bombermoon

What’s not to like about a renewable energy company? Fuel prices were already on the rise, when the Russia-Ukraine war started earlier in the year, underlining more than at any time in recent history the need to seek out alternative energy sources that would reduce dependence on fossil fuel-rich countries. Further, at the ongoing COP27 in Egypt, António Guterres, the UN secretary general has pressed on the urgency to tackle climate change declaring that we are on the “highway to climate hell”, once again bringing into focus the need for clean energy sources. To reach the target of Net Zero emissions by 2050, the International Energy Agency envisages that renewables would have to account for a huge 90% of global electricity production compared to 29% in 2020. In a nutshell, it’s quite clear that the future of the world is green. It helps that the falling costs of these technologies are making them more competitive as well.

This implies a high potential for clean energy producers like Brazil’s Eletrobrás (NYSE:EBR), which produces, transmits and distributes hydro, wind and solar power. It also has thermal assets, but 96% of its power comes from clean sources. However, just a sector’s global potential isn’t a guarantee that a company, or indeed, a stock will perform. The analysis drills down to the conditions in EBR’s home country, Brazil, its financial performance and its market valuations to assess what’s next for it. Despite a lot going for it, contrary to the unanimous buy rating on it, it concludes that the best course of action right now is to hold the stock or hold off from buying it for now.

Brazil’s climate focus

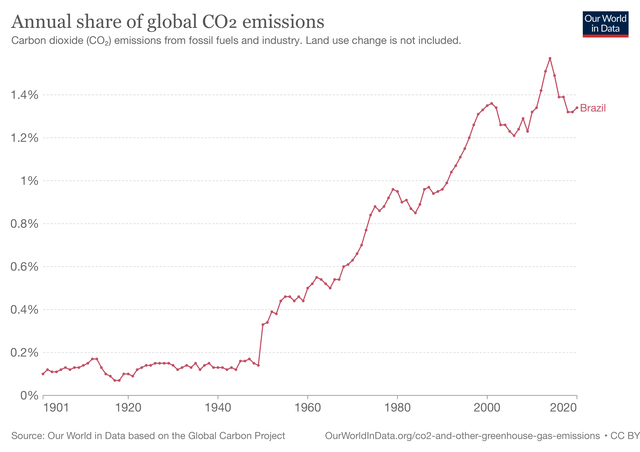

First, the positives. At COP26, Brazil announced an intention to reach net zero emissions by 2050, which is indicative of the potential for renewable energy in the country. In fact, it has already made progress in that direction. 45% of Brazil’s primary energy demand is already met through renewables, with hydropower estimated to provide 80% of domestic electricity generation. The new President-elect Luiz Inacio Lula da Silva of the Workers’ Party also plans an environmental policy in line with the US’s Green New Deal, put forward for legislation in 2019, which could also provide a fillip to the sector. Besides mentioning a need for a reduction in the deforestation of the Amazon, he has also talked about emissions reduction. After reaching a peak in 2014, the country’s share of global carbon dioxide emissions fell but has started rising recently (see chart below).

Source: https://ourworldindata.org/co2/country/brazil#what-share-of-global-co2-emissions-are-emitted-by-the-country

Good financial performance

Eletrobrás’s own performance also goes in its favour. Its second quarter (Q2 2022) revenue growth is at 19% year-on-year (YoY), driven significantly by price increases. Its operating margin is also at a big 39.7%. These numbers came in close to the heels of its long-pending privatisation, with a reduction in the government’s stake from 72% to 45%. Analysts see the move as potentially lowering consumer energy bills, increasing company investment and providing good returns to shareholders. In other words, the company’s performance might remain positive if nothing changes.

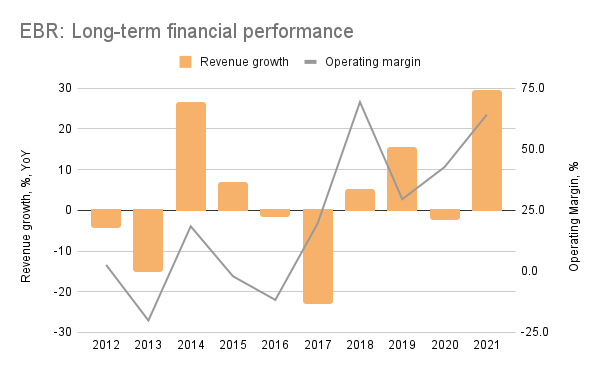

Its long-term performance isn’t bad either, though it isn’t quite as robust as it has been recently since it was impacted by power rate cuts in the years following 2012 when they were first agreed on. Over the past decade, its revenues have grown at a CAGR of 3% and they have risen inconsistently (see chart below). Operating margins have averaged 21% over the last 10 years, but this also includes years when the company has reported operating losses. Over the last five years, however, its operating margin has been at 45%, which is impressive.

Source: Seeking Alpha, Author’s Estimates

Political stumbling blocks ahead

The big challenge for the company as I see it, while the political changes in the country could have some positives in store, there’s a downside as well. During his campaign, Lula assured that he wasn’t going to reverse the privatisation of companies, but it’s speculated that aspects of the package might just be revised considering that the government still has a big stake in the company. Also, changes in power prices or tax rates could be in the offing. This is because while the country’s inflation has come off, the central bank stays vigilant. Also, the government grapples with its fast-rising debt. It’s worth pointing out that Eletrobrás mentions power rate cuts that followed from 2012 onwards created profound financial challenges for it. The Workers Party was in power at the time as well, with Lula’s protege Dilma Rousseff as President.

Such moves could impact the returns on Eletrobrás, which have been strong recently. Year-to-date (YTD) it has seen a 66% price rise compared to a 21% fall in the S&P 500 (SP500) at the time of writing. If sustained, it could improve its comparative performance even over the last 10 years, which is quite decent at 144% but lags behind the index’s at 178%. Even if nothing damaging is announced, just the uncertainty around political actions could impact the stock’s performance negatively.

Valuations in line with the sector

Its market valuations, too, don’t show much potential for an upside. EBR’s twelve months trailing [TTM] price-to-earnings (P/E) ratio is at 18.1x, which is just shy of the median 18.7x ratio for the utilities sector. Similarly, its TTM price-to-sales (P/S) at 2.1x is in line with the sector average. Further, its forward P/S is actually more than double that for the sector at 4.5x. There could still be some room for an increase in its price, considering that its forward P/E is significantly lower at 11.5x compared to the utilities average at 18x.

However, I’m not holding my breath. Its EPS declined consistently for the last three years. While its numbers so far this year are strong so far, it remains to be seen whether they can continue to rise for the remainder of the year. Analysts’ outlook doesn’t look encouraging here. This has three implications. One, at today’s price, a fall in earnings would result in a jump in its P/E, possibly making it pricier than the sector. Two, a decline in earnings is a negative which could impact investor outlook on EBR driving its price down. And finally, it impacts the company’s likely dividend payouts. In any case, its dividend history is chequered. Over the past ten years, it hasn’t paid dividends in three years and the dividend amount in 2021 was just 37.5% of what it was in 2012. In any case, its dividend yield at 1.6% isn’t terribly attractive and the added inconsistency doesn’t make it the key reason to buy EBR.

What next?

In sum, there’s no denying that there’s a significant push towards clean energy. Brazil’s inclination towards net zero emissions is encouraging too as its President-elect Lula’s potential focus on a more effective environmental policy. However, unlike his predecessor, he’s unlikely to be in favour of greater privatisation of government-owned companies and in the current economic climate, price caps and tax increases could be in the offing. This could reduce Eletrobrás’s already declining EPS. Its market valuations, too, leave little room for further potential for a price increase. Keeping these factors in mind, as much as I like the sector and believe in its long-term potential, for now, it’s best to wait and see how the scenario evolves for the company over the next few months.

Be the first to comment