DNY59/E+ via Getty Images

Recessions are painful. People lose their jobs, they can’t make their mortgage or rent payments, and some lose their homes. There’s no money for luxuries like vacations or nights out on the town, and there’s less money for essentials such as food and medical care.

Economic Recession Definition

A recession is a serious decline in economic activity that lasts longer than a few months. It is measured by drops in these five economic indicators:

- Real gross domestic product (GDP)

- Income

- Employment

- Manufacturing

- Retail sales.

Headquartered in Cambridge, Massachusetts is the National Bureau of Economic Research (NBER). It is a private, nonprofit research organization that disseminates economic research to public policymakers, business professionals, and the academic community. It is NBER who officially declares the beginning and the end of recessions, and its definition of a recession is:

… a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

GDP, or gross domestic product, is the monetary measure of the market value of all the final goods and services produced by a country within a specific time period. “Real” GDP means that the effects of inflation on that figure have been removed.

GDP is usually calculated annually, but it can be calculated quarterly as well, and during some quarters, GDP is negative while in other quarters it is positive. Because of these fluctuations in quarterly GDP, NBER keeps a close eye on the other four components of a recession: income, employment, manufacturing, and retail sales, all of which are reported monthly.

How Do Recessions Happen?

Recessions occur when the following events occur:

- A drop in real income: Real income is income that is adjusted for inflation, and with Social Security and welfare payments removed; when real income falls, consumers cut back on purchases, lowering demand.

- Lower employment: A fall in employment numbers and an increase in requests for unemployment insurance assistance.

- A drop in manufacturing: As measured by the Industrial Production Report which is issued by the Federal Reserve.

- Lower wholesale-retail sales: These figures are adjusted for inflation and they reflect companies’ responses to consumer demand.

- A drop in monthly GDP estimates: NBER looks at monthly estimates of GDP which are provided by Macroeconomic Advisers.

What isn’t reflective of a recession is the behavior of the stock market. This is because stock prices are based on the anticipated earnings of public companies, and they reflect either investors’ exuberance or pessimism. During a recession, the stock market may enter what is known as a bear market which occurs when the market declines by 20% or more over a period of at least two months. Large declines in the stock market can contribute somewhat to a recession because investors lose confidence in the economy.

5 Recession Stages

Recession is an integral part of the economic cycle, which is also known as the business cycle. It is comprised of these stages:

- Recession: growth slows, the rate of employment falls, but prices stagnate, meaning they stay the same.

- Trough: the economy hits its lowest point.

- Recovery: growth begins again.

- Expansion: the economy grows rapidly, interest rates are low and production goes up, however, inflationary pressures are building.

- Peak: when growth hits its maximum rate, imbalances in the economy occur that will be corrected by a recession.

What Happens During a Recession?

The first inkling of a recession may appear in manufacturing jobs numbers. This is because manufacturers receive their orders months in advance, and when manufacturing orders decline, so do factory jobs. Those who have lost their factory jobs cut back on their spending and this affects other sectors of the economy.

When consumer demand falls, businesses stop hiring, unemployment continues to rise, and consumer spending drops even further. It is at this point that businesses begin to go bankrupt, people are unable to make their mortgage or rent payments, and they lose their homes. Probably the worst effect of a recession is on young people, especially recent college graduates who can’t find jobs following graduation.

U.S. Historical Recession Examples

1. 2020 Pandemic Recession

The Covid-19 pandemic caused the worst recession since the Great Depression with the U.S. economy contracting by record amounts in 2020. In April 2020, 20.8 million jobs were lost, and the unemployment rate reached 14.7%. The unemployment rate remained in the double digits until August 2020.

The stock market experienced what is now known as the 2020 stock market crash. To combat this recession, the Federal Reserve lowered the fed funds rate to 0% and Congress issued $3.8 trillion in aid. In response to these measures, in Q3 2020, the economy grew by 33.1%.

2. 2008 Great Recession

The Great Recession began in December 2007 and lasted until June 2009. The subprime mortgage crisis and the widespread use of derivatives triggered a bank credit crisis which then spread globally to the general economy.

In 2008, GDP shrank in Q1, Q3, and Q4, dropping 8.4% in Q4. In 2009, GDP dropped in Q1, and in October 2009, the unemployment rate reached 10%. In Q3 2009, the GDP became positive and NBER declared the recession over.

3. 2001 Dot-Com Bubble Burst Recession

Lasting just eight months, from March 2001 to November 2001, the economy contracted by 1.1% in Q1 2001 and by 1.7% in Q3 2001. This recession was caused by a boom followed by a bust in dot-com businesses. Part of that boom was caused by companies’ concerns over the change from “19XX” dates to “20XX” dates in their computer software, however, many dot-com businesses were overvalued then failed. This recession was further exacerbated by the 9/11 attack.

4. The 1990-1991 Recession

This recession began in July 1990 and lasted until March 1991. It was caused by the 1989 savings and loan crisis, which led to higher interest rates, and the Iraqi invasion of Kuwait which led to the Gulf War. In Q4 1990, GDP dropped by 3.6%, and in Q1 1991, it dropped by 1.9%.

5. The 1980-1982 Recession

This was essentially two recessions, with the first occurring from January through June of 1980, and the second beginning in July 1981 and lasting until November 1982. This recession was caused in part by the Federal Reserve’s attempt to combat inflation by raising interest rates.

During the 12 quarters, four each in 1980, 1981, and 1982, GDP was negative in six, with the worst being Q2 1980 when it fell by 8.0%. In November and December 1982, unemployment reached 10.8% and it remained over 10% for 10 months. This recession was exacerbated by the Iranian oil embargo which reduced U.S. oil supplies, driving up prices.

6. 1973 Nixon/OPEC Embargo Recession

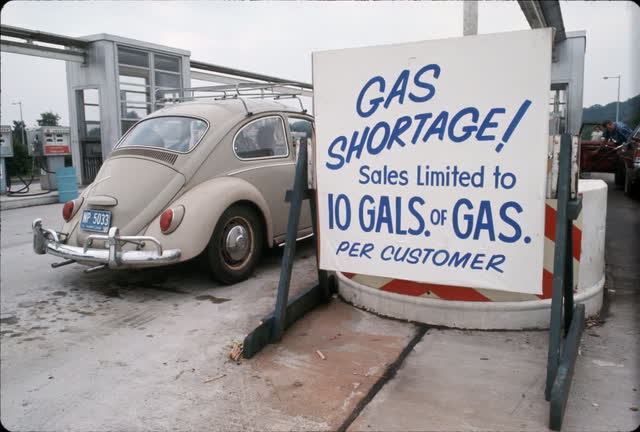

1973 gas shortage (Environmental and Energy Study Institute)

Beginning in November 1973 and lasting until March 1975, this recession was initiated by the OPEC oil embargo which caused oil prices to quadruple. Actions taken by then-president, Richard Nixon, were also causative factors with the wage and price controls he initiated keeping prices too high and this reduced demand. The wage controls kept salaries too high which caused companies to lay off workers.

President Nixon also took the U.S. off of the gold standard which caused the price of gold to skyrocket while the dollar’s value fell, and this, in turn, led to inflation. In Q3 1973, GDP fell by 2.1%, in Q1 1974, it fell by 3.4% and this was followed by falls in Q3 1973 of 3.7%, 1.5% in Q4, and 4.8% in Q1 1975.

7. 1929 Great Depression

The difference between a recession and a depression is that during a recession, the economy contracts for two or more quarters, while during a depression, the economy will contract for several years.

Between 1929 and 1938, two recessions battered the U.S. economy. During the first downturn, between August 1929 and March 1933, GDP was down by 12.9% and unemployment peaked at 24.7%. Unemployment remained in the double digits until 1939.

Several factors created the Great Depression. In the Spring of 1928, the Federal Reserve raised interest rates, then the stock market crashed in 1929, wiping out people’s life savings. This was compounded by a 10-year-long drought in the country’s breadbasket, the Midwest, which devastated farmers and created the infamous Dust Bowl.

The Dust Bowl (Colorado Virtual Library)

President Franklin D. Roosevelt’s New Deal boosted growth by 10.8% in 1934, 8.9% in 1935, 12.9% in 1936 and 5.1% in 1937. It took until the end of the drought in 1937 to finally end the second recession, and it was at that same time that the government increased spending in the ramp-up to World War II.

Global Recession Examples

The International Monetary Fund defines a global recession as “a decline in annual per-capita real world GDP (purchasing power parity weighted), backed up by a decline or worsening for one or more of the seven other global macroeconomic indicators: industrial production, trade, capital flows, oil consumption, unemployment rate, per-capita investment, and per-capita consumption”.

According to that definition, since World War II there have only been four global recessions: in 1975, 1982, 1991, and 2009. All lasted only a year, but 2008’s Great Recession was by far the worst due to the number of countries affected and the decline in real-world GDP per capita.

How Do Recessions Impact Investors & Non-Investors?

During recessions, investors usually sell speculative investments and move into safer securities, such as government bonds. Equity investors eschew risk and move into well-established, high-quality companies that have strong balance sheets and little debt. Companies that have significant debt and weak cash flows may be unable to handle their debt payments along with the cost of continuing operations.

During recessions, one area of the stock market that generally remains stable is consumer staples. These include: food, beverages, household goods, alcohol, and tobacco, which are products that consumers tend to buy regardless of their financial situation and they are the last products that consumers eliminate from their shopping lists.

Who Benefits From a Recession?

Those who have positioned themselves to profit from economic struggle may benefit from a recession. However history has shown that it is very difficult, if not impossible, to consistently time these events. A recession may slow inflation as less money is circulating throughout the economy. The Federal Reserve attempts to stop recessions by stimulating the economy by lowering taxes, spending on social programs, and not considering the budget deficit. In response to the Great Recession, in 2009, Congress passed the economic stimulus package known as the American Recovery and Reinvestment Act.

Are We Heading Into a Recession?

Troubling signs that we might be heading into a recession are building. These include:

1. An inverted bond yield curve: normally, bonds having shorter maturities pay, or yield, less than those having longer maturities. For example, three-month Treasuries yield less than 10-year Treasury notes, which in turn yield less than 30-year Treasury bonds. This is because long-term bond investors accept more risk, such as the possibility that inflation could erode the value of their future payments. Bond issuers pay higher yields to compensate investors for this additional risk.

In a yield curve inversion, short-term bonds yield more than long-term ones, and according to the Financial Times, “An inversion of the yield curve has preceded every U.S. recession for the past half-century.” The yield curve inverted in 2019 just before the 2020 Pandemic Recession, it inverted in 2007, before the 2008 Great Recession, and it inverted in early 2000 just before the 2001 Dot-Com Bubble Burst recession. As of March 14, 2022, the difference between the two yields was 0.25%, with the 2-year bond yielding 1.75% and the 10-year bond yielding around 2%.

2. A rising unemployment rate: As of February 2022, the current unemployment rate is 3.8%, and as of March 5, 2022, unemployment insurance claims stood at 2.1 million. New employment numbers are expected to be released on April 1, 2022, and should the unemployment rate and claims for unemployment insurance rise, that could signal a coming recession.

3. An increase in energy prices: The surge in oil prices has pushed prices at the pump to record highs. According to AAA, on March 11, 2022, the national average price for a gallon of gas was $4.331, the highest it’s ever been. As Russia’s recent invasion of Ukraine has shown us, Europe is highly dependent on Russia for its energy, especially natural gas, and should supplies narrow or be suspended, prices could increase rapidly. It’s also possible that Russia and some of its companies involved in energy such as Gazprom, Lukoil, and Sberbank, could default on about $150 billion in foreign-currency debt.

4. Rising commodity prices: Supply chain difficulties have been common since the start of the Covid pandemic. Russia and Ukraine account for 28% of global wheat exports and 16% of global corn exports. Production of stainless steel requires nickel, and Russia is a major nickel producer which has caused nickel prices to rise sharply. Ukraine is a big supplier of pig iron to Europe, and there is now a shortage. In Asia, semiconductors have been in short supply for well over a year now, and this has caused worldwide auto manufacturers to temporarily suspend production because modern cars rely heavily on semiconductors.

5. Rising interest rates: The Federal Reserve began a two-day meeting on March 15, 2022, and Federal Reserve Chair Jerome Powell has been quoted as saying that the central bank would begin hiking interest rates as a way to combat inflation. The fed is expected to raise borrowing costs by a quarter of a percentage point which it will announce at 2 p.m. EDT (1800 GMT) on March 16, 2022.

6. Rising inflation: At 4.7% (and many other metrics calculate it as much higher), the current inflation rate is at a 40-year high. To cool this inflation, economists expect the Federal Reserve to raise rates from the current near-zero to between 1.25% and 1.50% by the end of 2022.

7. Severe drought: The drought in the Western states over the last 20 years has been classified by scientists as a megadrought. The area affected extends from Wyoming south to the Mexican border, and from the Pacific Ocean to the Mississippi River. This drought will have an impact on U.S. food prices, with farmers unable to grow crops or raise livestock.

The electricity supply will also be affected because the 13 Western states get over 22% of their electricity from hydroelectric dams.

Bottom Line

Even though recessions are a part of the economic cycle, living through them isn’t always easy. Knowing the signs of a coming recession can help both investors and non-investors alike take steps to avoid the worst effects of a recession such as paying down debt and avoiding speculative investments.

Be the first to comment