Juan Jose Napuri

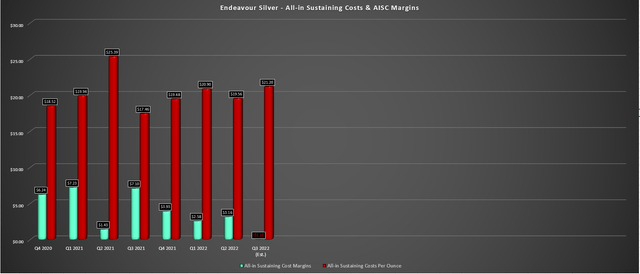

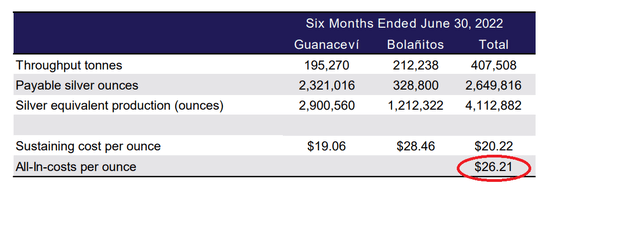

Just over seven weeks ago, I wrote on Endeavour Silver (NYSE:EXK), noting that while the company’s operating performance this year was solid, its margin profile left much to be desired. This is because its all-in-sustaining costs [AISC] came in at $20.22/oz in H1, while its all-in costs were above $26.00/oz. While this cost profile might have worked during the silver squeeze and for some of FY2021, it doesn’t work nearly as well at sub $20.00/oz silver prices as the company is experiencing today. Additionally, the decision to withhold inventory in the most recent period certainly hasn’t paid off for the time being.

Given the negative all-in-sustaining cost margins, it was hard to justify owning the stock. Unsurprisingly, the stock saw a more than 20% draw-down from my previous update, with the silver price coming under further pressure. The stock has rebounded since late September, but little has changed from a fundamental standpoint. If anything, the investment thesis has weakened, given that Endeavour may be borrowing at a higher rate as it works to finance Terronera. Let’s take a look at the Q3 results below:

Endeavour Silver Operations (Company Presentation)

Q3 Production

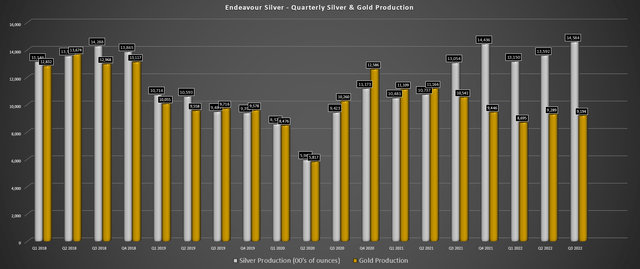

Endeavour Silver released its preliminary Q3 results last week, reporting quarterly production of ~1.46 million ounces of silver and ~9,200 ounces of gold. This represented an 11% increase in silver production from the year-ago period, partially offset by a 13% decline in gold production. However, considering that the company was working with two mines vs. three (shutdown and sale of El Compas), this was a solid performance and above plan due to grade outperformance at Guanacevi. The result is that Endeavour is tracking to potentially meet the upper end of its guidance range of ~8.0 million silver-equivalent [SEOs], with ~6.3 million SEOs produced year-to-date.

Endeavour Silver – Quarterly Metals Production (Company Filings, Author’s Chart)

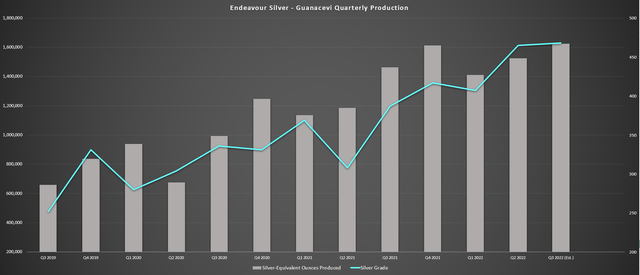

The star performer, as usual, was Guanacevi, with the mine producing ~1.33 million ounces of silver and ~3,600 ounces of gold in Q3 2022. This translated to over 1.60 million SEOs in the period, beating out its Q3 2021 results despite being up against difficult comps, given that this was a 45%+ increase year-over-year for the mine. On a two-year basis, production at Guanacevi has soared approximately 65%, helped by rising grades at the asset. In Q3, Endeavour noted that high grades at El Curso helped to drive higher production and exceeded budget, with grades helped further by purchasing third-party ore (making up 12% of quarterly tonnes processed in the period).

Guanacevi Production (Company Filings, Author’s Chart)

Notably, this increase in production was despite heavy rainfall, which impacted throughput in late September, resulting in slightly lower tonnes processed than planned. Guanacevi processed ~97,700 tonnes in Q3 at an average grade of 468 grams per tonne of silver and 1.29 grams per tonne of gold, with an average recovery rate of 90.6% for silver and 89.9% for gold. The company noted that it continues to look at ways to potentially increase throughput above the capacity of 1,200 tonnes per day, exploring the possibility of changes in grinding size and leach time.

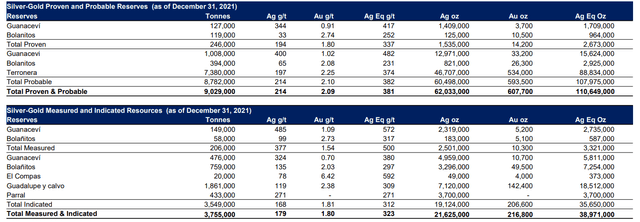

Moving over to Bolanitos, the mine produced ~126,300 ounces of silver and ~5,600 ounces of gold, pushing year-to-date production to ~470,000 ounces of silver and more than 16,000 ounces of gold. This represented a slight increase in silver production from the year-ago period, offset by a decline in gold production, impacted by much lower grades and slightly lower throughput (1.88 grams per tonne of gold vs. 1.09 grams per tonne of gold). The issue for Bolanitos, though, will be reserve replacement, with reserves and measured & indicated resources combined now standing at just ~1.3 million tonnes (year-end 2021), representing barely three years of mine life at the current milling rate.

Endeavour Silver – Reserves & M/I Resources (Company Presentation)

Silver Price & Recent Developments

While Endeavour’s operating performance is commendable and certainly much better than what we’ve seen in previous years, this has been overshadowed by a violent decline in the silver price and rising costs. From an operating cost standpoint, Endeavour’s all-in-sustaining costs [AISC] came in just shy of $20.50/oz in H1 of this year, leaving the company with razor-thin margins. However, assuming slightly higher costs in H2 2022 and with a sub $20.00/oz silver price, I would expect AISC margins to fall into negative territory. In terms of Q3, I would not be surprised to see (-) $0.70/oz AISC margins, with the average realized price possibly coming in below $20.50/oz.

Endeavour Silver – Costs & AISC Margins (Company Presentation)

This is certainly not ideal from a profitability standpoint, and it doesn’t help that Endeavour chose to withhold inventory in Q2 with a plan to sell it at higher prices, which hasn’t worked out this time around. In fact, the silver futures price spent less than five trading days above its Q2 lows in Q3, and Endeavour is currently carrying ~1.53 million ounces of silver, ~3,200 ounces of gold, and additional concentrate in its inventory. To date, Endeavour has had some success with this strategy, but I dislike this strategy in a turbulent market environment for the S&P-500 (SPY), where many assets are getting dragged down past expected support levels.

Some investors might note that the current cost profile of $21.00/oz is not a big deal and that a spike back above $24.00/oz will easily put the company back in good shape from a profitability standpoint. However, this is not the case, with the company’s all-in costs coming in above $26.00/oz in H1 2022, including growth exploration/evaluation and growth capital expenditures. This means that from an all-in cost standpoint, Endeavour is actually losing $6.00/oz for every ounce it sells at current prices.

Endeavour Silver – All-in Costs H1 2022 (Company Filings)

Given that Guanacevi’s grades are significantly outperforming reserve grades year-to-date and the company is dealing with inflationary pressures, we could see a further increase in all-in costs next year to more than $26.50/oz in FY2023, making it very difficult for the company to generate free cash flow without higher gold/silver prices. So, while I had previously assumed that cash flow from operations might help to fund Terronera a little, with silver prices well above $25.00/oz for much of 2021, this does not look to be the case, at least based on the current landscape. Let’s take a look at the valuation:

Valuation

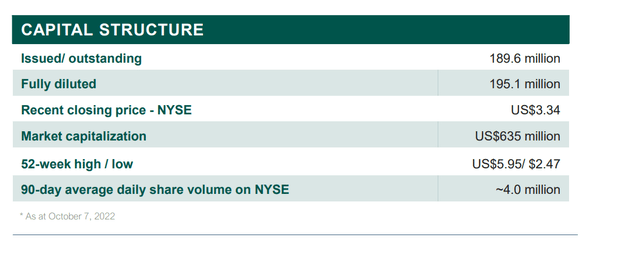

Based on ~195 million fully-diluted shares and a share price of US$3.30, Endeavour has a market cap of ~$644 million. This translates to a P/NAV multiple of 1.31 compared to its estimated net asset value of $490 million. Although this is in the lower portion of the stock’s range over the past two years, Endeavour is also in the weakest position it’s been in for the past two years from an operating standpoint, down to two mines from four and set to report two consecutive quarters of negative all-in-sustaining cost margins unless the silver price can recover very quickly.

Endeavour Silver Share Count (Company Presentation)

Based on what I believe to be a conservative multiple of 1.25x P/NAV to reflect Endeavour’s leverage and solid development pipeline offset by its high-cost profile, short reserve life at Bolanitos, and less favorable jurisdictional profile, I see a fair value for Endeavour of US$3.15 per share. This suggests limited upside for EXK from current levels, especially if the company sees any share dilution over the next 18 months when it comes to funding Terronera.

With over $100 million in cash and the ability to fund the remaining ~$100 million with debt (estimated capex adjusted for inflation: ~$200 million), I don’t see any meaningful share dilution as likely. However, it can’t be ruled out at current silver prices with no free cash flow generation currently. So, if we did see share dilution, Endeavour Silver’s fair value would drop further from a current value of US$3.15. To summarize, I think there are far more attractive bets from a valuation standpoint elsewhere in the sector. With a required 30% discount to fair value to justify buying small-cap miners, EXK would only become interesting below US$2.20.

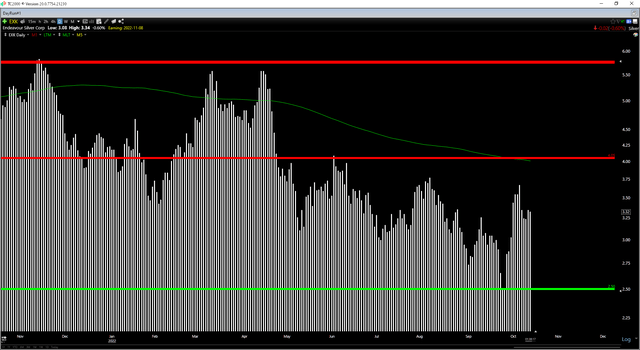

Technical Picture

The technical picture confirms that EXK is not yet in a low-risk buy zone, with strong resistance at US$4.05 (broken previous support) and no strong support until US$2.50. Based on a current share price of US$3.30, this translates to an unfavorable reward/risk ratio of 0.94 to 1.0, with $0.80 in potential downside to support and $0.75 in potential upside to resistance. In a cyclical bear market, like we’re experiencing for the Silver Miners Index (SIL), the ideal strategy is to buy at support (US$2.50) or pass entirely. So, from a technical standpoint, I don’t see a favorable entry here either, with the ideal swing-trading entry being at US$2.52 or lower before year-end (within 2% of support).

Summary

Endeavour Silver had a solid quarter again in Q3, and when it comes to things within its control, it’s done a great job this year managing expectations. However, the silver price, outside of its control, has put a massive dent in margins. This has left Endeavour with negative all-in costs, and even a rally back to $24.00/oz won’t do much to help. So, with EXK continuing to sport industry-lagging margins and first production at Terronera being at least two years away, I continue to believe that sharp rallies above $3.75 will offer profit-taking opportunities. In summary, I see far better opportunities elsewhere in the sector, favoring names with lower-cost profiles like SilverCrest Metals (SILV).

Be the first to comment