wdstock/iStock via Getty Images

There has been a lot of talk about recession lately. Recession is not a certainty, but we certainly are trembling on the brink, barring a major turnaround.

During such times, investors are often interested in low-volatility, high-yielding securities. Easterly Government Properties (NYSE:DEA) pays an above-average 5.4% Yield, and its federal government tenants remain stable payers in all economic conditions.

Meet the company

Easterly Government Properties

Easterly Government Properties, founded in 2014 and headquartered in Washington, DC, owns 93 operating properties across 29 U.S. states, with a total of 9 million square feet under lease. Easterly is the second-leading owner of federally leased real estate in the country, behind only Boyd Watterson. The weighted average age of Easterly buildings is 13.6 years, the weighted average remaining lease term is 10.1 years, and the occupancy rate is a near-perfect 99%. Almost two-thirds of the buildings are office space, with another 16% VA outpatient facilities, 7% labs, and 4% courthouses. And of course, 100% of all lease income is backed by the full faith and credit of the United States government. Ahem.

The GSA (General Services Administration) leases 188 million RSF (rentable square feet) in 6800 locations every year. Of this, 119 million RSF are in properties of over 40,000 RSF each (1000 leases in 800 locations). Since 1998, the GSA has increased its leased properties by 23%, and now leases more real estate than it owns. That trend is likely to continue.

The GSA leases 71 million RSF (500 locations) in single-tenant buildings. The VA (Veterans Administration) also has 4 million RSF in 50 single-tenant locations. Together, these single-tenant locations form Easterly’s total market of 75 million RSF in 550 locations.

Easterly begins by selecting agencies with

- enduring missions,

- growing head count, and

- increasing priority, especially those that are

- engaged in security-related work

- core mission agnostic as to political party

Easterly seeks buildings that are

- Class A construction, less than 20 years old,

- at least 85% leased to a single government agency, and

- at least 40,000 RSF, with expansion potential

- in strategic locations, critical to the agency’s mission, thus minimizing the agency’s options in moving to another building

Because of all these features, DEA is not your typical office REIT. It is much less susceptible to business cycle fluctuations and work-from-home.

Some agencies also require special, build-to-suit features in a building, and the existence or development of such features further enhances the stickiness of the lease. Easterly also builds some facilities, provided they have at least a 10-year lease term guaranteed.

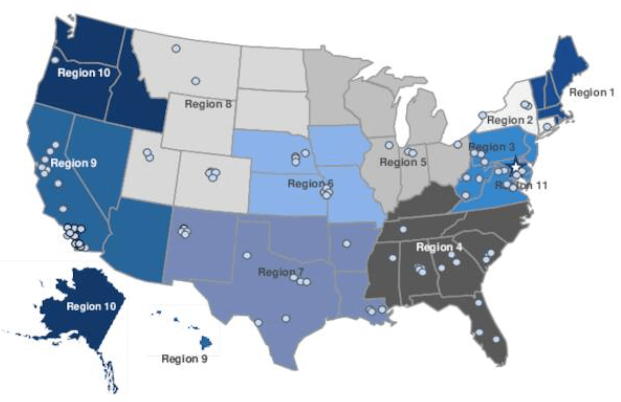

The GSA is divided into 11 regions. Easterly owns properties in all 11, with the greatest concentrations in Region 11 (around Washington, DC) and Region 9 (California). All GSA leases contain operating expense escalators of CPI (Consumer Price Index) + 1.4% starting in year 2, and CPI plus 7.8% starting in year 3, providing Easterly a measure of protection from inflation.

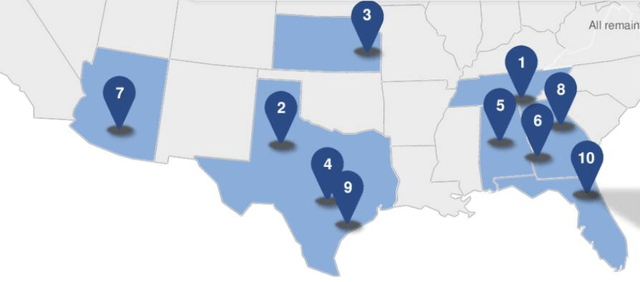

Company investor presentation

Easterly’s VA portfolio includes 10 properties, in 7 states in the southern half of the U.S., totaling 1.2 million RSF, 100% occupied, with average lease terms of 19.6 years.

Thus far in 2022, Easterly has acquired two new non-VA facilities: one for the FBI (Tampa, Florida), and one for the National Archives (Broomfield, Colorado). The two buildings total just under 300,000 RSF, and both have build-to-suit features completed years ago. The archives building provides services across 7 states, and is 100% leased through 2032, while the FBI building is a regional headquarters, 100% leased through 2040.

Easterly has only six leases expiring in 2022 and 2023, representing just 5.2% of annual lease income, and about 473,000 RSF. The FBI building in Birmingham and the EPA building in Kansas City have already renewed for 20 more years. The two combine for about 151,000 RSF and 2.7% of annual lease income.

Opportunities abound. The top 10 owners of federally-leased assets combined have only 26% of the total, with no single landlord owning more than 5.4%. Easterly is number 2 on the list, with 4.8%.

Barriers to entry are high, as these large building acquisitions are capital-intensive, and require thorough familiarity with all the paperwork and procedures involved in dealing with the GSA.

Easterly tracks acquisition opportunities through a proprietary database, and is currently evaluating about $350 million worth of potential purchases. The company also grows through build-to-suit development projects, as noted above, completing one each in 2018, 2019, and 2020. The company is currently building an FDA facility in Atlanta, with completion expected in 2024.

Growth metrics

Here are the 3-year growth figures for FFO (funds from operations), TCFO (total cash from operations), and market cap.

| Metric | 2018 | 2019 | 2020 | 2021 | 3-year CAGR |

| FFO (millions) | $73.1 | $94.4 | $111.3 | $124.2 | — |

| FFO Growth % | — | 29.1 | 17.9 | 11.6 | 19.3% |

| FFO per share | $1.17 | $1.20 | $1.26 | $1.31 | — |

| FFO per share growth % | — | 2.6 | 5.0 | 3.9 | 3.8% |

| TCFO (millions) | $62.8 | $142.3 | $145.2 | $118.3 | — |

| TCFO Growth % | — | 126.6 | 2.0 | (-18.5) | 23.5% |

| Market Cap (billions) | $0.95 | $1.77 | $1.83 | $1.97 | — |

| Market Cap Growth % | — | 86.3 | 3.4 | 7.7 | 27.5 |

Source: TD Ameritrade, CompaniesMarketCap.com, and author calculations

Easterly crossed the market cap escape velocity threshold of $1.4 billion in 2019, and has remained above it ever since, growing steadily right through the pandemic, but remaining a lower mid-cap. Despite its pedestrian 3.8% growth rate in FFO/share, DEA’s growth rates for FFO and TCFO are eye-popping and FROG worthy.

Meanwhile, here is how the stock price has done over the past 3 twelve-month periods, compared to the REIT average as represented by the Vanguard Real Estate ETF (VNQ).

| Metric | 2019 | 2020 | 2021 | 2022 | 3-yr CAGR |

| DEA share price July 18 | $18.71 | $22.70 | $21.83 | $19.38 | — |

| DEA share price Gain % | — | 21.3 | (-3.8) | (-11.2) | 1.18 |

| VNQ share price July 18 | $88.88 | $78.67 | $105.31 | $91.14 | — |

| VNQ share price Gain % | — | (-11.5) | 33.9 | (-13.5) | 0.84 |

Source: MarketWatch.com and author calculations

Lack of share price Gain is the only thing that disqualifies DEA as a FROG. It is a value play, rather than a growth play. DEA investors avoided the 2020 pandemic sell-off, but also missed out on the epic 2021 REIT rally.

Balance sheet metrics

Here are the key balance sheet metrics.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| DEA | 1.83 | 35% | 7.6 | — |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

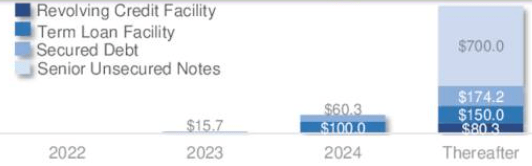

Easterly currently faces no debt maturities for the remainder of 2022, and only $15.7 million in 2023. Then it jumps to $160.3 million in 2024, with the remaining $1.1 billion due thereafter.

Company investor presentation

Dividend metrics

Easterly pays a higher current Yield than most REITs, even those in the high-yielding Office sector. However, its dividend growth rate is anemic, leaving it with a Dividend Score very typical for an Office REIT, which is to say, nice and fat. Its payout ratio is aggressive at 80%, but its Dividend Safety rating of D+ is picture perfect. (Safety ratings higher than C suggest to me that the company could be doing more for the investor, while safety ratings of D or lower suggest the dividend could be in danger of a cut, which spells disaster for any REIT. A D+ suggests the company is doing everything they can for the investor’s cash flow, short of risking a cut.)

| Company | Div. Yield | Div. Growth | Div. Score | Payout Ratio | Div. Safety |

| DEA | 5.41% | 0.6% | 5.51 | 80% | D+ |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Dividend Score projects the Yield three years from now, on shares bought today, assuming the Dividend Growth rate remains unchanged.

Valuation metrics

DEA is appropriately priced at 14.6 times 2022 FFO, a little higher than the Office REIT average, which is well justified, but considerably below the REIT average overall. High Yield at a low price. Music to the value investor’s ears.

| Company | Div. Score | Price/FFO ’22 | Premium to NAV |

| DEA | 5.51 | 14.6 | (-10.9)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

What could go wrong?

The full faith and credit of the U.S. government is not what it used to be. The Federal government simply is not as stable as we have become accustomed to thinking it is.

To address this risk to Easterly requires an acknowledgment of the political facts of our country at this time. Because this is a touchy subject, I will keep this to facts and logic, and leave my opinion out, as much as possible. I would appreciate it if you would do the same in the comments.

According to the law and the Constitution, Joe Biden is the legitimately elected President of the United States. The theory that there was a concerted effort by the Democrats to steal the 2020 election by fraud has been thoroughly tested in court, in over 60 lawsuits, all of which failed. Many of those courtrooms were presided over by Trump-appointed judges, so we can rest assured those cases got as friendly a hearing as the law would allow.

Only one of those court actions merited appeal. That case did not allege fraud, but simply challenged the legality of approximately 10,000 ballots in Pennsylvania, a state which Biden won by about 80,000 votes. The Supreme Court declined to hear the case.

The Declaration of Independence reads in part,

That whenever any Form of Government becomes destructive of [the unalienable rights of the people], it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to affect their Safety and Happiness.

Thus, the people have a right to withdraw their consent and seek to alter or abolish the Federal government. This appears to be exactly what some wish to do, and the sentiment has become mainstream. The Republican Party of Texas at its recent convention, adopted a resolution that reads,

We reject the certified results of the 2020 presidential election, and we hold that acting President Joseph Robinette Biden Jr. was not legitimately elected by the people of the United States.

Texas is by far the most populous of all the states carried by the Republican Party in the last 5 Presidential elections. It is as mainstream as Republican politics gets.

Millions of Americans now regard the Federal government as illegitimate. This bodes ill for 2024. If one major party refuses to abide by the results of any election they don’t win, free and fair elections become impossible. We are rapidly reaching a point where no matter who wins the 2024 election, millions (perhaps tens of millions or hundreds of millions) will regard the U.S. government as illegitimate.

The increasing perception of illegitimacy surrounding the U.S. government likely would lead to tax revolts of various kinds, which would affect the Federal government’s ability to pay its bills, and thus poses a risk to Easterly Government Properties and its revenue stream.

Investor’s bottom line

As long as the U.S. government holds together, Easterly Properties will be a reliable dividend payer. Its share price floats placidly along in all types of economic conditions. If that’s all you want, DEA is a good choice for you. As an investor, I personally want a company that is not just stable, but vibrant, so I consider DEA a Hold.

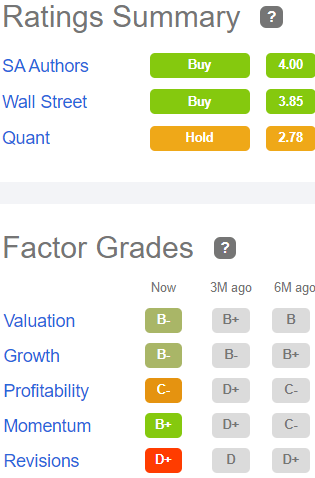

Seeking Alpha Premium

Ford Equity Research and the Seeking Alpha Quant ratings concur with my rating, as do Jeffries, Truist, and Raymond James. The average price target is $22.50, implying about 15% upside. Revisions-sensitive Zacks rates DEA a Sell. So as usual, it’s anybody’s guess.

Be the first to comment