SimoneN

Encore Wire (NASDAQ:WIRE) is one of the leading companies in the Electrical Components and Equipment Industry. It enjoys strong competitive advantage controlling its input cost and benefits from strong competitive pricing, which translated this opportunity to an outstanding growth in its EPS of $35.92, up from $2.78 recorded in FY ’19.

WIRE produced slowing growth figures in both its top and bottom line and has an unattractive outlook from analysts. Additionally, the company posted a slower copper spread, which may put pressure on its future margin. WIRE is trading at a logical resistance and has unattractive forward multiples, making this stock unattractive as of this writing.

Company Overview

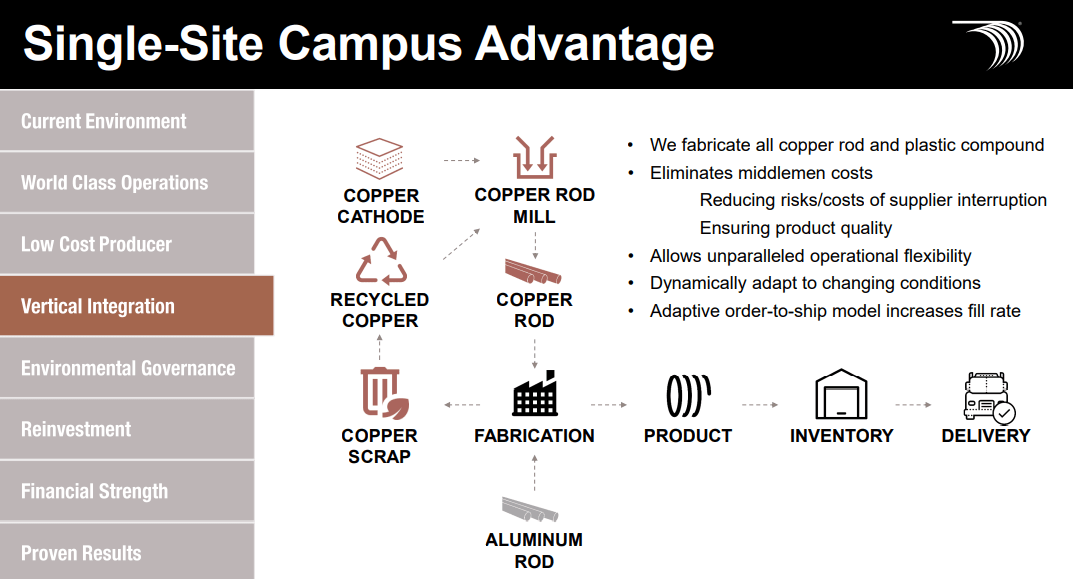

WIRE is a low-cost producer of electrical building wire and cable. It has copper rod facilities and distribute its finished products from a single site which allows the company to provide competitive pricing.

WIRE: Single-Site Campus Advantage (Source: Shareholder Value Presentation)

The management team is still focused on increasing capacity and renovating its facilities to further cut costs, which will position the firm to capitalize on growing demand in Data Centers, Renewables such as EV charging, Industrial, and Health Care electrification. In fact, during Q3 ’22, WIRE ended its trailing CAPEX to $138.3 million, up from $118.3 million recorded in FY ’21 and $86.1 million in FY ’20. The management expects to end FY ’22 with $140 to $150 million in CAPEX, a little bit lower from its prior forecast of $150 to $170. Additionally, the management reiterated its $150 to 170 million in FY ’23, and will moderate between $80 to $100 million in FY ’24. With its improving capacity, it is not surprising to see huge boosts in its trailing total revenue amounting to $3,011.5 million, up from its $1,275 million in FY ’21.

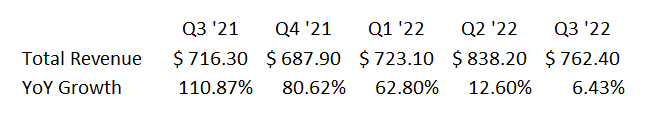

WIRE: Concerning Growth Figure (Source: Data from SeekingAlpha. Prepared by the Author)

However, based on the YoY growth statistic presented in the image above, it seems that growth is maturing already. In fact, according to analysts, copper demand is falling but will remain elevated compared to its FY ’21. Furthermore, they are seeing a declining trend on copper prices, according to the management.

