Leon Neal/Getty Images News

We are still bullish on Elbit Systems Ltd. (NASDAQ:ESLT), as in our previous Seeking Alpha articles, but there are more caveats and warnings.

The Good News

Defense News ranks Elbit Systems this year at 31st among the Top 100 defense companies worldwide by revenue. Two other Israeli defense companies are also in the top 50. Elbit’s FY ’21 total annual revenue was $5.2279B; that was an increase of +13.2% over $4.66B in FY ’20.

We estimate the FY’22 annual revenue will top $5.5B. FY ’22 earnings will be better than expected, up close to 18%. Q1 was $1.19 and Q2 was $1.82. Earnings from back-order fulfillment are potentially going to raise revenue and earnings in the second half. Seeking Alpha estimates the EPS in Q3 will be $1.90 and $2.38 in the fourth quarter.

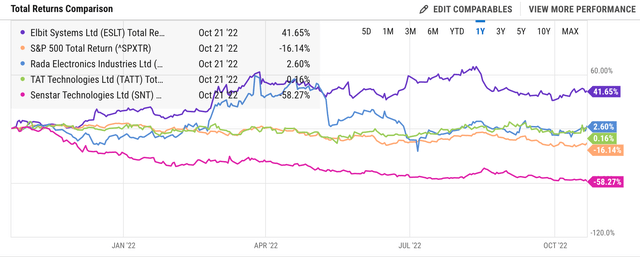

The good news is likely factored into the current share price. Shares are up over 40% in the past 12 months. In August, they topped $244 per share, their highest in 52 weeks. They popped from $161 at the beginning of 2022. The price fell to ~$190 in September. It rose to $204 in October.

Wall Street analysts have a hold rating and Seeking Alpha’s Quant Rating is a sell, though somewhat leaning to hold. We recommend cautiously adding shares below in the $190 range when the price dips again. The overall outlook for defense stocks is choppy, but demand is indubitable. Defense, homeland security and aerospace sectors comprise 5% of the U.S. GDP. These sectors are the heart of Elbit Systems.

Bullish Supports

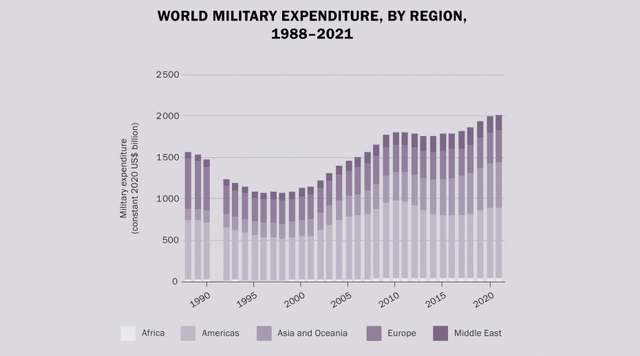

First, the demand for weapons and tech services is high. World expenditures on military goods passed $2T for the first time in 2021.

Military Expenditures (sipri.org)

War in Ukraine is draining stockpiles. War drums are beating in Asia-Pacific. The U.S. and its allies are holding “War Games,” sending ships, planes, electronic surveillance equipment, and weapons to the tension-filled region. The Middle East continues consuming huge amounts of defense weapons; the region accounts for 43% of U.S. arms transfers.

Our second factor supporting our long-term bullish position is based on Israel’s dependence on military high-tech, precision offensive weapons, and defensive homeland security. Israel’s military budget is almost $23B annually and growing at a CAGR of over 4%. Elbit always has a customer. Elbit is a minor but innovative player in the global defense industry. Its market cap is $9B, but its share price gains are outpacing bigger competitors.

Elbit Systems designs build and sell defense tech and weapons portfolio including weapons electronics, cybersecurity, and airborne, land, and naval systems. Elbit has a subsidiary addressing needs in the medical industry and commercial aviation. Drones, especially combat battlefield aerial vehicles, are a major part of Elbit’s activities. The company introduced anti-drone protection and neutralization tech over three years ago. The Swedish-German Elbit deal mentioned above is a $23M contract for the company to supply military communications software. UAV tech and products are skyrocketing to a $40B market by 2027.

It owns Elbit America and KMC Systems. KMC sells medical engineering services, and complex manufacturing platforms for supply chain, quality assurance, and compliance management. It is an FDA-registered and ISO-compliant provider. Elbit also has operations in Europe, Latin America, and Asia-Pacific. The company was incorporated in 1966 and is based in Haifa, Israel.

Valuation

We believe the company will outperform in the long term. The average target price for the next 12 months, in our opinion, is a potential $260. We base this on historical numbers of the P/E, P/B, and price-to-free cash flow ratios, company returns, and future estimates of revenue and earnings.

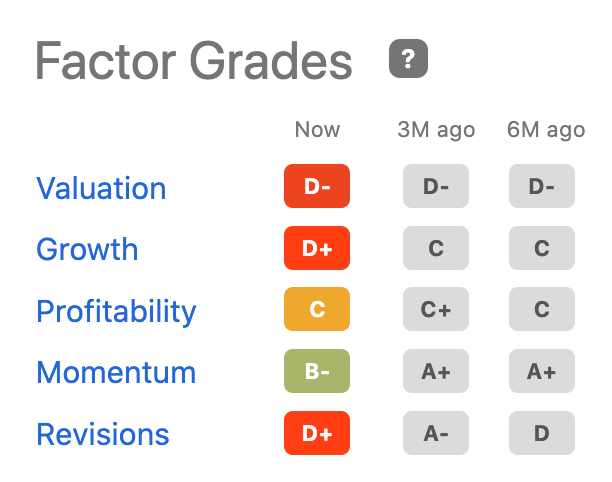

Factor Grades (seekingalpha.com)

Seeking Alpha’s Factor Grades paint a moderate picture. More weight needs to be given to the likely election of a conservative government in Israel that demands greater military spending on cybersecurity and weapons. NATO and U.S military spending have to increase to replenish weapons sent to Ukraine. Europe is a good customer of Elbit. For example, in the last weeks,

Elbit’s back-orders did not factor into Q2 earnings. Backlog orders are a record $14B. They rose +3% from Q1 and are +4% higher than Q2 ’21. Revenue in Q2 ’22 was slightly higher Y/Y. The share price fall was due to estimated and actual lower earnings. Hedge funds bought more than 300K shares in each of the three quarters in 2021 but sold shares throughout this year. Funds decreased holdings by some 30K shares last quarter.

Funds have not been significant stockholders of Elbit Systems for a long time, we believe for two reasons. It is politically threatening to invest in an Israeli weapons company. Second, there is heavy government influence over the company. Management has to delicately dance between making profitable products and fulfilling government needs.

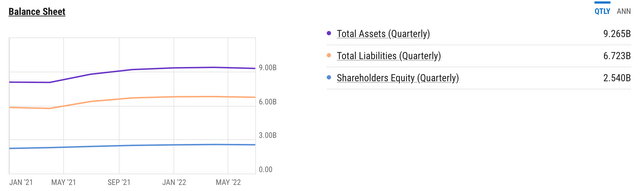

But the Elbit Systems balance sheet looks healthy. Equity has been rising for six years. The debt-to-equity ratio is not a bad 33.1%. Assets are over $9.26B, exceeding liabilities of $6.78B.

Matters for Caution

There are four matters about which investors need to proceed with caution. Debt as of June 29, ’22, was $1.09B. Cash flow from operations does not satisfactorily cover the debt.

Second, the dividend yield is less than 1%. It is comparable to the defense industry average, but there are higher-yielding investments.

Third, the CEO’s compensation rose 20% despite lower reported earnings. Private companies, institutions, and the government or reps own two-thirds. The public owns the remaining third. Both situations make some investors wary.

The fourth reason is political. Activists want to end government funding and investment in defense industry firms. Israeli firms and Elbit Systems, in particular, are targets of boycotts and disinvestment movements. As recently as October 7, ’22, the Bank of Nova Scotia’s asset management segment drew criticism for its $440M investment in Elbit. Australia’s Future Fund and Norway’s largest pension fund sold their investments in Elbit. It is ironic since Elbit Australia opened a new AI defense tech facility in the country this year.

Takeaway

Elbit Systems Ltd is a technology company specializing in defense that designs and builds software and weapons. It has a small non-military segment in commercial aviation and the medical industry.

Elbit Systems Ltd is financially strong and profitable. We would like management to cut debt and increase the dividend yield. Investors can expect steady revenue growth. The share price will dip along with defense industry stocks, but we see a potential opportunity for Elbit stock to rise higher. It has products every country wants in its defense inventory, whether there is a recession, inflation rages or deflates, even regardless of war or peace.

Be the first to comment