pandemin

By Warren Patterson (Head of Commodities Strategy) & Gerben Hieminga (Senior Sector Economist)

Both oil and European gas prices may be off those highs we saw earlier in the year, and immediate gas supply worries have eased recently. Demand concerns, however, are weighing on sentiment for oil. We do expect both markets to tighten again in 2023 and that, of course, suggests higher prices.

Oil outlook: Russian oil supply set to fall

The key supply uncertainty for the oil market this year has been how well Russian supply would hold up following a number of countries banning Russian exports, along with an increased amount of self-sanctioning. Russian supply has held up better than many were expecting, with India, China and a handful of other smaller buyers increasing their purchases of Russian crude oil, given the steep discounts available. As a result, exports in October were 7.7 million barrels a day (MMbbls/d), down just one hundred thousand barrels per day (Mbbls/d) Year-on-Year (YoY).

However, the impact of the EU ban on Russian crude oil is still playing out, and we will have to wait until early February for the ban on Russian refined products. The ability of India and China to absorb a still more significant amount of Russian oil is likely limited. As a result, we expect Russian supply to fall in the region of 1.6-1.8MMbbls/d Year-on-Year in the first quarter of 2023. As for the G-7 price cap, we expect it to have little direct impact on Russian oil supply for now, given that at US$60/bbl, it is above where Russian Urals are trading.

How the Russia/Ukraine war evolves will be important for oil markets in 2023. While a de-escalation might not lead to the return of pre-war oil trade flows, it would remove a lot of supply risk from the market.

OPEC+ sticks to its guns

OPEC+ has largely ignored calls from the US and other key consumers to increase oil supply more aggressively this year amid higher prices and supply concerns. And the group’s decision to reduce output targets by 2MMbbls/d from November 2022 until the end of 2023 has been criticised, particularly by the Amcericans. Although, with hindsight, the decision by OPEC+ might appear to be the right one, at least in the near term, as it offers stability to the market. Given that most of its members are producing well below their production targets, OPEC+ supply cuts work out to an effective cut of around 1.1MMbbls/d. In aggregate, OPEC+ production was 3.22MMbbls/d below target levels in October.

However, the cuts may prove to be more destabilising in the medium term, given the expectation of a tighter market through 2023.

US oil producers are not there to fill the gap

The response from US producers to the higher price environment this year has been anything but impressive. And this appears to have also given OPEC+ confidence to cut supply without the risk of losing market share. US crude oil supply is forecast to grow by less than 600Mbbls/d to average around 11.8MMbbls/d in 2022. While for 2023 supply is forecast to grow by less than 500Mbbls/d to around 12.3MMbbls/d. This growth is much more modest than the supply growth seen in previous upcycles.

The mentality of US producers has changed significantly from producing as much as possible to focusing on shareholder returns and as a result, continuing to show discipline when it comes to capital spending. Supply chain issues, labour shortages and rising costs have also played a role in the more modest supply growth expected over the next year.

Oil demand is weaker than expected

High energy prices, a gloomier macro outlook and China’s zero-Covid policy have all weighed on oil demand this year. At the beginning of 2022, global oil demand was expected to grow by more than 3MMbbls/d YoY and hit pre-Covid levels. However, demand is estimated to grow at a more modest 2MMbbls/d this year, leaving it below pre-Covid levels. While for 2023, demand is expected to grow in the region of 1.7MMbbls/d.

Almost 50% of this growth is expected to come from China with the expectation of an economic recovery.

Oil market remains tight in 2023

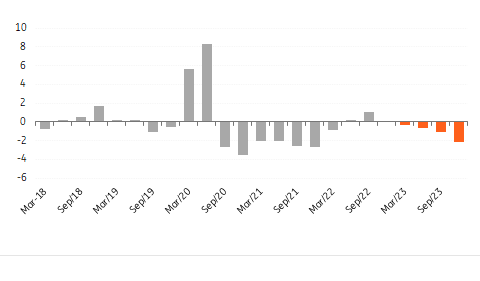

Quarterly global oil balance (MMbbls/d)

ING Research based on IEA, EIA and OPEC

Tighter oil market in 2023

A combination of lower Russian oil supply and OPEC+ supply cuts means that the global oil market is expected to tighten over 2023. We expect a growing deficit over the course of the year, which suggests that oil prices should trade higher from current levels. We currently forecast ICE Brent to average US$104/bbl over 2023, but the uncertainty around our forecast is high given the geopolitical situation and the direction of the global economy. You can find our oil scenarios here.

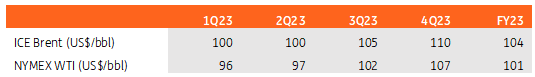

ING oil price forecasts

ING oil price forecasts (ING Research)

Given the circumstances, Europe could not have hoped for a better situation heading into this winter. Demand destruction and milder-than-usual weather in the early part of the heating season have ensured that the region has continued to build storage deeper into winter. EU storage continued to grow until mid-November, with it reaching nearly 96% full. This is above the five-year average of almost 88% for mid-November. This leaves Europe in a better-than-expected position for this winter and the next few months should be more manageable. However, it is still vital that the region remains cautious as Europe needs to try to end the current heating season with storage as high as possible given the expectation of a further reduction in gas flows next year.

European demand has responded to higher prices

Higher prices through much of this year have ensured demand destruction, and as a result, the European Commission has been able to stick to its voluntary demand cut of 15% between August and the end of March, rather than imposing a mandatory 15% reduction. Eurostat data shows that in September, EU natural gas demand was 15% below the five-year average, while numbers from third-party consultants suggest that in the months since, demand reductions have exceeded the 15% target.

Europe will need to see continued demand destruction through 2023 to ensure adequate supply for the 2023/24 winter. This is particularly the case given the risk that we see further declines in Russian gas supply to the EU.

Russian natural gas flows remain a risk

Russian pipeline gas flows have fallen significantly this year. The latest data shows that Year-to-Date pipeline flows from Russia to Europe have fallen by around 50% YoY to roughly 58bcm. And, obviously, these flows have declined progressively as we have moved through the year with reduced output via Ukraine and Nord Stream. Daily Russian gas flows to the EU are down around 80% YoY at the moment. Therefore, if we assume that Russian gas flows remain at current levels through 2023, annual Russian pipeline gas to the EU could fall by a further 60% to around 23bcm in 2023. And clearly, there is a very real risk that the remaining flows will be halted.

Limited LNG supply growth

The liquefied natural gas (LNG) market has helped Europe significantly this year. LNG imports into the EU over October grew by almost 70% YoY, with volumes exceeding 9bcm.

However, there are constraints to how much more LNG Europe can import due to limited LNG regasification capacity. However, we have seen the start-up of a fair amount of regasification capacity in the form of floating storage regasification units (FSRUs) over the second half of this year. The Netherlands, Germany, Finland & Estonia have – or are in the process of – starting up operations at these FSRUs with a combined capacity in the region of 23-27bcm. Germany is expected to bring a further 15bcm of regas capacity online early next year. This will help with some of the infrastructure constraints Europe is facing, but the issue is also around global LNG supply and the limited capacity which is expected to start next year.

Global LNG export capacity was set to grow by around 19bcm in 2023, driven by the US, Russia and Mauritania. However, following Russia’s invasion of Ukraine and the sanctions which followed, it is likely that any ramping up of Russian capacity is surely on hold. Russian capacity makes up for 46% of the total new capacity expected next year. Therefore, we could see just 10.5bcm of new supply capacity.

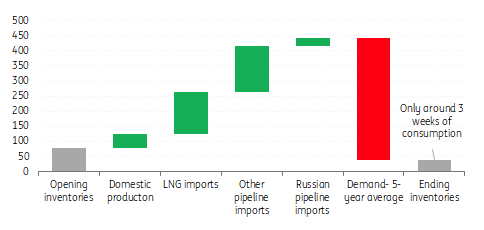

2023 will be tight for European gas

The pace of inventory builds during the 2023 injection season will be much more modest compared to what we have seen this year, given the reductions in Russian supply. The ability of the EU to completely turn to other sources is just not possible. Therefore, Europe is likely to go into the 2023/24 winter with tight storage, which could leave the region vulnerable.

In order to get through the 2023/24 winter comfortably, we will have to see continued demand destruction once again. This will have to be either as a result of market forces or EU-mandated demand cuts. While Europe should be able to scrape through the 2023/24 winter if current Russian gas flows continue, it is much more challenging if remaining Russian gas flows come to a full stop.

Therefore, we believe that there is upside to European gas prices in 2023. However, much will depend on how much storage the EU manages to draw down this winter.

Europe is likely to start the filling season with lower gas reserves

2023 EU natural gas balance in billion cubic metres (BCM)

2023 EU natural gas balance in billion cubic metres (BCM) (ING Research based on ENTSOG, GIE and Eurostat)

The US natural gas market is more comfortable

The US natural gas market this year has also seen significant strength, trading to multi-year highs. Strong global LNG prices, stronger demand from the power sector and below-average inventories have all proved bullish for Henry Hub. However, the outlook for US gas prices is more bearish. US dry gas production is expected to hit record levels next year, growing by a little more than 1.6bcf/d to average almost 99.7bcf/day over 2023, whilst finishing 2023 with output in excess of 100bcf/day.

In addition, this year saw stronger demand from the power sector over the summer, which pushed overall gas demand higher this year. Expectations are that domestic demand will fall back towards more normal levels. Meanwhile, on the export side, while there is more LNG capacity set to start up over the course of the year, this is fairly limited. LNG exports are expected to average a little over 12.3bcf/day in 2023, up from an estimated 10.8bcf/day in 2022.

As a result, over the course of 2023, we should see US natural gas inventories moving from below their five-year average to above it ahead of the next heating season. In fact, the US could go into the 2023/24 winter with storage at its highest levels since 2020. Therefore, we expect Henry Hub to trade lower in 2023 relative to 2022.

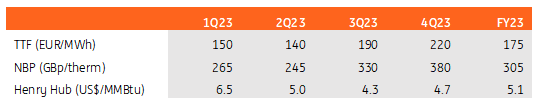

ING natural gas price forecasts

ING natural gas price forecasts (ING Research)

The uncertainty around our gas price forecast is high given the geopolitical situation and the direction of the global economy. You can find our gas price scenarios here.

Power outlook: 2023 could be another perfect storm for European power markets

In 2022 Europe not only faced a major gas crisis, it also had to cope with a broader power crisis. Yes, this was partly a result of what was going on in the gas market, but there are a number of other factors which have helped to see power prices skyrocket.

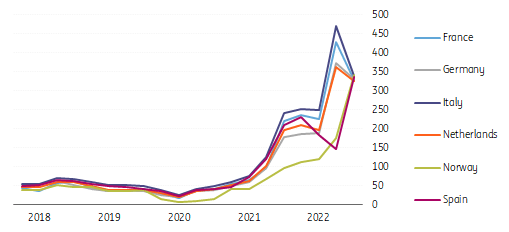

High power prices across Europe

Average daily closing price per quarter in euro/MWh

High power prices across Europe (ING Research based on Refinitiv)

Lower nuclear capacity

First, France experienced prolonged periods of nuclear capacity outages. This is partly due to regular maintenance and refuelling, but reactors are also taken offline due to more serious weld issues and signs of corrosion. Nuclear summer output in 2022 stood at around 25 GW, well below the levels above 40 GW seen in the summer of 2021. Nuclear output was also down because of heatwaves which limited the amount of cooling water for nuclear power plants. As a result, France experienced the highest power prices in Europe, while it used to have the lowest when nuclear power operated at full capacity. The distress in the French power had knock-on effects on Germany due to lower exports of electricity to the industry-rich southern part of the country.

Unusually hot weather

Second, Europe’s hydropower market was also negatively impacted by severe droughts. Reservoirs started drying up. Hydro stocks in France, Spain, Italy and Portugal were all below the 5-year average.

Finally, Rhine water levels recorded record lows in 2022. As a result, some river-based coal plants are facing supply issues and cannot generate as they would like.

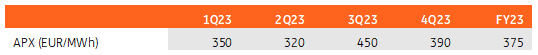

We expect power markets to remain very tight in 2023, with benchmark APX prices averaging €375/MWh. The height of the summer price peak will depend on whether Europe will experience another drought and whether it can keep existing nuclear capacity running while maximising output from coal-fired power stations. And as always, power markets remain local markets with large variations in the level of power prices across European bidding zones.

ING power price forecast

ING power price forecast (ING Research)

|

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment