imaginima

Enterprise Products Partners L.P. (NYSE:EPD) is one of the largest and most well-known midstream partnerships in the United States. This sector in general has long been quite attractive to income investors due to its incredibly high yields and general stability regardless of conditions in the broader economy. Enterprise Products Partners is certainly no exception to this, as the partnership currently yields 7.73% and the company handled both the commodity price collapse in 2020 and the recent rebound with a great deal of ease. This stability is reflected in the firm’s market performance, as the partnership units have been almost completely flat over the past year. In addition to its high yield and general stability, Enterprise Products Partners boasts significant growth prospects. Thus, the company is very well positioned to be an anchor in your portfolio that will provide you with a steadily growing source of income.

About Enterprise Products Partners

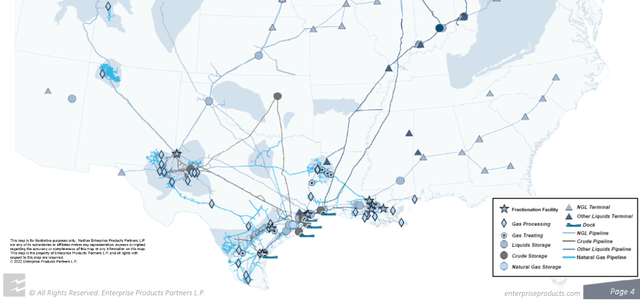

As stated in the introduction, Enterprise Products Partners is one of the largest and most well-known midstream partnerships in the United States. The company boasts an expansive infrastructure network that consists of more than 50,000 miles of pipelines, 260 million barrels of liquids storage capacity, fourteen billion cubic feet of natural gas storage capacity, and various supporting facilities such as gas processing plants and fractionators:

One of the first things that we notice here is that Enterprise Products Partners has exposure to a few different basins in which fossil fuels are produced, although it is very highly centered around the Permian Basin in West Texas. This gives it a bit less breadth and diversification than Energy Transfer (ET) or Kinder Morgan (KMI) but this is not necessarily a bad thing. The Permian Basin has generally been the epicenter of America’s shale oil boom, although it has lost a bit of its shine over the past as a center of production growth. The basin is a major producer of both natural gas and liquids and as we have seen, Enterprise Products Partners handles both products.

This is a good thing, as natural gas and liquids have very different fundamentals. Most notably, natural gas has substantially more growth potential, although both products are very likely to see increasing consumption going forward. This could prove beneficial for Enterprise Products Partners going forward as the industry moves to supply the growing demand. We will discuss this more later in this article.

As everyone reading this is very well aware, the prices of both crude oil and natural gas have increased substantially over the past year. As of the time of writing, natural gas at Henry Hub is up 75.00% and West Texas Intermediate crude oil is up 42.29% over the past year. However, Enterprise Products Partners does not benefit significantly from this, as may be surmised by the unit’s performance over the past year. This is because of the business model that the company uses.

In short, Enterprise Products Partners provides transportation and storage of the customers’ natural resources in exchange for a fee that is based on the volume of resources that are handled and not on their value. This has the effect of protecting Enterprise Products Partners against steep declines in resource prices, like what occurred back in 2020. Unfortunately, this also works in reverse, as the company does not benefit significantly when energy prices increase as they did over the past year. There may be some readers that point out that resource production tends to decline when energy prices go down, which could pose a problem for the company’s volume-based business model.

Fortunately, Enterprise Products Partners has a way to protect itself against this as well. Basically, the contracts that the company has with its customers contain what are known as minimum volume commitments. These commitments specify a certain minimum volume of resources that must be sent through the company’s infrastructure or the customer has to pay for it anyway. This provides Enterprise Products Partners with a substantial amount of financial stability, regardless of anything else that goes on in the economy. We can see this stability by looking at Enterprise Products Partners’ cash flows over the past three years:

| FY 2019 | FY 2020 | FY 2021 | |

| Distributable Cash Flow | 6,623.9 | 6,407 | 6,608 |

(all figures in billions of U.S. dollars)

In the first quarter of 2022, Enterprise Products Partners reported a distributable cash flow of $1.837 billion, which gives the company a distributable cash flow of $6.708 billion over the trailing twelve-month period. We can thus see that the company’s cash flow tends to be remarkably stable over time while still exhibiting a moderate amount of growth, albeit at a slower rate than companies in many other sectors tend to possess. Fortunately, the partnership’s distribution yield more than makes up for this.

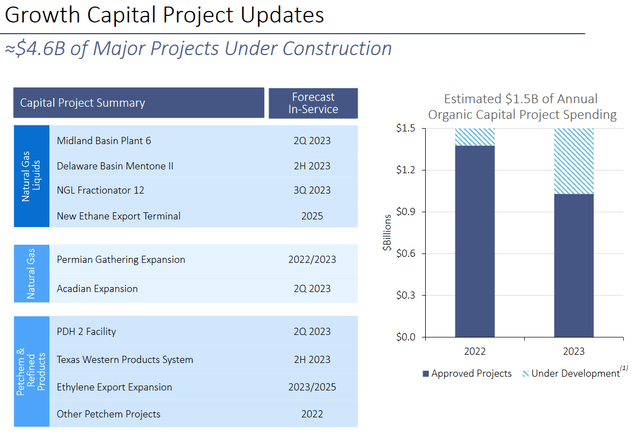

Enterprise Products Partners is well-positioned to continue this growth trajectory going forward. It will accomplish this by upgrading and constructing new infrastructure in order to increase the number of resources that it can handle. The company currently has about $4.6 billion worth of such projects currently under construction scheduled to come online between now and 2025:

These projects should each result in a cash flow boost for Enterprise Products Partners as they come online. The nicest thing about all of these projects is that Enterprise Products Partners has already secured contracts from its customers for their use. This benefits Enterprise Products Partners because the company can be certain that it is not spending a great deal of money to construct infrastructure that nobody wants to use. This situation also benefits the company because Enterprise Products Partners knows in advance how profitable the project will be so it knows that each project will be a worthwhile investment. Enterprise Products Partners does not specifically state how profitable each project will be but on average midstream projects pay for themselves in four to six years so that is probably a reasonable estimate for these ones.

One of the more interesting of these projects is the PDH2 propylene fractionation plant. This is not exactly what most people think of when picturing a midstream company because it does not involve the transportation or storage of liquids or natural gas. However, there are a few midstream firms that fractionate natural gas liquids, which involves the separation of raw natural gas liquids into purity components such as butane, propane, and ethane.

This particular plant is intended to manufacture propylene, which is primarily used to create polypropylene. Polypropylene is used to manufacture various products including synthetic fibers and plastics. The global demand for this compound has been rising substantially in recent years and overall production capacity has failed to keep up. That is the driving force behind the reason for the construction of this facility. Enterprise Products Partners has already secured ten- to fifteen-year fixed-fee contracts from various investment-grade customers to purchase the entire output of this facility so overall it fits quite well with the partnership’s business model of minimizing commodity risk and producing stable long-term cash flows.

Investors thus should overall appreciate this. We should therefore expect to see a boost to the company’s revenues and cash flow when the facility starts operating, which is expected to be in the second quarter of 2023.

Fundamentals Of Natural Gas And Liquids

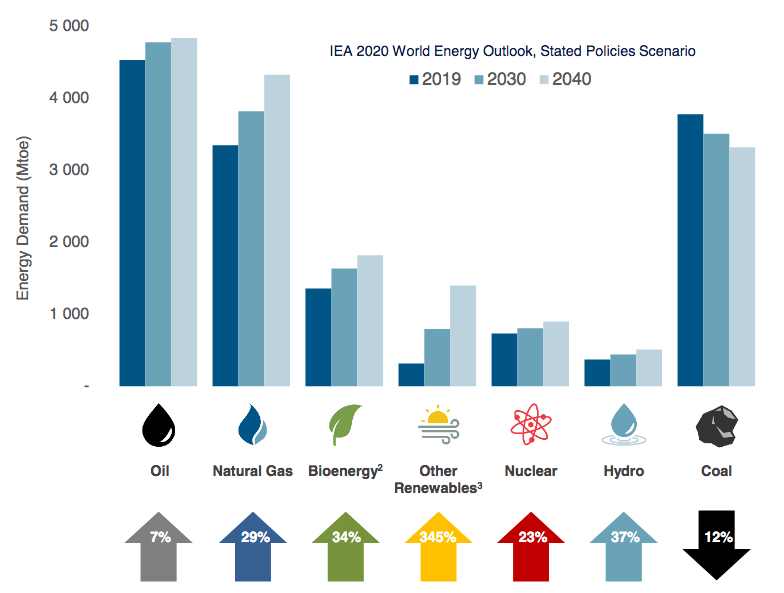

As we have seen, Enterprise Products Partners benefits when its transported volumes of natural gas and liquids increase. Fortunately, the fundamentals are pointing to this as a very likely possibility. This is because the demand for these products globally is expected to grow going forward. According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The tremendous surge in natural gas demand that we see over the twenty-year period will, perhaps surprisingly, be driven by the growing popularity of renewable sources of energy. As everyone reading this is well aware, many governments have been incentivizing utilities to abandon coal-fired electricity production in favor of renewables. However, renewables are not nearly reliable enough to support a modern electric grid on their given current technology. After all, wind turbines do not work when the air is still and solar panels do not work at night.

Thus, something else is needed to keep the electric grid operational when renewables are unable to do so. A typical solution to this problem is to use natural gas turbines to supplement renewables because natural gas burns much cleaner than other fossil fuels and enjoys the reliability needed to keep the grid operational in less-than-ideal conditions. This is why natural gas is often called a “transitional fuel,” since it provides a way to keep the grid operational and reduce carbon emissions until renewable technologies are sufficiently advanced to do this without the extra support.

The demand for natural gas liquids is also expected to increase going forward. This is due mostly to the growing demand for plastics (including in electric cars). In addition, we are seeing rural areas in many markets shifting from wood and coal for space heating and cooking to the use of butane and propane. This is particularly true in emerging nations, which still have many areas that lack utility-grade infrastructure.

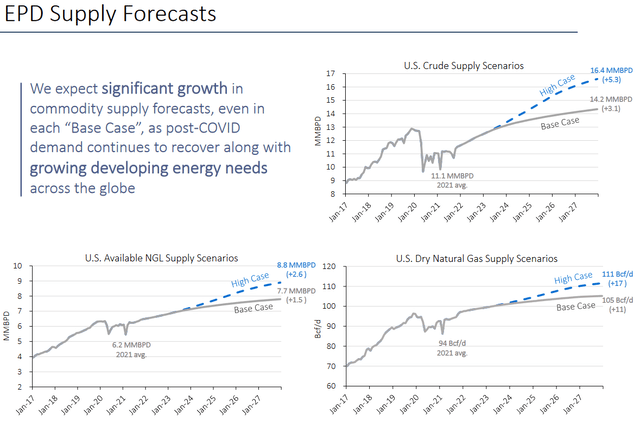

The United States is one of the only nations in the world that has the capability of increasing its production of both natural gas and liquid hydrocarbons in order to meet this demand. All three compounds are frequently found together in areas like the Permian Basin, and we have already seen that Enterprise Products Partners has substantial operations in this area, so it stands to benefit if hydrocarbon production in the basin increases. This is indeed expected to happen as the production of all three resources is expected to grow over the remainder of the decade:

Naturally, should hydrocarbon production increase, someone will need to take the incremental production to the market. This is exactly the business that Enterprise Products Partners is in. When we consider the incredible extent of Enterprise Products Partners’ infrastructure, it seems likely that it will receive at least some of this business. Thus, the company clearly has some long-term growth prospects in excess of its current projects.

Distribution Analysis

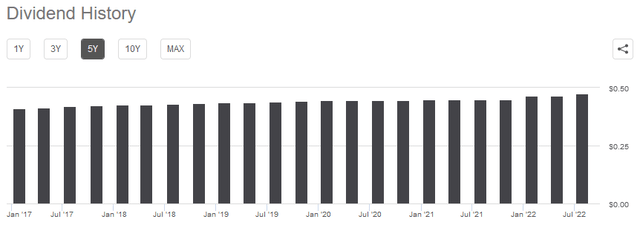

One of the biggest reasons why investors purchase partnership units in Enterprise Products Partners is because the firm has historically boasted a market-beating distribution yield. Indeed, as of the time of writing, the units yield 7.73%, which is substantially above the 1.54% yield of the S&P 500 index (SPY). Enterprise Products Partners has also been quite consistent about its yield over time and was one of the midstream firms that did not cut the payout back in 2020:

Enterprise Products Partners recently increased its quarterly distribution, although the 2.2% yield is not nearly enough to keep up with the current rate of inflation. I suppose it is better than nothing, though. As is always the case, it is critical that we ensure that the company can actually afford its distribution. After all, we do not want it to suddenly be forced to reverse course and implement a cut since such an event would both reduce our income and cause the unit price to plunge.

The usual way that we judge a midstream company’s ability to cover its distribution is by looking at a metric known as the distributable cash flow. This is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be paid out to the limited partners. In the first quarter of 2022, Enterprise Products Partners had a distributable cash flow of $1.837 billion as mentioned earlier. The company currently has 2.1805 billion common units outstanding so the current distribution of $0.475 per unit costs the company approximately $1.036 billion quarterly. This gives Enterprise Products Partners a distribution coverage ratio of 1.77x, which is quite reasonable.

Analysts generally consider anything over 1.20x to be sustainable, but I am more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the investment. As we can see, Enterprise Products Partners easily meets both of these requirements. Overall, then, the company’s distribution appears to be quite safe at the current level.

Conclusion

In conclusion, Enterprise Products Partners is one of the largest and most well-known midstream partnerships in the United States. The company has long been a favorite of income investors for a very good reason as its 7.73% yield appears to be quite sustainable and is higher than most others in the market.

In addition to this, Enterprise Products Partners boasts some significant growth prospects that could allow it to boost that distribution over time, which any investor should be able to appreciate. The company’s market price has admittedly been flat over the past year, but that yield more than makes up for any shortcomings in the market performance. Overall, Enterprise Products Partners may be worth considering for any portfolio.

Be the first to comment