We Are/DigitalVision via Getty Images

Entravision Seeks To Reach New Customers and Along With It A Return To New Highs

Entravision Communications Corporation (NYSE:EVC) is a media company that reaches and engages Hispanic audiences in the United States and other markets. The company owns and operates television and radio stations, as well as digital and mobile platforms. EVC has a portfolio of over 60 media properties in 19 U.S. states and 29 markets (Figure 1).

EVC’s stock has been on a tear lately, up nearly 30% in the last 3 months at its highs just a couple weeks ago. The company’s recent earnings results have been strong, continuing to grow revenue at an around 20%+ clip, and EVC is well-positioned to capitalize on the growing Hispanic population in the United States. With a market cap of only $460 million, EVC is a cheap stock that is trading at a discount to its peers and has more potential room to run going forward.

EVC is a moderate buy for value investors looking for a cheap discounted stock with upside potential for growth.

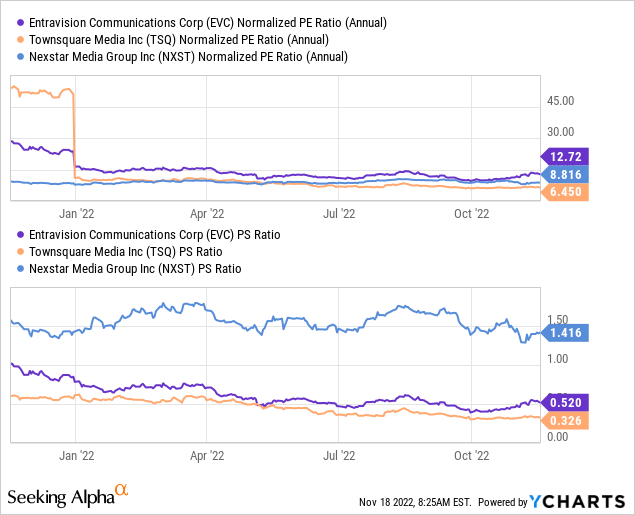

Figure 1. Entravision provides advertising across TV, Audio, & Digital platforms, as well as more

Current Valuation of Entravision

Entravision Communications Corporation owns and operates television and radio stations in both the United States and Latin America. As of December, the company’s current price to book ratio sits at around 1.7x earnings and their EV to sales ratio around 0.6x sales, well below competition.

Despite the current economic uncertainly in microcap stocks, Entravision’s stock has been trading relatively in lockstep with the NYSE over the past year down ~20% YTD. However, some Wall Street analysts believe that the stock is undervalued and believe that it could reach as high as $14 per share within the next year. The stock trades fairly valued at a 13.5x Price to earnings ratio. Although looking towards price to sales EVC looks deeply discounted trading at a 0.5x revenue P/S ratio over half that of peers. Not bad at all for a stock that has averaged over 40% revenue growth over the last 5 years.

Figure 2. EVC trades relatively discounted with a PE ratio trading on par to peers and a PS ratio discounted to other names

We believe the stock still has plenty of upside. A bullish move for us would be if the company utilized some of its $160 million in cash to both pay off debt as well as buy back stock. This would allow for the P/E to come down and in turn make the stock an overall cheaper investment to draw in new shareholders.

With a reduced PE ratio due to earnings expansion and overall share reduction from buybacks the stock could see as much as 120% upside in our view based off of current PS levels. This would put the stock close to wall street analyst price targets, and would obviously be best case scenario and require macroeconomic tailwinds as well. Therefore we believe a much more conservative price target of half that in the next 1-2 years is more likely and see a price target of ~$8 very possible. Only time will tell if something to this aspect will playout, but for now, Entravision’s stock appears to be a relatively safe investment as far as small caps go.

Risks

Investing in Entravision Communications Corporation’s stock does come along with a number of risks. The company has a history of financial losses, and its stock price is rather volatile (Beta of 1.1). Moreover, the company is heavily dependent on advertising revenue, which is susceptible to economic downturns. We believe stocks have very little further downside and therefore are rather bullish on EVC, but for investors who believe a more significant recession is on the horizon, Entravision may be worth avoiding.

Before investing in Entravision Communications Corporation’s stock, please carefully consider the risks outlined above. The company also carries around $257 million in total debt, a rather significant value for a $450 million valued company. This should be monitored going forward in future conference calls.

Conclusions

In conclusion, Entravision Communication Corporation stock is a moderate buy for small cap value investors. The company is cheap relative to its growth potential, and its dividend yield (1.9%) is an appealing bonus. The company’s growth prospects appear to be solid with a rapidly growing Hispanic market within the U.S., making it a good investment for the long term in our view. Other compelling small cap value names within the business include Cumulus Media (CMLS) although Entravision has provided more consistent historical growth. Our recommended strategy would be to accumulate the stock at any dips below $5, but not for it to make up more than 1-2% of one’s portfolio partition. It is a speculative buy on the notion that small caps with value will outperform the overall market on returns to all time highs over the next year or two with potential to bring 60%+ gains in our opinion.

Be the first to comment