dolgachov/iStock via Getty Images

For those who care about the personal care space, one company that definitely should be on the list to consider is Edgewell Personal Care Company (NYSE:EPC). This business, which has a market capitalization of around $2.1 billion, produces and sells a variety of personal care products in the wet shave, sun and skin, and feminine care categories across more than 50 countries worldwide. For the most part, the enterprise ended the 2021 fiscal year with strength. But results so far this year have been rather mixed. An increase in revenue is nice to see, but when that comes with decreased profitability, the picture looks quite discouraging. Shares do look cheap on an absolute basis. But when you consider how affordable other players in the space are, the company comes across as just another prospect that might make sense to add to a watch list, but may not make sense to buy today.

There’s better out there

The last time I wrote an article about Edgewell was a little over a year ago in August of 2021. In that article, I acknowledged the company’s mixed operating history. At the same time, however, I lauded management’s efforts to improve operations, even going so far as to exclaim that success on that front could lead to some nice upside for shareholders. Even though I mentioned that this upside was contingent on management’s success, I still felt confident enough to rate the company a ‘buy’, reflecting my belief that it should outperform the broader market moving forward. Using that definition, my call so far has proven to be fairly solid. Although shares in the company are down 8.3% since the publication of said article, the S&P 500 is down by 12.2%.

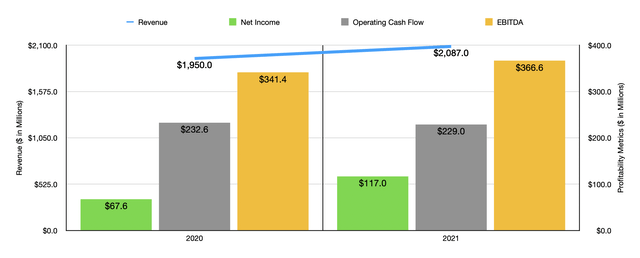

Author – SEC EDGAR Data

Part of this return disparity is likely driven by the performance the company achieved in 2021. Revenue for that year came in at $2.09 billion. That represents an increase of 7% over the $1.95 billion the company generated in 2020. Profits were also largely higher year over year. Net income, for instance, rose from $67.6 million in 2020 to $117 million last year. Operating cash flow worsened a bit, falling from $232.6 million to $229 million. However, EBITDA made up for that, rising from $341.4 million to $366.6 million.

Considering this is a fairly low-growth space, any sort of expansion is great to see. And to be fair, growth for the company from a revenue perspective has continued into 2022. For the first three quarters of the year, sales came in at $1.64 billion. That’s 5.9% higher than the $1.54 billion generated the same time last year. This increase was driven by a combination of factors. For instance, organic net sales by the company were up by 4.8%. This was driven by increased volumes and higher pricing for the quarter. The company also benefited to the tune of 3.6% from its acquisition of Billie, a consumer brand company that offers personal care products for women that the company acquired in November of last year for $309.4 million. Unfortunately, the company was negatively impacted to the tune of 2.5% from foreign currency fluctuations.

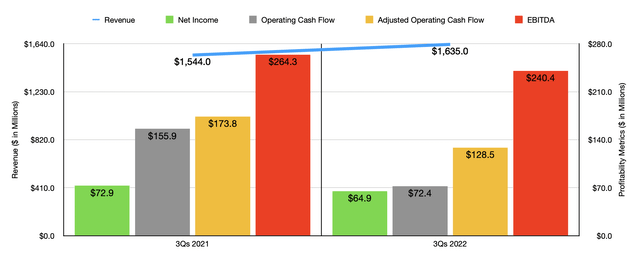

Author – SEC EDGAR Data

This increase in revenue is fantastic to see, especially when you consider that it would have been greater had it not been for foreign currency fluctuations. At the same time, however, profits for the company did worsen. Net income dropped from $72.9 million in the first three quarters of 2021 to $64.9 million the same time this year. On this front, the company was hit hard by a decrease in its gross profit margin from 45.7% down to 40.4%. Some of this had to do with a $22.5 million charge for the write-off of inventory for certain Wet Ones products. But even without that, gross margin would have declined from 45.8% to 42%, driven by commodity inflation, higher warehousing and distribution expenses, and unfavorable product mix. It would be one thing if net income was the only category that suffered. Unfortunately, we saw profit weakness across the board. Operating cash flow plunged from $155.9 million to $72.4 million. Even if we adjust for changes in working capital, it would have fallen from $173.8 million to $128.5 million. Even EBITDA worsened, dropping from $264.3 million to $240.4 million.

When it comes to the 2022 fiscal year as a whole, management expects revenue to rise by around 4%. This would be driven by a 3.4% increase caused by the aforementioned acquisition and by a 4% increase in organic revenue. Unfortunately, foreign currency fluctuations should impact the company to the tune of 3.1%. Earnings per share, meanwhile, should come in at between $1.83 and $1.93. Though on an adjusted basis, it should be between $2.50 and $2.60. The company also said that EBITDA should be between $335 million and $340 million. No guidance was given when it came to other profitability metrics. But if we assume the same year-over-year change for operating cash flow as what we should see with EBITDA, then we should anticipate a reading for that of $169.3 million.

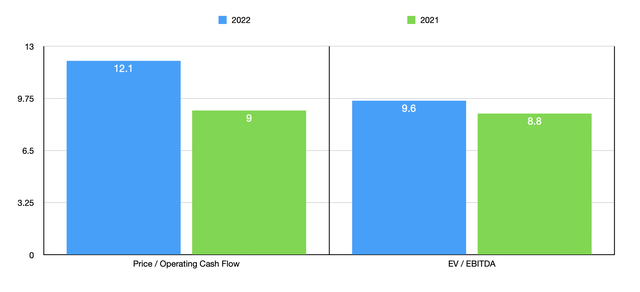

Author – SEC EDGAR Data

Taking these figures, I calculated that the company is trading at a forward price to adjusted operating cash flow multiple of 12.1. The EV to EBITDA multiple for the company, meanwhile, should come in at 9.6. If, instead, we were to use the data from the 2021 fiscal year, these multiples would be 9 and 8.8, respectively. As part of my analysis, I also compared the company to five similar firms. Using the price to operating cash flow approach, the four companies with positive results had multiples ranging from 7.7 to 55.1. Two of the four were cheaper than Edgewell. When it comes to the EV to EBITDA approach, the range for the five companies was between 4.6 and 35.9. In this case, three of the five were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Edgewell Personal Care Company | 12.1 | 9.6 |

| e.l.f. Beauty (ELF) | 55.1 | 35.9 |

| Coty (COTY) | 7.7 | 8.6 |

| Inter Parfums (IPAR) | 49.3 | 14.2 |

| Olaplex Holdings (OLPX) | 11.7 | 7.4 |

| Natura &Co Holding SA (NTCO) | N/A | 4.6 |

Takeaway

Based on what data we have, I do believe that the long-term outlook for Edgewell will probably be positive. The company has definitely outperformed the broader market like I said it should. Having said that, I’m no longer as bullish about the firm as I once was. The continued increase in revenue has been great, but I don’t like seeing the margin contraction the company has experienced. And truthfully, I don’t know when that will let up. Although shares of the company are affordable on an absolute basis, I do think they look more or less fairly valued when placed next to the competition. So that, combined with the other factors I mentioned, have led me to decrease my rating on the company from a ‘buy’ to a ‘hold’.

Be the first to comment