Prykhodov

Perhaps one of the least understood (and respected) online retail and Big Tech companies is eBay (NASDAQ:EBAY). The organization today looks far different than 2019, before the COVID-19 pandemic hit. Essentially, it has slimmed down and refocused on its bread-and-butter internet listing service for third-party transactions of all types.

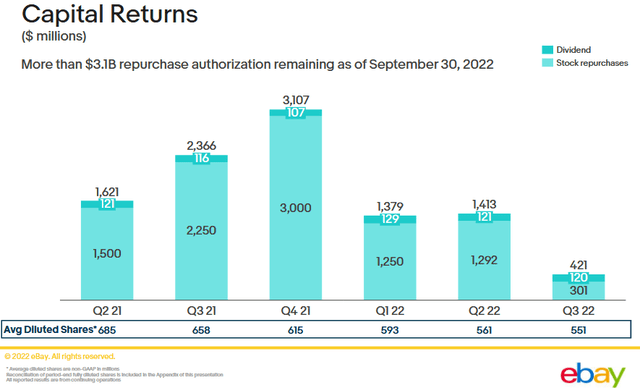

The company has sold off many assets and repurchased about 20% of its shares over less than three years, and traffic/sales are much higher than pre-pandemic levels. For me, I believe eBay represents one of the best ways to ride high inflation rates into the future. As the organization takes a cut (fees and percentages) on a rising price base for merchandise (excluding volume growth), with super-high existing profit margins, abnormal rates of general inflation in the economy should expand EPS at a stronger-than-expected pace, all other variables remaining equal.

EBAY – Q3 2022 Earnings Presentation

The problem with eBay as an investment in 2022 has been the slowdown in e-commerce retail interest by consumers around the world (especially in the U.S.), as physical stores draw larger crowds, with COVID fears and mandates fading over time. The result has been sliding sales and profits overall. However, with the vastly lower share count, per share numbers have remained steady to showing slight growth.

My buy argument is focused on a still decent operating future, crossed with a near-decade low valuation on trailing results in late 2022. An above-average dividend yield story, and conservative analyst estimates for growth could mean prices under $40 per share are actually a bargain level, when we look back in a year or two.

Earnings Beat And Steady Guidance

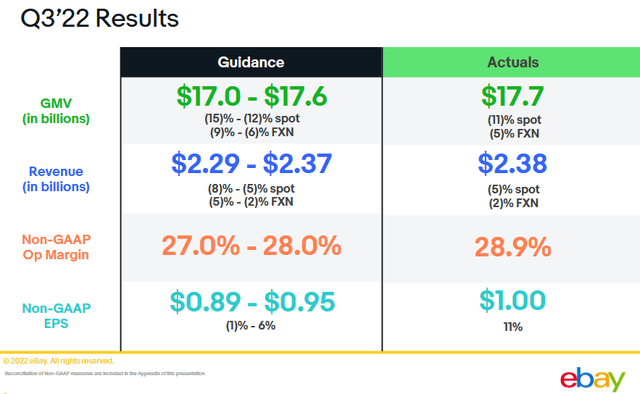

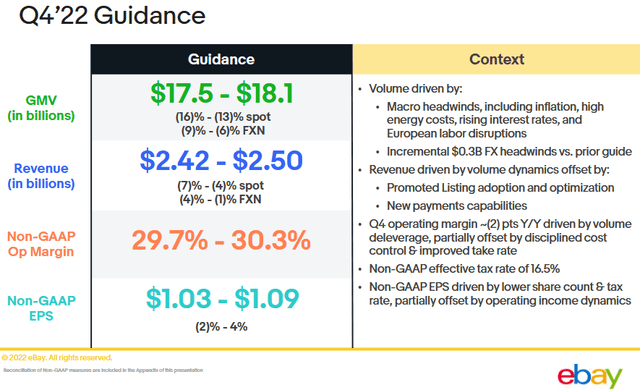

Almost nobody noticed that eBay actually outlined a much better quarter in September than expectations, and this good news report was one of the best in either online or brick-and-mortar retail. Plus, guidance for Q4 was far stronger than its main online competitor Amazon (AMZN). Amazon in comparison, downgraded its sales outlook for the important Christmas season by a whopping 5% to 10% vs. analyst expectations a few weeks ago!

Below are snapshots from the Q3 earnings presentation posted this week. Basically, Q3 numbers beat expectations, and slight progress is projected again for Q4.

EBAY – Q3 2022 Earnings Presentation EBAY – Q3 2022 Earnings Presentation

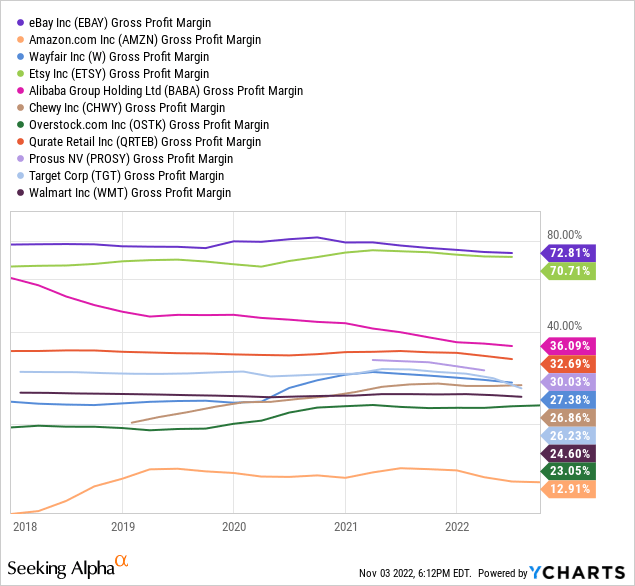

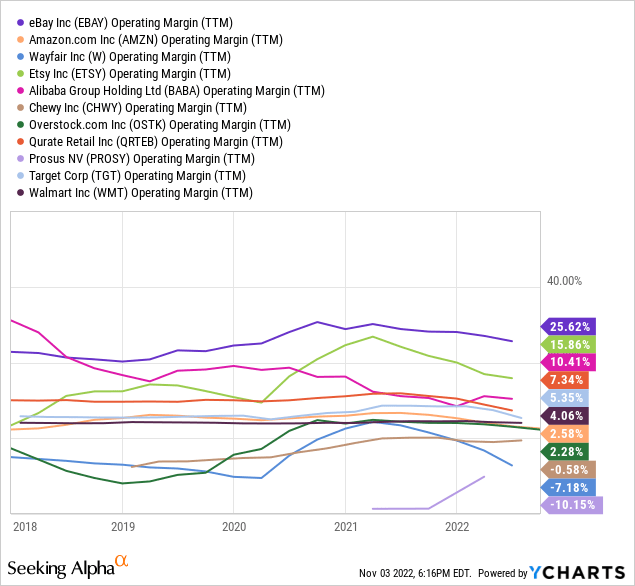

Strongest Margins For Online Retail

Believe it or not, eBay sports the highest gross and operating margins from a major company in the retail sector on Wall Street. Below are 5-year graphs of this positive and desirable investment foundation. I am comparing the company to the top internet-focused sellers Amazon, Wayfair (W), Etsy (ETSY), Alibaba (BABA), Chewy (CHWY), Overstock.com (OSTK), Qurate Retail (QRTEB) and Prosus NV (OTCPK:PROSY), plus the leading hybrid merchandisers (e-commerce and physical stores) Target (TGT) and Walmart (WMT).

YCharts – Online Retailers, Gross Profit Margins, 5 Years

YCharts – Online Retailers, Operating Profit Margins, 5 Years

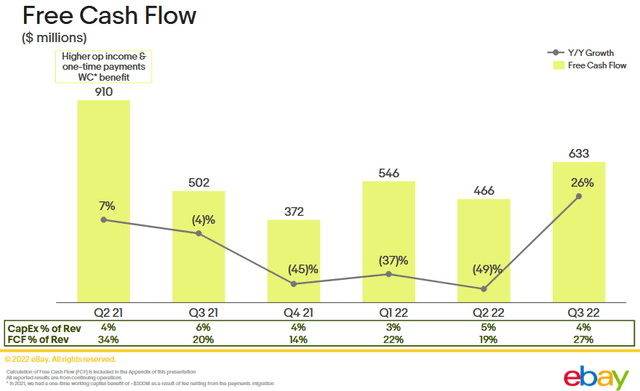

In addition, trailing 12-month free cash flow of $1.9 billion is noteworthy (adjusted for one-time and non-operating items). This sum represents a free cash flow yield of 9% on today’s $40 stock quote. In comparison, Amazon’s adjusted free cash flow yield is -1%, Target +2% and Walmart +1.5%.

EBAY – Q3 2022 Earnings Presentation

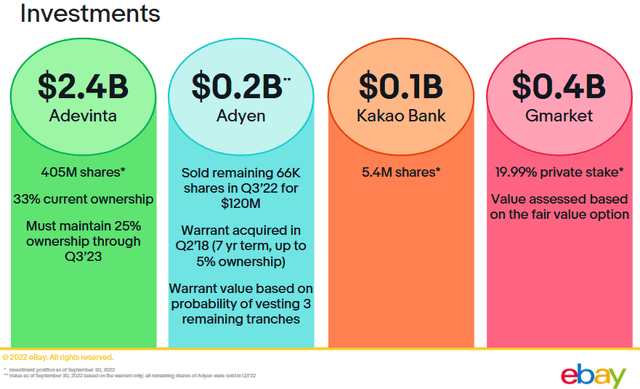

Another reason investors have shied away from eBay during 2022 is the bear market in technology-based retailers has crushed the worth of its varied investments in other firms. The company remains involved in incubating new online retail ideas and retained ownership in four other investments worth $3.1 billion at the end of September.

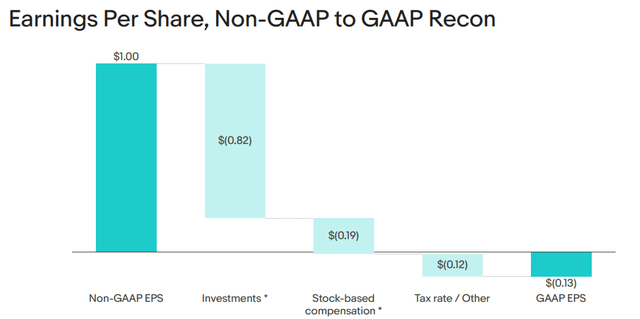

For example, Adevinta ASA (OTCPK:ADEVF) is a major online classified business in Europe, still 33% owned by eBay. The market value of this holding has tanked by -60% over the last year, causing paper asset writedowns against GAAP EPS. Including sliding worth in other owned online retail businesses in Asia, the company has been forced to mark down its extensive investments by some $4.2 billion this year. Current investment values and a reconciliation of cash earnings vs. GAAP reported results are highlighted below, a function of the nasty bear market in technology assets in 2021-22. The good news is a stabilization or reversal in tech stock fortunes in 2023 will flow back to “GAAP earnings” and balance sheet net worth (liquidation book value).

EBAY – Q3 2022 Earnings Presentation EBAY – Q3 2022 Earnings Presentation

The Value Proposition

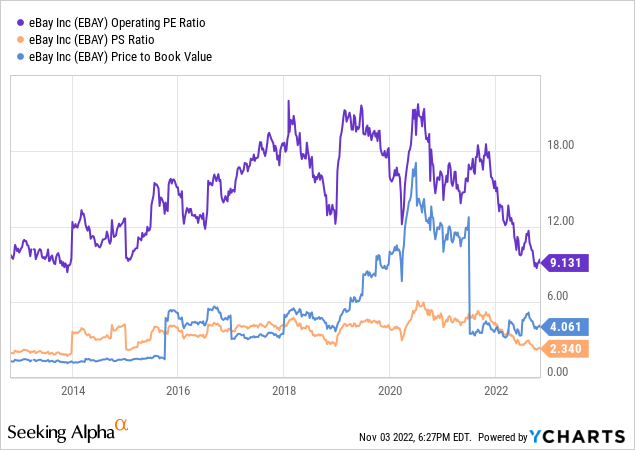

My research suggests eBay is trading at its cheapest valuation on trailing business fundamentals since 2013. It’s not easy finding any retail stock or Big Tech name valued the same as nine years ago, even after the nasty U.S. equity bear market price decline of 2022. Then, contemplate how this low valuation setup fits side-by-side with a decent growth future. In the end, growth and value characteristics delivered by a single investment during a recession may start to garner greater analyst/trader interest soon.

Price to trailing annual earnings (operating to smooth out all the restructuring changes), sales, and book value are drawn below.

YCharts – EBAY, Price to Trailing Operating Earnings, Sales, Book Value, Since 2012

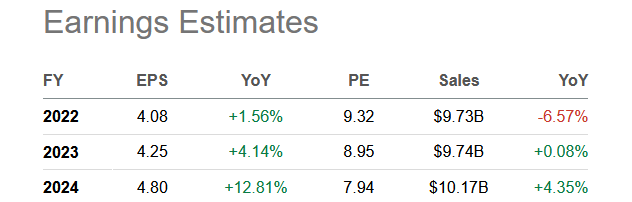

I personally believe the slowing economy, high inflation world of 2022-23 is a terrific backdrop to highlight the mettle of eBay’s assets. I am modeling the analyst consensus view on EPS and sales gains into 2024, pictured below, will prove to be on the low side of reality. Abnormal sales softness from COVID reopenings is being misinterpreted by Wall Street as a forward trend past 2022. I disagree. Cash EPS of $4.50+ next year and $5+ in 2024 seem more reasonable estimates to me.

Seeking Alpha Table – EBAY, Analyst Estimates for 2022-24, November 4th, 2022

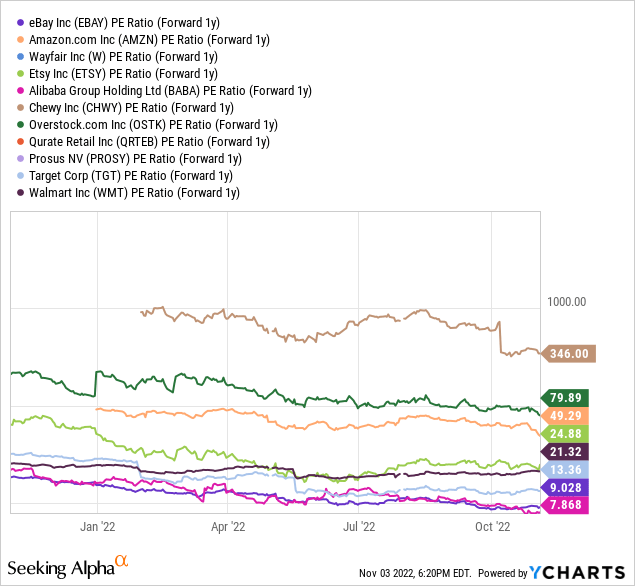

Only the Alibaba trainwreck of Chinese government intervention provides a better price to forward 1-year EPS ratio. And, if I am correct, the 9x multiple outlook is even lower for eBay as earnings likely beat expectations next year. (Note: several peer companies are projected to show negative income next year and are not pictured.)

YCharts – Online Retailers, Forward Estimated 1-Year P/E Ratios, Since October 2021

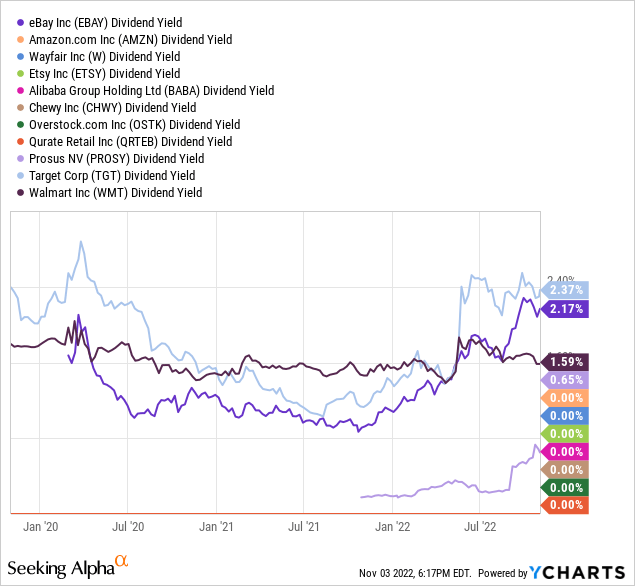

The last piece of the investment puzzle, working in favor of eBay ownership, is the company pays a solid dividend yield, sure to rise in the future on improving earnings and cash distribution payouts. The trailing 2.1% cash yield is higher than every other company in the peer retail/tech group, outside of Target’s similar level. Since the dividend represents just 25% of free cash flow, management has the ability to double it or more in coming years as earnings growth continues. The dividend story is A+ for the group, and perhaps an A-rated setup vs. all the companies in the S&P 500 index (with a blue-chip average 1.7% trailing yield and estimated 50% payout today from free cash flow generation).

YCharts – Online Retailers, Trailing Dividend Yield, 3 Years

Technical Trading Momentum

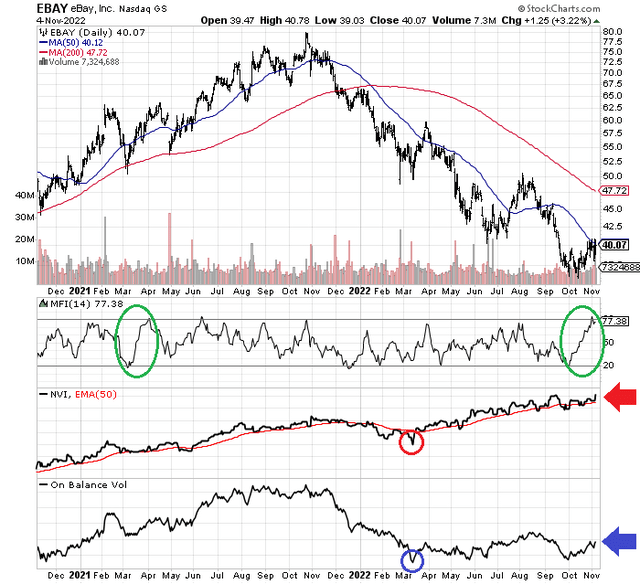

My last bullish argument is selling pressure in the stock has been subsiding rapidly since the summer. I have charted a 2-year picture below of daily price/volume changes, alongside several of my favorite momentum indicators.

We can review the monster uptick in the 14-day Money Flow Index, circled in green, witnessed over recent trading. The October reversal from selling to buying interest has not been this extreme since March 2021. Following that instance, price rose +30% over the next six months.

In addition, the Negative Volume Index (marked with a red arrow and circle) and On Balance Volume (marked with a blue arrow and circle) both bottomed in March 2022. My read is selling since $50 in the spring has been more of an arbitrage play riding sector weakness. It has not been a company-specific liquidation event.

StockCharts.com – EBAY with Author Reference Points, 2 Years of Daily Changes

Final Thoughts

With $3.1 billion in easily sold investments in other technology businesses overseas, today’s $21 billion equity market capitalization looks even cheaper than most of the price and EV ratios presented in this article. If its long-term investments rebound in worth next year and are liquidated, an extra 15% to 20% in total value on share buybacks or a special dividend could be harvested. This financial flexibility creates a conservative balance sheet, as investments and current assets like cash approach total liabilities. Given stagnant earnings/cash flow, and depending on the future value of these investments, I figure the company could theoretically be net debt/liability free in 2-3 years.

My view is eBay at $40 is a stock with low investment “risk” built into the price, but unlimited upside in a high-inflation environment over the rest of the decade. Realistically, a severe recession could be largely discounted in the stock quote. Remember, a weakening economy may actually be good news for transaction volumes of used goods and collectibles, if individuals around the world need money fast to pay bills and shore up income levels failing to keep up with cost-of-living adjustments. In this sense, a high-inflation recession (stagflation) may not hurt company finances and growth at all. So, putting a decade low valuation on trailing results would be my worst-case scenario (outside of a depression), equal to about $35 per share.

On the flip side, looking at potential upside, I am using $60 as “fair value” analyzing the last decade of trading fluctuations vs. underlying business results. Of course, a rebound in the stock market during 2023, with Big Tech stocks rerated with higher multiples on lower inflation and an improving economy generally would be the best future for eBay shareholders. It’s kind of a win-win from the macroeconomic backdrop, regarding eBay’s investment price future. The outlier events of a stock market crash or once-in-a-lifetime depression appear to be the only honest possibilities preventing a nice stock market return for buyers under $40.

Given a number of potential levers that the Federal Reserve and Washington politicians could pull to change economic reality, my research suggests today’s $40 quote is getting close to a screaming buy. Best-case upside beyond $60 in 12-18 months, vs. worst-case downside to $35 generates an investment total return forecast range of +52% vs. -11% over the next 12 months. Nothing spectacular for gains, but also an idea with far greater reward than risk. I rate eBay shares a Buy for long-term investors, and own it with an average position size in my portfolio.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment