the extent of overvaluation should therefore not be overstated.

At the right price, however, I still believe that an investment in EOG serves as a good long-term hedge against inflation, as the prices of oil and gas are correlated to the prices of numerous primary and secondary economic sector constituents (e.g., mining products, fertilizers, plastics, cosmetics, industrial machinery, electric energy).

However, it is obviously not a good idea to buy straw hats in summer or umbrellas during rain. As a result, I am not currently invested in the company, but would gradually begin to build a position if the stock were to fall to the low $100s. News that the U.S. or the entire world is in a recession will likely have a negative (but temporary) impact on the price of oil, and therefore most certainly also EOG’s share price. I can see myself taking advantage of such an opportunity.

Figure 4: Historical valuation of EOG Resources (own work)

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment