Sunshine Seeds

While the Gold Miners Index (GDX) was humming along to start 2022, the wheels have come off the proverbial wagon, and the sector has driven off a cliff since. This is evidenced by the sector’s 37% decline in a span of barely 50 trading days or an annualized rate of decline of more than 85%. Eldorado Gold (NYSE:EGO) has not been spared from the sector-wide selling pressure, down 55% in the same period. While this has been a painful move for long-term investors, it’s left Eldorado at 0.35x P/NAV, making it one of the most undervalued producers sector-wide.

Lamaque Operations (Company Presentation)

Just over six weeks ago, I wrote on Eldorado Gold, noting that the stock’s pullback below US$8.00 looked to be providing a buying opportunity. While the stock put together a small bounce, it slid beneath key support in mid-June and has seen a draw-down of more than 30%. This turned out to be a terrible call from my previous article, with the stock declining more than 25%, compounding my brutally early call on Kinross (KGC). However, poorly timed calls aside, this waterfall decline for EGO looks to have created one of the best buying opportunities for the stock since March 2020 from a valuation standpoint. Let’s take a closer look at its recent results below:

Q2 Production Results

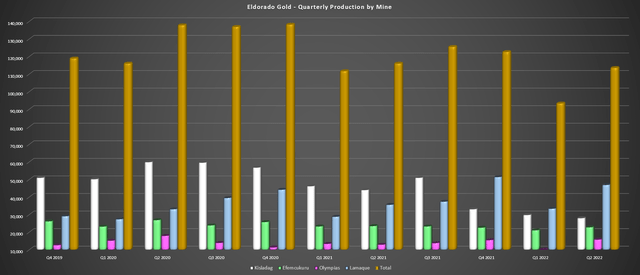

Eldorado Gold released its Q2 production results this week, reporting quarterly production of ~113,500 ounces, a 2% decline from the year-ago period. While the headline number doesn’t look great, this was largely due to the slow start to 2022 for Kisladag, where fewer tonnes were placed on the leach pad in Q1. Fortunately, Kisladag should bounce back in H2 with a sharp increase in tonnes stacked at higher grades in Q2, which will help push quarterly production back above the 30,000-ounce mark. Meanwhile, Lamaque helped to pick up the slack in Q2, producing ~46,900 ounces, its second-best quarter since Eldorado acquired the asset from Integra in 2017.

Eldorado Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

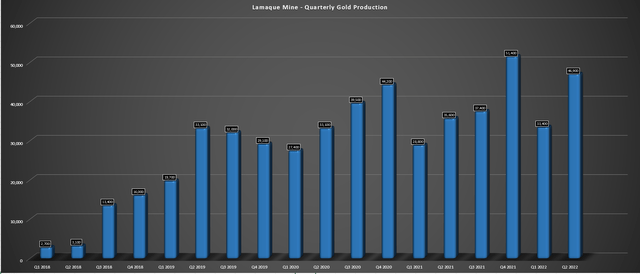

Digging into Lamaque’s results a little closer, we can see that quarterly production was up 32% year-over-year and 42% from pre-COVID-19 levels. The strong performance was driven by higher throughput and grades and was above plans, pushing year-to-date production to ~80,300 ounces. This has placed the mine on track to meet guidance of 170,000 ounces at the mid-point, with Lamaque typically having a stronger second half. Importantly, while production continues to trend higher, this asset is nowhere near its full potential, which could be a 200,000-ounce plus production profile, with a mine life that could extend into the 2030s with Ormaque.

Lamaque Quarterly Production (Company Filings, Author’s Chart)

While the quarter was positive overall, the much-awaited news of a financing package for Skouries has still yet to be announced, which is what the market seems to be waiting for to solidify Eldorado’s medium-term growth plan. This is because this Greek asset has the potential to add 140,000 ounces of gold production per annum at sub $100/oz costs, helping to drag Eldorado’s costs down below $900/oz on a consolidated basis. However, until we see whether a stream is sold or Eldorado partners on the project, it’s difficult to know the exact economics or how much of this growth will be attributed to Eldorado. This could be why the market has been slow to give Eldorado much credit for Skouries, with no confirmation yet on its financing plans.

Eldorado has noted that options for financing include project and debt financing through European and Greek lenders, and the European Union’s Recovery and Resilience Fund. In these cases, we will not see any change in project economics, whereas a stream would lead to a degradation in the After-Tax NPV (5%), and a partnership would reduce Eldorado’s exposure to the project, leading to less margin expansion than if it owned 100% of the project.

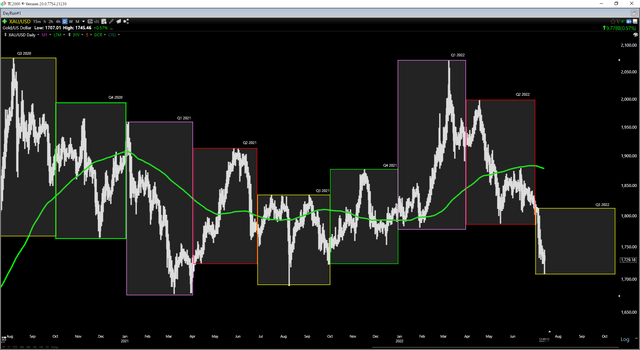

Gold Price & Margin Impact

Unfortunately, despite Eldorado putting together a much better quarter in Q2 and expecting a strong second half, the gold price has reversed its considerable outperformance in Q1, affected by the strength of the US Dollar (UUP). In fact, the metal has slid down to its Q3 2021 trading range, giving up all of its year-to-date gains. Following the Q1 strength, it looked like the gold price would average at least $1,875/oz in 2022, but a more conservative outlook might be a gold price of $1,810/oz, given the recent weakness and trend change.

Gold Futures Price (TC2000.com)

This correction in the gold price is a negative development and will impact Eldorado’s margins this year. Assuming Eldorado comes in just above its guidance mid-point ($1,135/oz) and the gold price averages $1,810/oz this year, its all-in sustaining cost [AISC] margins will dip to $675/oz. If we compare this to FY2021, all-in sustaining cost margins will decline by over 4% year-over-year from the $706/oz reported in 2021. That said, this is not company-specific, and if Skouries is green-lighted, Eldorado has a clear path to margin expansion, separating it from many of its peers. So, while the short-term margin pressure is not ideal and has weighed on the stock, I would be careful not to miss the forest for the trees.

Valuation

Based on ~184 million shares and a share price of US$5.70, Eldorado trades at a market cap of just ~$1.05 billion, which is less than the NPV (5%) of its two main assets combined (Kisladag, Lamaque). This gives Eldorado a dirt-cheap valuation, with investors getting its smaller Efemcukuru Mine, Olympias, and Skouries for free. Even after subtracting an estimated $320 million in corporate G&A and using a conservative P/NAV multiple of 0.80, I see a fair value closer to $13.00 per share. Hence, following this recent correction, I see more than 100% upside to fair value for Eldorado Gold, making it one of the most undervalued names in the sector currently.

So, what’s holding the stock back?

Besides the recent gold price weakness, which has put a dent in the sector, Eldorado Gold hasn’t announced its financing plans at Skouries yet or fully green-lighted the robust (and partially constructed) project. As of the Q3 2021 Conference Call, Eldorado noted that they were aggressively targeting a solution in Q1. It’s now looking like this could slip into late Q3 or Q4. With Skouries being one of the highest-margin projects globally and able to dramatically improve Eldorado’s production profile, this is a key catalyst for a re-rating that has yet to come to fruition.

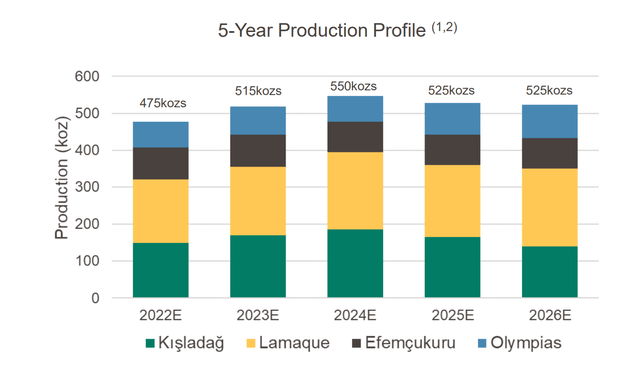

Eldorado – 5-Year Production Profile (Ex-Skouries) (Company Presentation)

While I expect to see the project green-lighted eventually, Eldorado Gold doesn’t stand out among its peers without Skouries and is more or less an average intermediate producer. This is because gold production is expected to remain below 2020 levels (~528,000 ounces) even in 2026 without Skouries. Hence, while I do see a fair value much higher than current levels, this is contingent on Board approval and the successful financing of Skouries, which would provide a more firm date on when we can expect to see this margin expansion. So, while I think Eldorado has tremendous upside to fair value, I have remained on the sidelines, favoring producers with more modest growth projects from a capex standpoint.

Technical Picture

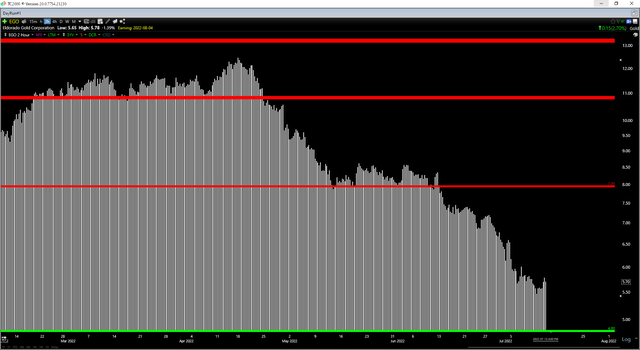

Moving to the technical picture, we can see that EGO broke below critical support at $7.95, and support levels, once broken, often turn into new resistance. This is because some investors who have bought at previous support and held their positions could become anxious to exit once they return to break even after suffering through a sharp draw-down. Meanwhile, the next support for the stock doesn’t come in until $4.80, which is 16% below current levels. Based on a current share price of $5.70, EGO’s reward/risk ratio comes in at 2.5 to 1.0, below my preferred reward/risk ratio of 6.0 to 1.0 for entering new positions.

So, while EGO is dirt-cheap from a valuation standpoint, the stock is in a tricky position from a technical standpoint, suggesting that while this is a decent entry point, a pullback closer to $5.00 would be a much more attractive setup. This doesn’t mean that the stock has to drop this far, but this is where the stock would become more attractive, back-testing a multi-year downtrend line from its previous bear market. To summarize, while I am bullish from a valuation standpoint, I am favoring other names here currently.

Summary

Eldorado Gold put together a solid Q2 report, and if we can see Skouries green-lighted before year-end, the stock should be able to launch back towards broken support near $8.00 (40% upside from current levels). That said, in a cyclical bear market for the S&P 500 (SPY), which can translate to above-average downside volatility, I prefer to focus only on the best companies. Eldorado Gold does not make my top-10 list for precious metals names, and it has not yet reached support; and I want to be as rigid as possible with entries if adding exposure in a bear market. This could lead to a missed opportunity, but from an investment standpoint, I think there are several more attractive bets elsewhere in the sector.

Be the first to comment