onurdongel

On Tuesday, November 1, 2022, midstream master limited partnership Enterprise Products Partners L.P. (NYSE:EPD) announced its third quarter 2022 earnings results. As Enterprise Products Partners was one of the first companies to report, we do not yet know what the earnings trend for the midstream sector will be but most of these companies have delivered growth over the past year. Enterprise Products Partners certainly did not fail to deliver on this as the company’s revenue and distributable cash flow were both up compared to the prior-year quarter. The company also beat the expectations of its analysts in terms of both revenue and earnings per share, but as I have pointed out in the past, earnings per share is not a particularly relevant metric for midstream companies. Curiously, however, the market seems ambivalent about these results as the partnership units are down slightly as of mid-afternoon on the announcement day. Despite the market’s lukewarm attitude, there is a great deal to like here and investors should be quite pleased with these results. Overall, Enterprise Products Partners continues to show us why it very much deserves a place as a core holding in anyone’s portfolio.

As my regular readers are likely well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Enterprise Products Partners’ third-quarter 2022 earnings results:

- Enterprise Products Partners brought in total revenue of $15.468 billion in the third quarter of 2022. This represents a 42.80% increase over the $10.832 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $1.712 billion in the current quarter. This compares quite favorably to the $1.513 billion that the company reported in the year-ago quarter.

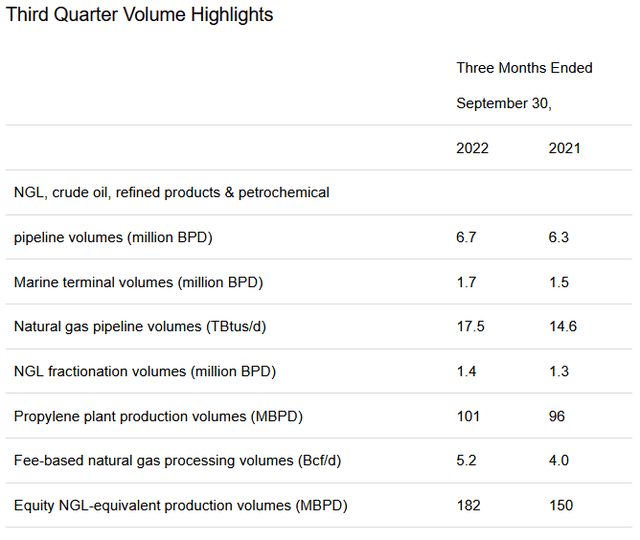

- Enterprise Products Partners transported an average of 17.5 trillion BTU of natural gas per day through its pipeline infrastructure in the reporting period. This represents a 19.86% increase over the 14.6 trillion BTU of natural gas per day that the company averaged during the equivalent quarter of last year.

- The company reported a distributable cash flow of $1.868 billion in the most recent quarter. This represents a 15.81% increase compared to the $1.613 billion that the company reported last year.

- Enterprise Products Partners reported a net income attributable to the common unitholders of $1.360 billion in the third quarter of 2022. This represents a 17.95% increase over the $1.153 billion that the company reported in the third quarter of 2021.

It seems essentially certain that the first thing that anyone reviewing these highlights will notice that is basically every measure of financial performance showed improvement compared to the prior-year quarter. One of the reasons for this is that Enterprise Products Partners transported higher volumes of products compared to the prior-year quarter. This was a constant across the firm’s entire business as every single segment handled more resources than last year:

This resulted in improved financial performance because of the business model that the company uses. Basically, Enterprise Products Partners enters into long-term (usually five to ten years in length) contracts with a customer under which the company transports the customer’s resources through its extensive infrastructure network. The customer then compensates the company based on the volume of resources that are handled, not on their value. This is the reason why the company held up much better in 2020 than most producers of crude oil or natural gas. As a result of this business model, Enterprise Products Partners brought in more money than it did in the year-ago quarter. All else being equal, the more money that the company brings in, the more money that is available to make its way down to the cash flow and earnings, which is exactly what we see here.

