Mario Tama/Getty Images News

Energizer Holdings, Inc. (NYSE:ENR) is recognized as the leading manufacturer of household batteries along with a related portfolio of consumer products like portable lights and auto care accessories. Shares have been volatile this year amid the broader market selloff against headwinds like record inflation and weaker economic conditions.

That being said, we believe the stock looks interesting here trading near its pandemic crash lows with an expectation that operating conditions can improve going forward. The company benefits from consistent profitability and we like the 4.1% dividend yield. We also highlight that ENR appears undervalued to a group of similar specialty consumer-products category leaders. In our view, ENR is a high-quality stock that has upside from the current level.

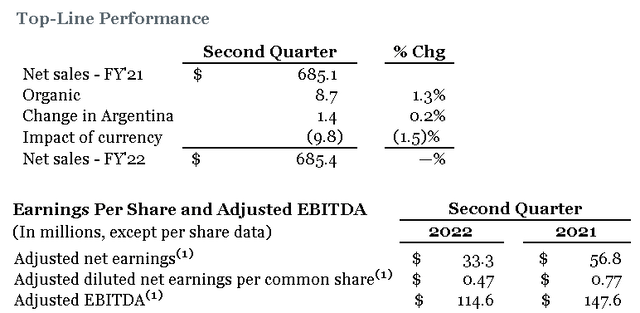

Energizer Key Metrics

ENR last reported its Q2 earnings back in May with a non-GAAP EPS of $0.47 which was $0.09 ahead of consensus. Revenue of $685 million was also above estimate although representing flat growth compared to the period last year. Earnings were also lower year over year.

One of the difficulties this year has been the headline-making supply chain disruptions adding to costs including logistics hitting the gross margin by nearly 900 basis points. Energizer has responded by implementing pricing increases of around 3% on average across its product portfolio to help mitigate some of the pressure. Nevertheless, the Q2 adjusted gross margin at 34.9% declined from 40.5% in Q2 2021 also including the loss of business in Russia as the company chose to exit operations in the region. SG&A costs as a percentage of revenue also climbed marginally leading to a Q2 adjusted EBITDA of $114.6 million, down 22% y/y.

source: company IR

Favorably, the messaging from management was optimistic at the time, citing the price hikes as a more meaningful impact through the second half. Considering some better-than-expected organic growth sales thus far in 2022, Energizer hiked its full-year revenue growth target to a “low single-digit range” compared to an old estimate for just flat sales over 2021. The company is reaffirming its 2022 EPS guidance of $3.00 to $3.30 per share while expecting full-year adjusted EBITDA of around $575 million.

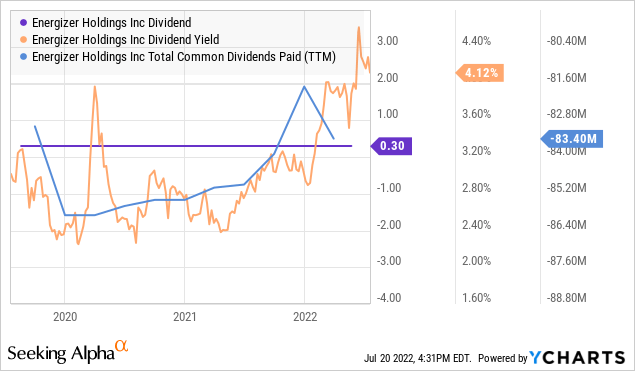

Is the ENR Dividend Safe?

One of the knocks on Energizer is its large debt position. The company ended the quarter with $213 million in cash and equivalents against a long-term debt position of $3.6 billion. Considering adjusted EBITDA of $557 million over the past year, the leverage ratio here is elevated near 6x although we believe the level is manageable considering positive cash flow generation. On this point, management expects free cash flow to improve through 2023 and has as a priority to reduce debt going forward.

In terms of the dividend, ENR’s quarterly payout of $0.30 per share represents an annualized distribution of approximately $85 million. This amount implies a dividend payout ratio of around 15% on its 2022 full-year adjusted EBITDA target. Compared to the full-year EPS guidance, the payout ratio is closer to 40%. By all indications, the dividend should be sustainable for the foreseeable future although we do not expect an increase until the company’s debt level trends materially lower.

Is Energizer Stock A Good Long-Term Investment?

The problem with ENR is that the stock is exactly the type of name that has been punished by the market this year against some very real macro headwinds. The idea with household batteries is that while the product is a consumer staple, there is also a complementary connection with more discretionary items. For context, batteries and lights segment net sales are down about -2.3% over the first six months of the fiscal year while firm-wide results have been supported by stronger momentum in the smaller auto care segment with management citing improved product availability compared to last year.

Anecdotally, consumers getting squeezed by inflation are pulling back on general merchandise purchases which include items like toys, sporting goods, and even television remotes that often utilize disposable batteries. In this regard, ENR has been dragged lower by the broader weakness in retail and e-commerce names. This explains both the soft sales trends along with the deep pessimism towards the stock.

On the other hand, there is a case to be made that the market is still underappreciating the more defensive aspect of the category. At the end of the day, batteries are often required and even a necessity depending on the applications that provide a floor to core sales. The point we’re getting at here is that beyond the current economic soft patch of data, the company will be fine.

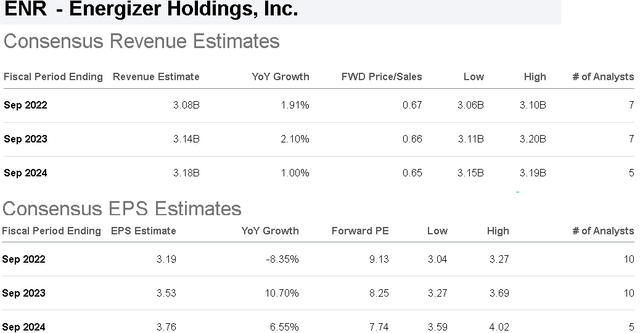

According to consensus estimates, the outlook is for top-line growth in the low single-digit range over the next few years, while earnings growth rebound higher by 10% in 2023, and again by 6% in 2024 to reach $3.76. The combination of pricing initiatives and improving supply chains lower costs, along with a greater contribution from its higher-growth automobile-care product lines like the “Armor All” brand, will keep the company moving forward.

Seeking Alpha

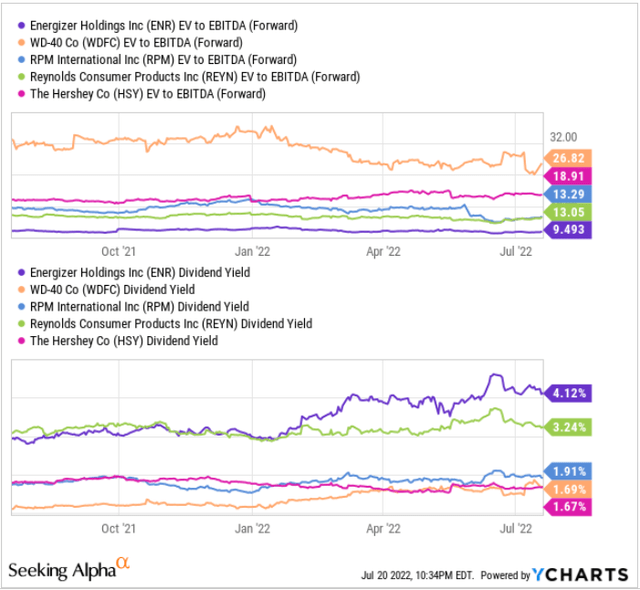

The attraction of Energizer is its reputation for high-quality batteries that carries a brand loyalty that supports a positive long-term outlook. The Energizer name also commands a higher price point which generates above industry margins. We draw parallels here to a group of specialty consumer product brands that share in common a market share leadership position in their respective categories.

Looking at WD-40 Co. (WDFC), RPM International Inc. (RPM), Reynolds Consumer Products (REYN), and The Hershey Co. (HSY); ENR stands out trading at a 9.5x forward EV to EBITDA multiple representing a large discount to these peers. Separately, ENR offering a 4.1% dividend yield furthers an argument that it’s a value-play for this type of exposure. Recognizing the differences in each of these companies, the bullish case here for ENR is that the stock is currently undervalued with room for these spreads to narrow, sending shares higher.

source: YCharts

Is ENR Stock a Buy, Sell, or Hold?

We rate ENR as a buy with a price target for the year ahead at $40.00 representing a 15x multiple on management’s 2022 EBITDA guidance in terms of its implied enterprise value. In our view, ENR deserves a higher earnings premium based on its brand positioning while the current dividend yield offers compelling value.

The company is scheduled to report its fiscal Q3 earnings on August 8th. We see the potential that the recent pricing increases gain traction in helping to generate a meaningful improvement in margins which could help the company outperform estimates. Looking ahead, normalizing supply chain disruptions in other industries should help support improving demand for its core products. Our bullish call also assumes that macro conditions stabilize and recover through 2023.

As it relates to risk, monitoring points include over the next few quarters include the cash flow levels and the top-line momentum. Weaker than expected results or a deteriorating in the macro outlook can open the door for another leg lower in the stock.

Be the first to comment