Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Enphase Energy (NASDAQ:ENPH) is a global energy technology company that designs, manufactures, and sells home energy products and an intelligent platform for solar panels. They are best known for their market-leading microinverter system. Reflecting the global push for green energy and growing popularity of microinverter systems, Enphase has been growing at an amazing pace in the past several years. Given their leadership position in the industry and upbeat forecasts for demand, I expect Enphase to continue its growth path in the future. I believe Enphase is a great investment option because:

- Enphase’s revenue and profit growth are accelerating, and an outstanding performance last quarter demonstrates that they are doing a great job at managing supply chain constraints.

- Enphase has a strong economic moat with superior technology, and the economic moat will be strengthened by ongoing R&D efforts and acquisitions.

- Enphase will benefit from large growth of the microinverter market in the next several years. Also, Enphase has room to grow outside of the U.S.

Outstanding Q1 2022 Results

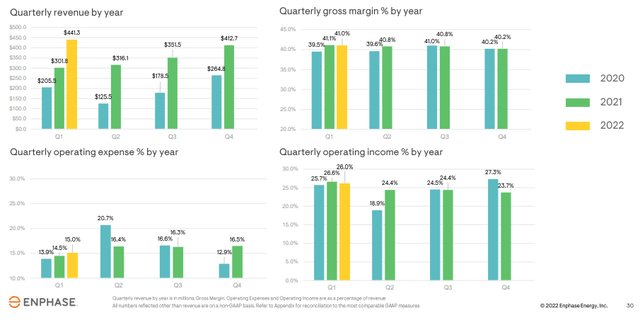

In late April, Enphase reported Q1 2022 results, and it was outstanding in many aspects. First of all, they recorded $441 M revenue, giving 46% growth YoY. Also, Enphase generated free cash flow of $90.1 M during the quarter. The most noticeable aspect of the results was the continued rapid growth, all while maintaining margins. Gross margin and operating margin basically stayed flat compared to last year. This was particularly impressive given ongoing supply chain constraints around the world.

Financial Performance of Enphase (Enphase Investor Relations)

This outstanding result stems from management’s smart allocation of capital and strategic placement of manufacturing sites. Currently, they maintain a majority of their contract manufacturing sites in three countries (Mexico, India, and China), and they are expanding capacity in Romania to satisfy the increasing demand from the European market. I expect them to continue their impressive growth trajectory, while maintaining profitability, in the foreseeable future.

Strong Economic Moat

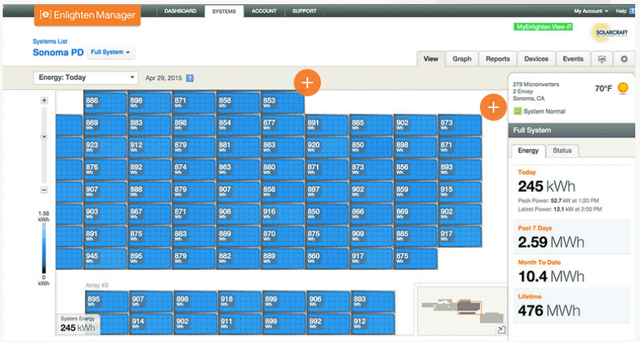

Enphase has a strong economic moat from their technological superiority. Microinverter technology, which Enphase is known for, has inherent advantages over the conventional string inverters. The conventional converter combines DC power from multiple panels (“string” of panels) and converts it into AC. In the microinverter system, each panel has a microinverter attached to it to generate AC independently. This structural difference enables the microinverter to overcome challenges from shading, soiling, and faulty panels. Basically, if a microinverter fails, it will only affect one panel, instead of the entire system.

Display of Enphase Panel Control Screen (Clean Energy Review)

On top of these inherent advantages, Enphase’s microinverters are more efficient and cost-effective thanks to their advanced grid-forming functions, predictive control system, and ensemble energy management technology. The ensemble energy management system optimizes energy generation, storage, and distribution. Enphase has been consistently investing in R&D ($119 M in last twelve months) to enhance these functionalities, and making acquisitions (e.g., Sofdesk in 2021) to further improve their technology. Therefore, I expect they will maintain technological superiority in the future.

Macro Tailwinds

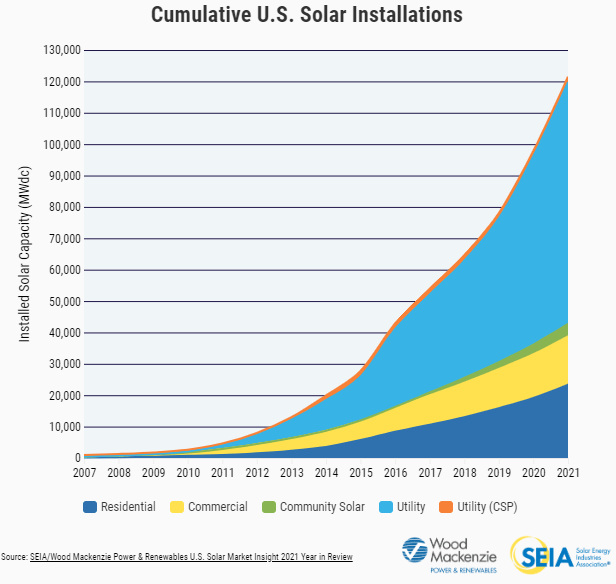

There are several macro tailwinds that will benefit Enphase’s growth in the long run. The first is the increasing popularity of solar energy. Thanks to favorable federal policies, rapidly declining costs, and increasing interest in green energy, the solar energy capacity in the U.S. has been growing at a rapid pace. As of March of 2022, 121 gigawatts of solar energy capacity have been installed nationwide, and I expect this trend to continue and benefit Enphase.

U.S. Solar Installation Trend (SEIA)

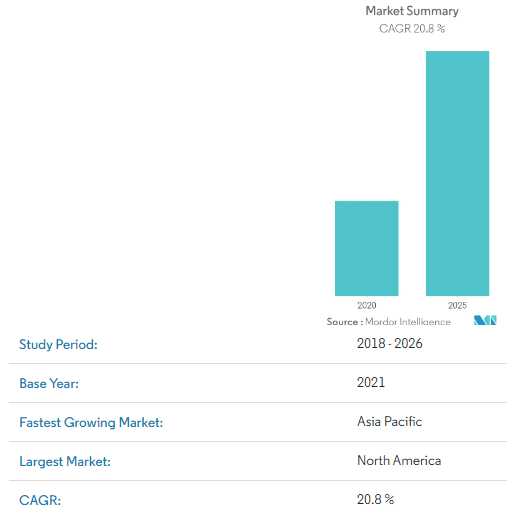

Another factor is the increasing popularity of microinverters. As mentioned in the previous section, a microinverter brings many advantages over a traditional inverter, and demand for microinverters is increasing. The demand for microinverters is expected to grow 20% per year for the next several years. As an industry leader in the space, I expect Enphase to grab the lion’s share of the growth. Also, their strategic partnership with SunPower (SPWR), Panasonic (OTCPK:PCRFY) (OTCPK:PCRFF), LONGi, Solaria (OTC:SEYMF), and Hanwha will ensure the growth of Enphase’s footprint.

Microinverter Market (Mordor Intelligence)

Intrinsic Value Estimation

I used the DCF model to estimate the intrinsic value of Enphase. For the estimation, I utilized current operating cash flow ($378 M) and the current WACC of 8.0% as the discount rate. For the base case, I assumed cash flow growth of 52% (in line with the revenue growth estimate) for the next 5 years, and zero growth afterward (zero terminal growth). For the bullish and very bullish case, I assumed cash flow growth of 54% and 56%, respectively for the next 5 years and zero growth afterward.

The estimation revealed that the current stock price represents 10-15% upside. The growing interest for renewable energy and favorable political environment will all positively contribute to Enphase’s growth trajectory, and I expect Enphase to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$201.04 | 2% |

|

Bullish Case |

$213.15 | 9% |

|

Very Bullish Case |

$227.90 | 16% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- Cash Flow Growth Rate: 52% (Base Case), 54% (Bullish Case), 56% (Very Bullish Case)

- Current Cash Flow: $378 M

- Current Stock Price: $196.34 (06/03/22)

- Tax rate: 15%

Cappuccino Stock Rating

Here is Cappuccino Stock Rating for Enphase.

| Weighting | ENPH | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 4 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 5 |

| Overall | 4.4 |

Economic Moat Strength (4/5)

Enphase has a well-defined economic moat, with technological superiority and great brand recognition. Given recent acquisitions and solid R&D investment, I expect them to maintain their edge over formidable competitors (SolarEdge (SEDG), Siemens (OTCPK:SIEGY), etc.) in the inverter market.

Financial Strength (5/5)

They have a solid cash position with over $1 B on the balance sheet and $378 M cash flow over the last twelve months. Thanks to their light CAPEX structure, Enphase tends not to spend big chunks of cash in any one place. Their R&D spending is consistently larger than CAPEX spending. Profit margins are above sector medians across the board. Enphase is far from financial distress.

Growth Rate (4/5)

The overall solar energy market has been growing at about 30% per year in the past decade, and Enphase’s revenue grew 36% per year. There are some signs that Enphase’s revenue growth is accelerating (most recent YoY growth at 46%). For now, 4 out of 5 would be appropriate.

Margin of Safety (4/5)

The current intrinsic value estimate represents about 10-15% upside. Given their strong economic moat, financial strength, and future industry outlook, Enphase will certainly achieve this upside. However, there are many other good investing options, since so many tech and growth companies were beaten down by the market-wide volatility and are now trading 40-50% below their intrinsic value.

Sector Outlook (5/5)

I expect the overall inverter market to grow very strongly for the next several years. Favorable government policies and technological advancement in the solar sector will fuel growth. For Enphase, I expect growth in the U.S. and European market will be substantial.

Risk

Enphase’s valuation is pretty steep at this point. P/E ratio (167.18x), EV/Sales (17.58x), and Price/Sales (17.39x) are all substantially higher than the sector median. Given their economic moat and growth trajectory, I believe their business value is justified. However, any miss on revenue or profit estimate in the future could bring a large drop in their stock price. A company with high valuation is like a company with a high multiplier. It rises faster in a bull market but falls faster in a bear market.

Currently, the push towards a green energy transition has created many favorable policies around the world (e.g., tax credit for solar PV). However, political climates can change quickly, which could make it less cost-effective to install solar panels in the commercial or residential markets. Unfavorable changes in political environment could negatively impact Enphase’s growth trajectory.

Conclusion

Enphase is a great option for a growth-oriented company. They have a well-defined economic moat, and their revenue and profit have been growing at a rapid pace. Given their continually improving technology and the favorable political environment, I expect a nice growth trajectory. Despite the high valuation, I still expect 10-15% upside.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment