adamkaz/E+ via Getty Images

The Thesis in a Nutshell

I start with a statement that will upset half the readers. And that’s ok, because if you don’t agree on this macro-thesis, then this article is not for you. And here is the claim: “There are some amazingly mispriced stocks in the Chinese ADR market. The negative sentiment is overblown and being courageous at the current valuation levels will ultimately turn out to be financially rewarding”.

One of the companies that have caught my special attention is DouYu International (DOYU), a company that is currently trading at negative enterprise value. Valued at $2.20 per share, I believe there is lots of upside potential and I issue a buy recommendation with a target price of at least $3.37 per share. In the worst case, DouYu’s balance sheet will protect investors for further downside risk and the company should at least be trading at levels that match the DouYu’s cash position.

About DouYu

Let us start with a brief company overview of DouYu. If you have heard of YouTube Gaming or Twitch, then you know what DouYu does, but in China. Founded in 2013, and headquartered in Wuhan, DouYu is a leading game-centric live streaming platform in China and a pioneer in the eSports value chain. DouYu operates its platform on both PC and mobile apps, through which users can enjoy immersive and interactive games and entertainment live streaming. DouYu’s platform brings together a deep pool of top live streamers. By providing a sustainable streamer development system built on advanced technology infrastructure and capabilities, DouYu helps ensure a consistent supply of quality content. Through collaborations with a variety of participants across the eSports value chain, the company has gained coveted access to a wide variety of premium eSports content. DouYu also organizes its own tournaments and produces exclusive eSports content.

As of Q3 2021, DouYu has a monthly active user base of 74.2 million. For your reference, this is half the user base of Twitch, a company that is rumored to be valued at +$15 billion. The bulk of DouYu’s revenues come from live streaming, where users donate money and tip their favorite entertainers, on which DouYu takes a small fee.

The opportunity

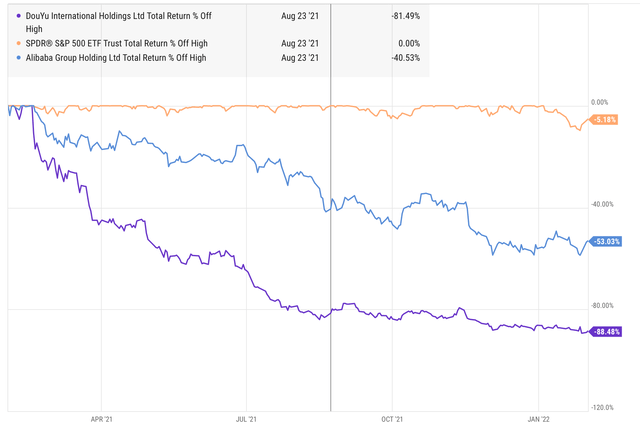

I strongly believe that every investment opportunity is a function of price. A company that doesn’t attract investor interest at $18 per share may suddenly become extremely attractive when trading at $2.20 per share. In my opinion, this is exactly how I describe the opportunity connected to DouYu. From its all-time-high in 2020, DOYU stock has crashed -88.48%.

There are multiple events to explain this sell-off: Firstly, Douyu stock price has been pressured by the failed merger with Huya (NYSE:HUYA), the company’s biggest market competitor. The merger was blocked by the Chinese market regulators based on antitrust grounds, essentially meaning that DouYu and Huya together would operate a monopoly. Secondly, DouYu has suffered from other regulatory headwinds in China, which were especially hard on gaming / data / technology companies. Thirdly, sector-independent and broad-scaled delisting fears of ADR stocks have triggered the latest sell-off and brought stock price down to another all-time low. Finally, on Friday 28th January rumors that Tencent would take DouYu private were dis-confirmed, which triggered disappointment and another sell-off pressured the stock price down as low as $2.02 per share. As we will see in the following section, DouYu is now valued less than the cash that the company records on its balance sheet.

Great Financials

Whenever I make an equity investment, I need to be comfortable with the following three data points: Growing revenues on the income statement, positive net operating cash-flow, and a healthy balance sheet.

First, let us look at the income statement. In the period 2016 until 2020, revenues grew from $118 million to $1.369 billion. This is a compounded annual growth rate of 84% per year. True, the company’s growth has decelerated strongly starting from 2019 and is now estimated to be between 5% and 15% per year going forward. Second, the cash flow statement shows that DOYU has positive operating cash flow, both in 2019 ($117.7 million) and 2020 ($96.7 million). For reference, the current market capitalization of DOYU is $715 million.

Finally, let us analyze the balance sheet, which I consider the strongest argument for an investment (speculation) in DOYU. With $929 million cash and short-term investments, which is 130% of the company’s market capitalization, no intangibles and only $299 million in total debt, DOYU appears ridiculously cheap.

In Q3 2021 DouYu announced a share repurchase program worth $100 million. With a market capitalization of $715 million this program implies a shareholder return of approximately 12%. Furthermore, since 47% of DOYU stock is held by Tencent and insiders, $100 million constitutes an enormous buying pressure on the available shares of float.

Finally, here are some popular multiples to give you reference of the relative valuation:

- P/S (price per sales ratio) – 0.512

- P/B (price per book value ratio) – 0.699

- Forward P/E ratio (1 year) – 13.49

Valuation

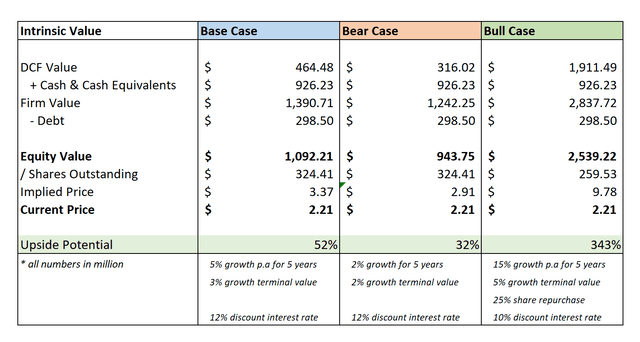

So DouYu is really cheap. But how cheap? Let us now look at what could be a reasonable price target for the company. I have constructed a DCF valuation with a sensitivity analysis of key assumptions. The results of my analysis are termed Base-, Bear-, and Bull Case. (Some assumptions for the analysis are listed under the respective case).

As you see, given the current knowledge, possible valuations for DOYU should be between $2.91 US per share (Bear Case) and $9.78 US per share (Bull Case). As I am neither overly bullish, nor overly bearish on DouYu’s business outlook – there are good arguments for both perspectives – I consider the ‘Base Case’ scenario as the most likely outcome and set a target price of $3.37 per share, implying an upside potential of 52%.

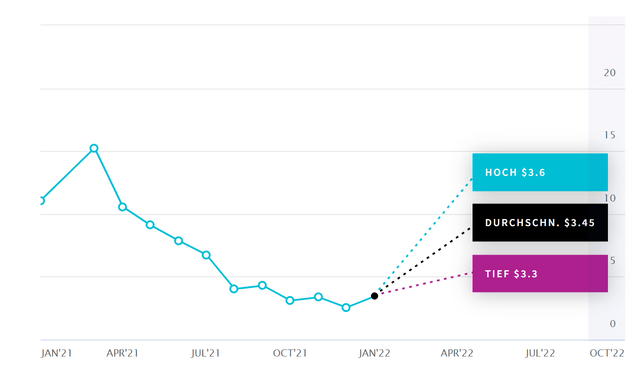

In the worst case, DouYu should at least be trading close to its asset base and cash & cash equivalent position. Most analysts, seem to agree and pin the valuation for DouYu at approximately $3.45 per share.

Risks and Challenges

Although I think that the market has priced in too much of negativity for DOYU already, there remain some risks. Besides the usual sources of possible challenges that may affect the profitability of every company – such as macroeconomic headwinds, industry competition, or poor managerial execution of strategy – I have identified three major possible sources of risks which are relatively idiosyncratic to DOYU.

Competition. Because the merger between Huya and DouYu has not been realized, uncertainty remains about the future competition between these two companies, which together control 80% of the e-sports market in China. In this context, it is worth noting that Huya trades at similar low levels as DouYu, and an additional investment in Huya could therefore be used to hedge the risk of a “winner-takes-it-all” scenario.

Regulatory Headwinds in China. Another main risk for the DOYU stock is obviously a continued pressure coming from the Chinese government. I don’t want to politicize the discussion, or present myself as an expert on China, which is why I would like to encourage every investor to assess the risk-reward of investing in China for himself. For me personally, the valuations – especially DOYU – are pushed to such ridiculously low levels that I regard investments in China as justified.

ADR Delisting Fears. This risk is closely tied to the previous concern of regulatory headwinds. I personally am not afraid of an ADR delisting, but the negative market sentiment and fear could definitely keep the stock price depressed for some time.

How to make money trading DOYU

Although the valuations of the company were certainly high in the past ($18 per share), the current financials of the company point to a case of substantial mispricing. Specifically, the cash on hand and short-term investments should provide a considerable margin of safety and protect investors from further downside risk. I consider a target price of $3.37 per share as very reasonable, implying an upside potential of 52%.

Finally, for those of you who trade options: Paired with the stock sell-off, volatility in DOYU shares has skyrocketed to +100%. Thus, the opportunity to sell covered calls while holding DOYU shares will further enhance an investor’s risk/return potential. For reference, 180 DTE CALLs with strike $2.50 trade at $0.70.

Be the first to comment