vittaya25

This article on DZS Inc. (NASDAQ:DZSI) has some similarities as my last one on Broadcom (AVGO). Similar to Broadcom, DZS Inc. is involved in the broadband business, has an attractive valuation, strong growth, and the potential for widening margins. One of the main differences is that Broadcom is a large, well-known company, while DZSI is a small, underfollowed company.

I expect DZSI to outperform the S&P 500 over the next several years due to the likelihood of the company achieving above-average growth from a reasonable valuation. DZSI has positive growth catalysts that are likely to provide a boost for the stock over multiple years.

Company Background

DZSI provides Broadband network access solutions and communications platforms in North & South America, Europe, the Middle East, Asia, and Africa. The company’s Velocity product offers Broadband connectivity solutions, high-definition video, high-speed internet access, switching & routing products, and business class services. The XCelerate product increases the velocity so that service providers can leap to multi-gigabit services. DZS Helix offers connected home and business solutions. DZS Chrome enables mobile operators to upgrade to 5G wireless technology. DZSI also offers cloud software solutions that support RAN and 4G/5G networks through DZS Cloud.

Positive Growth Catalysts

DZSI is seeing strong demand for its solutions even in the face of economic uncertainty. This demonstrates that the company’s business has some resilience during economic downturns. DZSI’s service provider customers are focused on upgrading their fixed and mobile networks to increase customer retention and revenue while lowering operating costs. DZSI’s solutions help service providers accomplish those goals.

The current and future broadband environment acts as a tailwind for DZSI and its customers. Reliable connections are important for businesses and workers to operate efficiently and for consumers to enjoy entertainment when they are not working. The work-from-home trend shows the need for reliable broadband connections.

The global broadband services market is expected to grow at about 9.1% annually to be worth about $707 billion by 2028. The expected growth is being driven by the demand for advancing technology providing improved user convenience/consumer awareness, proactive government initiatives, and the increased use of various devices (smartphones, tablets, notebooks, and other connected devices).

Other drivers of broadband growth include: increased video calls for conferences and personal use, more online classes in education, increased online shopping, and increased consumption of online entertainment.

DZSI is expected to grow revenue by about 14% to 15% and earnings by 70% in 2023 according to consensus estimates. The company is expected to average 20% annual earnings growth over the next 3 to 5 years. As a comparison, companies comprising the S&P 500 (SPY) are expected to grow earnings at an average of about 12% annually over the same period. DZSI’s above-average growth has the likely potential to drive the stock to possibly outperform the broader market as measured by the S&P 500.

Potential for Increased Profit Margins

Currently, DZSI’s gross margin of 33% lags the sector median GM of 50%. However, DZSI can increase its GM by growing its software and service business. One bright spot for this portion of the business is that the total addressable market for cloud software is expected to grow at a CAGR of 41% over the next 2 years.

Over the past two years, DZSI built a cloud software portfolio that complements the company’s other solutions. DZSI acquired RIFT a disruptive cloud platform in 2021. In Q2 of 2022, the company acquired ASSIA’s Service Assurance and WiFi management software portfolio. Software tends to have wider margins than hardware. As a result, DZSI can help drive higher margins by increasing recurring software revenue over time. The company stated in its latest SEC filing that this is one of their initiatives.

The company expects to achieve a gross margin of 33% to 35% in Q3 2022 with the full year GM expected to be 32.5% to 34.5%.

DZSI is increasing transparency by reporting 2 business segments starting with Q3 2022. The Software and Services segment currently comprises 9% of total revenue. Reporting this segment will allow investors to see the growth of the software/services portion of the business which can help increase profitability over the long term. The other reportable segment will be Access Networking which is DZSI’s broadband connectivity and mobile transport offerings.

Valuation

Since DZSI is a high-growth company, I like to use the PEG ratio to analyze the valuation since it takes the 3- to 5-year earnings growth rate into consideration. DZSI is trading with a PEG of 1.88. This is right in the reasonably valued range of between 1 and 2 for the high-growth companies that I have covered. Companies trading in this range with high earnings growth tend to outperform the S&P 500.

DZSI is trading slightly above the Communication Equipment industry’s PEG ratio of 1.74. However, DZSI is still trading at a fair valuation with its PEG ratio under 2.

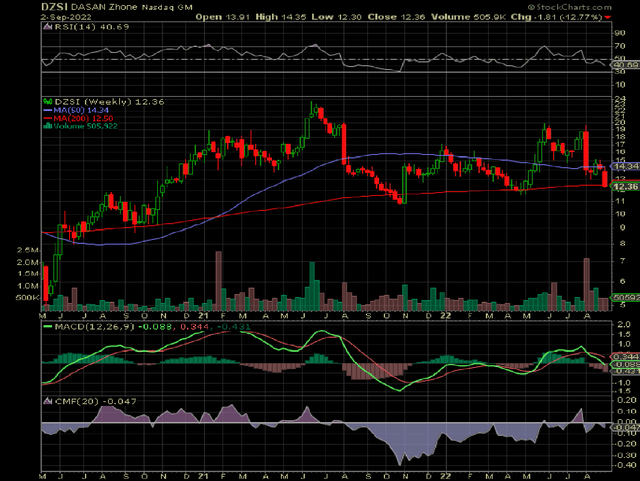

The weekly stock chart above shows the price dropping to the 200-day moving average. The 200-day has provided support for the stock on the weekly chart on numerous occasions. So, it is possible that it bounces higher from here again. The money flow (CMF) has been increasing since November 2021. This indicates that investors were accumulating the stock during this time after the sharp sell-off last year.

The daily chart above shows the stock near an oversold level according to the RSI. It is possible that the price bounces higher soon from this level. The stock also has support in the $12 range. Watch for a confirmation of a change in trend, indicated by the green MACD line rising above the red signal line. Also, the RSI should be pointing back up at the same time.

DZS Inc. Long-Term Outlook

The long-term outlook looks positive for DZSI. The company has a strong tailwind with the expected long-term growth for broadband. DZSI’s move into the software/services business is likely to widen margins over the long term for improved profitability.

The valuation is reasonable enough to allow for further price appreciation as the company continues to grow. The stock is likely to outperform the S&P 500 over multiple years, with DZSI’s expected average annual earnings growth of about 20% over the next 3 to 5 years.

Analysts have a one-year price target of $22 for the stock. This represents a potential gain of 78% over the current price. Just keep in mind that a possible recession over the next year could delay that size of a gain.

Be the first to comment