ZU_09/E+ via Getty Images

Those who read my articles regularly will likely know that one of the most attractive opportunities I have identified, at least in my opinion, is pipeline/midstream owner and operator Energy Transfer (NYSE:ET). As of this writing, the company is one of only six holdings in my portfolio, ranking number five based on portfolio percentage at about 15% of my total holdings. Although I only own common units of the enterprise, there is another way for investors to benefit from the business. This is by owning one of the classes of preferred stock the company currently has outstanding (ET.PC) (ET.PD) (ET.PE). Naturally, there are both positive and negative aspects to investing in preferred units, just as there are positive and negative aspects to owning the common units. For investors who want strong cash flow but who also want stability, even if that means that upside potential is capped, buying into the preferred units could be a solid idea. But at the end of the day, I still maintain that for most investors the common units make the most sense.

What’s special about the preferred?

Just as with any security, there are traits that are inherent in the investment no matter which company is involved, just as there are traits that can be unique from one business or security to another. Inherent traits regarding preferred units can be summed up into a couple of categories. For starters, preferred units are, by definition, senior to common units. This means that, in virtually every circumstance, ranging from a buyout to a liquidation to a bankruptcy, the preferred holders get paid before the common. However, they do still rank junior to debt securities and other liabilities. Another inherent trait is that, in almost every case, common units do not see cash distributions unless the preferred units are receiving the distributions they are entitled to receive. Other inherent traits include issues related to tax treatment, voting rights, and more.

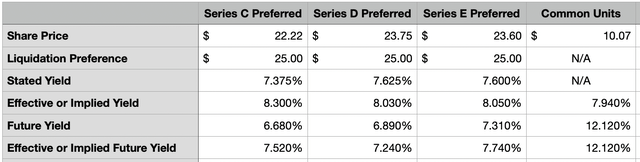

On the other side of the spectrum, we have unique traits like the specifics related to conversion or redemption and the specific distribution terms associated with each security. This is where we should focus most of our efforts regarding Energy Transfer. Of the three classes of preferred stock I am highlighting in this article, it’s worth noting that the distributions that investors are entitled to are rather large relative to the liquidation preference of said securities. The lowest distribution is attributable to the Series C preferred units. This comes out at 7.375% of the liquidation value of $25 per share. The Series E are slightly higher at 7.60%, while the Series D comes out at 7.625%.

But it’s important to stress that these preferred units fluctuate based on market conditions and investor sentiment. While the Series C units currently have the lowest stated yield, they actually have the highest implied yield as of this writing at 8.30%. This is based on the fact that units are currently trading for $22.22 apiece. So in addition to getting a higher yield, investors also get the potential upside of 12.5% that is the spread between the current price and the eventual redemption price. For the Series C units, the effective yield is 8.05% with shares at $23.60, while the Series D units are slightly lower at 8.03% with a share price of $23.75.

These are hefty yields, even in the current interest rate environment. Management does have the right to buy back these units at liquidation preference at the dates highlighted. They can also, for a small premium, redeem the units under certain circumstances. Without these special circumstances coming into play, the earliest that a redemption could occur for any of these three classes of preferred units would be May 15th of 2023. However, as interest rates rise, buying back preferred units becomes less appealing.

At present, the implied yields on the preferred units of Energy Transfer are slightly higher than the implied yield for the common units of 7.94%. However, that picture is going to change before too long. For the Series C preferred units, May 15th of 2023 will be a big day. Because starting then, the preferred units would change from having a fixed payout relative to the liquidation preference to a variable one that is the sum of the three-month LIBOR and 4.53%. Given current interest rates, this works out to a payout of 6.68% on the liquidation preference. Given current prices, that means a 7.52% implied yield for holders of the units. When it comes to the Series D preferred units, the relevant date is August 15th of next year, with the rates being 6.89% and 7.24%, respectively. And when it comes to the Series E preferred units, the date is May 15th of 2024, with the rates being 7.31% and 7.74%, respectively.

Given how close these implied payouts are to what the common units currently offer, a valid question would be why an investor would choose the preferred units over the common. Because of how financially stable Energy Transfer is, I would make the case that the seniority that the units have over the common is virtually insignificant. I also don’t opine on issues of taxation because that’s not my forte and because each individual’s tax situation is unique. The biggest benefit to owning the preferred units, then, would be the stability they offer. Because of the seniority in both liquidation and distribution, and because of the defined liquidation preference, these securities don’t tend to move significantly from high to low or from low to high. The most volatile of these preferred units over the past 52 weeks has been the Series C ones. The difference between their 52-week high and their 52-week low is 21.5%. On the low end, we have the Series D preferred units with a difference of 14.7%. Considering how volatile the market has been, this is incredibly stable. By comparison, the common units have a difference of 56.8%.

This particular attribute makes the preferred units incredibly appealing for investors who have shorter-term investment horizons and who still want to generate attractive cash flows. An example would be somebody either in retirement or getting close to it. Individuals saving up for their children’s college might be another. But if you don’t fit into this kind of category, I believe that owning the common units is a vastly better idea. Yes, there is more volatility. But there are many upsides to accepting this volatility if you can. While it is true that the common units are not entitled to distributions in the way that preferred units would be, leading to a possible scenario of preferred units accruing distributions in the event that payments were ever halted while common units would just miss out on cash flows, Energy Transfer is such a stable company that this kind of event is unlikely to transpire.

One of two major benefits to owning Energy Transfer’s common units is the fact that they benefit from unlimited upside potential. Whether it’s from market sentiment or improved fundamental condition, the company’s share price could theoretically rise to any number. By comparison, it’s unlikely that the preferred units would see their prices rise materially higher than their $25 liquidation preference. If they did, it would incentivize management to eventually force a redemption at the liquidation preference and to them issue new units at the higher price the market will accept. And with interest rates rising, the probability of such an event becomes much lower.

There’s also the fact that the common units are not capped in terms of their payout. You see, as the company grows over the years, cash flows should increase and common unitholders can see upside potential from that. At present, the common units of Energy Transfer receive annualized distributions of $0.80 per share. However, management has expressed significant interest in eventually increasing this to $1.22 per share. Given current prices, this would take the company’s implied yield to 12.1%. More likely than not, such a yield would draw in a significant inflow of buyers to the units, pushing the stock up in the process. With distributable cash flow for the company estimated at $7.96 billion for the 2022 fiscal year, and planned distributions at current levels totaling just $2.47 billion, the company definitely has the potential to increase its payout when it wants.

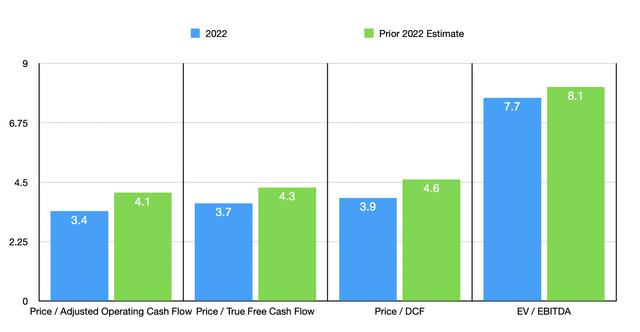

Given recent market turbulence, some investors may think that attractive upside for Energy Transfer is unlikely. However, shares have gotten even cheaper since I last wrote about the firm. Based on the same estimates in my prior article but updating for the company’s current share price, the firm is trading at a price to adjusted operating cash flow multiple of 3.4. This is down from the 4.1 I calculated in my prior article. The price to true free cash flow multiple has dropped from 4.3 to 3.7. The price to distributable cash flow multiple has gone from 4.6 to 3.9. And the EV to EBITDA multiple has dropped from 8.1 to 7.7. This is remarkably cheap and I have previously said that I would be shocked if shares are not worth roughly double what they are trading for today.

Takeaway

The variability of investing is one of the things that makes it most interesting to me. The concept of different securities with different traits is fascinating to me and I believe that investors in any company would be wise to examine all potential avenues of partaking in a company’s upside when they consider buying into it. I can understand why some investors might prefer the preferred units in Energy Transfer, but I still maintain that for most investors the absolute best way to participate is to buy the common units. Though they are more volatile, and they are subject to a potential distribution cut if times get difficult, their upside potential is significantly greater and I don’t believe their near-term risk is materially different than what the preferred units experience.

Be the first to comment