GOLD, SILVER PRICE OUTLOOK:

- Gold and silver prices extended higher, buoyed by a weaker US Dollar and stimulus hopes

- Rising inflation expectations may cushion precious metal prices against higher yields

- The world’s largest bullion ETF saw continuous outflow as investors turned to riskier assets

Recommended by Margaret Yang, CFA

Get Your Free Gold Forecast

Gold and Silver prices advanced for a third day against the backdrop of a weaker US Dollar. Markets awaited a fresh US$ 1.9 trillion US Covid-relief package to be approved by Congress. The US Dollar (DXY) index retreated to 90.74 from a two-month high of 91.55 as stimulus hopes were built against the backdrop of a much weaker-than-expected non-farm payrolls report. Only 49k positions were added in January, falling sharply below market expectations of a 105k increase. Tepid job market sentiment called for more fiscal support and may refrain the Fed from considering tapering any time soon.

The Democrat-led Senate is working towards approving the US$1.9 trillion stimulusbill, which aims to revitalize consumer spending, strengthen vaccine delivery and foster a faster recovery from the pandemic. House Democrats proposed to broaden the eligibility of stimulus payments for middle-income households. Individuals earning up to 75k and couples earning 150k annually may be able to receive US$ 1,400 cheque payments.

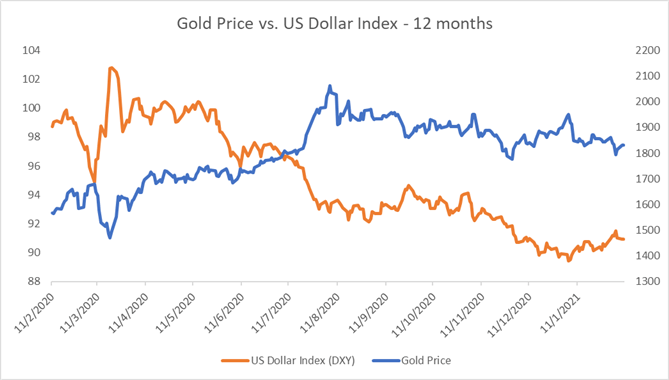

Further weakness in the Greenback may continue to support precious metal prices, which tend to be inversely correlated to the US Dollar. Gold and silver prices exhibited a negative relationship with the DXY US Dollar index, showing correlation coefficients of -0.79 and -0.92 respectively over the past 12 months.

Gold vs. DXY US Dollar Index – 12 Months

Source: Bloomberg, DailyFX

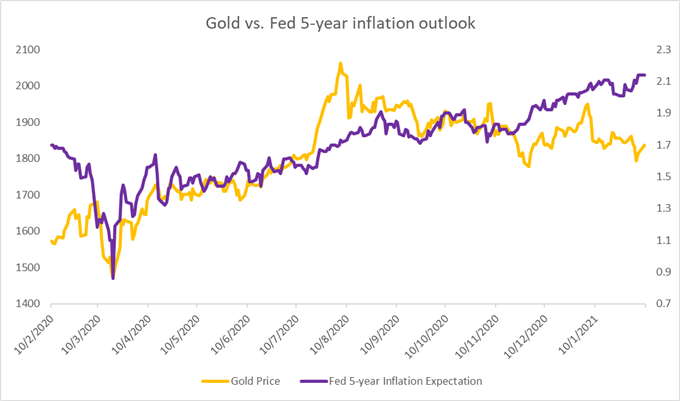

While inflation expectations and gold prices appear to have diverged over the past few months (chart below), a rising inflation outlook may still provide longer-term support to precious metals. That is because they are perceived as inflation hedges and a store of value. Renewed stimulus hopes sent the Federal Reserve Bank of St. Louis 5-year forward inflation expectation to a two-and-half year high of 2.14%. It could continue to rise should the economy bounce back strongly in the first quarter. Besides, relative underperformance of gold prices this year could be attributed to rising longer-dated US Treasury yields and an exuberant stock market rally. These have been making the yellow metal less appealing compared to riskier assets.

Gold vs. Fed 5-year Inflation Outlook – 12 Months

Source: Bloomberg, DailyFX

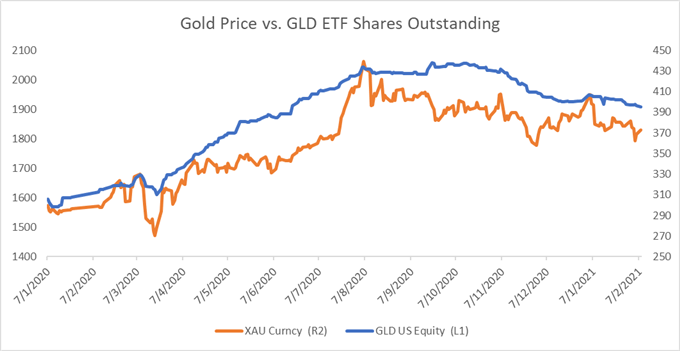

The world’s largest gold ETF – SPDR Gold Trust (GLD) – saw continuous net capital outflow over the past few weeks. The number of GLD shares outstanding deceased to 396.6 million for the week ending February 5th 2021 from a recent high of 407.1 million observed on January 4th, marking a 10.5 million decline. Gold prices and the number of outstanding GLD shares have exhibited a strong positive correlation of 0.92 over the past 12 months (chart below).

Gold Price vs. GLD ETF Shares Outstanding – 12 Months

Source: Bloomberg, DailyFX

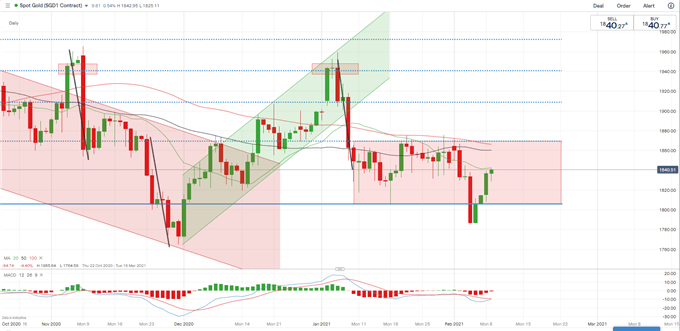

Technically, gold prices returned to ‘range-bound’ trading conditions after briefly dipping below it, with US$ 1,810 and US$ 1,870 serving as immediate support and resistance levels respectively (chart below). The overall trend remains bearish-biased as suggested by downward-sloped moving average lines. The MACD indicator is about to form a bullish crossover but overall trend remains below the centerline, reflecting weak upward momentum.

Gold Price – Daily Chart

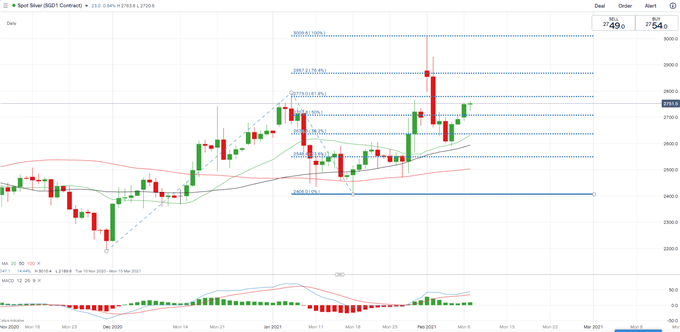

Silverprices regained strength after falling sharply from last week’s peak of US$ 30.00. The overall trend appears to be bullish-biased, as suggested by the formation of higher highs and higher lows recently. Immediate resistance levels can be found at US$ 27.80 (61.8% Fibonacci extension) and US$ 28.67 (76.4% Fibonacci extension). A pullback from here may lead to a test of US$ 27.07 (50% Fibonacci extension) for support.

Silver Price – Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -7% | 23% | -3% |

| Weekly | 5% | 20% | 7% |

IG Client Sentiment indicates that retail gold traders are leaning heavily towards the long side, with 84% of positions net long, while 16% are net short. Traders have increased short positions substantially (+20%) while reducing long exposure overnight (-5%). Compared to a week ago, traders have increased both short (+14%) and long (+7%) bets.

{{GUIDE|BUILDING_CONFIDENCE_IN_TRADING }}

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter

Be the first to comment