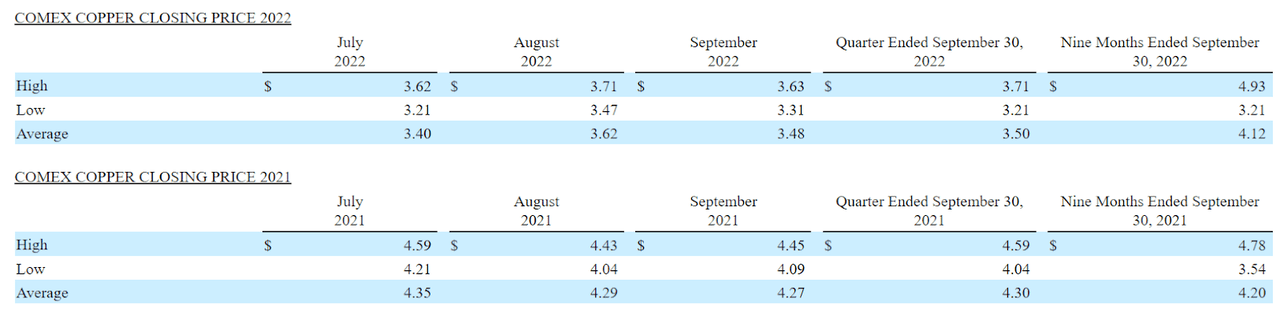

WIRE: Declining Copper Trend (Source: Q3 2022 Report)

However, contrary to what happened before, WIRE is currently experiencing a declining Copper Spread trend.

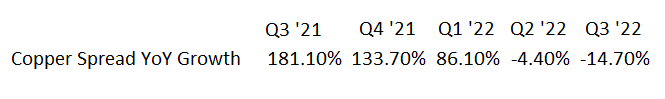

WIRE: Declining Copper Spread (Source: Data from company filings. Prepared by the Author)

This is a metric calculated by the management which calculates spread between selling price and purchase price of copper. Hence, I believe WIRE’s gross margin will slow down in confluence with the consensus EPS estimates, as shown in the image below.

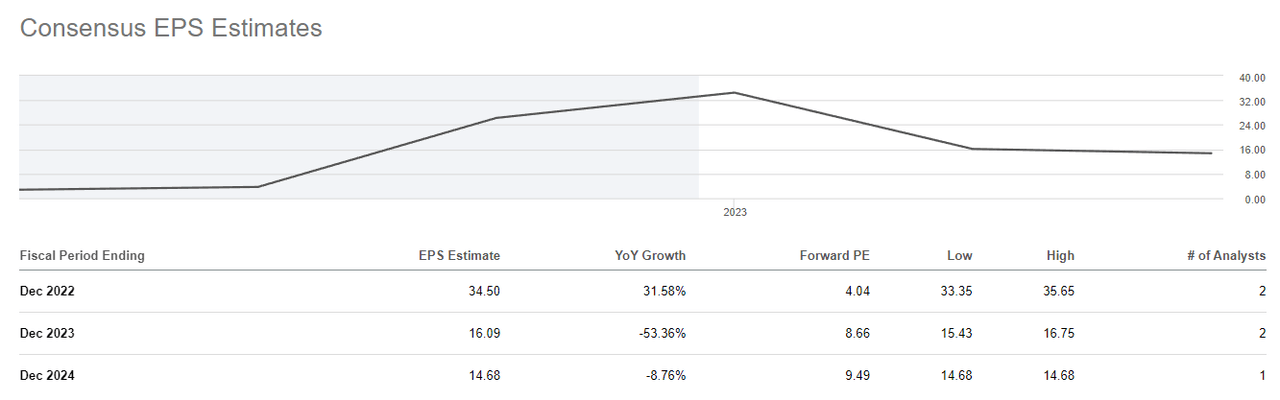

WIRE: Declining Consensus EPS Estimate Trend (Source: SeekingAlpha.com)

WIRE ended the quarter with a positive bottom line figure of $191.8 million, up from $175.5 million recorded in Q3 ’21 or a 9.25% YoY growth. However, it appears that this growth is already maturing as well, comparing it from 15.01% YoY growth recorded in Q2 ’22 and 292.17% in Q1 ’22.

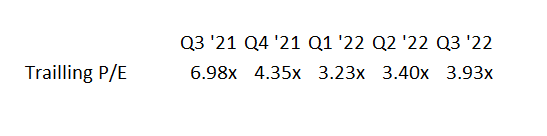

Pressured Based On Its Forward Multiples

WIRE is currently trading at a trailing 3.93x P/E ratio, which is a little bit unattractive compared to its forward P/E of 4.04x. Given that the consensus P/E estimate for FY 24 is 14.68x, it represents a significant premium than its trailing P/E as well as its 5-year average of 13.39x . This massive increase in its P/E multiple calculation is due to the fact that analysts are anticipating WIRE’s EPS to fall to $16.09 in FY23 to $14.68 in FY24. As mentioned before, I believe challenges from the pricing environment can potentially hurt its earnings per share.

WIRE: Declining Copper Spread (Source: Data from company filings. Prepared by the Author)

Looking at the actual P/E performance of the company, we can see a potential bottom in Q1 ’22 which is to be P/E of 3.23x. As of this writing, this signals an unfavorable trend, making a prospective 52-week breakout unappealing.

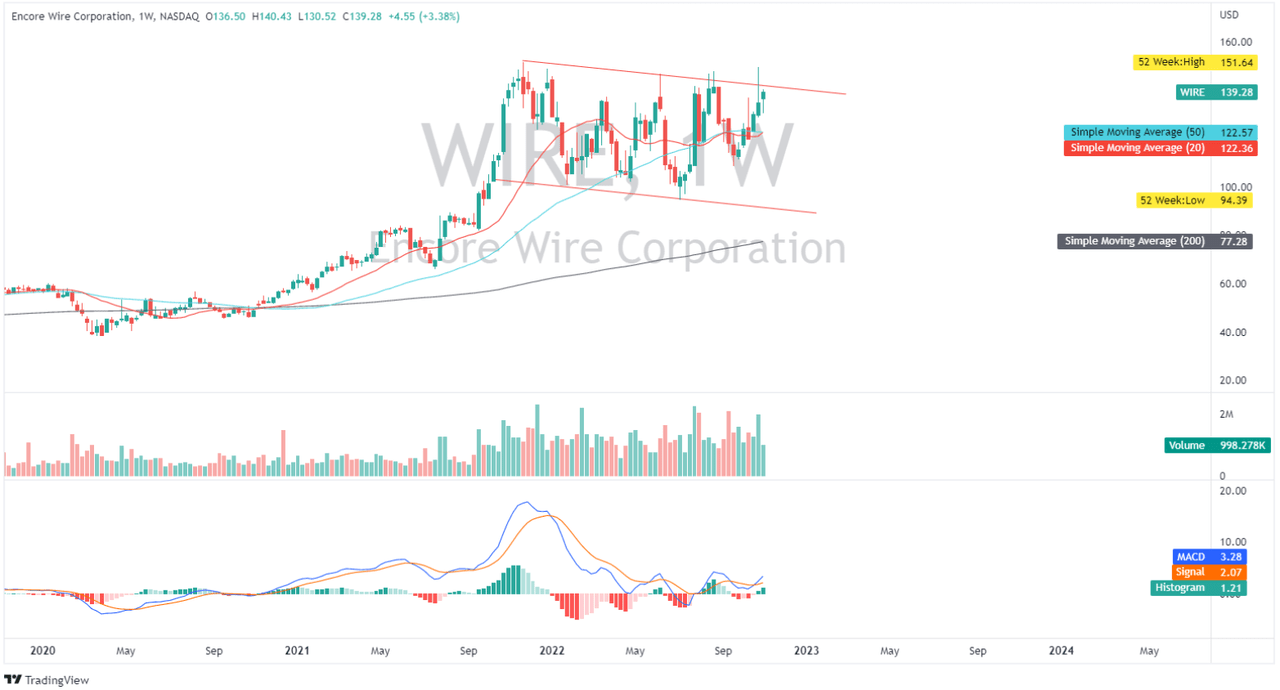

Trading Near Resistance

WIRE: Weekly Chart (Source: Tradingview.com)

WIRE is currently retesting its multi-month resistance, as shown in the chart above. Based on its weekly chart, this is the fourth time it has tested this resistance zone. The first time was in November, the second in June, and the third in August. I believe this still serves as a strong resistance point to monitoring.

With a bullish crossover of its MACD, a breakout of this upper channel is feasible. However, taking into account WIRE’s current price distance from its 200-day simple moving average, I believe it is ripe for a meaningful pullback.

Margin Supported by Volume

WIRE: Strong Competitive Advantage (Source: Shareholder Value Presentation)

While there is a negative sentiment from its copper spread, WIRE still recognized a growing copper unit volume sales this quarter of 12.9% YoY, better than its 2.7% recorded in Q2 ’21. This implies strong competitive advantage which could reverse its copper spread performance and improve margin outlook.

Final Key Takeaway

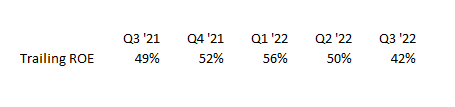

Another negative catalyst to mention is WIRE’s declining ROE performance, as shown in the image below, implying some profitability weakness to monitor.

WIRE: Declining ROE (Source: Data from SeekingAlpha. Prepared by the Author)

WIRE ended the quarter with a record cash and cash equivalent of $573.6 million. Despite the slowing growth performance, it remains committed to buying back its own shares. In fact, as of this writing, it still has 1,214,253 authorized share buybacks in place. The company remains liquid with no long-term debt in the balance sheet. WIRE maintained a positive trailing FCF margin of 17.1% up from 16.4% recorded in Q2 ’22 and up from 14.4% recorded in Q1 ’22, despite its CAPEX ramp up. To sum it up, I believe WIRE possesses some weakness both in financial performance and on a valuation standpoint, making it an unappealing stock.

Thank you for reading!

Be the first to comment