claffra/iStock via Getty Images

Introduction

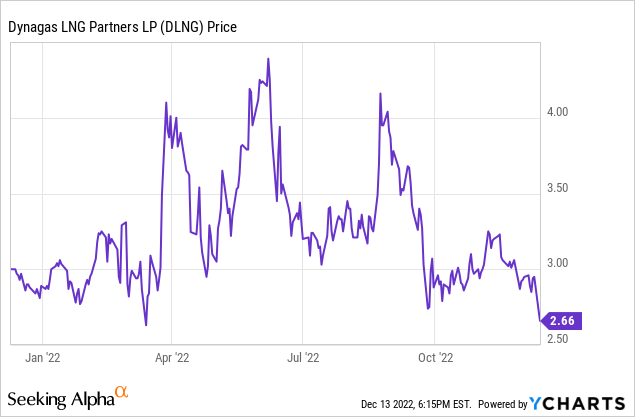

I have been keeping an eye on Dynagas LP (NYSE:DLNG) the past year. Not for the common shares as the distributions remain suspended as every available incoming dollar is used to reduce the gross debt and net debt, but I am very interested in the preferred shares. Although the obvious priority right now is to pay down debt, Dynagas continues to make its preferred dividend payments and as the prices of the preferred shares have been going down a bit, I think the risk/reward ratio is now pretty intriguing.

A dive into the Q3 results

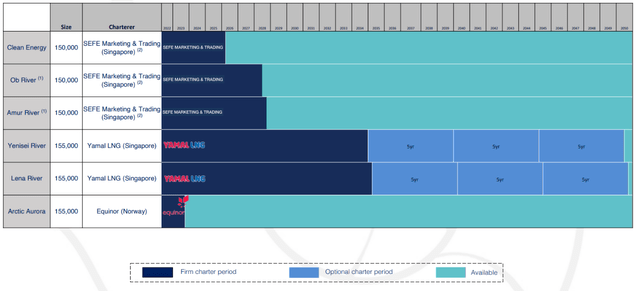

In this article I will mainly focus on the Q3 results. For a better understanding of the company’s business model and how the sanctions on Russia are impacting Dynagas’ business, I’d like to refer you to this older article from a few months ago.

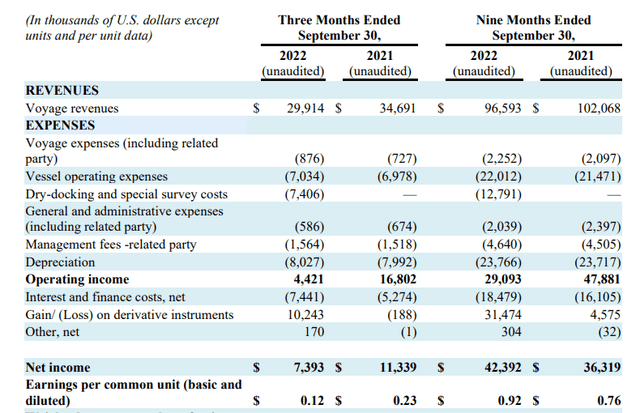

During the third quarter, the total revenue came in at $29.9M. That’s lower than the total revenue in the third quarter of last year and the revenue in the first few quarters of this year, and this could be explained by the dry-docking schedule: Two vessels were scheduled for a dry-dock in July and August so there is no reason to be worried about the revenue decrease: this is entirely related to the 67 off-hire days.

The combination of a lower revenue and higher dry-docking costs (which are expensed and not capitalized by Dynagas) caused the operating income to fall by more than 70% compared to a year ago: the operating income was just $4.4M and even after adding back the net finance income of almost $3M resulted in a net income of just $7.4M.

The interest rates on the market are increasing, and so is Dynagas’ cost of debt. However, Dynagas made the smart choice to hedge its interest expenses for the next two years, and that’s why there was a gain on derivative instruments which helps to mitigate the impact of higher interest rates.

That’s why it’s important to judge Dynagas based on its cash flow result and not on its net income which is pretty volatile as any change in the interest rates will have a big impact on the value of the interest hedge.

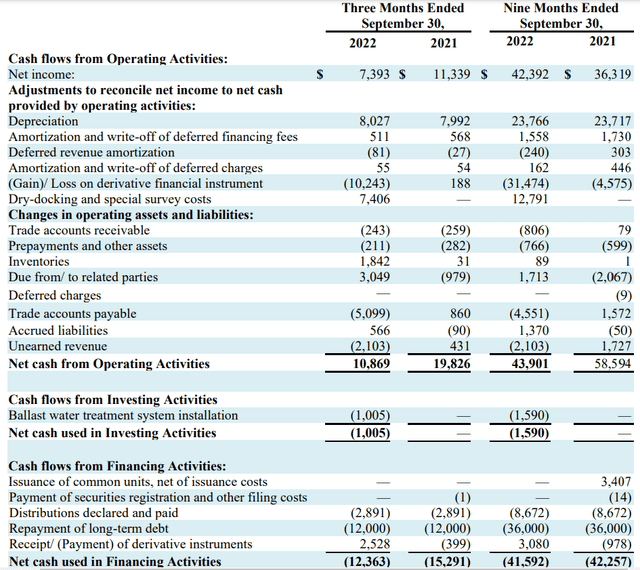

The reported operating cash flow was $10.8M for the quarter and as you can see below, this removes the $10.2M non-cash gain on the interest hedges, but it also adds back the $7.4M in dry-docking and special survey costs. I’m not quite sure what this refers to as the other dry-docking expenses incurred earlier this year were also added back to the cash flow statement. On the conference call, the management referred to a Q4 cash outflow related to the outstanding payments of the dry-docks. While that makes sense for the Q3 dry-docks, I had expected to see a portion of the dry-dock expenses to already have been paid, so this definitely is something I’ll have to keep an eye on in the Q4 financial statements.

After adding back the net investment in the working capital position of $2.2M, the adjusted operating cash flow was $13M and the free cash flow was approximately $12M after deducting the $1M capex. If you would include the positive cash impact from the interest rate hedges, the underlying free cash flow result was $14.5M.

Keep in mind this likely means the Q4 cash flow result will be weak due to the timing of the dry-docking payments. However, this should be compensated by having fewer off-hire days so I still expect Dynagas to be free cash flow positive in the final quarter of the year.

And as you can see, DLNG continues to make debt repayments and it wired another $12M back to its lenders during the quarter. As of the end of September, Dynagas LNG Partners had almost $98M in cash and $528M in gross debt for a net debt of approximately $430M. Subsequent to the end of the quarter, Dynagas made a $18.7M payment to the credit facility. This will help to keep the pressure from increasing interest rates limited. While the LP has indeed hedged its interest rate exposure, keep in mind that the gain on these hedges is predominantly non-cash: of the $10.2M gain reported on the interest rate hedges, only $2.5M was a cash gain.

There’s no distribution in sight for the common units, but the preferreds are increasingly attractive

As I explained in my previous article:

Back in September 2021 I definitely preferred the Series A of the preferred shares as those offer a fixed 9% preferred dividend ($2.25 per share, payable in four equal quarterly tranches of $0.5625 per share). The B-Series were interesting but did not offer as much protection as those B-shares will soon offer a floating preferred dividend. From November 2023 on, the quarterly preferred dividend will be set at the 3M LIBOR + 5.593%. The LIBOR will no longer be in use, and the quarterly preferred dividend will likely use the 3M SOFR as benchmark.

The 3M SOFR rate is currently established at approximately 4.5%, and this means the preferred dividend yield could exceed 10% on the principal amount and based on Tuesday’s closing price of $22.90 the current yield could reach 11%. Of course, the reset date is still almost a year away and a lot can happen between now and then. The B-series are trading with (NYSE:DLNG.PB) as ticker symbol.

If the situation doesn’t change, the Series-B of the preferred shares are becoming too good to ignore. But there’s a second option. Those who want additional visibility should purchase the Series A. These preferreds have a fixed preferred dividend of $2.25 per share. At Tuesday’s closing price of $22.91 the current yield is approximately 9.8%.

Investment thesis

I think the preferred shares of Dynagas Partners offer an excellent risk/reward ratio. Income-seeking investors who think the short-term interest rate will remain high and the 3 month SOFR rate will continue to exceed 3.75-4% should buy the B-Series of the preferred shares. I’m leaning towards the A-series as I simply prefer knowing what I’m getting into as these types of preferred securities are a useful addition to my ‘low maintenance’ income portfolio: a sub-portfolio where I don’t want to spend too much time on checking what’s changing on a daily or weekly basis.

I am not interested in the common shares. I do have a small long position in the Series-A of the preferred shares and I expect to continue to expand this position as the current share price is pretty attractive.

Be the first to comment