Sakorn Sukkasemsakorn

The BlackRock ESG Capital Allocation Trust (NYSE:ECAT) is a recently launched, ESG-focused closed-end fund. While ECAT pays an attractive distribution yield of 7.8% on market price, the distribution has been funded mostly through return of capital and appears unsustainable. I would avoid ECAT until performance improves, or the distribution rate is reduced to a more sustainable level.

Fund Overview

The BlackRock ESG Capital Allocation Trust is a closed-end fund (“CEF”) that aims to provide total return and income while investing in securities that meet high levels of Environmental, Social, and Governance (“ESG”) standards. Although the fund has only been in operation for a little more than a year, it has $1.7 billion in assets.

Strategy

The ECAT fund invests in a portfolio of equity and debt securities to achieve its objective. The fund will invest 80% of its assets in securities that meet certain ESG criteria.

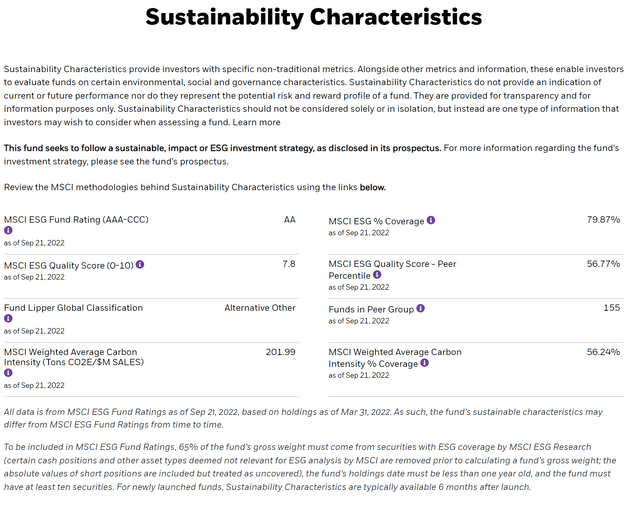

To build the fund’s investment universe, the manager will first screen out certain issuers that 1) engage in the production of controversial weapons, 2) produce civilian firearms, 3) produce tobacco-related products, 4) derive more than 25% of revenues from thermal coal generation, 5) derive more than 5% of revenues from oil sands extraction, 6) issuers that are ranked in the bottom half of the applicable fossil fuel issuers peer group by internal / external ESG criteria, 7) issuers that have been identified by third-party rating agencies to have violated the United Nations Global Compact (globally accepted principles covering human rights, labor, environment, and anti-corruption), and 8) issuers that have received an ESG rating of CCC or equivalent by a recognized third-party rating agency. This screening criteria may be changed in the future at the manager’s discretion.

ECAT’s ESG ratings are shown in Figure 1.

Figure 1 – ECAT ESG ratings (blackrock.com)

Once the investment universe has been narrowed down, the manager then proceeds to consider potential investments using normal investment criteria such as valuation and macro-economic factors.

At any given time, the fund may choose to emphasize debt or equity securities. The fund may also invest in high yield ‘junk bonds’, loans, and distressed securities in the fixed income portfolio. In the equity portfolio, the fund may write call options to generate current income. ECAT may also employ leverage to enhance returns.

Portfolio Holdings

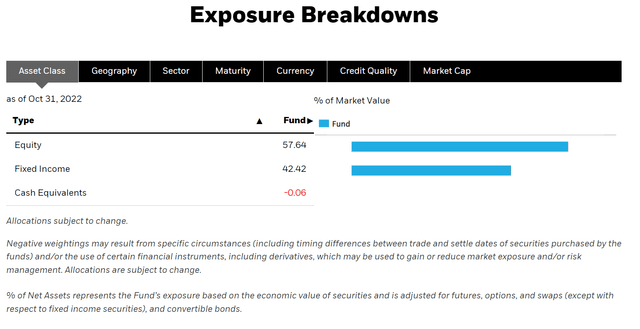

The ECAT fund has 58% of its assets allocated to equities, and 42% allocated to fixed income as of October 31, 2022 (Figure 2).

Figure 2 – ECAT asset class allocation (blackrock.com)

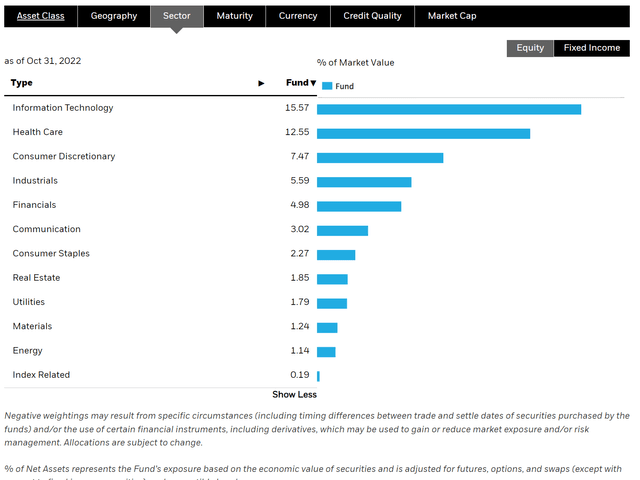

The fund’s equity portfolio is heavily weighted to technology and healthcare, and has minimal weights in materials and energy (Figure 3).

Figure 3 – ECAT equity sector allocation (blackrock.com)

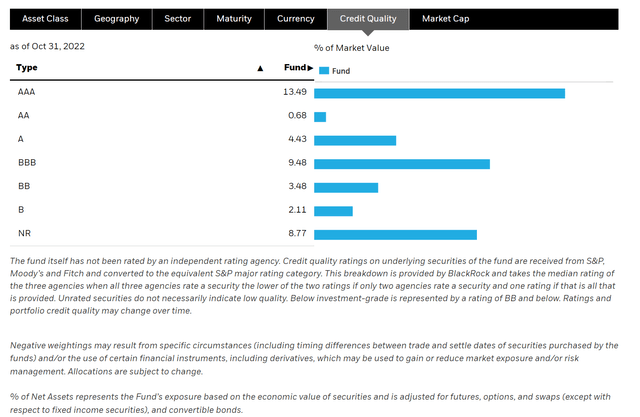

The fixed income portfolio is 64% invested in investment grade (“IG”) bonds and 36% invested in non investment grade or unrated securities (Figure 4).

Figure 4 – ECAT credit quality allocation (blackrock.com)

Returns

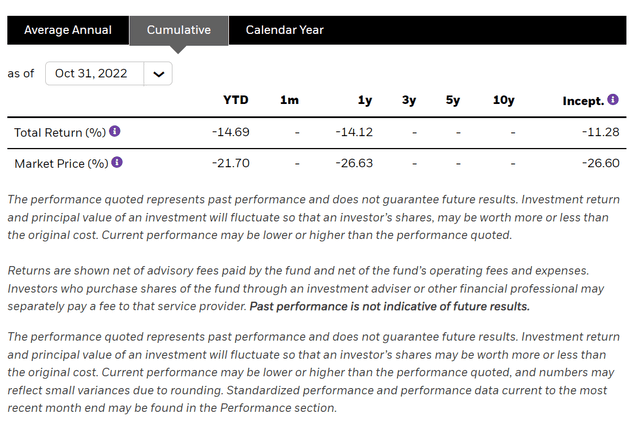

The ECAT fund has only been in operation for a little over a year, so it is hard to draw conclusions from its limited returns history. So far, the fund has had poor returns, as it was essentially launched just ahead of the peak in equity markets and before interest rates started rising. ECAT has YTD returns of -14.7% and 1Yr returns of -14.1% (Figure 5).

Figure 5 – ECAT returns (blackrock.com)

Distribution & Yield

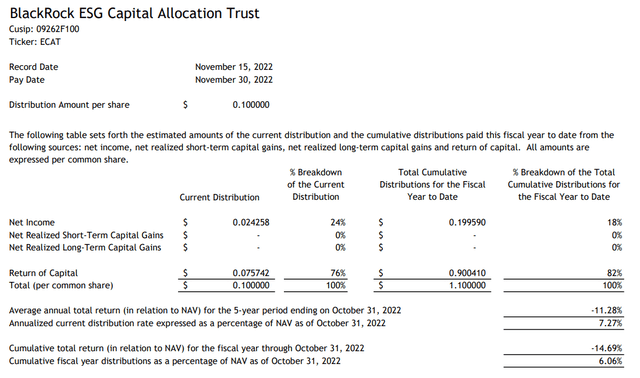

ECAT pays a monthly distribution of $0.10 / share or a current yield of 7.8% on market price or 7.0% on NAV. A strong word of caution though, ECAT’s YTD distribution has been funded 82% by return of capital (“ROC”), which eats away at NAV to the detriment of future income earning assets (Figure 6).

Figure 6 – ECAT’s distribution mostly funded through ROC (ECAT Section 19 notice)

ECAT Trades At Substantial Discount

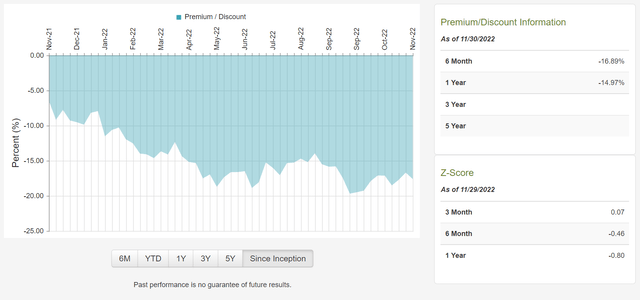

ECAT’s poor performance out of the gate along with its high distribution yield could be the reason why investors have largely shunned it, causing the ECAT fund to trade at a wide discount to NAV. Most recently, the discount was 17.5% (Figure 7).

Figure 7 – ECAT discount to NAV (cefconnect.com)

Investors may be betting that the $0.10 per month distribution is unsustainable, as ECAT has only earned 18% of the distribution YTD in income.

Fees

ECAT charges a 1.35% gross expense ratio.

Good To See ESG Does Not Materially Reduce Returns

Most investors probably want their investments to have a positive impact on the environment and would like to avoid investing in controversial companies like those that produce weapons or fossil fuels. The challenge is that when broad swathes of the markets are excluded from consideration due ESG considerations, total returns may suffer as there are less investment choices.

Fortunately, that does not seem to be the case with ECAT. For comparison, BlackRock has an asset allocation fund called the BlackRock Capital Allocation Trust (BCAT) that is managed by the same team of portfolio managers (Rick Rieder, David Clayton, and Russ Koesterich) without the strict ESG investment selection criteria.

Despite dramatically different portfolio composition, for example BCAT has 50% invested in fixed income and 43% invested in equities versus ECAT’s 42% and 58% respectively, ECAT has been able to keep pace with BCAT on a 1Yr basis (Figure 8).

Figure 8 – ECAT has kept pace with BCAT despite ESG rules (Seeking Alpha)

While a single year is not enough time to make a conclusion, it does suggest one can ‘do well while doing good’.

Conclusion

While ECAT pays an attractive distribution yield of 7.8% on market price, the distribution has been funded mostly through return of capital and appears unsustainable. That is why the fund trades at a substantial discount to NAV. I would avoid ECAT until performance improves or the distribution rate is reduced to a more sustainable level.

Be the first to comment