Daniel Balakov

‘Information Asymmetry’ is a term investors should be very familiar with, as it theoretically underpins the very essence of how traders of stocks are able to make money.

It’s a term used to represent the imbalance of information between two parties while negotiating or considering a transaction.

If one party holds more information than the other, they enjoy an advantage in their negotiation over the other party.

Investors have an advantage in their corner when assessing information asymmetry, as we can see when another party feels that they hold more information than the market. Thanks to short-selling reports and trading volume reports, we can see how others in the market view the stock based on the size and frequency of trades, or the volume of short-sold securities.

So it both excites, yet concerns me, when I see a stock with perfect financial health, solid growth prospects and very attractive valuation metrics begin to see short-sellers pile on.

This is information asymmetry at play, but who is right?

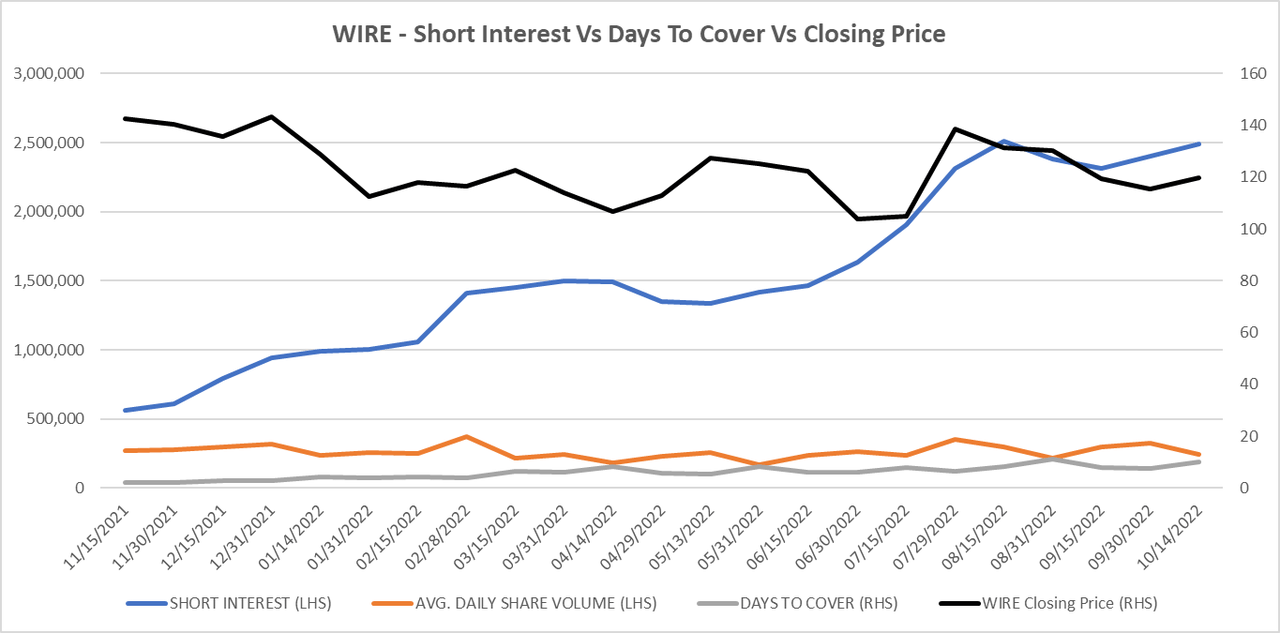

We’re talking about Encore Wire Corporation (NASDAQ:WIRE), and below you’ll see a graph I concocted thanks to short interest data from NASDAQ and closing prices of the ticker on those days, and what’s immediately evident is the rising short interest over the past 12 months despite the relatively stable share price.

What we see is the build-up of when an immovable object meets an unstoppable force, and the fireworks are about to begin!

Author

So there’s only one thing we can do to decode this tantalizing situation: let’s break down the firm’s financial health to give us a base rating of the firm’s sustainability, give it a valuation attractiveness score, attempt to find a pricing mechanism for the firm and finally discuss some of the major risks investors would need to consider.

We’ll compare WIRE to the full list of the “All US Stocks” Seeking Alpha screener to find out what is going on here.

(Data & prices correct as of pre-market 5th November, 2022)

(The “All US Stocks” list referred to in this article can be found on this Seeking Alpha screener)

WIRE’s Base Financial Health

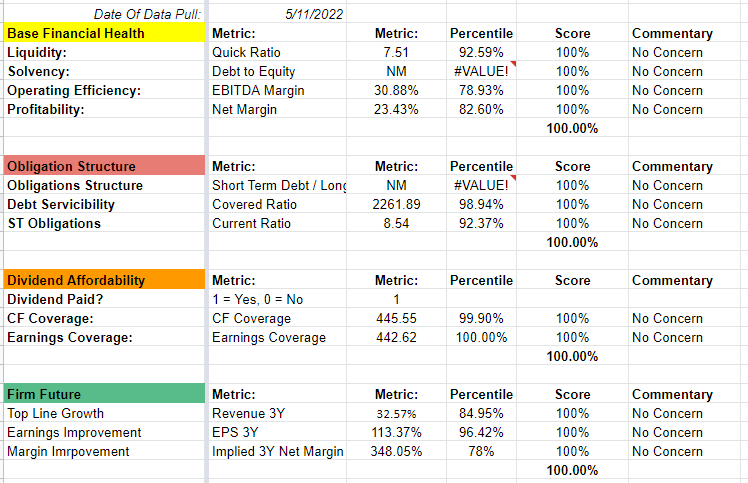

We’ll start by breaking down the basics of WIRE’s financial health and carefully consider all aspects of the balance sheet.

The really odd thing about WIRE is there are no red-flags in any of these items. There’s no debt to speak of and the balance sheet is plump, margins are phenomenal, all short term obligations are covered 8.5 times over, the dividend is tiny hence it is well-covered and the 3Y outlooks are for continued exceptional growth.

Author

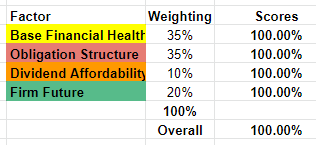

Perfect scores all round, and to double check I’m not seeing things differently to the experts, this analysis backed by an Altman Z score of 12.75.

Author

So if there are no financial risks to the firm presently, what do the valuations look like?

Assessing WIRE’s Pricing Attractiveness

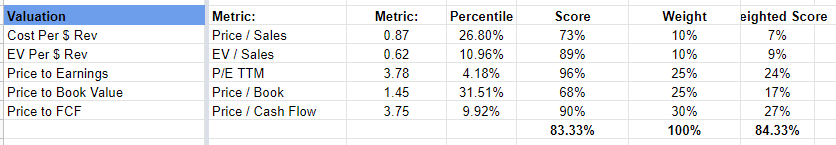

Let’s look at the firm’s valuation metrics compared to the market and see if perhaps the firm is overweight in its pricing compared to the peer group.

Here again, I scratch my head. Price to sales is 0.87, and price to earnings is a measly 3.78.

Heck, even the price to book is excellent at only 1.45.

Overall, we get a tantalizing glimpse of where pricing this firm will lead us, with an 84.33% valuation attractiveness score relative to the market.

Author

So now I’m itching to find the pricing mechanism for WIRE and see what we’re in for…

Finding An Appropriate Valuation Method For WIRE

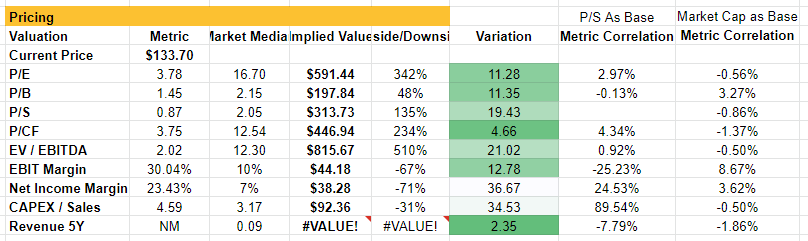

We’ll start by looking at normal, and several abnormal, pricing metrics for WIRE to see how it shapes up, and then look at variation in the metrics, correlation with P/S and market cap, in order to determine which metrics are our best guides to price WIRE.

Unfortunately, we don’t have 5-year earnings estimates which is a shame because they are such a noise-free metric when pricing firms.

Author

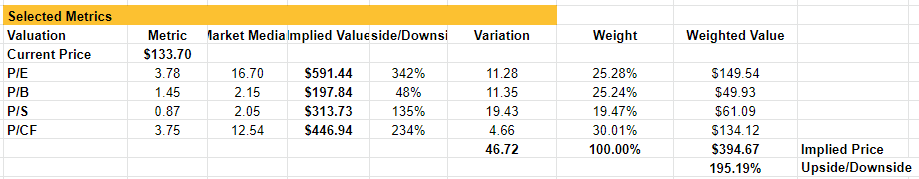

Selecting a shortlist of the least noisy metrics, leaves us with the following, and wowzer… with a fair value based on how the market has valued the comparison group representing a 195% positive risk, coupled with the immense short interest, the WIRE share price is coiled like a spring.

Author

So we really need to break down the risks and try to understand the short-seller thinking.

Risks & Headwinds

Well firstly, there’s a looming US recession. With Bloomberg Economics model projections now predicting a recession with 100% likelihood, this presents a significant macro risk to WIRE and its outlooks.

Next is commodities prices, with the price of copper currently elevated, it is possible that many of the short sellers of the stock are using WIRE as a proxy for copper prices and expecting a fall when the recession rolls around. This risk is offset by huge spending plans in China to massively increase the output of renewable energy sources, and similar projects in the US.

Further, there is also political risks associated with project and infrastructure spending in the US with mid-terms underway and a constantly shifting political landscape. As I write this, voting for the mid-terms is underway, and this could have huge implications for WIRE down the road.

Conclusion

Every investor should be very carefully planning their next move, as your next trade is likely one that you will need to carry with you through a recession.

But WIRE appears well-prepared to face a recession (I’ve discussed in detail elsewhere how investors should be searching for recession-ready stocks), with no debt, an exceptional balance sheet, CAPEX spending already underway, a huge stockpile of cash and moderate inventory levels.

I would be willing to put a ‘Strong Buy’ recommendation on WIRE, as I feel the short-sellers have lost the information asymmetry game given theirs appears to be based more on speculation on commodities prices rather than fundamentals.

I would place a moderate price target on the stock of at least par to P/S valuations for the broader market ($313.73 / 135% upside), and look to ride a short-squeeze beyond the fair value estimate of $394.67 / 195.19% upside.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firms financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the market as a whole but does not consider the specific industry the firm operates in, and does not break down a near-peer comparison. Investors should use this analysis as a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment