JHVEPhoto

Enbridge (NYSE:ENB) is an interesting company because in the midst of a strong oil market it’s underperforming. That’s because the company operates as a midstream toll-based fee taker meaning that it’s more susceptible to interest rises than it is to the capital markets. With the potential for growing volumes, that puts the company in an even tougher place.

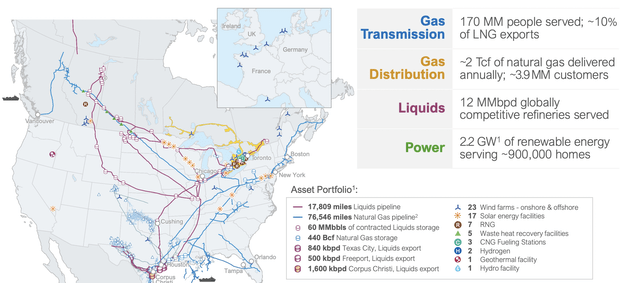

Enbridge Asset Portfolio

Enbridge has an impressive portfolio of assets.

Enbridge Investor Presentation

Enbridge has an incredibly strong and unique asset portfolio. The company’s gas transmission network serves a massive 170 million people and the company’s gas distribution is ~2 Tcf with 3.9 million direct customers. The company’s liquids business moves a massive 12 million barrels / day. Lastly, is the company’s power business with 2.2 GW serving almost 1 million homes.

The company is a powerhouse in the energy distribution business markets meaning it’s less susceptible to climate change.

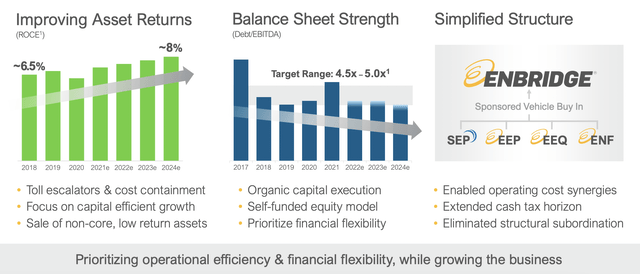

Enbridge Steady-State Growth

The company’s assets offer steady-state growth, although there is one caveat here.

Enbridge Investor Presentation

Enbridge has managed to improve its asset returns consistently while improving its balance sheet. The company has changed its guidance towards the lower end of its target range at 4.5x, however, even at the new range the company is implying that it’ll be continuing to raise debt in line with its EBITDA to maintain a target structure.

The company is looking to simplify its structure, a popular midstream trend recently, however, there’s still substantial work to be done.

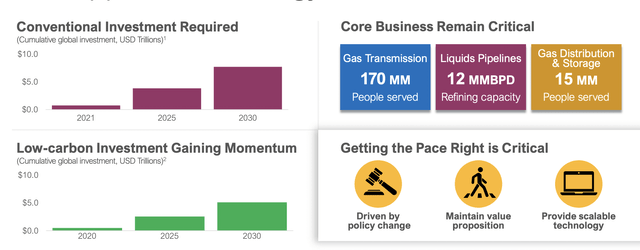

Enbridge Energy Transition

The company is operating in an environment with a changing energy transition, meaning substantial capital obligations.

Enbridge Investor Presentation

By 2030 global cumulative investment is expected to pass a massive $5 trillion. The company continues to have core fossil fuel businesses, although even here, the company’s focus is on natural gas which is much cleaner from a fossil fuels standpoint than other fuels such as coal. The company is also investing in renewables.

The company expects renewable investments to hit $1 billion / year. Its 2022 capital spend is expected to be $10 billion USD. Offshore wind is expected to be a substantial part of the company’s investments with $2.4 billion over the next 3 years. European governments in a renewable crisis are ramping up renewable spending and offshore wind represents a massive opportunity.

Enbridge Merger Phillips 66

Enbridge has done some stake trading with Phillips 66 increasing its Gray Oaks stake to almost 60%.

The company will be earning hundreds of millions from liquidation of its entire DCP stake given Phillips 66 offer to purchase the company. The company has also extended its Gray Oaks pipeline stake, a sensible move in our opinion given the probably for continued growth in the Permian Basin as a U.S. focused major source of supply.

This is another example of the company monetizing its assets to focus on future growth.

Enbridge Debt Risk

Enbridge has a substantial amount of debt and the company has continued to take advantage of debt in its capital stack. The company has more than $50 billion in long-term debt (USD) and it’s continued to take advantage of that debt load. At some point, that debt, as the company continues to expand it, will need to be refinanced.

It will need to be refinanced at much higher interest rate.

Our View

Enbridge’s recent share price weakness means the company now has a double-digit DCF yield and a dividend yield that’s gone past 7%. The company is continuing to grow and from a capital perspective it has a massive number of opportunities where it can deploy capital. The company can continue deploying billions in capital annually.

Regardless of how the company deploys capital it has a unique and well distributed portfolio of assets. It can continue paying dividends, growing, and repurchasing stock. All of this together makes Enbridge a valuable long-term investment. We feel that this company is a valuable component of any investment portfolio.

Thesis Risk

The largest risk to the company’s thesis, in our view, is two-fold.

The first is the pace of the transition. It needs to move at a pace where the company’s assets can comfortably transition through capital spending. Too slow and the company’s investments don’t pan out. Too fast and the company’s old assets risk going obsolete hurting its prior capital returns and its ability to drive returns from them.

Conclusion

Enbridge has a unique portfolio of assets. The company has one of the strongest midstream portfolios and it’s continuing to expand in numerous markets. Renewables, such as European offshore wind represent a massive source of potential growth for the company and something that has substantial government support.

Enbridge has a dividend yield of more than 7% and we expect it to continue increasing its dividend. By itself, that dividend yield almost makes the company a suitable investment. The company is continuing to invest in growth on top of that. Putting all of that together, we recommend investing in the company for the long run. Let us know your thoughts in the comments below.

Be the first to comment