Jeff Swensen/Getty Images News

Even if the extension vote fails on October 10, the merger between Digital World Acquisition Corp. (NASDAQ:DWAC) (NASDAQ:DWACW) and former President Trump’s media company, Trump Media & Technology Group, is not dead. In this article I will examine the issues associated with the voting extension and how this SPAC merger deal still can be completed. While I again will try to avoid the politics involved in this deal, the reality is that politics could very much determine if the merger deal actually gets completed.

(I expect those who make comments on this article will avoid political bashing. Seeking Alpha is a financial website. However, those interested in political comments can visit the political part of SA’s platform.)

October 10 Extension Vote by DWAC Shareholders

DWAC shareholders are voting on a proposal that would approve additional time for DWAC and Trump’s media company to complete their proposed merger. It would allow an extension up to September 8, 2023. Because of a number of issues, this deal has been dragging on for a long time and may still take a long time before it is finally completed.

The biggest hurdle is that 65% of shares outstanding on record date, August 12, are required to approve the extension proposal. It is not 65% of shares voted at the special meeting-it is 65% of the outstanding shares. There are many problems trying to get to the magical 65%. First, a non-vote is effectively a vote against. Second, many shareholders never vote. Third, often brokers can vote shares on non-critical issues, such as accounting firms at annual meetings, but brokers in this case can’t vote shares that their customers have failed to vote.

For example, the recent vote to approve the merger of Rumble (RUM) with the SPAC CFVI only had about 57% of their shares voted at their special meeting. (They needed 50%+1 share to approve their merger.) Next, those who held DWAC on the August 12 record date and then sold those shares are still allowed to vote. Often shareholders feel uncomfortable voting on issues when they no longer are shareholders. This problem is even more complex with DWAC. If an investor was long DWAC on the record date and now is short DWAC securities, that investor would be very unlikely to vote those shares to approve the extension.

There were some problems with their original proxy solicitation firm, Saratoga Proxy Solutions, because it was replaced with Alliance Advisors. Saratoga was just a new very small proxy firm. Alliance is a very large, respected firm.

Since DWAC has so many tiny retail holders it is extremely difficult to have a successful proxy outreach program to contact shareholders. These proxy solicitations are difficult because all DWAC shares are in “street name” at brokers. The proxy firm, in this case, does not get proxies directly from shareholders who hold a stock in their own name, which would have allowed the proxy firm to see which “registered” shareholder has and has not voted yet.

I tried to find out if Alliance was able to get the list of “non-objecting beneficial owners”- NOBOs of DWAC and if they tried to contact them regarding voting their proxies. (I will post in the comment area any responses from them.) Shareholders who have instructed their brokers to have their accounts classified as “objecting beneficial owners”-OBOs have their holdings hidden and those names are not, in theory, ever given out that would allow direct solicitation by proxy firms. (Almost all my accounts are OBO accounts, except at a few discount retail brokerage firms.)

Insiders own 17.9% of the stock and have pledged to vote for the extension. Another 47.1 % of the shares would have to vote for the proposal for it to pass. Given all of these issues, the extension may not pass at the special shareholder meeting at 12 pm on October 10. (To listen to the meeting call 1-880-450-7155 and use passcode 74792551#)

Merger Can Still Be Completed Without the Extension

The extension proposal would allow for four three-month extensions for a total of twelve months to September 8, 2023, to complete the merger. Already the SPAC sponsor, ARC Global Investments II LLC, loaned DWAC $2.875 million to allow an extension to December 8, 2022. Even if the extension proposal is not approved, the parties could have until March 8, 2023, if the sponsor deposits an additional $2.875 million into the DWAC account, to get the deal done. While it would be clearly better to get an extension, the deal could be done by March if the SEC declares the S-4 effective in the immediate future.

If the merger is not completed DWAC would be liquidated, and shareholders, except those mentioned below, would receive cash for their DWAC shares. Holders of the warrants (DWACW) would, however, receive nothing-the warrants would be worthless. DWAC shareholders also currently have until 5 pm on October 7 to request a redemption of their shares, which would give them about $10.40. (Brokerage firms may have established their own time/date limits.) This redemption is somewhat different than a potential future liquidation.

There are some major incentives that have often been ignored in the media for the deal to be completed. The SPAC sponsor that holds 5.49 million founder shares and 1.13 million private placement units would receive nothing if DWAC is liquidated. The eleven institutional holders that hold 1.65 million founder shares would receive nothing. Directors and the CFO would also receive nothing for their holdings. Clearly these investors want this deal done.

The SEC is the problem. I know that I try to avoid politics in my DWAC articles, but the reality it is an issue here. If the Republicans gain control of either the house or senate, I expect those members who strongly support Trump will immediately call SEC officials to testify regarding why the SEC is playing politics for not declaring the Form S-4 effective, which allow the merger to move forward. Given how officials in other departments ignore what the Republicans assert, it is uncertain if this potential change in control of Congress will have an impact.

At this point, in my opinion, pressure on the SEC by congressional committees and/or litigation brought by Trump against the SEC in federal court mostly likely is needed to get this merger done. Trump even mentioned potential litigation in a recent statement: “In light of the obvious conflicts of interest among SEC officials and clear indications of political bias, TMTG is now exploring legal action against the SEC”.

Many in the media had negative opinions regarding investors representing $138.5 million of the potential $1.0 billion PIPE dropping out of the deal in September. I actually think the fact that there is still the potential of $861.5 million would still be available for financing TMTG after the merger is a huge plus. It would allow them to have a significant amount of cash to build the company before it reaches a positive cash flow.

As I covered in great detail in prior articles, there is the potential for extensive dilution under the terms of the PIPE deal. “It is possible that the parties will restructure the PIPE or renegotiate such arrangements in view of the PIPE closing conditions, evolving market and regulatory conditions” according to a filing in September. Often SPAC mergers only have PIPE financing around $100 million. This very large remaining amount is still very impressive.

Conclusion

The reality is and as many investors worried about over the last year, this SPAC merger case has become just a political tool using the SEC against Trump. I will pass over all the other political weapons used against Trump because I want to just focus on this merger. While the merger has been in trouble from almost day one, it is still achievable.

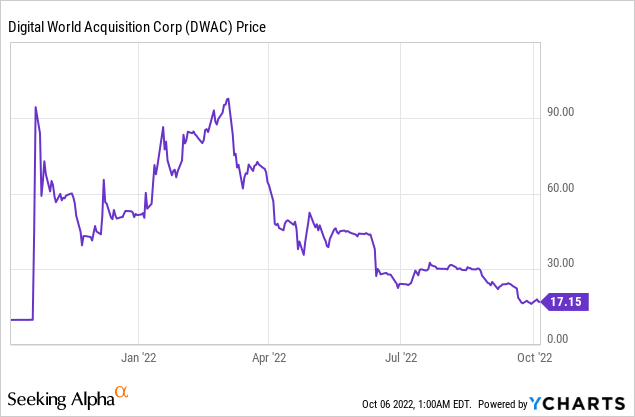

Given the difficulty of getting the needed 65% approval of shares outstanding, it would not be a shock if the extension proposal does not pass. I think the current stock price of DWAC reflects that it will not be approved. The merger deal can still be completed by March, but it will be tight, especially if the SEC continues to sit on the S-4. A Republican Congress might help get it done, but I have my doubts. It may take a court order. I continue to rate DWAC a hold.

Be the first to comment