FG Trade/E+ via Getty Images

Introduction

In recent times, the food-delivery industry has undergone a drastic transformation as the post-pandemic world has reduced the demand for food-delivery services. Among the companies negatively affected by these headwinds is DoorDash (NYSE:DASH), which has dropped over 56% YTD. Fundamentally, DoorDash has seemingly preserved despite the macro conditions. However, its valuation presents an upside that is too little to justify the many risks facing the company.

Company Overview

Headquartered in San Francisco, California, DoorDash is a middleman, providing delivery personnel to transport meals from restaurants to customers. The majority of their revenue stems from fees and commissions, which come from both restaurants and consumers. Their subscription model, DashPass, also contributes to their revenue, as users pay $9.99/month for reduced service fees.

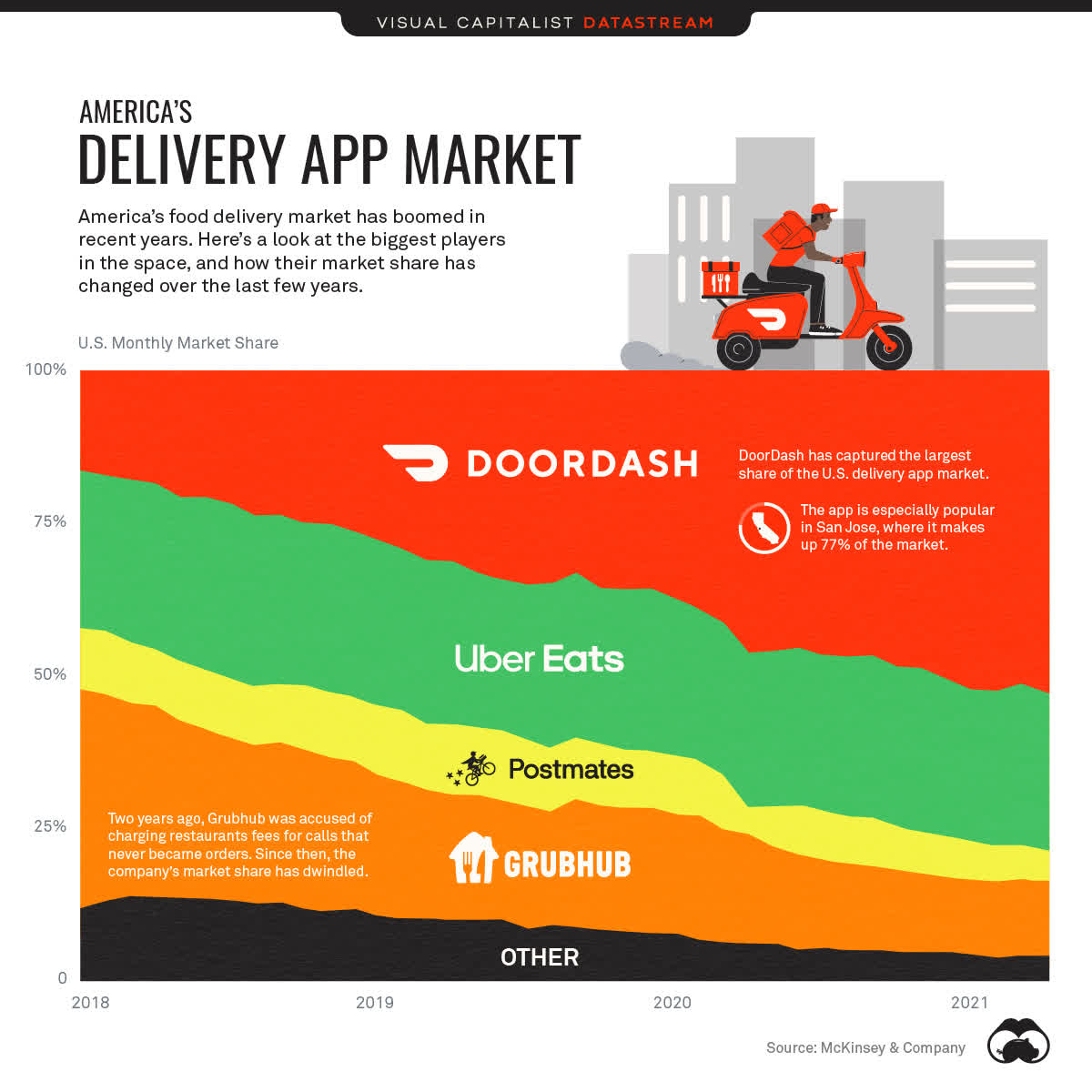

Consumers choose DoorDash for its distinction from other food-delivery apps, such as Uber Eats or GrubHub. Rather than primarily serving large cities like their competitors, DoorDash focuses on smaller (often suburban) areas, catering to new locations and gaining niche target audiences. DoorDash is currently a market leader, with a 53% market share. The overall market has a growth CAGR of 13.68% and is estimated to reach about $1.45 trillion by 2027.

McKinsey

Earnings Analysis

In Q3 2022, DoorDash reported a total revenue of $1.7 billion, which showed a 33.9% YoY increase and beat estimates by an astounding $70 million. The company’s EPS of -$0.77 did not perform as well, however, as it missed the consensus by $0.12. In Q4, management is expecting a higher Marketplace GOV (gross order value; the profit DoorDash makes from sale commissions), specifically within a range of $13.9 billion – $14.2 billion, as the number of restaurants partnering with DoorDash continues to grow.

Sound Fundamentals

Overall, DoorDash has exhibited solid performance on a fundamental level. Management reported that their number of Monthly Active Users (MAUs) “has continued to grow,” signaling that even in times when food delivery is decreasing, DoorDash has been able to grow. Additionally, they disclosed that they have seen “all-time highs” in their DashPass subscription program, which investors like for its recurring nature and inspire customer loyalty.

Risks

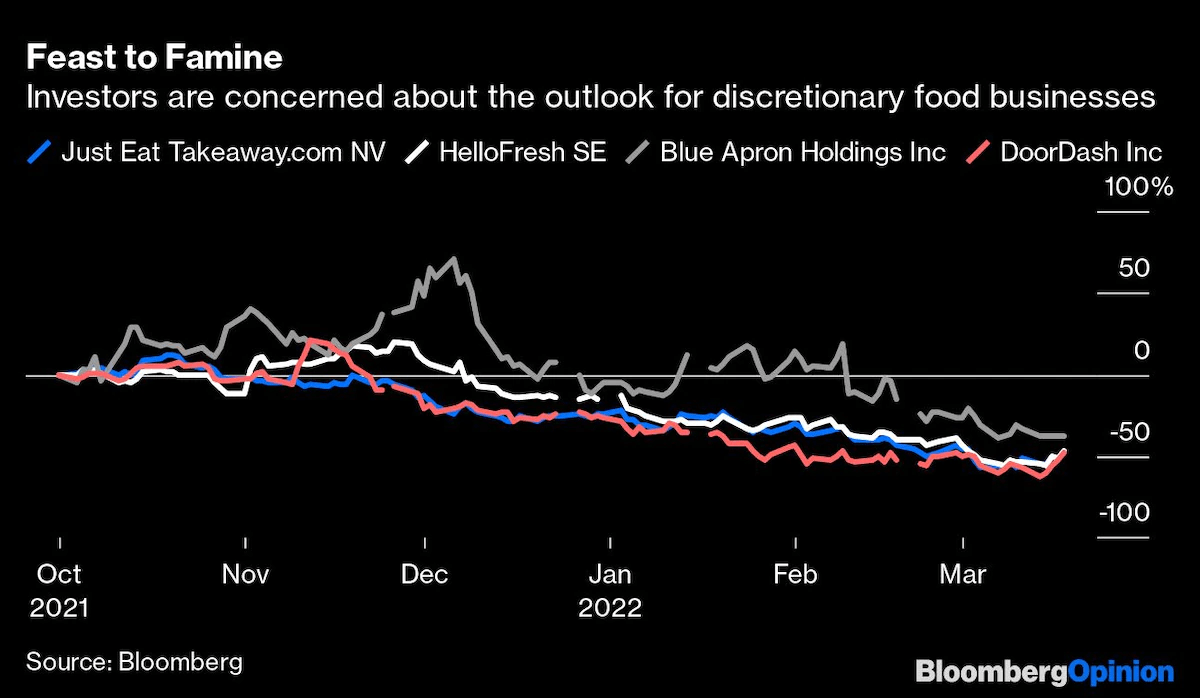

Like most tech companies, the ongoing heightened inflation could plague DoorDash’s growth from reaching its full potential. Studies indicate that as prices continue to increase, consumers tend to cut back spending on non-essential items – food delivery is one of them. In fact, 53% of U.S. adults reported that they recently changed their dining habits due to inflation, essentially meaning that they are choosing to order food less often to save money. Not to mention, due to their past deceptive practices, legislation has been passed to guarantee that restaurants set their own menu prices. To compensate for their DoorDash fees, restaurants mark up their DoorDash menu prices by another 10% to 20%, making it even more expensive for consumers in an inflationary environment.

Bloomberg

ESG

DoorDash’s public reputation has been significantly hurt by its treatment of workers and restaurants. This has already led to regulations and potentially invites more stringent ones in the future.

Firstly, DoorDash was notorious for charging restaurants up to 30% in commissions. Although restaurants are reportedly seeing more revenue, the low-margin nature of the business means fewer profits. In San Francisco for example, 62% of restaurant owners say they lose money on every order for delivery services. As a result, cities like San Francisco and New York City have already capped delivery fees at 15%.

DoorDash has continued to be scrutinized for its treatment of its drivers. In 2020, DoorDash settled a lawsuit after being accused of pocketing millions of dollars of tips. Consequently, legislation was passed in California that banned this practice in the following year. Because drivers are classified as independent contractors, they do not receive the benefits and insurance policies guaranteed to employees. Worse, because workers are not compensated for fuel costs or time spent waiting, they earn an estimated average of $5.34 an hour, far below the minimum wage.

DoorDash’s treatment of workers and small businesses has hurt its reputation. However, its profits have continued to soar because of a series of legislative wins. In 2022, San Francisco weakened its cap to allow delivery companies to charge above 15% for add-on benefits, which DoorDash offers. In 2020, Proposition 22 passed in California which allowed gig workers to continue to be classified as independent contractors but provided some benefits. However, the company had to subsequently increase prices on customers in California in order to shoulder those costs.

In the long term, however, worker and restaurant dissatisfaction will continue to be a lingering risk. For one, the Biden labor department is continuing the fight to classify gig workers as employees. Dissatisfied restaurants are giving special deals for direct orders and sometimes assembling their own delivery fleet to reduce their reliance on delivery apps.

Valuation

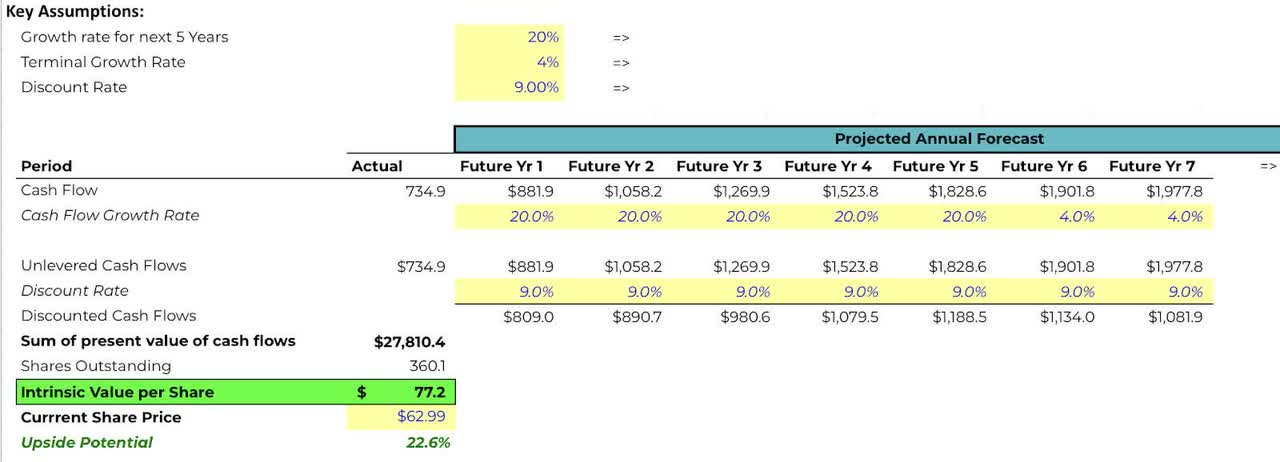

To value the company, I performed a DCF analysis assuming the following:

-

20% growth CAGR for 5 years

-

4% Terminal growth rate

-

9% discount rate (taken from Finbox)

My DCF model gave me a price target of $77.2, which is roughly a 22% upside from current price levels. However, I still don’t believe that the valuation is attractive as 20% is hard to maintain, and any disruptions could drastically affect its valuation. The stock was much more attractive in the $40s range just a couple of weeks ago, but the market has now priced in most of the optimism in DASH.

Excel

Conclusion

DoorDash rode the wave of venture capital and made it a good deal for everyone: consumers, delivery drivers, and merchants. However, amidst the macro conditions and the need to become profitable, one of those three stakeholders will have to shoulder the brunt. Though DoorDash has performed well so far, its valuation does not present enough reward to justify the risks facing the company. Until DoorDash can implement a more sustainable business model, I do not view its long-term performance favorably. In the short term, however, I believe DoorDash can be a “Buy” if market sentiment pushes the price too far below its intrinsic value.

Be the first to comment