Berkut_34

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 22nd, 2022.

Enterprise Products Partners L.P. (NYSE:EPD) and NextEra Energy Partners, LP (NYSE:NEP) are two players in the energy space. Both are essential as long as human civilization is on this earth. EPD is an MLP focused on pipelines and moving fossil fuels primarily. NEP is a subsidiary of NextEra Energy, Inc. (NEE), which focuses on producing energy through renewable means. While the transition to renewables is a strong focus – the need for fossil fuels isn’t and won’t go away.

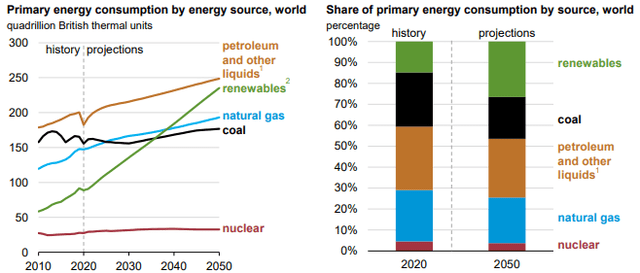

In fact, both energy sources are expected to grow in demand over time. Renewable sources are expected to play a leading role, but demand for natural gas and oil isn’t going away. Even the consumption of coal is expected to grow over time through 2050.

Projected Energy Consumption (EIA Presentation)

For those still considering EPD and NEP, I believe both choices have their pros and cons. Naturally, as they focus on two different areas of the energy space between the two of them, you should have your bases covered!

Tax Considerations And Benefits

Before looking at either of these investment choices, it should be noted that EPD is an MLP that issues a K-1. This can often make investors less receptive to an investment choice. In my opinion, the fundamentals and the merits of an investment should supersede a tax form. However, I respect that some investors are very against K-1 forms.

That’s where NEP is unique. NEP, interestingly, while being organized as a limited partnership, has chosen to be taxed as a C-Corp for U.S. federal tax purposes. That means they will issue on form 1099 – however, they still benefit from the return of capital classifications.

Each distribution (and I say distribution because it isn’t classified as income to be a dividend, same as EPD) has been 100% classified as a return of capital in at least the last several years.

Return of capital can be beneficial because it reduces an investor’s cost basis. So taxes aren’t due in the year they are received but are deferred until the position is sold, if ever. If a position is never sold, then no taxes will be due until the basis reaches $0.

Alternatively, under current tax law, if the units are passed down to heirs, they will receive a stepped-up basis. In this case, they can begin the whole process back over again.

Distributions And Growth Potential

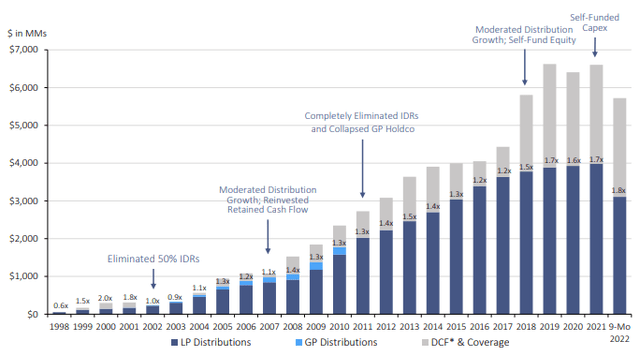

Both EPD and NEP have provided investors with growing distributions over the years, even though the COVID crash. That was a particularly rough time for fossil fuel energy sources. However, thanks to EPDs strong balance sheet, competent management and greater reliance on fixed contracts, EPD’s cash flow remained strong – and continues to remain strong today. In their latest slide, their gross operating margin for total operations in the 9 months of 2022 was 78% fee, 11% commodity and 11% differential.

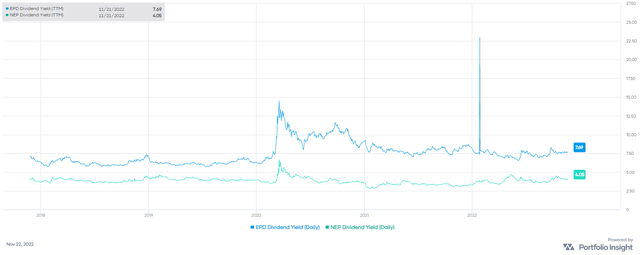

In terms of yield today, EPD is the clear choice for a higher yield.

EPD And NEP Current Yields (Portfolio Insight)

What NEP can offer is the growth of its payout to investors is coming in stronger. This is an important point for consideration because, at this time, a Treasury can be picked up for around a 4% yield today. So if you are investing in NEP, you are doing so because you believe that there is a potential upside to take on the greater risk.

With EPD’s larger yield, this is less of a consideration but is still something worth considering. If an investor is comfortable with a 4% yield rather than a 7.7% yield from EPD, that is taking some potential buyers away.

Of course, the Treasury bond you buy today won’t be increasing its coupon next quarter like EPD and NEP should continue to do with their distributions. That’s one of the big trade-offs, aside from the chance for some upside potential over the longer term.

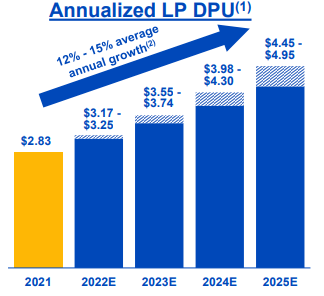

NEP’s 5-year CAGR for the distribution comes in at 14.95%, while EPD’s comes in at 2.43%. NEP believes that they are going to deliver 12-15% distribution growth through at least 2025.

NEP Expected Average Annual Growth Of Distributions (NextEra Partners)

EPD has a longer history and, therefore, a longer history of growing its distribution. The latest distribution increases were better, with the Q3 2022 distribution of $0.475 being an increase of 5.6% the year prior.

EPD Distribution And Coverage (Enterprise Products Partners)

Performance Of Units Past…

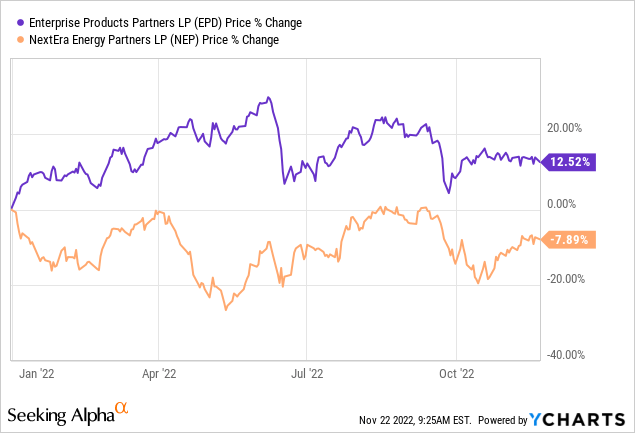

With the strength in energy overall through 2022, EPD’s unit price has benefited with positive returns on a price basis only.

Ycharts

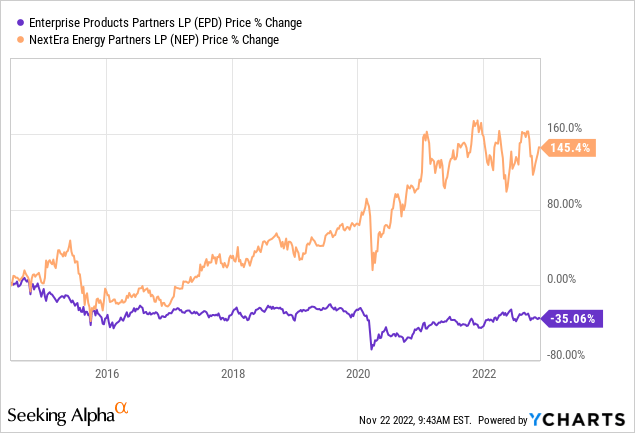

For NEP, returns have been weaker on a YTD basis. Over the longer term, since NEP was spun from NEE, it has been a much stronger performer.

Ycharts

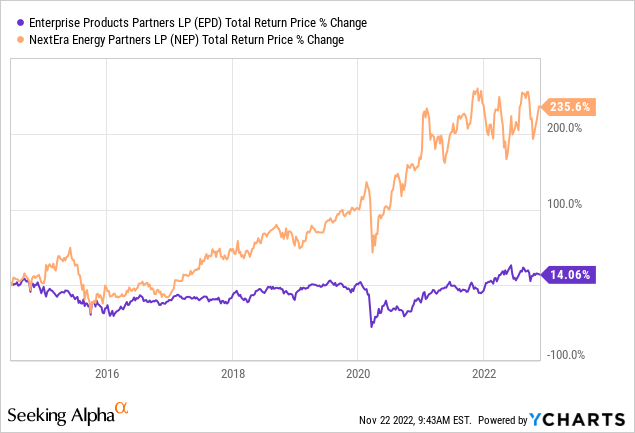

This is even the case when considering the distributions in being reflected by total returns. For total returns, it is assumed that the distributions are reinvested. Thus, we see in that case, EPD’s results are positive but still lag. This goes back to how weak fossil fuel investments had been through 2015 and 2020.

Ycharts

This is important to consider because energy prices, for the most part, in theory, aren’t supposed to impact EPD too significantly. They work on mostly fixed-fee contracts. While that is the case, that doesn’t play out in practice. They do have some price sensitively.

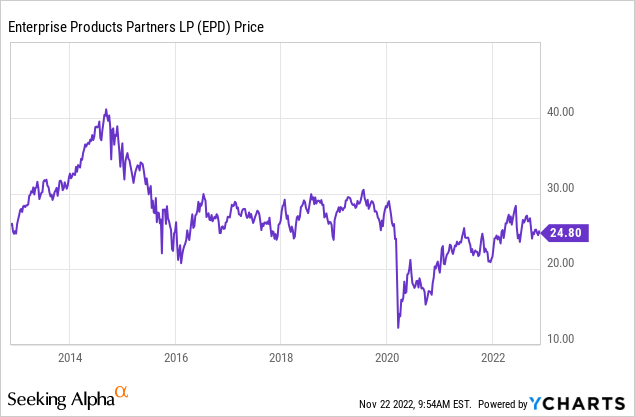

The units have participated in the declines of each previous crash. However, they are also limited on the upside when the rebound happens. I think that is quite clear just by looking at the price over the last decade.

Ycharts

When prices are weaker in natural gas and oil, they would see less volume shipped through their pipelines. When bankruptcies are going all around them for exploration and production companies, that likely means they aren’t getting paid – fixed-fee contract or not!

Despite these issues, it does mean that they are relatively less sensitive to changes in energy prices in terms of their cash flows. That’s generally what investors are buying MLPs and midstream companies for in the first place, as income plays. With EPD, this is where the quality had shown. They were able to maintain strong distribution coverage even through the weaker years for oil.

One thing that can benefit EPD is how large and conservatively they are managed. That puts them in a better position to take advantage of any future transitions to other forms of energy that they can push through their pipes. I think it means they’ll remain relevant and an important player all around for decades to come.

It’s true they can’t push sunlight or wind through the tubes, but they have a lot of flexibility in other fuels. In the latest quarter, they highlighted six different quarterly records.

We achieved six operating records, including transporting the record 11.3 million barrels per day of oil equivalent in the form of NGLs, crude oil, natural gas, refined products and petrochemicals. We transported a record of 17.5 trillion Btus per day of natural gas. We also set quarterly volumetric records for NGL fractionation, ethane exports, butane isomerization and fee-based natural gas liquids.

This isn’t even to mention that renewable energy is reliant on fossil fuels for the materials. So essentially, NEP, to operate, requires operations in the E&P space, as well as the midstream space. If they didn’t have that, they wouldn’t get the materials they needed to set up wind and solar farms.

…And Future Potential

Where we are today leaves neither one a particularly screaming buy. However, both can be considered for a dollar-cost average approach for a long-term investor.

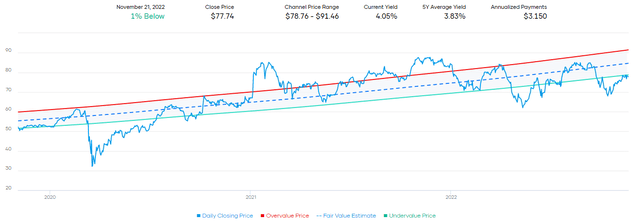

EPD is trading below its fair value based on its average historical yield range.

EPD Fair Value Estimate On Yield (Portfolio Insight)

This is the same case for NEP.

NEP Fair Value Estimate On Yield (Portfolio Insight)

As noted above, though, with higher risk-free rates. This might be exactly where these names should be trading to be considered fairly valued in this new environment. What could benefit these names is if the Fed pauses rates. In that way, investors wouldn’t be anticipating even higher risk-free rates in the near term.

Since the Fed is still expected to raise rates to at least around 5%, there could be some added pressure. Again, that’s why I don’t see these names as screaming buys. But for an investor that has some years to go, these seem like fine choices.

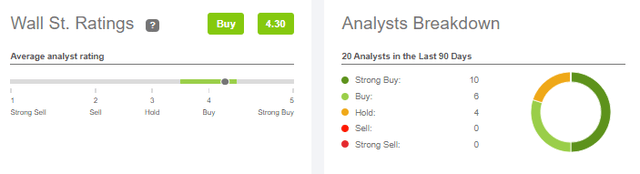

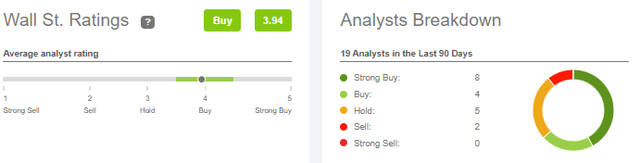

On the other hand, Wall St. analysts rate EPD a “Buy.” They also have an average price target of $31.20. That would indicate a 25.5% upside from the current level at the time of writing.

NEP Analyst Rating (Seeking Alpha)

Wall St. is similarly enthusiastic about NEP, with a “Buy” rating and an average price target of $85.25. Less potential upside at around 7.77% relative to EPD’s upside potential based on the average price target, but nonetheless, it still indicates some upside potential.

EPD Analyst Rating (Seeking Alpha)

Conclusion

EPD and NEP might approach the energy space in different ways, but they are both means to provide the power that is needed in everyday life. They will stay essential for decades to come, and they present great opportunities for generating income for investors. NextEra Energy Partners, LP might have a higher growth potential from here, but the stability of Enterprise Products Partners L.P. can mean each is a nice complement to the other.

Be the first to comment