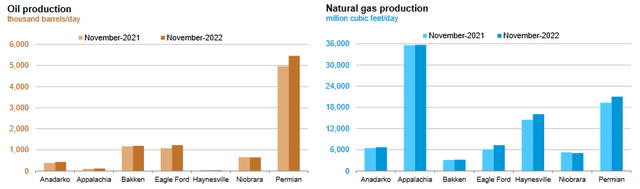

The company may be able to continue this trend of year-over-year performance. This is because the nation’s energy producers have been steadily increasing their production in order to take advantage of today’s high energy prices. As we can see here, many of the major hydrocarbon basins in the United States are producing more resources than they did in the year-ago quarter:

U.S. Energy Information Administration

Enterprise Products Partners primarily operates in the Permian Basin, although it does have operations in a few other areas. We can clearly see that production of both crude oil and natural gas is higher now than it was last year. Somebody will need to transport these incremental resources to the market where they can be sold. This is the business that Enterprise Products Partners is in so we can conclude that it will see some higher volumes in the fourth quarter than in the year-ago quarter. This should result in the company’s fourth-quarter 2022 results coming in somewhat stronger than its fourth-quarter 2021 results.

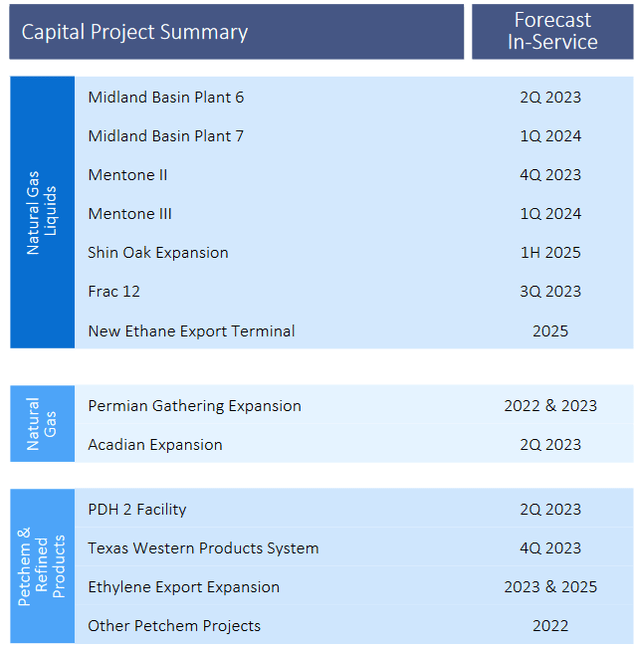

Enterprise Products Partners’ growth trajectory will not stop with the fourth quarter, either. The company is actively working to increase the volume of resources that it can handle over and above its current capacity. As midstream infrastructure has a finite capacity of resources that it can transport, the company needs to construct new infrastructure to increase its maximum capacity. This is exactly what it is doing as Enterprise Products Partners currently has approximately $5.5 billion worth of projects under construction:

The nice thing about all of these projects is that Enterprise Products Partners has already obtained contracts from its customers for their use. This is nice because it ensures that the company is not spending a great deal of money to construct money that nobody wants to use. In addition, Enterprise Products Partners knows in advance exactly how profitable each project will be in advance. This allows it to make sure that it is receiving an appropriate return to justify the investment. Unfortunately, the company has not stated exactly what return it will be generating but on average midstream projects pay for themselves in about four to six years. That is therefore probably a reasonable estimate for these projects. Enterprise Products Partners also has one final benefit, which is that each of these projects will begin generating revenue and cash flow as soon as they come online. As we can see above, the company’s projects will generally be coming online between now and the end of the first half of 2025. Thus, the company appears to have a solid pathway for growth for at least the next two to three years. This is something that we should be able to appreciate, particularly considering that Enterprise Products Partners has historically raised its distributions when cash flows increase.

In a previous article on Enterprise Products Partners, I stated that the partnership’s acquisition of Navitas Midstream earlier this year would likely result in growth. We see that reflected in the company’s third-quarter results. According to Jim Teague, co-chief executive officer of Enterprise Products Partners’ general partner:

Enterprise reported a $232 million increase in gross operating margin for the third quarter of 2022 compared to the third quarter of last year. These results were primarily driven by contributions from the partnership’s Midland Basin natural gas gathering and processing business (acquired in February 2022) and higher gross operating margin from our natural gas processing, octane enhancement, and natural gas pipeline businesses.”

Please notice how he specifically states the company’s gathering and processing unit in the Midland Basin. Enterprise Products Partners did not have any operations in the Midland Basin until it purchased Navitas Midstream back around the start of the year. Thus, this has to be the business that Mr. Teague is referring to. This business will likely contribute to the company’s fourth-quarter results as well since Enterprise Products Partners did not own it during the fourth quarter of 2021 so the company could not possibly have received money from it. This acquisition is also likely another contributor to the year-over-year volume growth that we see in these results. Overall, this acquisition is thus proving to be a net positive for the company.

Unfortunately, not all of the company’s operations performed strongly during the quarter. For example, the Enterprise Hydrocarbons Terminal in Houston, Texas saw its gross operating margin decline by $18 million relative to the third quarter of 2021. The company states that the biggest reason for this was that loading fees at the terminal were lower than they were last year. The company’s pipelines in the Rocky Mountain region also saw a decline in gross operating margin, which was mostly due to lower fees imposed on customers that failed to meet the minimum volume commitments that their contracts with Enterprise Products Partners require. This is one way that Enterprise Products Partners protects itself against a decline in energy prices, which will typically lead to a reduction in volumes. In short, the customer must send a certain volume of resources through the company’s pipelines or pay a fee to Enterprise Products Partners. The company collected fewer fees from its customers this year relative to last year, although it did partially make up for this by transporting a higher volume of resources out of the region.

One of the most attractive things about Enterprise Products Partners is that the company boasts a very strong balance sheet with only limited amounts of debt. This is nice because debt is a riskier way to finance a company than equity. After all, the company must repay its debt at maturity, which can cause its interest expenses to increase depending on the conditions in the market and whether or not the company has the cash to avoid a rollover. In addition to this, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline may push it into insolvency if it has too much debt. Although midstream companies like Enterprise Products Partners tend to have remarkably stable cash flow, this is still a risk that we should keep in mind.

We can see the strength of Enterprise Products Partners’ balance sheet by looking at its leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how long it would take the company to completely repay its debt if it were to devote all its pre-tax cash flow to that task. As of the end of the third quarter, Enterprise Products Partners has a leverage ratio of 3.1x based on its trailing twelve-month adjusted EBITDA. This is a very reasonable ratio that is well below the 5.0x that analysts usually consider to be acceptable. Although analysts consider a 5.0x ratio to be acceptable, many midstream companies have been working to get their leverage ratios below 4.0x ever since the COVID-19 pandemic temporarily crashed energy prices. We can see that Enterprise Products Partners is well below that much more conservative ratio and, in fact, the company currently has one of the lowest ratios in the industry. All in all, there should be little reason to be concerned about the company’s leverage.

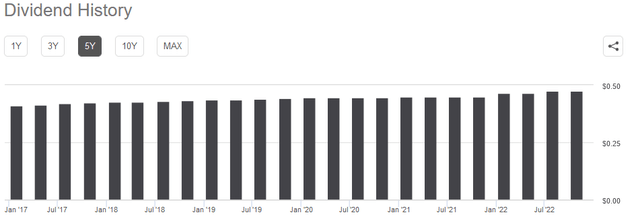

One of the biggest reasons why investors purchase partnership units in companies like Enterprise Products Partners is because of the remarkably high yields that many of these companies possess. Enterprise Products Partners is certainly no exception to this as the company’s $0.475 per unit quarterly distribution gives it a 7.52% yield at the current unit price. Enterprise Products Partners also has a track record of growing its distribution over time, albeit at a fairly slow pace:

This is something that will certainly be appealing since it is a far better track record than peers such as NuStar Energy (NS), DCP Midstream (DCP), and Energy Transfer (ET) possess. The slow distribution growth also helps somewhat in today’s highly inflationary environment since the higher amount of money that we receive from the company helps to offset the decline in purchasing power that accompanies inflation. As is always the case though, it is critical that we determine whether or not the company can actually afford this distribution. After all, we do not want to be the victims of a distribution cut since that would reduce our incomes and almost certainly cause the unit price to decline.

The usual way that we judge a midstream company’s ability to pay its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be paid out to the limited partners. As stated in the highlights, Enterprise Products Partners reported a distributable cash flow of $1.868 billion in the third quarter of 2022. That was sufficient to cover the company’s distributions 1.80 times over. Generally, analysts consider anything over 1.20x to be reasonable and sustainable. As we can clearly see, Enterprise Products Partners clearly exceeds that so we can generally conclude that the company should be able to maintain its distribution at the current level and increase it as the growth story plays out. Overall, there is nothing for an income-seeking investor to worry about here.

In conclusion, Enterprise Products Partners posted the relatively solid results that we have come to expect from this company. The firm showed respectable year-over-year growth, which is likely to continue for at least the next few years. We are also seeing a real impact from the Navitas acquisition that the company made earlier this year. When we combine this with a strong balance sheet and a reasonably high and sustainable yield, the company continues to deserve its place as a core position in any income-focused portfolio.

Be the first to comment