Michael M. Santiago

Elevator Pitch

I retain my Hold rating for DoorDash, Inc.’s (NYSE:DASH) shares. I discussed DASH’s valuations in my prior article for the stock published on December 7, 2021. I turn my attention to DoorDash’s outlook for the remainder of this year in this article.

Strong (albeit slower) revenue growth and lackluster profitability (as indicated by EBITDA margins) are what investors should expect of DoorDash’s financial performance for the rest of 2022. This translates into a Neutral view and a Hold rating for DASH’s stock.

DASH Stock Key Metrics

Before providing a preview of DoorDash’s expected financial performance for the rest of 2022, it is worthwhile to evaluate the key metrics revealed as part of the company’s most recent Q1 2022 financial results.

DASH’s key financial and operating metrics for the first quarter of 2022 beat market expectations.

DoorDash’s top line expanded by +35% YoY to $1.46 billion in the most recent quarter, and this turned out to be +5% higher than the sell-side’s consensus revenue estimate of $1.38 billion. DASH’s non-GAAP adjusted EBITDA increased by +26% YoY from $43 million in Q1 2021 to $54 million in Q2 2022, which was +35% better than the market’s consensus EBITDA projection of $40 million as per S&P Capital IQ.

Marketplace GOV (Gross Order Value) for DASH rose by +25% YoY to $12.35 billion in the first quarter of this year, and this exceeded the market’s expectations of $11.71 billion (source: S&P Capital IQ) in Marketplace GOV by +5%. DoorDash also disclosed in its Q1 2022 investor letter that it “added more new consumers than any quarter since Q1 2021”, and this led DASH’s monthly active users and average order frequency metrics to rise to the highest they have ever been in the company’s history.

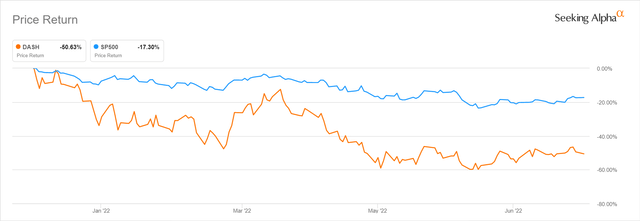

But DoorDash’s good financial and operating performance didn’t boost its share price. DASH’s stock price has halved year-to-date in 2022, and the company’s shares continued to underperform the broader market even after it reported above-expectations numbers for Q1 2022 on May 5, 2022.

DASH’s 2022 Year-to-date Share Price Chart

In my view, it is the fear that DoorDash’s financial and operating performance for the rest of 2022 won’t be as good as that of Q1 2022 which has resulted in DASH’s share price weakness.

What Is DoorDash Stock’s Price Target?

DoorDash’s average sell-side price target is $109.29, which suggests that the company’s shares could potentially rise by +52% as compared to its last done stock price of $71.76 as of July 25, 2022. I am of the view that the Wall Street analysts are still overly bullish on DASH, as its current valuations are already very rich which don’t justify an upside of +52%.

As per S&P Capital IQ’s valuation data, DoorDash is valued by the market at consensus forward FY 2023 EV/EBITDA and normalized (non-GAAP) P/E multiples of 49.4 times and 99.7 times, respectively. In this current market environment, investors assign a substantial valuation discount to loss-making companies, and DASH is still expected to be unprofitable on a GAAP basis for the FY 2022-2024 period as per consensus forecasts sourced from S&P Capital IQ.

In conclusion, I think that the current consensus target price for DASH is unachievable in view of DASH’s valuations now.

Is DoorDash Stock Expected To Recover?

I have a mixed view of DoorDash’s share price recovery prospects.

On one hand, DASH’s food delivery business might do better than what the market expects in a weak economic growth environment. A June 17, 2022 article published on Insider Intelligence cites a recent survey of US consumers done by CivicScience which indicates that 51% of survey respondents intend to reduce their spending on dining out as compared to 37% of them who will do so for food delivery. In other words, food delivery might be a relatively more resilient category of consumer spending than what is expected.

On the other hand, a new partnership between Amazon (AMZN) and Grubhub, one of DASH’s key competitors in the US food delivery market, could be negative for DoorDash. A July 6, 2022 Seeking Alpha News article highlighted that “Prime members in the U.S. can enjoy a free, one-year Grubhub+ membership with no food-delivery fees on eligible orders” following a deal between Amazon and Grubhub’s parent, Just Eat Takeaway (OTC:JTKWY). The competitive threat posed by the Amazon-Grubhub partnership could translate into market share losses for DoorDash going forward. As a reference, analysts from Morningstar have predicted that Grubhub’s subscriber base will increase by +100% to 6 million in a year’s time as result of the Amazon deal.

In other words, I don’t expect a meaningful recovery in DASH’s shares in the near term considering both the positive and negative factors outlined above.

What Is DASH Stock’s 2022 Outlook?

The mixed outlook for DASH in 2022 is reflected in the consensus financial forecasts for the company, which I view as reasonable.

According to the sell-side’s consensus financial projections obtained from S&P Capital IQ, DoorDash’s YoY revenue growth is expected to moderate from +35.2% in Q1 2022 to +22.9%, +23.4%, and +29.2% for Q2 2022, Q3 2022, and Q4 2022, respectively. This appears to be realistic, as consumers will naturally cut back on discretionary items like food delivery in a challenging economic environment, but the extent of the cut might be narrower than expected as per the CivicScience survey referred to in the earlier section.

Revenue growth rates in excess of +20% for the remaining quarters of this year are still pretty decent. But it is disappointing that DASH’s EBITDA margins are expected to remain low at 3.8%, 3.2% and 4.3% for Q2 2022, Q3 2022, and Q4 2022, respectively. This is consistent with DoorDash’s comments at its Q1 2022 results briefing that “we’re not trying to manage the business to increase margins or even the dollar amount of EBITDA, because we’re essentially reinvesting those profits in order to grow these other areas.”

Is DASH Stock A Buy, Sell, Or Hold?

I rate DASH as a Hold. It is impressive that DoorDash is expected to sustain a top line expansion in excess of +20% for the remaining quarters of this year. On the flip side, investors won’t have a favorable view of DASH’s low EBITDA margins and its expensive valuations. This warrants a Hold rating for DoorDash in my view.

Be the first to comment