Jon Feingersh Photography Inc/DigitalVision via Getty Images

Investment Thesis

The key to successful trading is in recognizing the right time to cash in key holdings, in order to lock in maximum gains. We are observing a similar phenomenon for Enphase Energy, Inc (NASDAQ:ENPH) now, given its elevated trading metrics. As of 12 August 2022, ENPH is trading at $299.26, up 263.8% from its 52 weeks low of $113.40. Traders who trade the stock now will easily see a 5Y Price Total Return of 36,462.0%, which would in turn boost their capital for further trading or other longer-term investments.

Naturally, as a solar enthusiast myself, it seems like blasphemy to recommend a sell on this excellent stock, given my previous bullish stance and the company’s robust fundamentals. However, besides building our long-term portfolio, it is also prudent to acknowledge that gains can only be realized by selling. We are naturally not suggesting a sell on all of your holdings, but only a portion, which may be recouped upon the next dip for ENPH. Otherwise, the bulls may continue holding on, since we expect the stock to perform excellently over the next decade. Long solar!

ENPH Is Bound For Massive Profitability Ahead

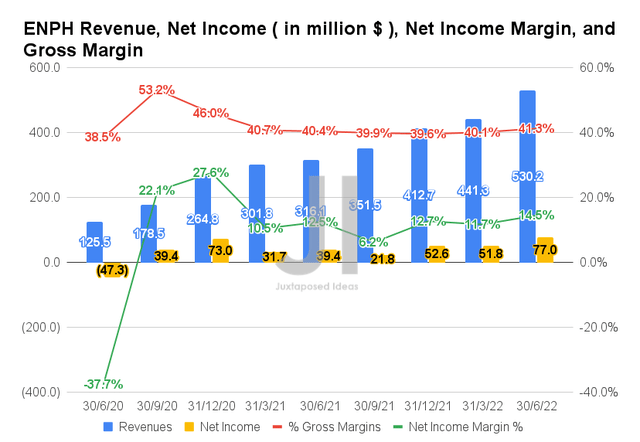

In FQ2’22, ENPH reported impressive revenues of $530.2M and gross margins of 41.3%, representing YoY growth of 67.7% and 0.9 percentage points, respectively. The company also recorded net incomes of $77M and net income margins of 14.5% in FQ2’22, representing an increase of 95.4% and 2 percentage points YoY, respectively. Given its elevated margins thus far, it is evident that ENPH has been relatively resilient against rising inflationary costs and global supply chain issues. This is probably attributed to ENPH’s strategic choice in relying on contract manufacturers, instead of producing its components in-house.

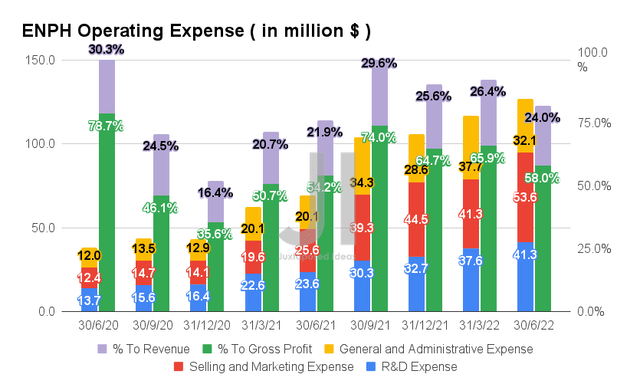

In the meantime, ENPH continues to aggressively expand its capabilities, with a total of $137M of operating expenses reported in FQ2’22, representing a notable increase of 17.4% QoQ and 97.6% YoY. However, it is also important to note that the ratio to its growing sales has been moderating thus far, at 24% of its revenues and 58% of its gross profits in FQ2’22. This represents a notable reduction from the peak in FQ3’21, at 29.6% and 74%, respectively. Thereby, indicating ENPH’s stellar management and operating efficiencies thus far.

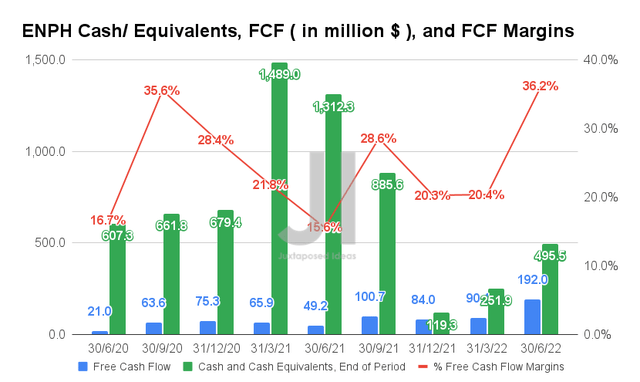

As a result, we are not surprised at all, by ENPH’s improving Free Cash Flow (FCF) generation thus far, with an FCF of $192M and an FCF margin of 36.2% in FQ2’22. It represented an immense improvement of 390.2% and 20.6 percentage points YoY, respectively. Thereby, boosting its cash and equivalents to $495.5M at the same time, beefing up ENPH’s balance sheet for further growth and expansion ahead. Potentially, for additional share buybacks given the dilutive effects of its share-based compensations and acquisitions thus far.

ENPH Has Been Massively Upgraded By The Optimistic Mr. Market

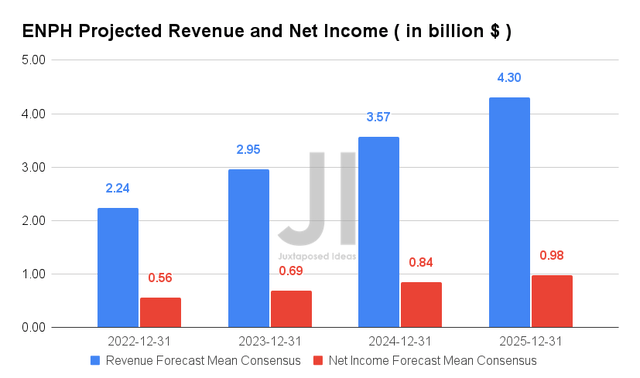

Over the next four years, ENPH is expected to report revenue and net income growth at an excellent CAGR of 32.86% and 61.24%, respectively. That is an apparent acceleration from the previous CAGR of 48.24% and 43.32% between FY2017 to FY2021, respectively, indicating a bull run for the company’s fundamental performance and potentially, stock prices ahead.

For FY2022, consensus estimates that ENPH will report revenues of $2.24B and net incomes of $0.56B, representing impressive YoY growth of 62.3% and 386.2%, respectively. These numbers also represent a notable 14.9% upgrade from the previous consensus estimates in March 2022, highlighting Mr. Market’s growing confidence in ENPH and its execution ahead.

In the meantime, we encourage you to read our previous article on ENPH, which would help you better understand its position and market opportunities.

- Enphase: Smashing The EV Market – Though Patience Is Recommended For Now

- Enphase Energy: Massive Adoption Expected In The EU, Thanks To Russia

So, Is ENPH Stock A Buy, Sell, or Hold?

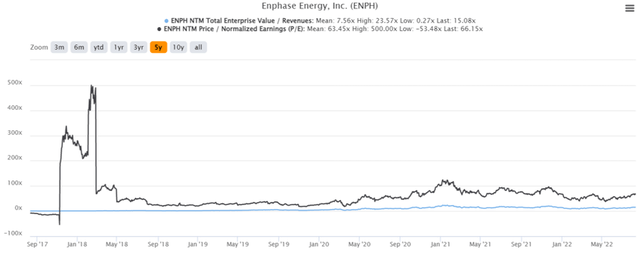

ENPH 5Y EV/Revenue and P/E Valuations

ENPH is currently trading at an EV/NTM Revenue of 15.08x and NTM P/E of 66.15x, higher than its 5Y mean of 13.25x and 62.76x, respectively. The stock is also trading at $299.26, near its 52 weeks high of $308.88, up 263.8% from its 52 weeks low of $113.40. It is apparent that ENPH is trading with a massive baked-in premium, given the recent development in the solar tariff for the next 24 months and its overwhelming performance in FQ2’22.

ENPH 5Y Stock Price

It is easy to surmise that ENPH’s current stock prices look relatively unsustainable, exceeding the consensus estimates price target of $289.20 and representing a -3.36% downside from the current elevated levels. Therefore, we urge investors to think carefully before adding at these levels, given the potential volatility once the market optimism is digested. On the other hand, long-term investors who have been looking to cash in, may definitely do so to lock in some gains now, especially given the sideways price action for the past two weeks.

In contrast, there are some speculative indications that ENPH may potentially hit new highs by the end of FY2022, assuming a raised guidance for FY2023. As Peter Lynch said, “Don’t cut your flowers and water your weeds.” It is tough to make a judgment call in this case, since there is no change in the company’s fundamental performance and it remains well poised for massive growth in the robust global demand for green energies over the next decade. The global solar power market is expected to grow from $197.23B in 2021 to $368.63B in 2030, at a CAGR of 7.2%.

Therefore, assuming that ENPH reports similar growth ahead, we may expect to see EPS of $6 and a forward PE of 60x for FY2023, which would bring its fair value to a speculative high of $360. However, that is a speculative event only suitable for investors with a higher tolerance for risk and volatility. So, we would not recommend waiting, since one may miss the boat at these levels.

This is the rare case in which we are recommending a sell, not for the lack of potential in the stock, but rather, the immense opportunity that one would possess with the additional investment capital. The bulls may always return once the stock retraces meaningfully to its previous support level of the low $200s. However, the crystal ball looks relatively murky now. So it is prudent to size your portfolios accordingly based on the risk tolerance levels.

Therefore, we rate ENPH stock as a Sell for now.

Be the first to comment