bernersteven/iStock via Getty Images

WisdomTree Japan Hedged Equity Fund (NYSEARCA:DXJ) is a way to get broad-based Japan exposure while hedging FX risks. Reopening helps many of the businesses in DXJ with substantial local exposures across many of the defining stocks. There is also a fair bit of energy exposures which we think are well positioned. The downside is that there’s a decent amount of exposure to consumer durables, and those have a lot of exposure to markets outside of Japan which have already benefited substantially from reopening. Japanese markets are cheaper than most, and durables exposures are probably offset by some other more well positioned markets. We think it warrants some attention.

DXJ Breakdown

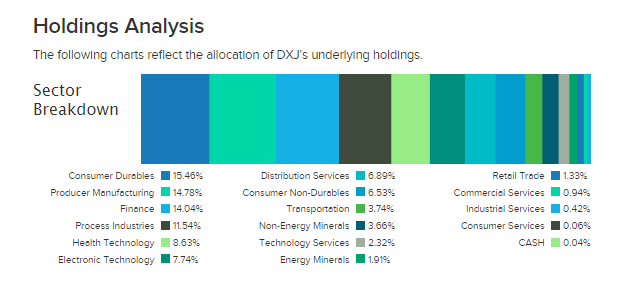

Let’s start with some broad notes on sectoral exposures.

Sectoral Exposure (etfdb.com)

There’s quite a bit of consumer durables exposure and it comes primarily from the automotive exposures in DXJ, consistent with the major automotive exposures in the Japanese economy. Big elements include Toyota Motors (TM). Financial companies are also quite a relevant exposure, and those are mostly full-service banks. Those, unfortunately, have substantial Japanese exposure, and therefore do not benefit from rate hiking that is happening in the rest of the world.

The rest of the exposures are quite cyclical, but benefit from substantial, local, Japanese exposure. There’s also a fair bit of energy exposure among the Shosha companies like Mitsui (OTCPK:MITSF), and our opinion is that energy will remain advantaged thanks to market dislocations. With the back breaking on inflation in every jurisdiction as the cost-push components of inflation see decline, speculative forces over the last months that were concerned with falling demand should reverse as supply remains structurally tight.

Bottom Line

DXJ’s stocks have substantial Japanese exposure. The recent jobs report show that there is a substantial surplus in job openings in Japan as the service sector ramps rapidly back up on a delayed Japan reopening. Tourism in particular was where jobs were seeing the most pronounced growth. Service oriented growth should fuel a lot of fragments of the economy. Consumer stocks like Nintendo (OTCPK:NTDOY) should see their substantial Japan exposures being well supported, likewise electronics companies should see sustained demand from customers in local markets. While quite a few of the exposures are commodified, and global market conditions affect pricing, they have niches in their Japan-facing exposures, and economies like the US will continue to support global demand as their recession appears to be quite mild. Even the consumer durables exposures have substantial Japanese markets in some cases, and those will be somewhat preserved not only by reopening but also favourable financing conditions for vehicles and local manufacturing that insulate local markets from FX effects, which we think will continue to play against Japan. The business benefits from weak FX but the DXJ insulates you from further Yen weakness, which we think is possible as the US is likely to proceed further with rate hikes.

The P/E is consistent with the lower multiples that we tend to see in Japanese markets at 12.2x. The expense ratio is also only 0.48%, which is pretty low considering the hedging that is going on to keep FX differentials under control. 0.48% is around average for any international ETF. With Japanese export and localised manufacturing benefiting from a weaker Yen, but the holding not feeling the pain in dollar terms, it’s yet another reason why investors may be interested in this ETF.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment