trait2lumiere

Investment Thesis

DraftKings Inc. (NASDAQ:DKNG) may be fighting a losing battle for Proposition 27 in California. Although a coalition of native and commercial gambling companies, including DKNG, have spent a record-high of $402M in marketing, early polls indicate minimal support for the legalization of online sports betting in the state. That is a shame, since analysts are projecting California to be worth up to $2.5B in annual gaming revenue upon legalization.

DKNG has also been burning through cash, with up to $1.1B of marketing expenses reported in the last twelve months (LTM), representing a massive increase of 38.54% sequentially from $794.7M. The company continues to rely on heavy marketing spending with up to three years in advertising ( also known as early customer engagement ) before generating profitable returns in each legalized state. Nonetheless, DKNG has also obviously benefited from the legalization of online sports betting, as more than $152B has been wagered in over 25 legalized states, generating the company more than $3B in revenues since 2018.

In the meantime, DKNG seems well poised for growth in H2’22, with the NFL season taking place in Q3 and the UFC game going live by late Q4. The company also continues to boast 1.5M in unique Monthly Users (MU) contributing $103 in Average Revenue Per Unique monthly payer (ARPU) by FQ2’22, indicating excellent increases of 30% YoY. Thereby, indicating the durability of vice spending in H1’22 despite the worsening macroeconomics. Assuming that FQ3’22 results hold as per its previous trend against the rising inflation, we expect to see the stock recover moderately, despite its notable lack of profitability. We shall see.

Profitability Is Elusive As Expenses Remain Elevated

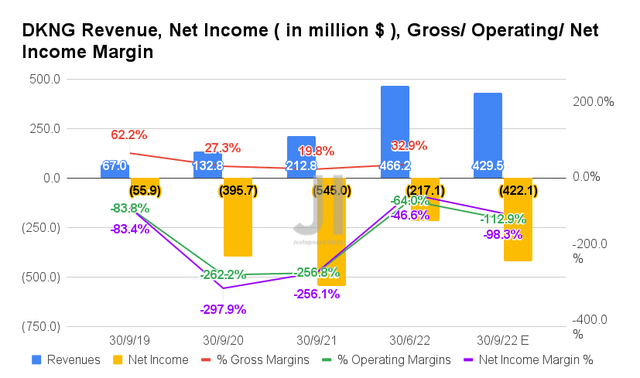

For its upcoming FQ3’22 earnings call, DKNG is expected to report revenues of $429.5M and operating margins of -112.9%, representing a notable QoQ decrease of -7.87% and -48.9 percentage points, respectively. Otherwise, a decent YoY growth of 201.83% and 143.9 percentage points, respectively.

In the meantime, profitability is still a long distance away, with projected net incomes of -$422.1M and net income margins of -98.3% for the next quarter. It indicates a massive decline of -94.42% and 51.7 percentage points QoQ, respectively. Otherwise, a minimal YoY growth of 22.55% and 157.8 percentage points, respectively.

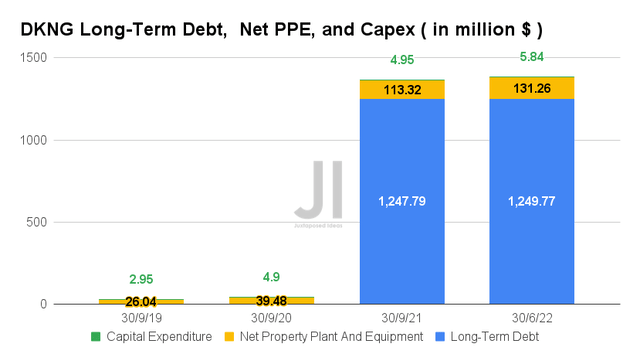

DKNG’s debt level remains elevated at $1.24B in FQ2’22, attributed to the Convertible Notes due March 2028. Assuming the original conversion rate of $94.85 per share and the principal amount of $1.26B, we are looking at another 13.33M in share issuance then. Otherwise, 88.58M shares based on its current stock prices.

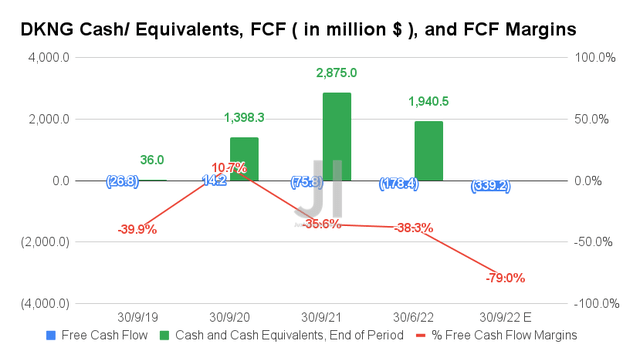

Given that DKNG continues to invest in its capabilities, with a capital expenditure of $24.15M in the LTM, it is natural that it has yet to report positive Free Cash Flow (FCF) generation thus far. By FQ3’22, consensus estimates that the company will report an FCF of -$339.2M and an FCF margin of -79%, representing a massive decline of -90.13% and -40.7 percentage points QoQ. Nonetheless, investors need not worry about its near-term liquidity, given DKNG’s robust cash and equivalents of $1.94B on its balance sheet in FQ2’22.

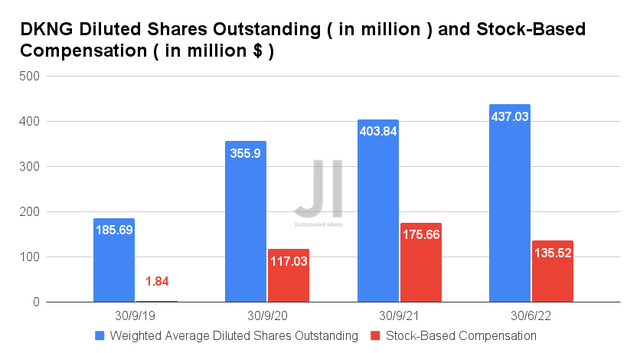

Given its lack of profitability, DKNG has also been reporting elevated Share-Based Compensation (SBC) thus far at $682.31M in the LTM, indicating an increase of 15.78% sequentially from $589.29M. In addition, DKNG investors must not forget the $1.56B impact from its Golden Nugget Online Gaming (GNOG) all-stock acquisition completed in May 2022. These activities have directly contributed to the company’s continued share dilution of 8.86% YoY, or 49.67% since its IPO in April 2020. Based on its latest 10-Q, there will be another $608.4M of granted and unvested SBC expenses to be recognized over the next 1.9 years as well. Thereby, further contributing to the stock’s dilution moving forward.

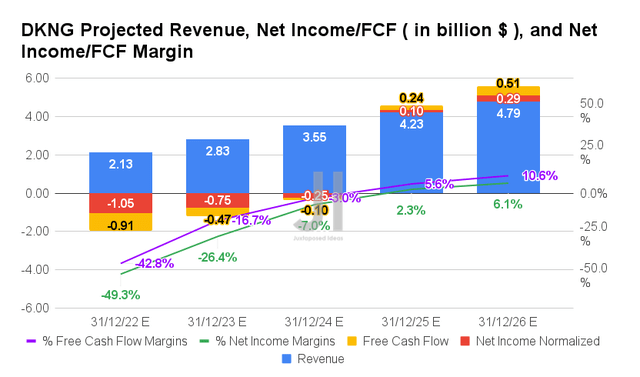

Over the next five years, DKNG is expected to report revenue growth at a CAGR of 17.60% while potentially reporting net income profitability from FY2025 onwards. By FY2026, consensus estimates that the company will report decent net income margins of 6.1% and FCF margins of 10.6%, lending strength to its balance sheet then. We shall see.

In the meantime, DKNG is expected to report revenues of $2.13B, net incomes of -$1.05B, and FCF generation of -$0.91B in FY2022, representing impressive YoY growth of 65.11%, 31.05%, though -52.15% decline, respectively. Unfortunately, the company has also disappointed in its historical performance in the past three consecutive quarters, potentially putting further downward pressure on its stock valuations, given the potential impact of reduced discretionary spending in the worsening macroeconomics and rising inflation. Its FQ3’22 performance and FY2022 forward guidance will be critical indeed.

So, Is DKNG Stock A Buy, Sell, or Hold?

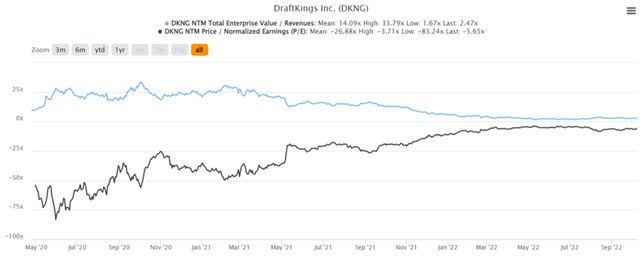

DKNG 2Y EV/Revenue and P/E Valuations

DKNG is currently trading at an EV/NTM Revenue of 2.47x and NTM P/E of -5.65x, lower than its 2Y EV/Revenue mean of 14.09x though massively improved from its 2Y P/E mean of -26.88x. The stock is also trading at $14.28, down -72.16% from its 52-week high of $51.30, though at a premium of 46.16% from its 52-week low of $9.77. Nonetheless, consensus estimates remain bullish about DKNG’s prospects, given their price target of $22.38 and a 56.72% upside from current prices.

DKNG 2Y Stock Price

Considering that the stock has fallen catastrophically by -79.31% from its pandemic highs and is currently trading near its bottom levels, it is pointless to recommend a sell now. The bulls likely continued to hold on in the hopes of recovery once the macroeconomics improved by H2’23 and consumer demand returns. In addition, we expect certain successes from DKNG’s expanded footprint as more states legalize sports betting, due to the management’s guidance of positive FY2022 contribution profit from at least ten legalized states and positive FCF from FY2023 onwards.

Nonetheless, though the DKNG stock is obviously trading below its historical 50, 100, and 200-day moving averages, we expect more pain ahead, triggering another retest of its June’s bottoms soon. The S&P 500 Index had already broken its previous June lows with a -24.69% plunge YTD, indicating the market’s peak FUD levels. The September CPI released on 13 October 2022 is also likely to show persistently elevated inflation rates, since the US job market remains relatively robust in September, with payrolls increasing by 263K and the unemployment rate falling by 3.5% sequentially. Thereby, ensuring another 75 basis point hike by the Fed for its November meeting.

Combined with the unlikely win for California, we rate DKNG stock as a Hold for now.

Be the first to comment