rustycanuck/iStock Editorial via Getty Images

All values are in CAD unless noted otherwise.

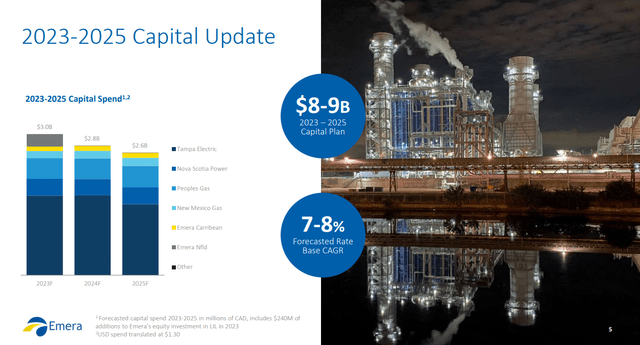

Headquartered in Halifax, Nova Scotia, Emera Incorporated (OTCPK:EMRAF) (TSX:EMA:CA) is an owner and operator of cost-of-service rate-regulated utilities in Canada, the US and the Caribbean. Cost-of-service rate-regulated simply means that the regulators determine the utility rates to be charged to the consumers such that the business recovers its costs and makes a reasonable return. As with all utilities, Emera remains extremely capital intensive and there is a lot of capex scheduled over the next three years.

Q3-2022 Presentation

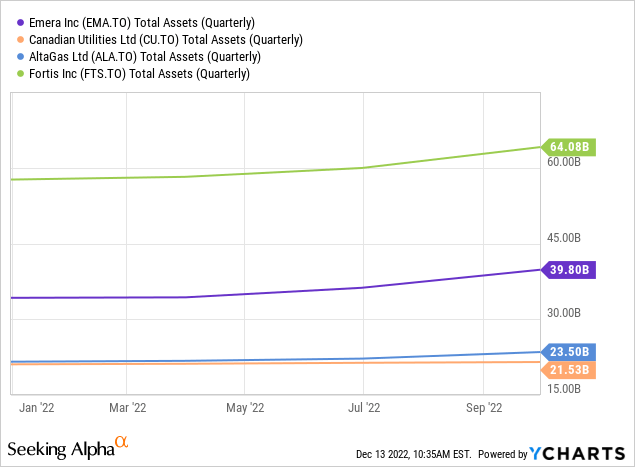

To put the planned capital spending into perspective, Emera has total assets of around $39 billion, coming in second amongst its peers.

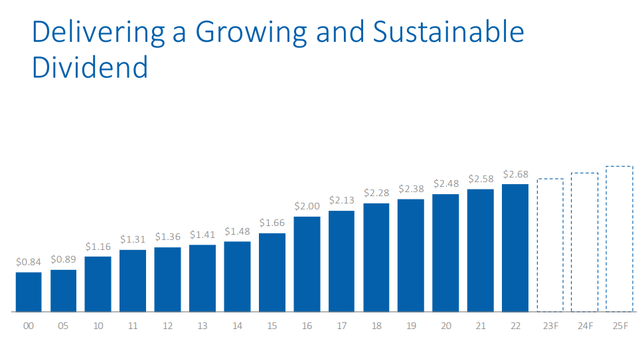

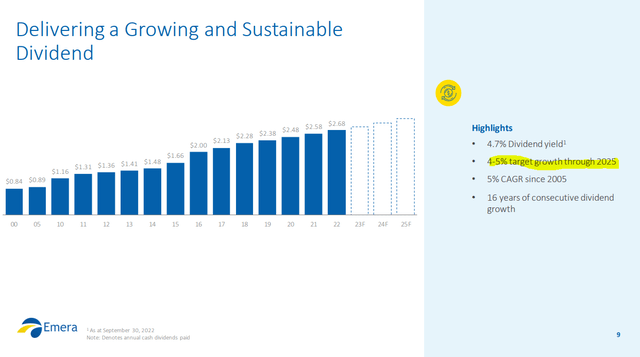

While it cannot be considered a dividend aristocrat just yet, it has impressed the dividend growth investing crowd by delivering in this area for several successive years.

Q3-2022 Presentation

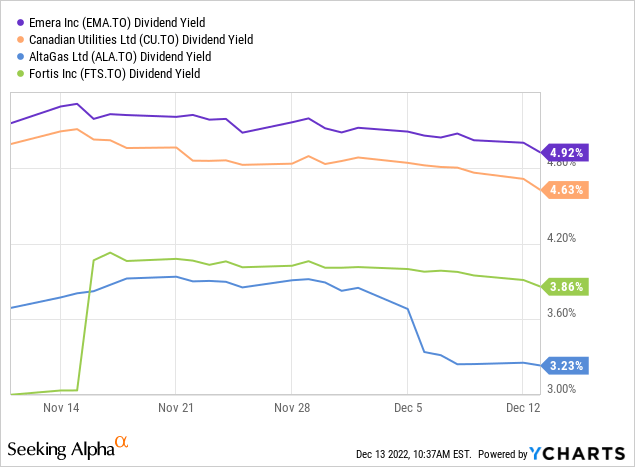

It also leads in this regard amongst its kind.

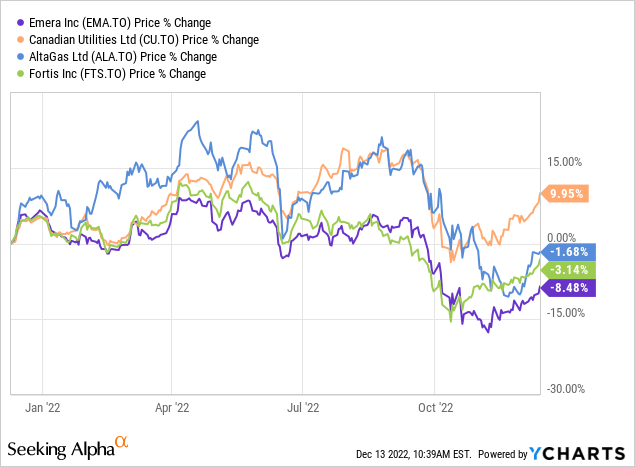

Some of the higher yield comes from its more generous dividend payout. Some of it comes from the fact that it also has fallen the most amongst its peers recently with hits from two hurricanes.

Let us review the recent numbers and see if this utility makes our buy list today.

Q3-2022

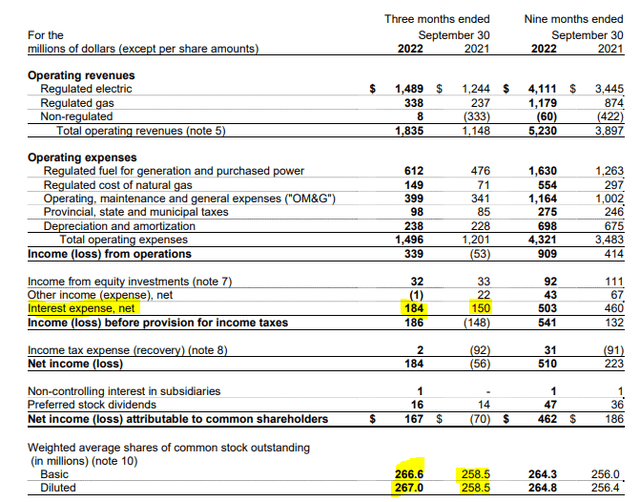

Emera recently reported its third quarter results and they were generally in line with expectations. The utility benefited from higher base rates and better margins on marketing. It also got a big boost from the stronger US Dollar as it reported results in Canadian dollars. On the downside, interest expenses rose 22% over 2021 levels this quarter. This was driven by rising rates on rolled debt, as well as a rising debt load. Share counts moved up as well with issuances coming from ATM facility as well as DRIP.

Q3-2022 Financial Statements

The company reiterated its capital plan for the year. That must have been a relief considering the havoc inflation has played with many budgets.

Challenges

While Florida forms the bulk of Emera’s revenues, the company does have a meaningful exposure to Nova Scotia (15% of earnings). The recently enacted Bill 212 handicaps Emera’s potential to make a decent buck over the next 24 months. The Bill limits non fuel expense increases to just 1.8% and also lowers allowed return on equity. This is not a game changer for Emera, but as we shall see next, the utility has other issues that make this change likely to be a straw that breaks the camel’s back.

Debt Load & Credit Risks

A lot of investors have used the term “it is regulated” as an easy (and dangerous) way to sidestep the necessary due diligence. Regulated revenues simply mean the odds of something really bad happening are low. It does not mean that you can run leverage risks to be bailed out by rate approving authorities. Algonquin Power & Utilities (AQN) (AQNU) investors found that out the hard way recently as they woke up to “8.0X debt to EBITDA may just be a tad too high.” While Emera is not in the same boat, it is toeing the line as well. Estimated debt to EBITDA is at 6.4X for this year. Keep in mind that these numbers have come despite the company having issued equity rather briskly on its ATM and DRIP programs. Further complicating the challenges is the fact that there is zero relief in sight as capex plus dividends is expected to handily exceed free cash flow in 2023 and 2024. All this creates zero margin for error. Of course, the credit agencies were watching this closely just as Nova Scotia dropped Bill 212.

Moody’s Investors Service (“Moody’s) today affirmed the ratings of Emera Inc. (Emera), including its Baa3 senior unsecured and Issuer Rating and Ba2 subordinated debt rating, and Emera US Finance LP’s guaranteed Baa3 senior unsecured rating. Moody’s also affirmed the ratings of Tampa Electric Company (Tampa Electric), including its A3 senior unsecured and Issuer Rating and P-2 short-term rating for commercial paper, and the Baa1 senior unsecured bank credit facility rating of TECO Finance, Inc. (TECO Finance). The rating outlooks for each company have been changed to negative from stable.

“Emera’s negative outlook is driven by its weak financial profile and the high execution risk associated with improving its financial metrics considering increasingly challenging market conditions for the company” said Yulia Rakityanskaya, Moody’s analyst.

As a result, we expect financial ratios to remain among the lowest in the North American regulated utility universe, including its ratio of cash flow from operations before changes in working capital (CFO pre-W/C) to debt below 12% in 2023. The combination of elevated under-recovered fuel balances from higher natural gas prices, rising debt to fund sizable infrastructure investments in a higher interest rate environment, political interference in the regulatory process in Nova Scotia, and incremental restoration costs from hurricanes that hit Emera’s service territories in September 2022 are pressuring the entire organization’s credit profile.

Source: Moody’s

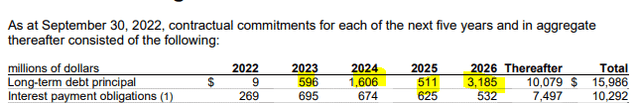

That is a sobering commentary from Moody’s (MCO) and we have to say that we agree with every single word. We have this commentary even as total debt load is projected to go up and meaningful debt comes up for refinancing at higher costs over the next four years.

Q3-2022 Financial Statements

Moody’s is hardly alone here in raising concerns. Here are some snippets from Fitch.

The Rating Outlooks for Emera, TEC and NMGC have been revised to Negative from Stable.

Emera’s Negative Outlook reflects recent political interference in the supportive regulatory environment in Nova Scotia, which increases Emera’s business risk at its second largest utility. Furthermore, Fitch now projects FFO leverage to remain above the negative sensitivity threshold of 6.0x over its forecast period through 2024. Continued elevated capex program, coupled with the regulatory lag and absence of the previously expected rate relief in Nova Scotia are projected to keep leverage high for the rating in 2023 and 2024.

Source: Fitch

Valuation & Verdict

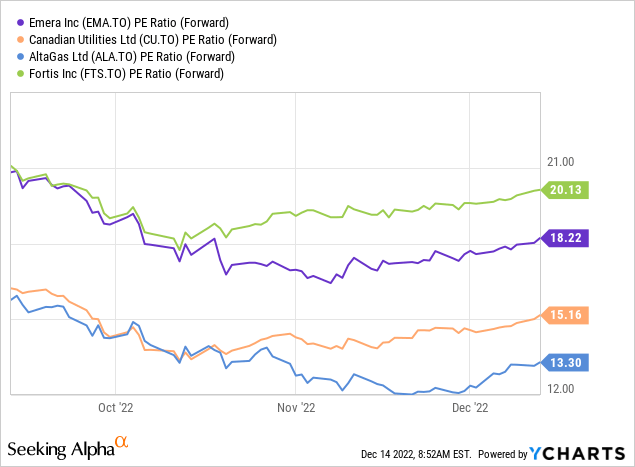

If the risks were well priced in, one could make a calculated gamble to buy the stock. At over 18X earnings, we have to take a hard pass just on the valuation.

What is drawing the crowd here is the high dividend yield and we don’t believe that should remotely be the way to look at it. The payout ratio is already close to 90% and with credit rating agencies nipping at their heels, at the minimum Emera will have to lower those dividend growth plans.

Q3-2022 Presentation

A more drastic step would be to freeze the dividend over the next five years alongside a massive equity issuance. Keep Fitch’s statement in mind as you jump on the “cause it is regulated” bandwagon.

Absent any mitigating measures such as additional equity issuance or asset sales to offset the cash flow shortfall, a negative rating action is likely to occur.

Source: Fitch

Some investors may assume that Emera has room considering that both Fitch and S&P are two notches above junk. That does give it some time, but we have to put our weight behind Moody’s here and think the Baa3 (one step above junk) with negative outlook, is more representative of the risks. We are issuing a Sell rating here and expect the combination of these headwinds to warrant a dividend freeze, large equity issuance and a move to 15X normalized earnings. That gets us to about $45 CAD per share.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment