Sundry Photography/iStock Editorial via Getty Images

DuPont (NYSE:DD) is a chemical company you’ll want to know how to trade/invest in. The company has significant upside at the right valuation – unfortunately, that valuation isn’t all that easy to find at times. I switched from “BUY” to “HOLD” back in January. Since that time the company has underperformed somewhat, though not as bad as broader indices.

Author’s Article, Dupont (Seeking Alpha)

As you can see, I have fairly straightforward targets for Dupont. It’s these targets that usually allow me to lock in fairly good profits as the stock goes back up. In this article, we’ll look at if we can buy DuPont at this time, or if we should just go ahead and buy something completely different.

Revisiting DuPont

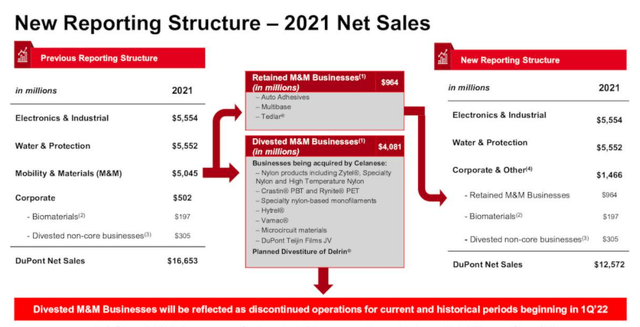

DuPont posted some very impressive end-year results. Aside from good 2021 results, the company has also shifted to a completely new reporting structure, reflecting its ongoing divestments where some of the businesses are being acquired by Celanese (CE), another chemical company I actually own quite a bit of stock in.

DuPont New Reporting Structure (DuPont New reporting)

In essence, the company no longer has a Mobility & Materials segment. DuPont is now Electronics & Industrial, Water & protection, and some Corporate and other segments which as you can see, reflect fairly low sales numbers. The company’s main segment and sales drivers will be the first two.

There are some overall sales impacts expected, around $4.4B because we’re now estimating the company’s M&M business as “discontinued” here.

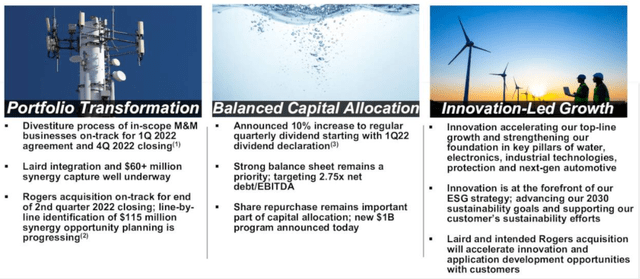

However, the main messages for DuPont are clear. First, the portfolio transformation is on track, and the company’s operational results are actually ahead of expectations here, due to massive customer demands and strong end markets.

The company has managed to fully offset raw material/input impacts with pricing actions alone, which means the company has maintained a price/cost neutral position for FY21. DuPont has plenty of strategies in order to deliver value to its shareholders.

DuPont Shareholder Value (DuPont IR)

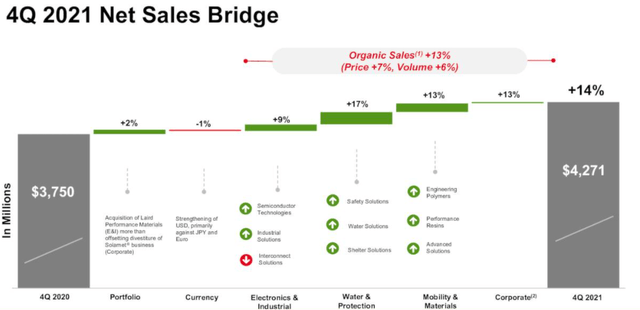

The company managed superb sales growth of 16% on a YoY 2021 basis, 14% of which was organic growth in all core segments. The company also managed to increase margins by a full percentage, with 95% in adj. EPS, and FCF of $1.4B during the year. The company really managed to navigate a very complex environment through price action.

That isn’t to say the company didn’t see some issues. Logistical costs were a horror show, with a $50M increase in one quarter alone, and they seem unlikely to let up for the time being. The company’s growth in sales can barely keep logistics and raw material inflation costs at bay.

Thankfully, the segment of M&M, which the company divested, was responsible for over 60% of the raw material inflation costs in the entire company. The remainder of the operations are spared more of this impact, and though it does exist, it’s far smaller. Company sales numbers clearly illustrate just how well the company is doing, and the overall appeal of its operations.

DuPont Sales Bridge (DuPont IR)

EPS saw negative impact from primarily logistics, but positives from volume and portfolio restructuring. Furthermore, the company is giving us FY22 guidance, with full-year net sales of upwards of $17.8B, and a full-year EBITDA of $4.5B on the high end, with an adjusted EPS not that far from $5/share on an adjusted basis. This is of course expecting that customer demand remains robust here, and the company continues to be able to manage some of the impacts well enough.

Overall, I have no issue giving you a positive picture of the company here. The customer demand, as evidenced by results and the company’s order book, remains incredibly strong, and the company has proven it’s able to offset some of the major negatives through price actions here, at least somewhat offsetting logistical effects and other issues here.

In other news, the Rogers acquisition remains on track, and it’s on track for a 2Q22 closing, which will result in the company’s ability to expand in key end markets. The company retains a superb balance sheet, with continued focus on share buybacks, dividend increases, and good capital allocation. The M&M segment will be fully divested from the company in late 2022, at which point DuPont will enter into a new era.

I, for one, like the company that’s being presented at the end of the tunnel here. I believe it has plenty of growth potential, and perhaps more importantly, growth potential in all the “right” segments and areas.

Risks?

Aside from your input pricing and logistical risks and as always, the M&A risks typical to any company, not that many significant ones. DuPont is a company that’s been around for some time. The one thing that seems to be that the headwinds aren’t going away or getting smaller yet. The company still expects sort of the same levels here.

So in the first quarter, we still see logistics as a headwind to earnings. They are probably in the same range that we called out for the fourth quarter of $50 million.

(Source: Lori Koch, 4Q21 Earnings Call)

While these are expected to go lower, and the company expects to be able to go neutral here in the end, there’s still a lot of impacts from some of these items we can expect to lower results here a bit for 2022. Raw material inflation also stays where it’s at for the full year – at least according to expectations.

So, overall the risk to DuPont is in the macro going forward – not in the company’s fundamentals or portfolio.

Let’s look at valuation.

DuPont’s Valuation

DuPont is a premium play on chemicals with a low yield but significant expected DGR. This is unlike many chemical companies, which are plays with higher yields but lower growth. What you prefer is, in the end, up to you. But I believe that chemicals and commodities companies make for excellent investments in this market environment.

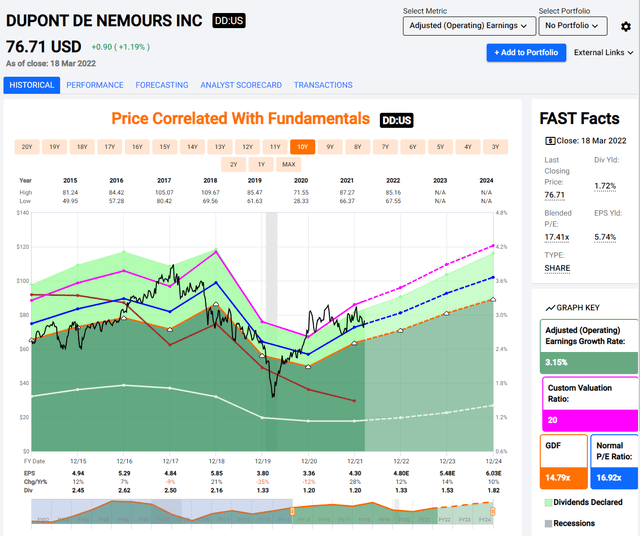

DuPont retains its extremely strong BBB+ rating, and its current yield is 1.72%. This puts it significantly below most of its peers, but that yield is set to almost double (in dividends) in 4-5 years if expectations are to be believed. What’s more, the high margin, low-impact segments that will remain after the M&M divestment speak to the typical premium level of the company’s valuation.

I don’t like valuations above 17.5x P/E for this company, but I have very little issue with a 17.5x P/E multiple here in the longer term.

That means that at 17.4x, I’m actually pretty okay with the valuation here.

F.A.S.T. graphs DuPont Valuation (F.A.S.T. graphs)

From this point onward on a forward 2024E basis, the company has an upside of around 15% annually, if we consider that premium to hold (which I do). That means that you could get a 47.28% RoR from a BBB+ rated, grade-A specialty chemicals company. Not a bad deal, if you ask me. The company is expected to average EPS growth of almost 12% per year. While there is a 38% error-adjusted (10%) miss chance here, those come from times when the company still had somewhat “lumpier” and more volatile segments.

Is this the best alternative in chemicals at this time? No, I wouldn’t say that it is. But it’s a damn good one, and if you’re already overexposed to some companies at this time, it’s not a bad investment, to be sure.

I believe the company is set to appreciate due to consistent EPS growth, as well as the ability to grow its dividend by double-digits for the next few years.

As we’ve discussed in previous articles on DD, analysts agree with this assessment. The company’s average targets range from a low of $86 to a high of $132 – a truly staggering level representing well above a 20x P/E here, which even I consider too high. The average is around $98.6, which would correspond to the current 2023E 17.5x P/E, indicating an upside of over 15% at this particular time.

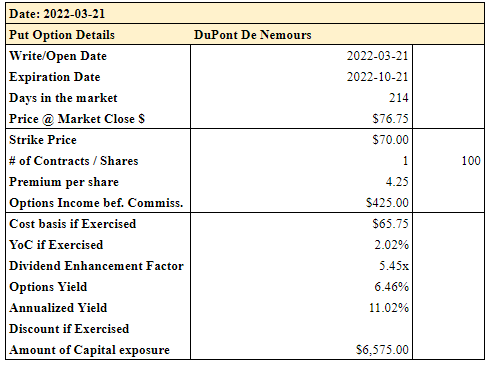

I would view the common share as a good investment at this particular time – though it’s not the only investment in DD that’s possible here. The options you could sell/write are pretty damn appealing. If you believe that the long-term price target may be accurate, and you see the risk for a downturn as low, I would show you these $70 strike price options with a premium of $4.25 at this time.

DuPont Options (Author’s Calculations)

This is a nice return – 11% annualized without you even having to own the stock. And if you do end up getting assigned, you’re buying DD at an effective cost basis of under $66/share, which dials that upside up to over 22% annualized here.

That’s a great deal. At almost $6,500 that’s a bit of capital exposure, but for me, I’m potentially willing to take that. I might write this PUT option.

Thesis

Chemicals are a very investable segment at this time. I own many major companies in the segment, including BASF (OTCQX:BASFY), Linde (LIN), Air Liquide (OTCPK:AIQUY), LyondellBasell (LYB), Covestro (OTCPK:COVTY), and others. But I do think that DuPont is a damn great deal here.

The company combines the appeal of specialty chemicals with a great market position, excellent fundamentals, and a yield that could double in less than 5 years if the company’s growth plan remains intact. I also like the pricing the market is giving some of the options for the company here, which is why I might go for some of them.

In the end, we need to remember that commodities and chemicals are things that we always have needed, need now, and will continue to need going forward. The companies that excel at delivering this continue going to do well.

That is what DuPont does – and that’s why I “BUY” it here, with a PT of no less than $90/share in the longer term.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment